April 2025

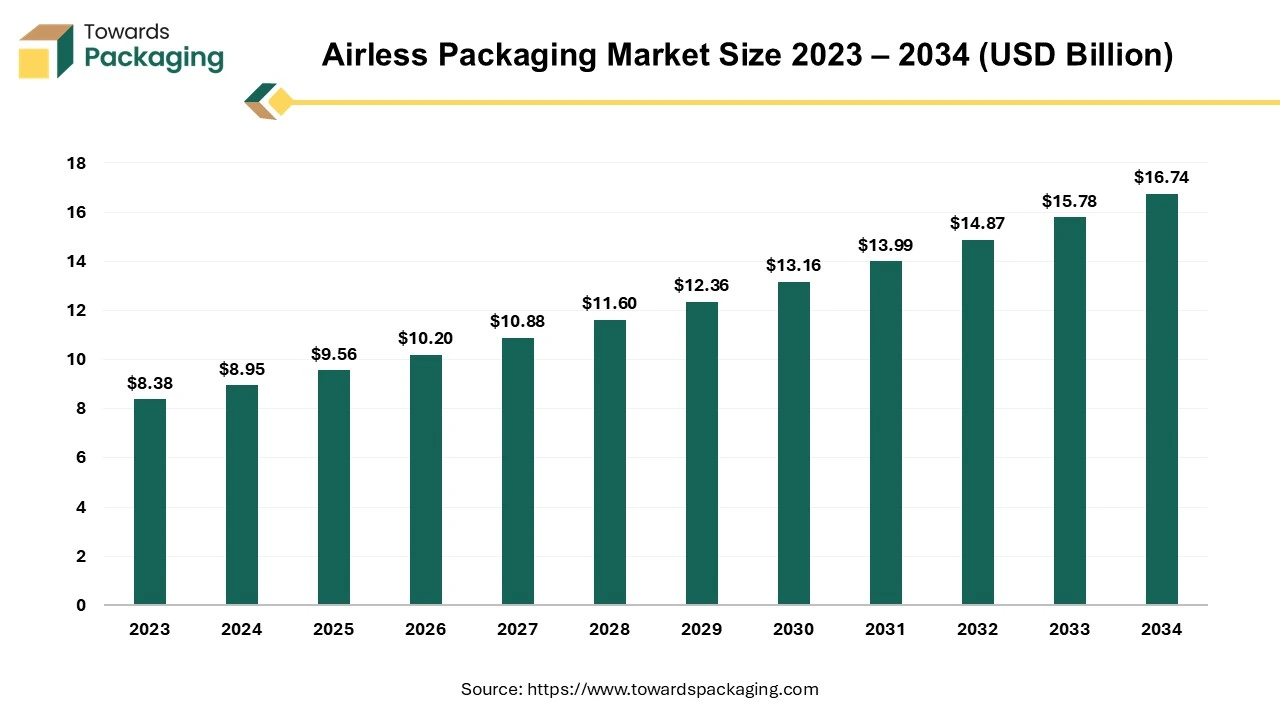

The airless packaging market is forecasted to expand from USD 9.56 billion in 2025 to USD 16.74 billion by 2034, growing at a CAGR of 6.79% from 2025 to 2034.

Airless packaging is a breakthrough product delivery technology that keeps an enclosed and air-free environment independent of the product level. It has a built-in piston made-up of the plastic that rises with the each usage, efficiently moving the product from the bottle's base towards the dispenser. This creative design removes the typical air gap that a conventional pump leaves behind. The airless packaging has swiftly achieved prominence in the cosmetics industry and is projected to experience a considerable growth during the forecast period.

The rising demand for extended product shelf life and enhanced quality preservation coupled with the increasing consumer awareness about the benefits of airless packaging is anticipated to augment the growth of the hot-fill food packaging market within the estimated timeframe. The rising focus on sustainability and eco-friendly materials along with the growing premium and luxury segments in the cosmetics and personal care industry is also expected to support the market growth. Furthermore, the growing strategic collaborations and partnerships within the industry as well as new product launches is also likely to contribute to the growth of the market in the years to come. The global packaging market size is estimated to grow from USD 1.20 trillion in 2022 to reach an estimated USD 1.58 trillion by 2032, growing at a 3.16% CAGR between 2023 and 2032.

The growing demand for product preservation is expected to support the growth of the market during the forecast period. The food and beverage packaging is seeing an increase in the utilization of the airless packaging as a way of maintaining the food's flavor and quality. The primary benefit of utilizing an airless bottle is its ability to preserve the product's freshness as well as the purity for an extended duration. Additionally, it lets the customers use every last bit of the item, which further cuts down the waste.

Furthermore, these containers are highly valued in the cosmetics sector for providing excellent shelf stability and comprehensive formula preservation. By utilizing these packages, the amount of chemical preservation that is utilized in the cosmetics can be decreased, which is beneficial as chemical preservation has damaging impacts on skin. As a result, a lot of companies favor using airless packaging. Numerous hair care items, lotions, creams, gels, and various other products that need to be shielded from environmental dangers are packaged in these containers. Although airless bottles are a tried-and-true standard in the cosmetics industry, certain packaging manufacturers have also incorporated the airless idea into various other packaging designs.

For instance,

Olive Packaging provides a variety of shaped Bag-in-Bottle (BIB) airless configurations. An exterior layer of PCR PET is heavy, thick, and moldable into an infinite variety of shapes. Depending on their formulation and application requirements, brands can select between an inner liner composed of an FDA-certified elastomer which contracts when used in conjunction with an airless dispenser and a two layer EVOH (or PET) choice.

With this growing demand for product preservation as well as the introduction of other packaging formats, the market for airless packaging is expected to increase as a popular packaging option in the beauty industry.

The main components of the airless packaging, including plastics, metals and glass are susceptible to the price fluctuations and unstable market conditions. For example, fluctuations in the price of plastics derived from the petroleum can cause abrupt shifts in the cost of producing packaging. Due to the uncertainties caused by geopolitical strife, oil prices are still unstable. Given that one-third of the global seaborne oil traffic originates from the Middle East, the most recent conflict there has increased geopolitical risks for the markets for commodities. Even though it would be a retreating situation, a conflict's escalation might cause significant disruptions to the oil supply, depending on its span and scope.

Furthermore, the oil sector also faces a number of possible upside threats such as the likelihood for Saudi Arabia and Russia to keep up or raise their production cuts. Even with the recent spike in the oil production, there's a chance that the U.S. shale oil sector won't be able to reach the anticipated production levels, particularly by 2025. These variations may lead to the increased manufacturing costs, which could then be passed down to the customers and have an impact on the competitiveness and affordability of the airless packaging options. Additionally, as raw material costs are unpredictable, producers may have difficulties with the financial planning and budgeting. Long-term expenditures in the research and development may be hampered due to this uncertainty since companies may be reluctant to commit resources in the absence of the reliable cost estimate.

Packaging innovation has been spurred by the consumer recognition of beauty's role in the worldwide problem of the waste from packaging in the oceans and landfills, forcing companies to reconsider how they make and pack their goods. Today's responsible shoppers take environmental effect and the package composition into account in addition to the aesthetics. Across all the demographics, one trend that is in demand is sustainability. According to a recent study, consumers from the baby boomers to the Gen Z—now value sustainability more than brand awareness when making decisions. Organizations have been leading this trend and are dedicated to producing packaging solutions that shape the standard of beauty in the future by creating items that are impactful and innovative for a market that is always evolving.

For instance,

Adopting the sustainable materials as well as practices in the airless packaging reduces the environmental footprint associated with traditional packaging solutions. Furthermore, companies that lead in sustainability can differentiate themselves in the market, gaining a competitive edge as consumers increasingly prioritize the eco-friendly products.

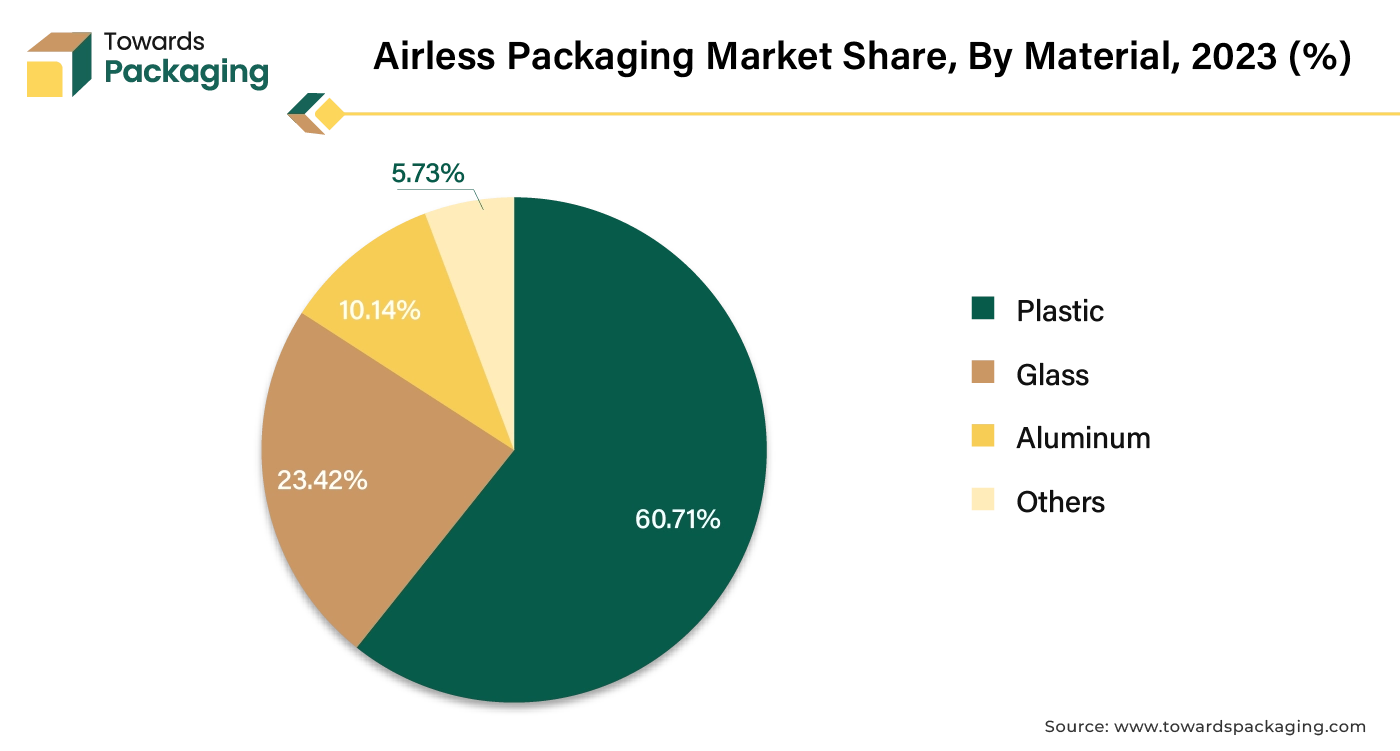

The plastic segment captured largest market share of 60.71% in 2023. Plastic has gained popularity as a packing material for the airless packaging due to its formability and technical versatility. In Europe, almost 40% of the plastic is used in the packaging and provides excellent product protection while being incredibly lightweight as well as economical. Using plastic in the packaging has also reduced the food waste and greenhouse gas emissions, essentially making it possible to feed everyone on the planet today. Furthermore, the majority of airless bottles are composed of polypropylene (PP) plastic, which makes them recyclable and contributes to the waste reduction. This guarantees product integrity and gives the international beauty brands easy access to an eco-friendly product that is highly sought after by the consumers who want to make more sustainable decisions about the skincare products they use and the brands they purchase.

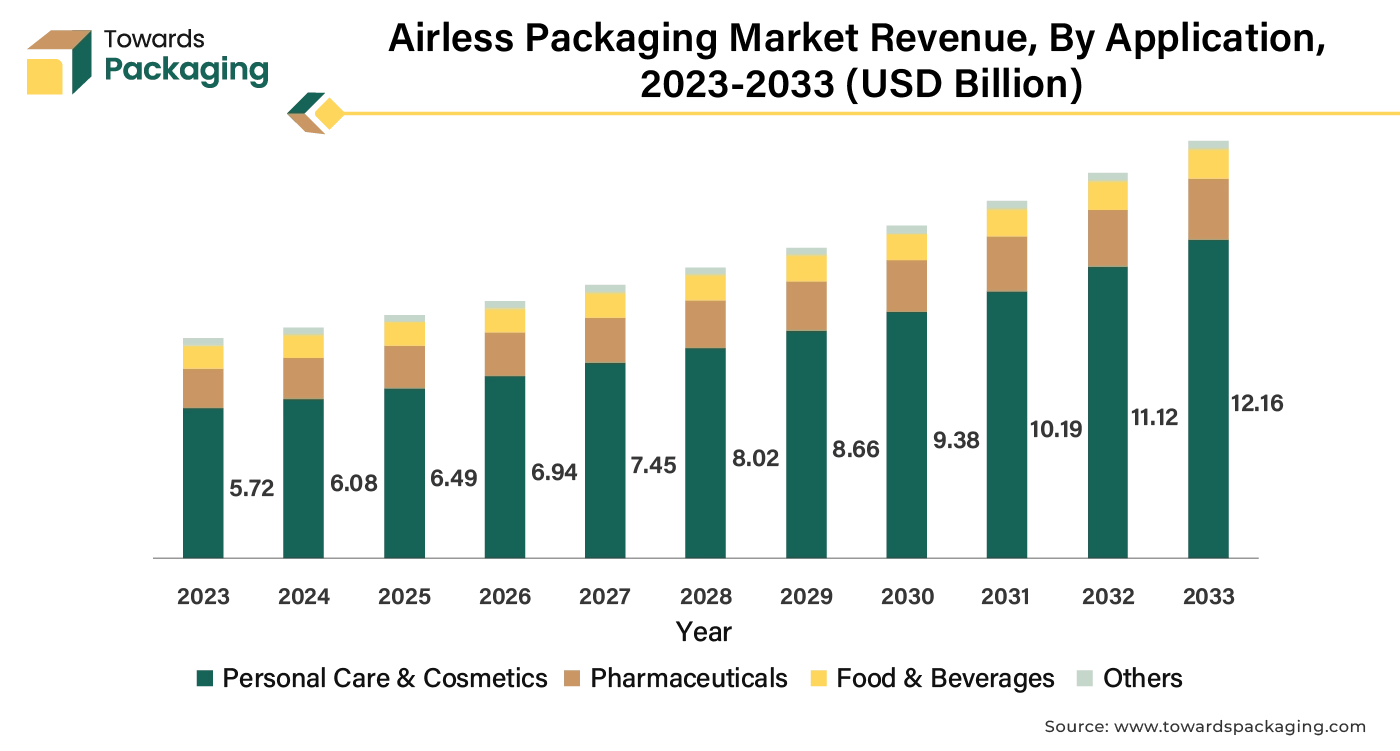

The personal care & cosmetics segment held largest market share of 68.23% in 2023. This is owing to the growing awareness of the personal grooming as well as self-care which has increased the consumer demand for the cosmetic products such as skincare, makeup and the anti-aging solutions. A lot of the best active chemicals for skin care, such as the retinol and vitamin C, degrade when exposed to the air. Skincare firms utilize airless packaging as a proactive precaution to make sure compositions stay powerful and effective. An airless pump made to prevent oxidation of lotions, creams and serums are an excellent example. It is also more hygienic and reduces the waste and permits accurate dosage—all of which contribute to a flexible, secure and efficient packing. Furthermore, the growing attraction of the sustainable alternatives and the clean-label items is also expected to increase the demand for airless packaging in the personal care and cosmetics sector.

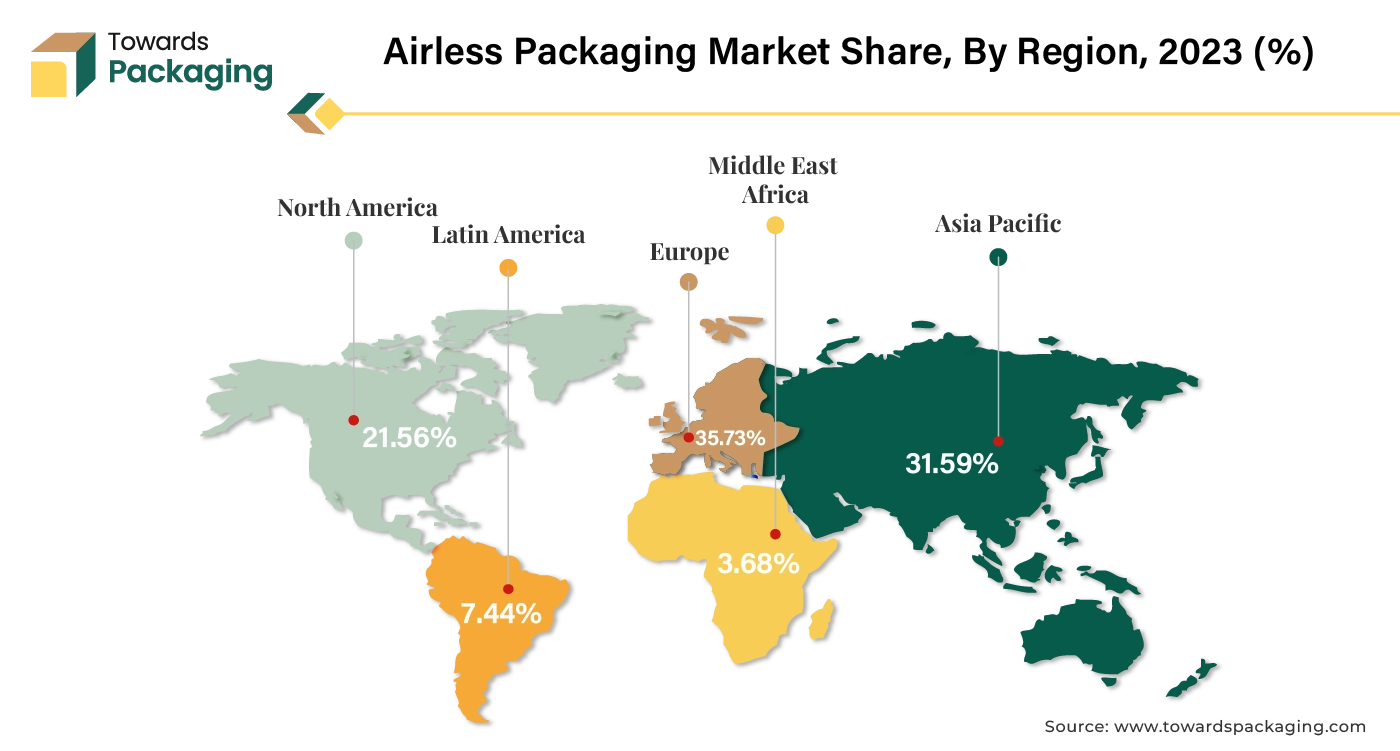

Europe held largest market share of 35.73% in 2023. This is owing to the growing cosmetics and the personal care industry across the region. According to the data by the Cosmetics Europe (The Personal Care Association), Europe, with a retail sales price estimated at USD 106.08 billion (€96 billion) in 2023, is the world's leading market for personal care and cosmetics products. In Europe, Germany is valued at €15.9 billion, France at USD 15.14 billion (€13.7 billion), Italy at USD 13.81 billion (€12.5 billion), UK at USD 12.16 billion (€11.0 billion) and Spain at USD 11.49 billion (€10.4 billion) and are the biggest national markets for the cosmetics and personal care goods. Additionally, the stringent regulations regarding product safety, quality and environmental impact as well as the strong focus on the environmental sustainability is also anticipated to promote the growth of the market in the region in the years to come.

Asia Pacific is expected to grow at the fastest CAGR of 8.76% in 2023. This is due to the ongoing industrialization in the economies like China and India which has accelerated the production and consumption of packaged goods like the cosmetics, pharmaceuticals, and food products along with the expanding middle class population with increased consumer spending on premium and high-quality products across the region. Also, the increasing focus on product safety and hygiene among consumers and the growth of the e-commerce shopping is further expected to support regional growth of the market in the years to come. Furthermore, the escalating population of the working women is also expected to support the regional growth of the market in the near future.

Some of the key players in airless packaging market are Albea Group, Silgan Dispensing Systems, Berry Global, APTAR Group, HCP Packaging, APC Packaging, Quadpack Industries, Cosmogen, Lumson, STP, M&H Plastics, and Mold-Tek Packaging, among others.

By Material

By Product Type

By Application

By Region

April 2025

April 2025

April 2025

April 2025