April 2025

Principal Consultant

Reviewed By

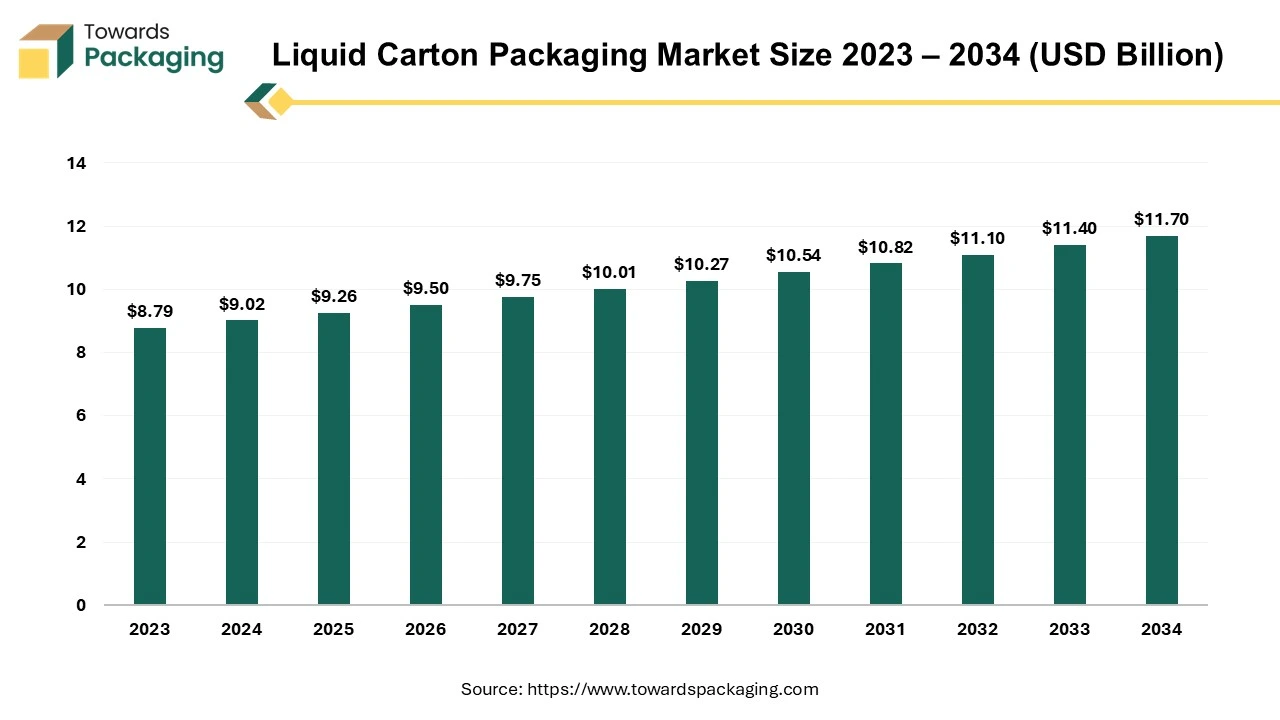

The global liquid carton packaging market was valued at USD 9.02 billion in 2024 and is projected to reach approximately USD 11.70 billion by 2034, growing at a CAGR of 2.63% during the forecast period from 2025 to 2034

Owing to the region's altering cultural patterns and social conventions, growing urbanization, population growth, and youth beer obsession has risen the demand for the liquid beverages has boosted. Hence, due to the risen demand for the liquid beverages the key players operating in the market are focused on increasing the production of the liquid carton packaging with longer shelf life which is estimated to drive the growth of the liquid carton packaging market over the forecast period.

A multi-ply paperboard with strong wet sizing, high stiffness, and a high barrier coating, such as plastic—is known as liquid packing board. There is only use of virgin paper fibers. The liquid must be retained by the barrier coating, which also stops tastes and air from passing through the paperboard. A multi-ply paper machine with online coating is used to manufacture liquid packaging boards, which can have up to five plies. Using three plies with a base weight of roughly 300 g/m2 is the most popular method. Typically, the base or middle ply is composed of broken (wastepaper from a paper mill) or chemi-thermo-mechanical pulp (CTMP), which is pulp that has been bleached or unbleached chemically. Chemi-Thermo-Mechanical Pulp (CTMP) increases rigidity and bulk.

The primary purpose of packaging fluid is to shield it from the external environment, particularly once the processing is finished, allowing the liquid to maintain its freshness, flavor, and moisture content for an extended amount of time. The liquid packaging carton material is made of Low-density polyethylene (LDPE), Polyethylene Terephthalate (PET), High density Polyethylene or Polypropylene, etc. coating on inner side of paperboard carton.

The rapid urbanization of developing nations is creating a need for packaged liquid products, which is encouraging market expansion. The market for liquid packaging cartons is expanding due to increased disposable income and rising consumer spending.

As environmental consciousness grows, the sector is growing by introducing environmentally friendly liquid packing cartons. Governments from a number of countries have implemented rules that encourage the use of recyclable and environmentally friendly packaging options, which is supporting this trend and accelerating liquid carton packaging market growth during the forecast period. Moreover, the key players operating in the market are focused on developing new material for liquid carton packaging which is estimated to fuel the growth of the liquid carton packaging market over the forecast period.

The liquid paperboard carton is not compatible with certain liquid beverages which is found to hinder the growth of the market over the forecast period. Carton packaging is not appropriate for every liquid product. Liquid carton packaging may not be the best option for products with high acidity levels or those with unique shelf life and protection needs. Product compatibility must be carefully considered by manufacturers. For liquids with a water base, liquid cartons are typically used. Their insufficient ability to fend off oil-based liquids may result in problems like shorter shelf lives. Liquid carton packaging may not be the best option for goods like alcoholic beverages that have a high alcohol content. The paperboard and the carton's structural integrity may be impacted by the alcohol. For the duration of the forecast period, these issues may limit market growth. Moreover, the liquid carton manufacturing system's complexity drives up manufacturing costs due to its high level of complexity. The demand for brick carton packaging would decline as a result, slowing the rate of market growth.

The market is expanding as a result of the sharp increase in demand for environmentally friendly packaging solutions as well as the packaging industry's growing R&D efforts aimed at reaching these sustainability targets. Because they are usually recyclable, these packaging cartons help to promote a circular economy by lowering waste and preserving resources. Liquid cartons are a desirable option for consumers who care about the environment because they are simple to recycle. Consumer demand is growing for paper-based liquid packaging cartons composed entirely of renewable or recycled materials that are supplied ethically. In response, manufacturers are also offering liquid cartons that maximize sustainability across the whole life cycle, taking customer feedback and demand into account. Hence, the exclusively beneficial features of liquid carton packaging are expected to create lucrative opportunity for the growth of the market over the forecast period.

One of the main factors driving the demand for liquid packing cartons is their low cost when compared to other packaging options. Paperboard is more affordable than glass or plastic and is mostly utilized in the manufacturing of liquid cartons. When weighed against many other container formats, such metal cans or glass bottles, they are rather light. This feature reduces the need for fuel during transportation, which lowers shipping and transportation expenses. Liquid cartons are not as likely to break during handling and transit as glass bottle containers are. By doing this, the chance of product loss is reduced, which lowers waste and its related expenses. Because their production costs are cheaper, brands are able to offer their liquid products at competitive pricing in the market, which is estimated to create opportunity for the growth of the liquid carton packaging market in the near future.

| Product Name | Product Description | Quantity | Loading Port | Unloading Port | Weight (kg) |

| Caps and Lids | Other paper, paperboard, cellulose wadding, and web | 150 CAS | Napoli, Italy | Port Everglades, FL | 2200 |

| Storage Rack Clip Storage Box Hook | Storage rack clip storage box hook | 1185 CTN | Ningbo, China | Long Beach, CA | 19269 |

| Molded Pulp Box (Starbucks) | Molded pulp box, PO No: 81690364-40 | 720 CTN | Ningbo, China | Oakland, CA | 4185 |

| Plastic Bottle Storage Box | Plastic bottle storage box | 829 CTN | Yantian, China | Long Beach, CA | 11853 |

| Bakery and Pizza Boxes (India) | 881 packages of paperboard boxes for bakery, pizza, and specialty sandwiches | 3404 PKG | Mandvi, India | Charleston, SC | 0 |

The brick cartons segment held the dominating share of the liquid carton packaging market in 2024 on account of advantages offered by the brick cartons packaging. Brick-cart packing shields the product from moisture and other outside impurities. Additionally, contributing to the product's longer shelf life is brick carton packing. Brick carton packaging is made of low-density polyethylene, paperboard, or aluminium and is available in square or rectangular shapes.

Brick carton packing comes in a range of sizes and closure choices. Brick carton packing usually has benefits over other packaging solutions, such as maximum usefulness, easier storage, and a longer shelf life. Without the need for any additives or preservatives, brick and carton packaging can maintain the items' nutritional value, which again helps the business by lowering production costs. Brick-cart packaging that complies with ergonomic requirements, such as one-stop packing, high energy efficiency, low emissions, and environmental protection, is being produced by businesses. The key players operating in the market are focused on adopting inorganic growth strategies like collaboration to develop brick carton packaging solution, which is estimated to drive the growth of the segment over the forecast period.

Additionally, it reduces carbon emissions by 33% overall and has earned the Carbon Trust's Carbon Neutral certification.

The gable top cartons segment is expected to grow at fastest rate due to some exclusive features of the gable top cartons. Gable top boxes feature a tapering top that forms a triangle that can be closed with a postal lock, sticker, tuck-flap, or other closure method. To produce a proper base to make packing strong both in transit and on the shelf, gable top cartons can be paired with other box styles like crash-lock and tuck-end. The gable top cartons are easy to handle as well as safe to ship, store and shelve. Being composed of recyclable and renewable materials, gable top containers are more environmentally friendly than plastic packaging options.

The company/ brand owner may cover package with intriguing, accurate, eye-catching images that will distinguish company’s brand goods from the competitors by printing right onto the gable top. Moreover, in 2022, according to the data published by the National Center for Biotechnology Information, it was found that delivering fresh products to consumers with the least amount of waste is made possible in large part by milk packaging. At the moment, pillow pouches, sometimes known as "milk bags," gable-top screw-cap laminated paper (liquid packaging board, or LPB) cartons, and stiff high-density polyethylene (HDPE) bottles are the three primary forms of milk packaging used in Canada. For the most part, Canada has access to the first two.

The plastic-coated paperboard segment held the significant share in 2024. The plastic coated paperboard liquid carton packaging is in high demand due to certain benefits offered by single layer plastic coat in the interior of the carton. The Poly-coated paperboard generates a barrier against moisture and other so packaged beverages and food items are stored safely inside. The plastic coating in the interior of the paperboard acts as barrier-coating to protect package’s contents from oxygen, light, heat, humidity, or grease. The key players operating in the market are focused on launching the new products in the market and expanding the company’s product portfolio which is estimated to drive the growth of the segment over the forecast period.

Moreover, when it comes to cost-effectiveness and sustainability, PET (polyethylene terephthalate) films are a great substitute for aluminium in liquid carton packaging. PET is a recyclable plastic whose use supports the company's efforts to lessen its impact on the environment and meet sustainability targets. PET film utilization lowers the carbon footprint compared to aluminium barriers because of its low weight and more energy-efficient manufacture. PET films can result in cost savings in packaging manufacture because they are often less expensive than aluminium. When paired with extra coatings and laminates, PET films offer sufficient defense against environmental elements, making them appropriate for maintaining the quality and shelf life of liquid items. These factors are anticipated to support the market’s expansion over the forecast period.

The cut opening segment held the significant share in the liquid carton packaging market in 2024. The cut opening at the surface of the liquid packaging cartons usually has caps at top and stores the product safe inside. The cut opening liquid carton packaging is mainly used to store fruit juices and milk products as it has cut opening that prevents leakage and maintain freshness. The key players operating in the market are focused on launching and installing new equipment for the development of cut opening liquid packaging which is expected to drive the growth of the segment over the forecast period.

The dairy products segment held the dominating share of the liquid carton packaging market in 2024. Milk, yoghurt, and cream are examples of dairy products that are susceptible to environmental elements like light, moisture, temperature, and oxygen. The taste and quality of these products are ensured by the great barrier that liquid cartons provide against these causes. Dairy brands may continue to offer competitive prices in the market without having to worry about sustainability issues because liquid cartons are quite inexpensive. Liquid cartons are made to comply with strict food safety laws while guaranteeing the integrity and safety of dairy products.

When taken as a whole, these elements establish liquid cartons as the industry standard for dairy product packaging. Proper milk packaging is crucial for maintaining its nutritional value and minimizing waste, as well as increasing its marketability and generating higher profits. Getting nutritious milk to consumers in the least clean, expensive, safest, and greenest package possible is a problem for the packaging sector. Multiple laminates, such as a triple layer of high density polyethylene, are employed because Ultra Heat Treatment (UHT) milks have certain shelf-life requirements. Depending on the manufacturer's discretion, an intermediary light barrier may be included.

Asia Pacific witnessed the highest revenue shares for the year 2024 in the liquid carton packaging market. Recent entry into China and India by well-known beverage businesses has greatly boosted sales for the Asia-Pacific liquid carton packaging industry. The rising consumption of packaged beverages by millennials, including juices, dairy products, and soft drinks, is another factor driving the need for liquid carton packaging. The rise of liquid packaging in China during the last 20 years has been ascribed to various factors, such as environmental concerns, advancements in technology, and appealing economics.

Quick changes are occurring in how consumers view and interact with packaging. The country's rigid packaging alternatives are being replaced by more creative and sustainable paperboard carton packaging, as vendors place a greater emphasis on sustainability. The market's increasing demand for consumer-friendly packaging and improved product protection is expected to make liquid packaging a more sensible and cost-effective substitute.

Carton materials for liquid packaging are easily obtained and made of natural resources. Additionally, the use of liquid packing cartons in industrial and institutional settings is growing, which is driving factor and beneficial for producers and customers alike and is driving the segment's growth.

Moreover, the key players operating in the market are focused on expanding their manufacturing capacity by deployment of new manufacturing plant to meet the increasing demand of the liquid carton packaging, which is expected to drive the growth of the liquid carton packaging market in the Asia Pacific region.

Moreover, increasing launch of the refillable carton package for liquid hand wash in the U.S. region is estimated to drive the growth of the liquid carton packaging market in the North America region during the forecast period.

Europe is expected to attain rapid growth over the forecast period. The European food and beverage authorities' regulatory rules, particularly those pertaining to the materials utilized in liquid cartons, promote the use of recyclable packaging materials, contributing to regional growth. Additionally, the growing research and development sector is also estimated to drive the European liquid carton packaging market. Moreover, the key players operating in the market are focused on adopting the inorganic growth strategies like partnership for increasing the rate of production of the liquid carton packaging in the market, which is estimated to drive the growth of the liquid carton packaging market in Europe over the forecast period.

By Product Type

By Material Type

By End Use

By Region

April 2025

March 2025

March 2025

March 2025