April 2025

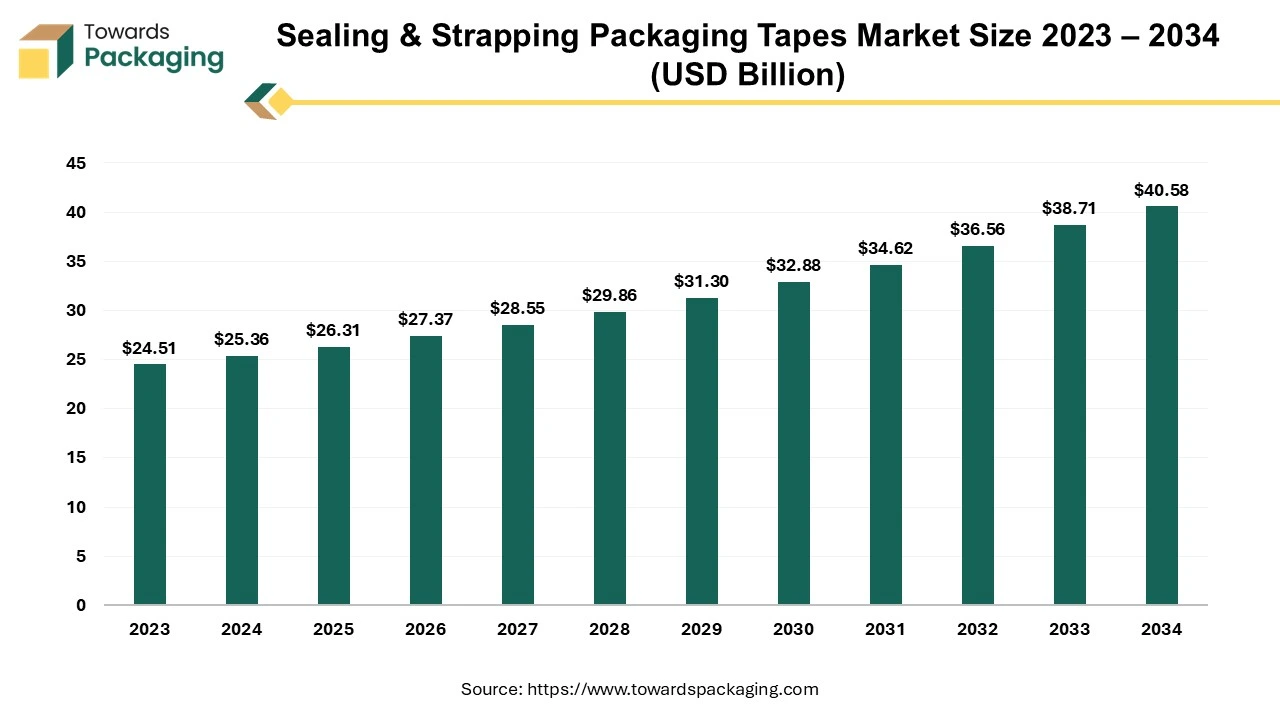

The global sealing & strapping packaging tapes market is estimated to reach USD 40.58 billion by 2034, up from USD 25.36 billion in 2024, at a compound annual growth rate (CAGR) of 4.81% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The sealing and strapping packaging tapes market is likely to see substantial expansion in the future. Sealing & strapping packaging tapes are adhesive tapes designed for packaging purposes, primarily to secure, seal and bundle items for transportation, storage, or display. These tapes are important for maintaining the integrity of the packaged goods, guaranteeing their safe delivery and protecting them from the tampering as well as environmental factors. These tapes find applications across different industrial sectors such as logistics, e-commerce, food and beverage, pharmaceuticals and industrial manufacturing.

The rapid expansion of the e-commerce industry along with the growing logistics and transportation sector is expected to augment the growth of the sealing & strapping packaging tapes market during the forecast period. Furthermore, the rise in industrialization and manufacturing activities as well as technological advancements in the adhesive properties and materials is also anticipated to augment the growth of the market. Additionally, the rise of the tamper-evident and branded tapes coupled with the increasing awareness about the cost-efficient and lightweight packaging choices and the regional infrastructure developments are also projected to contribute to the growth of the market in the near future.

The expansion of the logistics and supply chain operations owing to the rapid growth of the e-commerce as well as the shift towards the just-in-time inventory systems is anticipated to augment the growth of the sealing & strapping packaging tapes market during the forecast period. Thus, the companies in the logistics sector are focusing on investing in the infrastructure development, warehouses, distribution centers, and transportation networks. For instance:

This expansion of the logistic facilities due to the surge in the shipments needs reliable packaging option to guarantee the safety of the products during the transit. Sealing tapes helps in securing the cartons and packages, while strapping tapes are important for the bundling and stabilizing the heavier loads like pallets. Furthermore, as supply chains evolve the demand for the track-and-trace-enabled tapes are likely to accelerate, making sealing and strapping tapes indispensable in the modern logistics systems.

The volatility in the raw material prices is anticipated to hamper the growth of the sealing & strapping packaging tapes market during the estimated timeframe. Key materials used in the manufacturing of these tapes such as polypropylene (PP), adhesives, and reinforcement fibers, are subject to the price fluctuations due to the various factors. Polypropylene, a primary component of the tape production, is derived from petroleum, making its cost highly sensitive to the crude oil price variations.

The inelasticity or low responsiveness of supply and demand to short-term price fluctuations is directly related to the fluctuation of oil prices. The price of the crude oil is one of the most attentively monitored commodity prices and is naturally unpredictable. This is due to the fact that crude oil affects expenses at every level of manufacturing, which in turn affects consumer goods prices.

Furthermore, a considerable amount of the crude oil produced worldwide originates across regions that have historically experienced conflicts over politics. Supply disruptions due to the political events have always coincided with the several instances of the substantial oil price hike. The prolonged violence in the Middle East remains a concern for the global oil markets currently. Any harm to the important oil infrastructures in this area could cause production to be disrupted that might increase prices.

The intensity of the war and the responses of the key oil producers to control supply levels, however, will determine how much the price fluctuates. Also, for the smaller players with limited financial flexibility, raw material volatility can hinder operations, forcing them to reduce production or even exit the market. These challenges make price stability an important factor in guaranteeing the sustained growth of the sealing and strapping packaging tapes market.

The increasing need for tamper-proof packaging is expected to create substantial opportunity for the sealing & strapping packaging tapes market growth in the near future. It has become further essential than ever for organizations to have an effective way of protecting their products due to the growing instances of theft and tampering. An additional layer of security provided by tamper-evident technologies can assist organizations in detecting as well as preventing theft before it occurs. Companies are actively working on addressing the theft challenges with innovative tamper-evident technologies. For instance:

In the logistics sector, cargo crime has emerged as a major problem that has an impact on both the enterprises and the economy. This has led to financial losses for the companies and delays in the deliveries. For instance, in 2021 the National Vehicle Crime Intelligence Service (NaVCIS) estimated that these crimes cost the UK economy over £428 million. These problems are making supply-chain organizations search for methods to stop and minimize theft, which is projected to increase the demand for these products in future.

Artificial Intelligence (AI) is substantially transforming the sealing and strapping packaging tapes market, driving innovation and efficiency across production, supply chain as well as end-user applications. In manufacturing, AI-powered systems improve the operational efficiency by optimizing production processes, reducing waste and guaranteeing consistent tape quality.

For instance, Avatack Company has partnered with Profet AI, an innovative technology firm that specializes in the machine learning platforms and enterprise AI tools for automated production. They work together to find the most effective strategy to optimize production utilizing AI.

Similarly, to stay ahead in the market that is changing quickly, Panamax Company has realized how important it is to adopt digitization. They are revolutionizing the industrial productivity and efficiency with the incorporation of automation and artificial intelligence into their manufacturing processes. Panamax has optimized a number of areas of their manufacturing operations by utilizing artificial intelligence.

Large volumes of data produced during manufacturing are analyzed by AI algorithms to find trends, forecast maintenance requirements and maximize resource use. As industries increasingly adopt AI technologies, the sealing and strapping packaging tapes market benefits from improved innovation, operational efficiency and adaptability that makes AI a key driver of growth and competitiveness in the industry.

The polypropylene tapes segment held the largest market share of 45.57% in 2024. Polypropylene is utilized as a base for a wide range of tapes. It is the ideal material for tapes when durability is important. Due to its affordability, dependability, strength as well as compatibility with common packaging equipment, polypropylene is commonly utilized for packing tape.

Additionally, polypropylene tape is a superior option for lengthy printing runs with plenty of detail as it is printed on a polymer plate. The versatility of the polypropylene tapes, available in various sizes, colors and customizable options, makes them suitable for branding and tamper-evident applications, providing added value to the end-users. These factors are likely to support the growth of the segment in the global market during the forecast period.

The rubber-based adhesive segment held the largest market share of 47.40% in 2024. Rubber tape adhesives are made with tackifying resins, oils, and antioxidants and are based on either synthetic or natural rubber. Rubber provides quick stick capability and is the most economical adhesive. The broad formulation latitude of these adhesives is one of its main advantages. This type of adhesive can be made to be highly permanent, repositionable, or detachable.

Rubber-based adhesives may also be utilized to create high-strength foam bonding tapes. Rubber-based adhesives stick to a variety of surfaces like polypropylene and polyethylene, which are relatively lightweight polymers. The segment's popularity is also owing to the growing e-commerce, where secure packaging is needed. Additionally, these are available in solvent-based and hot-melt formulations to meet the specific industry needs and expand their application range.

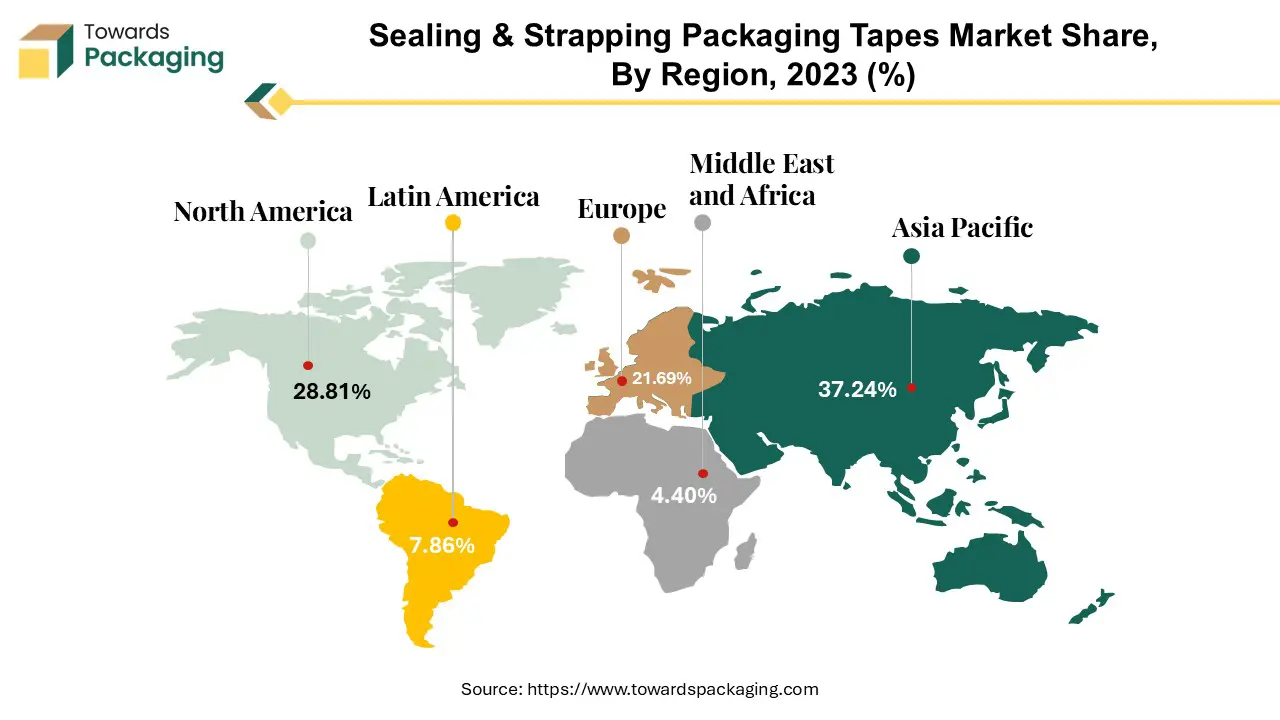

Asia Pacific is likely to grow at the fastest CAGR of 6.63% during the forecast period. This is due to the rapid growth in the e-commerce across countries such as China and India. Also, the rising export activities along with the increasing manufacturing hub are likely to contribute to the regional growth of the market. As per the Observatory of Economic Complexity (OEC), China had a positive trade surplus of $95.7 billion in October 2024 after exporting $309 billion and importing $213 billion. China's exports increased $34.2 billion (12.5%) from $275 billion to $309 billion during October 2023 and October 2024, while imports fell $-4.96 billion (-2.27%) from $218 billion to $213 billion. Furthermore, the availability of low-cost raw materials and labor is also expected to contribute to the regional growth of the market.

North America held substantial market share of 28.81% in 2024. This is owing to the well-established and technologically advanced supply chain infrastructure. Additionally, the high penetration of the online shopping in the U.S. and Canada is also expected to contribute to the regional growth of the market. As per the Census Bureau of the Department of Commerce, the 3rd quarter of 2024 had a 7.4 percent increase in the e-commerce, while the same time saw a 2.1 percent increase in the total retail sales. In 2024, 16.2 % of the total revenues came from e-commerce in the third quarter. Furthermore, the rising concerns about tampering and theft of the products as well as the stringent regulations for secure and hygienic packaging is also expected to contribute to the regional growth of the market.

By Material

By Adhesive

By Application

By Region

April 2025

April 2025

April 2025

April 2025