February 2025

.webp)

Principal Consultant

Reviewed By

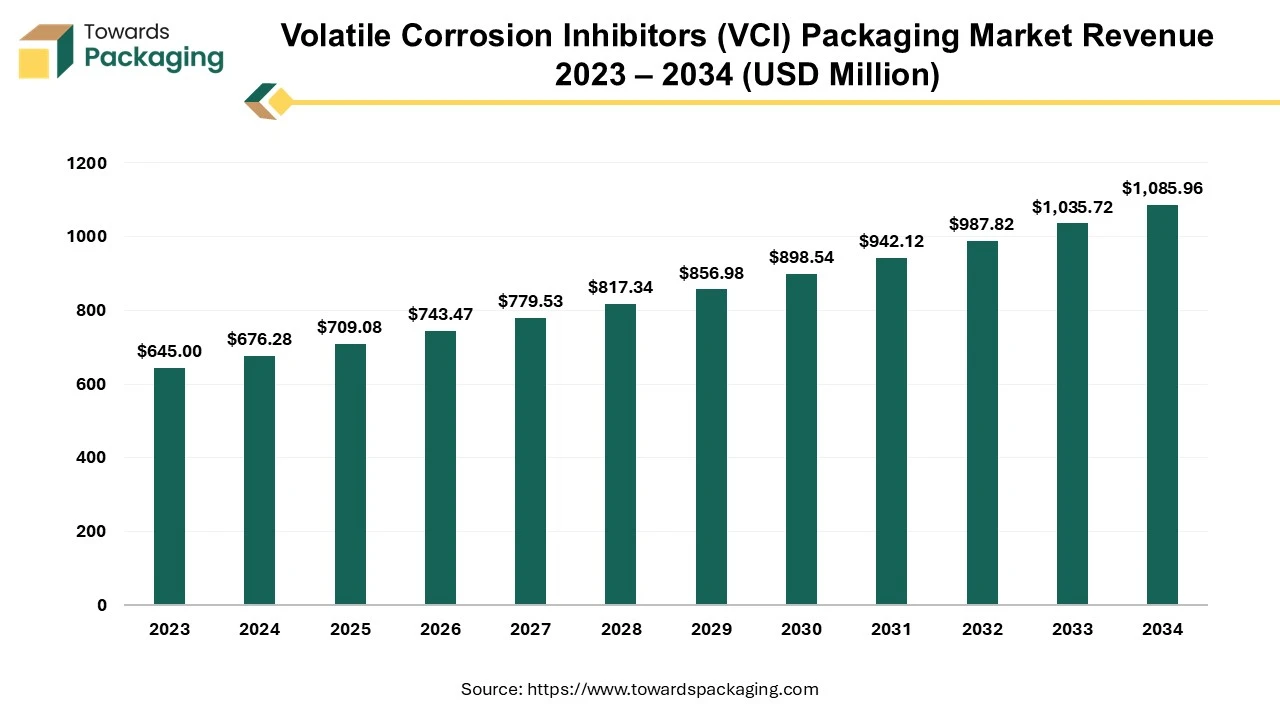

The volatile corrosion inhibitors (VCI) packaging market is expected to grow from USD 709.08 billion in 2025 to USD 1085.96 billion by 2034, with a CAGR of 4.85% throughout the forecast period from 2025 to 2034.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing volatile corrosion inhibitors (VCI) packaging which is estimated to drive the global volatile corrosion inhibitors (VCI) packaging market over the forecast period.

The materials that release corrosion-inhibiting vapours to protect metal surfaces from rust and corrosion is known as Volatile Corrosion Inhibitor (VCI) packaging. This type of packaging often includes films, papers, or coatings that emit VCI compounds, which develop a protective atmosphere around the metal items enclosed within. The inhibitors work by adsorbing onto the metal surfaces, forming a protective layer that prevents moisture and corrosive agents from causing damage. VCI packaging is commonly used for shipping and storing metal parts in various industries.

Volatile Corrosion Inhibitor (VCI) packaging is a specialized form of packaging designed to protect metal items from corrosion during storage and transport. This technology utilizes materials that release vapour-phase inhibitors into the air within the packaging, creating a protective atmosphere around the enclosed metal surfaces.

Volatile Corrosion Inhibitor (VCI) compounds volatilize and diffuse throughout the packaging environment. They adsorb onto the surfaces of metals, forming a thin, protective film that repels moisture and other corrosive agents. There are several types of VCI compounds, including amines, carboxylates, and phosphates, each offering different levels of protection and compatibility with various metals. Many VCI products are developed to be environmentally friendly and non-toxic, making them safe for use in various settings. VCI packaging is widely used across various industries, including automotive, aerospace, electronics, and manufacturing. It is particularly beneficial for storing spare parts.

The rise of e-commerce and global shipping increases the need for reliable packaging that protects products from corrosion during transit. Increase in online shopping leads to higher volumes of goods being shipped, particularly metal components that require protection from corrosion during transit. eCommerce allows businesses to ship products worldwide, necessitating effective packaging solutions like VCI to safeguard items over longer distances and varied environmental conditions. The customers expect products to arrive in good condition. VCI packaging offers reliable protection against moisture and corrosion, enhancing customer satisfaction. As companies seek to minimize losses from damaged goods, VCI packaging provides a cost-effective solution by reducing corrosion-related issues and associated costs.

There is a growing emphasis on eco-friendly packaging solutions. Manufacturers are developing biodegradable and recyclable VCI materials to meet environmental regulations and consumer preferences.

Companies are focusing on customized VCI packaging solutions tailored to specific industries and products, enhancing functionality and effectiveness.

The development in the automobile industry has significantly driven the growth of the global volatile corrosion inhibitors (VCI) packaging market over the forecast period. As global automotive production increases, the need for protective packaging during shipping and storage of parts and components rises, boosting demand for VCI solutions.

Automakers prioritize high-quality components, and using VCI packaging assists to ensure that parts remain corrosion-free, thus maintaining product integrity and reliability.

The automotive industry usually depends on intricate supply chains involving numerous suppliers. Volatile Corrosion Inhibitors (VCI) packaging streamlines logistics by protecting metal parts from corrosion, minimizing damage during transport.

As the automotive industry moves towards more sustainable practices, Volatile Corrosion Inhibitors (VCI) packaging provides eco-friendly options that help meet regulatory requirements and reduce environmental impact.

The key factor restraining the growth of the volatile corrosion inhibitor (VCI) packaging market is threat of competition from alternative packaging solution and the variability in performance. The manufacturing of specialized VCI materials can be expensive, which may limit adoption among cost-sensitive industries. Many potential users may not be fully aware of the benefits and applications of VCI packaging, hindering market growth. Other corrosion protection methods, such as coatings and traditional packaging, may be preferred due to lower initial costs or established use.

Compliance with environmental regulations regarding certain chemicals in volatile corrosion inhibitor (VCI) products can complicate production and limit some formulations. The effectiveness of volatile corrosion inhibitor (VCI) products can vary based on environmental conditions, leading to concerns about reliability among users. In mature markets, the presence of established competitors can lead to intense pricing pressures and limit growth opportunities.

Asia Pacific region dominated the global volatile corrosion inhibitors (VCI) packaging market in 2024. Asia Pacific region's booming manufacturing and industrial sectors, particularly in countries like China and India, drive demand for effective corrosion protection solutions. Strong growth in the automotive and electronics sectors in Asia Pacific region, which require robust packaging solutions, contributes significantly to VCI market expansion. The region's high levels of export activities necessitate reliable packaging to prevent corrosion during transit, boosting the demand for VCI solutions.

Europe region is anticipated to grow at the fastest rate in the volatile corrosion inhibitors (VCI) packaging market during the forecast period. Europe has a strong manufacturing base, particularly in industries like automotive, aerospace, and machinery, which require effective corrosion protection. The region's strict environmental and safety regulations drive the adoption of high-quality, compliant VCI packaging solutions. Strong investment in R&D within Europe fosters innovation in VCI technology, enhancing product performance and broadening applications. Secondly, as German is the major manufacturer of the automotive parts, metals, and heavy equipment, the demand for the volatile corrosion inhibitors (VCI) packaging is more in the Europe region.

The VCI bags (flat, gusseted, and zipper) segment held a dominant presence in the volatile corrosion inhibitors (VCI) packaging market in 2024. VCI bags release volatile compounds that form a protective layer on metal surfaces, preventing oxidation and rust. Protecting against corrosion can save costs related to damage, repairs, and maintenance, making VCI bags a cost-effective solution. These bags are easy to handle and can be used without additional coatings or treatments, simplifying the packaging process. They are safe for use with various metals, including steel, copper, and aluminum, and do not leave residues that could affect product performance. Many VCI bags are designed to be environmentally friendly, with some being recyclable or biodegradable. VCI bags can be used across multiple industries, including automotive, electronics, and aerospace, enhancing their market applicability. These benefits attribute to make VCI bags a preferred choice for industries looking to protect their metal products effectively.

The automotive segment accounted for a considerable share of the volatile corrosion inhibitors (VCI) packaging market in 2024. Automotive components are frequently exposed to moisture and corrosive environments during storage and transport, necessitating effective protective solutions. The automotive industry relies on a complex supply chain, where VCI packaging helps ensure the integrity of parts throughout the manufacturing and delivery processes.

The electrical and electronics segment is expected to grow at the fastest rate in the volatile corrosion inhibitors (VCI) packaging market during the forecast period of 2024 to 2034. Electronic components are sensitive to corrosion, which can lead to malfunctions and reduced lifespan. VCI packaging provides effective protection during storage and transportation. The growing consumer electronics market, including smartphones, laptops, and other devices, drives demand for protective packaging to ensure product quality. The electronics industry often involves global supply chains where VCI packaging can safeguard components from corrosion during transit across varying climates.

Telecommunications, consumer electronics, automotive electronics, industrial automation, and other industries are all included in the electronics business. The demand for electronic devices and components has increased as a result of the notable expansion and technological advancements in each of these areas. The need for efficient corrosion protection solutions has increased as electronic devices become more complicated and smaller, making them more susceptible to corrosion. Because of their dependability and convenience, VCIs are a popular option.

By Type

By Application

By Region

February 2025