April 2025

Principal Consultant

Reviewed By

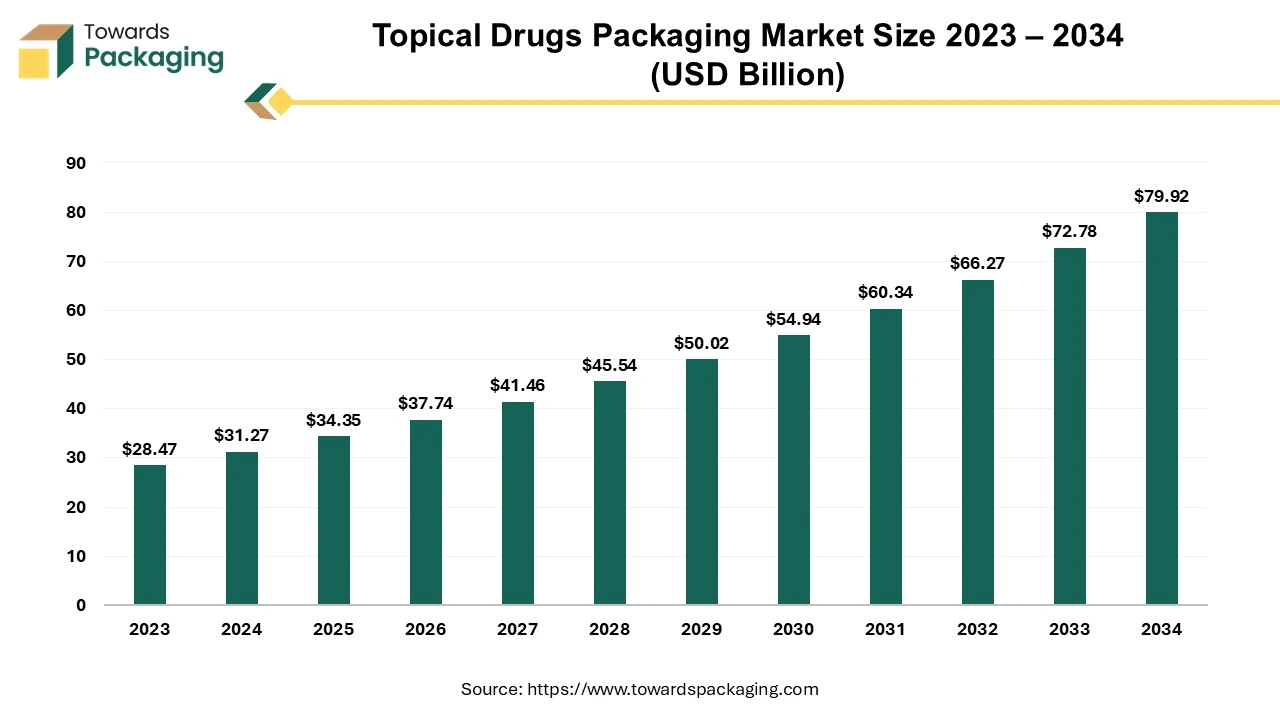

The topical drugs packaging market is anticipated to grow from USD 34.35 billion in 2025 to USD 79.92 billion by 2034, with a compound annual growth rate (CAGR) of 9.82% during the forecast period from 2025 to 2034.

The topical drugs packaging market is expected to experience significant growth throughout the forecast period. Topical medications are intended to treat a range of skin ailments and diseases. They come in the form of creams, gels, ointments and lotions. Topical medicines are delivered in the packaging composed of a range of materials, the most popular being composites comprised of the plastic, aluminum and polymers.

Aluminum is a material that lends itself well to recycling, making it a good option for the environmentally friendly packaging. Medicines that are in semi-solid form, such as the ointments, are often packaged and kept in tubes or jars. The jars might be opaque and porcelain white, or they can be constructed of glass and colored green, amber or blue. Plastic jars are not used very often. Tin or plastic is mostly utilized to make the tubes.

The rising prevalence of skin disorders, such as eczema and psoriasis and the innovations in packaging technologies, such as airless pumps and smart dispensers are expected to augment the growth of the topical drugs packaging market during the forecast period. Furthermore, the growing focus on the sustainability is pushing companies to adopt an eco-friendly packaging material which is also likely to support the growth of the market. Additionally, the increasing popularity of over-the-counter (OTC) topical treatments as well as the global expansion of pharmaceutical markets is also projected to contribute to the growth of the market in the years to come.

The increasing prevalence of skin disorders like eczema, psoriasis, atopic dermatitis and acne is projected to support the growth of the topical drugs packaging market during the forecast period. In terms of numbers, 223 million people (including 43 million aged from 1 to 4 years old) worldwide had atopic dermatitis in 2022 (GBD 2022). This demonstrates the remarkably elevated occurrence in the early age children. Atopic dermatitis can have detrimental effects on a kid's growth, schooling and employment along with the burden of the disease on children and their caregivers. Also, psoriasis affects over eight million people in the US. The World Psoriasis Day consortium estimated that 125 million individuals across the globe, 2 to 3 percent of the world's population have psoriasis. Roughly 30% of those who have psoriasis suffer from psoriatic arthritis.

Furthermore, according to the 2019 Global Burden of Disease Study, 4.86 billion new instances of skin and subcutaneous disorders were reported worldwide. South Asia had the greatest rate of new skin and dermal disease cases as well as mortality from these conditions. The majority of new cases worldwide occurred in children aged 0–4 years, and the states with low socio-demographic index (SDI) had the highest burden, which had gone up from earlier estimates. The GBD Study 2021's most current data revealed 4.69 billion occurrence incidents.

This is likely to increase the demand for tropical drugs to treat the skin disorders. This surge in demand for topical drugs in turn necessitates packaging choices that not only preserve the efficacy of the product but also improve the user convenience. Consumers today are more informed and particular about the products they use, expecting packaging that is easy to handle, provides precise dosing and at the same time prevents contamination.

The difficulty in product protection from environmental influences and microbial contamination is anticipated to hamper the growth of the topical drugs packaging market within the estimated timeframe. Novel drug formulations will probably require more protection from primary packaging. After the initial dispensing, product left within the dispensing system is likely to dry out or possibly crystallize. This is especially true for the liquid formulations, where the drying product can cause clogging and subsequent dispensing system malfunction. Topical products frequently contain oily or fatty secondary components. These formulations are frequently reactive with different environmental factors.

For example, exposure to the oxygen or sunlight can cause the drug substance activity to deteriorate and cause an undesirable color to develop. As a result, diffusion must be prevented by using suitable packaging material that offers an effective barrier function.

Furthermore, Preservatives are typically utilized in the products to keep the number of microorganisms low while it is in-use. Preservatives may cause more irritation, particularly in the patients with skin conditions. Parabens, also known as the parahydrobenzoic acid esters, have been the subject of inquiry due to the reports of patients experiencing an increased risk of contact sensitization when they have cracked or inflamed skin. Although the amount of the paraben used in most of the modern skin drugs are below levels and usually accepted as safe, most skin medications still contain parabens. Nevertheless, there is similar irritation issues associated with the alternative preservatives. Thus, achieving high level of protection can be complex and this further limits the market growth.

The growing pharmaceutical sectors in emerging economies of Asia-Pacific, Latin America and other emerging regions is expected to create opportunities for the growth of the topical drugs packaging market in the near future. These regions are experiencing rapid development in their pharmaceutical sectors owing to the increased healthcare access, rising disposable incomes as well as the growing awareness of health and wellness.

For instance,

Furthermore, governments in these regions invest more in the healthcare infrastructure and services due to the demand for the pharmaceutical products, including topical drugs, is rising steadily. For instance, as per the data by the International Trade Administration, with US$161 billion in healthcare spending, or 9.47% of GDP, Brazil has the biggest market for healthcare in Latin America. For companies in the topical drugs packaging industry, this represents a substantial opportunity to expand their market presence and meet the specific needs and preferences of the consumers in these regions.

The plastic segment captured considerable market share in 2024. Due to its exceptional versatility and qualities of flexibility, mechanical strength along with the stability, plastic is utilized extensively in the pharmaceutical sector as well as in the other industries to produce the packaging systems. Plastic also provides a dependable and reasonably priced option for the product packaging. Regardless of the material's basic qualities, additives can be utilized to improve its qualities more.

These materials increase the mechanical performance of the final product by strengthening it or by acting as a barrier against air, moisture and the UV radiation. Others, including the slip additives that make the part processing and filling easier, also contribute to the production process' optimization. Furthermore, the industry is looking for ways to create packaging that is more sustainable owing to the growing awareness of the adverse impact of the plastics on the environment. These plastics include R-PET (recycled PET), recycled HDPE and biodegradable plastics.

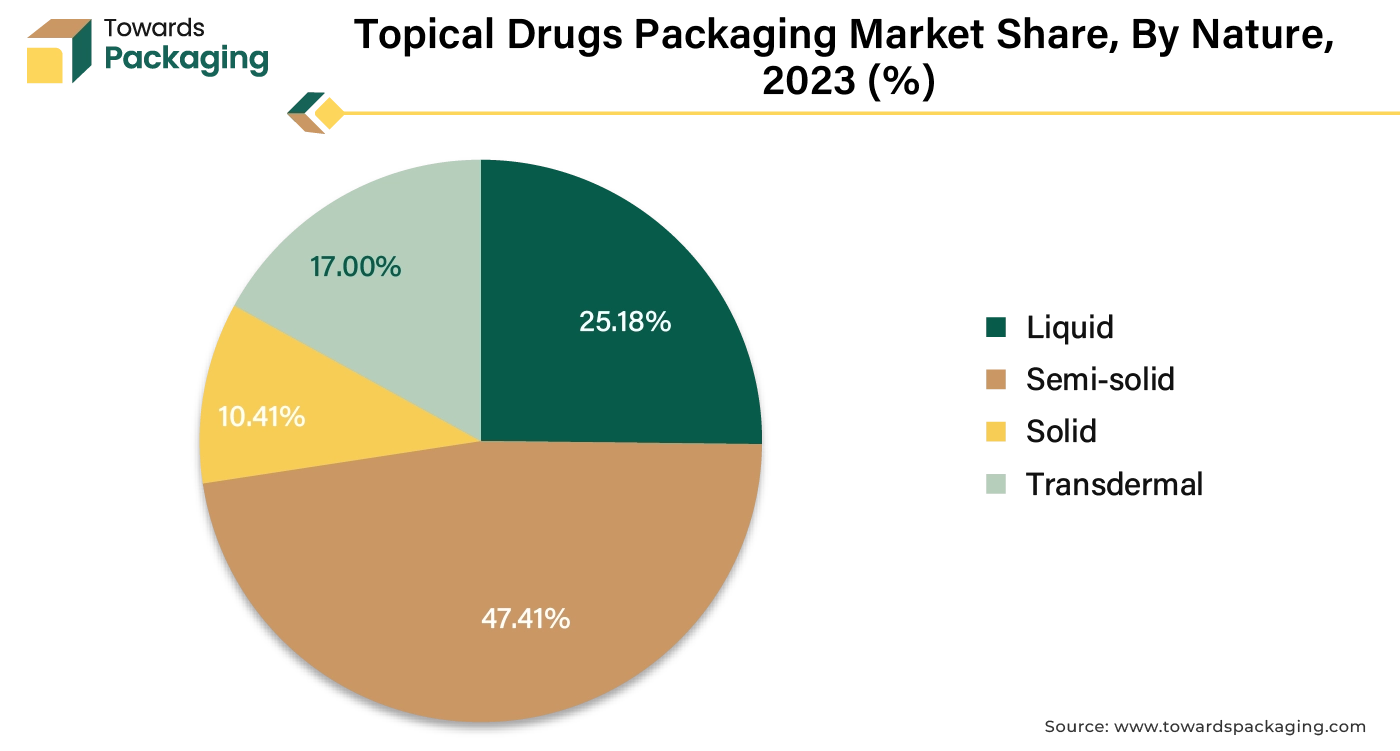

The semi-solid segment held largest market share of 47.41% in 2024. Typically, semisolid dosage forms consist of gels, creams and the ointments. These drugs are administered topically to the skin, cornea, ears, nasal mucosa, buccal tissue, rectal or vaginal tissue or urethral membrane. These usually consist of an aqueous or non-aqueous base with a polymer, drug and any necessary excipient suspended or dissolved as a fine powder. Hydrogels are also useful for administering drugs to the oral cavity in semi-solid form. Skin wounds, eczema, infections and acne are among the dermatological diseases that are commonly treated with topical doses. Topical SSD formulations are becoming increasingly popular due to the rise in skin disorders caused by rising temperatures and dermal responses to medicine use in elderly populations.

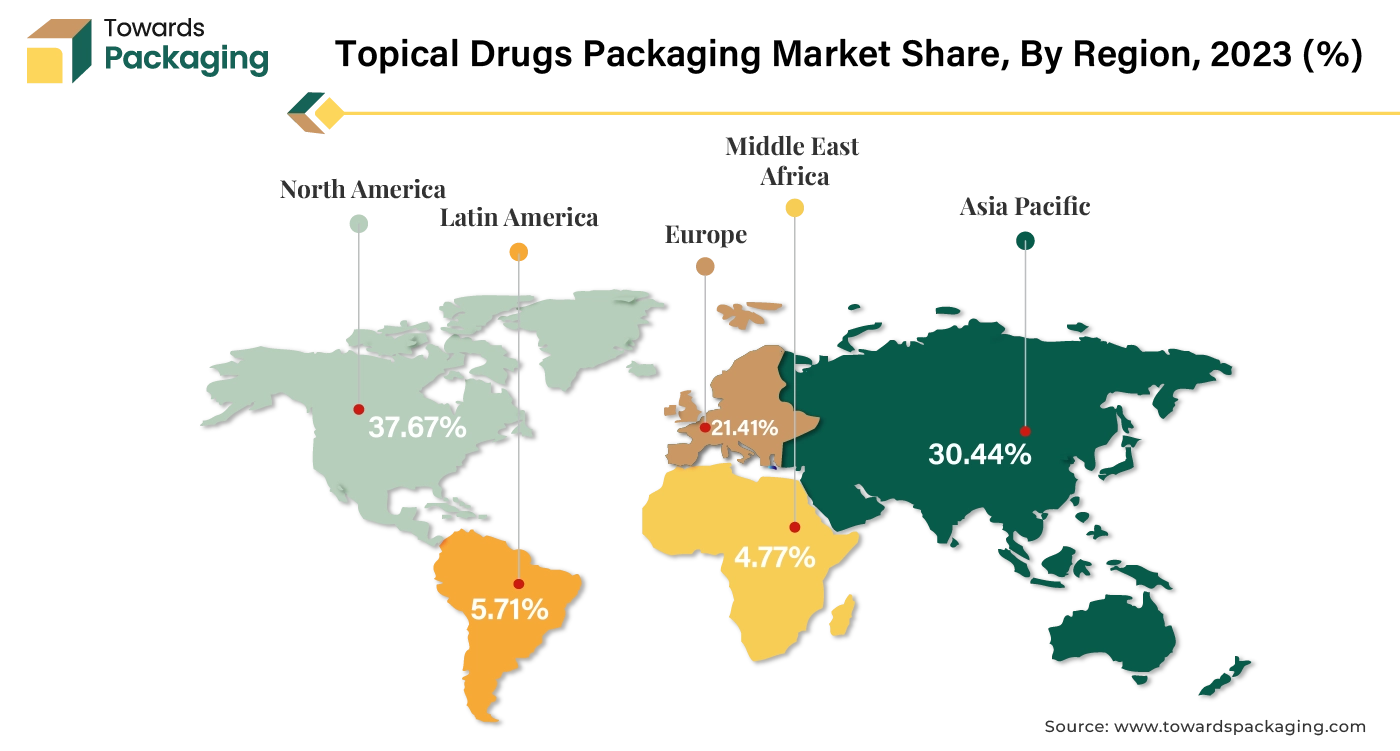

Asia Pacific is likely to grow at fastest CAGR of 12.15% during the forecast period. This is owing to the growing middle class population which is increasingly focused on health and wellness and higher healthcare expenditure across the region. Furthermore, the growing pharmaceutical sector in countries like India and China that are leading the production of both active pharmaceutical ingredients (APIs) and finished products is also expected to contribute to the growth of the market in the region. Since the start of the 14th Five-Year Plan period (2021–2025), China's pharmaceutical industry has witnessed an average yearly growth of 9.3 percent in its major business revenues, according to the Ministry of Industry and Information Technology (MIIT).

Additionally, the increasing investments in improving the healthcare infrastructure and access by the governments along with the rapid growth of e-commerce and modern retail channels are also anticipated to promote the growth of the market in the region in the years to come.

North America held largest market share of 37.67% in 2024. This is due to the presence of the most developed healthcare systems in the world, with significant investments in medical research, drug development and healthcare services across the region. Also, the strong consumer demand for skincare products driven by an increase in focus on personal care, wellness and the prevention and treatment of skin conditions along with the popularity of over-the-counter (OTC) topical treatments and cosmetic products is further expected to support regional growth of the market in the years to come. Furthermore, the high prevalence of dermatological conditions as well as the increased awareness and diagnosis of skin issues is also expected to support the regional growth of the market in the near future.

By Packaging Material

By Product Types

By Nature

By End Use

By Region

April 2025

March 2025

March 2025

March 2025