April 2025

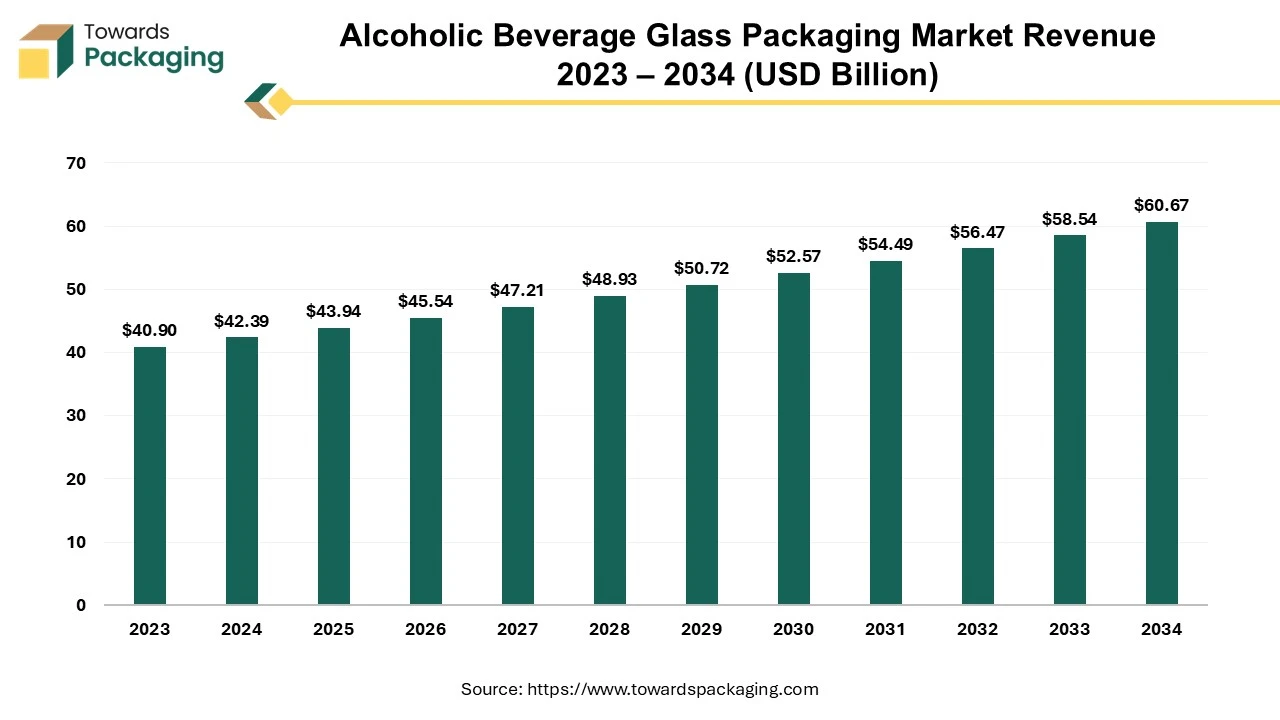

The alcoholic beverage glass packaging market is expected to increase from USD 43.94 billion in 2025 to USD 60.67 billion by 2034, growing at a CAGR of 3.65% throughout the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The market is proliferating due to the increasing consumption of alcoholic beverages by people for celebrations, high disposable earnings, societal demand, and many other factors. Consumers' continuous demand for eco-friendly packaging is pushing the alcoholic beverage glass packaging market.

The alcoholic beverage glass packaging market is an important industry in the packaging sector. Alcoholic beverage glass packaging shields the product or improves its brand distinguishability and plays an important role in customer decision-making. This deals with sustainable packaging and moving alcohol bottles to several places. This market is commonly determined by the growing trend of premium-looking bottle demand among consumers which should also be suitable to use.

The alcoholic beverage glass packaging industry deals with producing different types of bottles with a variety of shapes, sizes, colors, locking systems, and many others. This industry manufactures different quality glass bottles with a variety of designs which makes it different from one brand to another. These bottles are of different types according to their weight as well. As there is a huge demand for lightweight glass bottles the growth factor of this industry is exponential.

While complicatedly designed beverage packaging might draw attention, consumers are more inclined towards brands that deliver effortlessness in their appearance. Thus, the development of alcohol incasements takes a diverse turn with inventions touching on pattern, sturdiness, and even environment-friendly takeout choices. In a mission to hit an equilibrium between presenting their brand competence and ecological preservation and also providing suitable takeout packages, producers are introducing unique packaging conditions that make it smooth for customers to be influenced into purchasing their beverages. The high-quality option of spirit existing matters significantly when starting brand identity and carbon footprints over these efforts.

One of the major developments in the alcoholic beverage glass packaging market is the growing consumption of alcohol globally. This rise in consumption is pushed by a rising number of people with growing disposable earnings and a social modification in the direction of drinking on occasion. Moreover, the craft beer drive has expanded, increasing the spread of brewpubs and microbreweries. These launches frequently favor glass bottle packaging for its finest look and capability to reserve taste and worth, thus driving the demand in the industry.

The availability of customization options for the beer glass bottles for different markets according to their requirement led to growth in the business of these glass packaging.

The capacity to withstand external conditions and transportation of these bottles from one place to another in an organized manner led to the growth of the market. These bottles help to transport beer without any contamination.

The growing demand for eco-friendly packaging raised the beer glass packaging market. It can be recycled and reused several times which makes it preferable to consumers.

Alcoholic beverage glass packaging plays a significant role in the beverage packaging sector. It plays a main portion in the customer's choice of consuming beverages. Unique alcoholic beverage packaging solutions permit brands to be exceptional in the market. Strategies that are made precisely to express the uniqueness of the alcoholic beverage brands and according to the demand of consumers can help to greatly enhance their market position.

Primarily, the growing demand for environment-friendly and sustainable alcoholic beverage packaging solutions has resulted in a revival in glass bottles because of their less negative impact on the environment and multiple times recycling options. Furthermore, customers observe glass as the finest and most secure packaging possibility, mainly for beverages such as craft beers, wine, and spirits improving the complete product demand. Moreover, glass delivers exceptional blockade properties, conserving the quality and taste of alcoholic beverages.

However, the market players face multiple challenges, such as the high manufacturing charges for glass bottles. Whereas other options for packaging materials such as aluminum and plastic. Also, the brittleness of glass packaging can intensify transport and handling charges, making logistics a main apprehension for producers and suppliers. Balancing the profits of glass packaging with budget-friendly solutions remains a serious challenge for the alcoholic beverage glass bottle packaging market.

Asia Pacific witnessed the highest revenue share for the year 2024 this growth is because rising disposable earnings increase the demand for alcoholic beverage glass packaging solutions. This progress is mainly determined by the growing urbanization, changing consumer preferences, and demand for sustainable solutions in countries such as Japan, China, South Korea, Thailand, and India. The increasing popularity of alcoholic beverages and their packaging among the young population and the rising adoption of superior quality and craft beers are contributing to the request for alcoholic beverage glass packaging in these countries.

Moreover, favorable government guidelines and funds in the brewery industry additional support to market development. The Asia Pacific market delivers noteworthy opportunities for alcoholic beverage glass packaging producers to tap into the increasing customer base and grow advanced packaging solutions personalized to the preferences of the region.

Some of the major market players contributing to the growth of the alcoholic beverage glass packaging market are Shandong Pharmaceutical Glass Co.,ltd, Hualian Bottle, Huaxing Glass, Roetell, Garbo Glass, Lumeng Glass, Crystal, and many others. These are well-known for producing eco-friendly packaging solutions for the alcohol industry.

North America is estimated to grow at the fastest rate over the forecast period. The alcoholic beverage glass packaging market shows changing developments in materials for better environment-friendly products along with several aspects such as sustainability, economic conditions, cultural preferences, and alcohol consumption trends. In countries such as the U.S. and Canada, the market is considered by a strong occurrence of brewers and a superior quality of alcohol consumption.

These countries have numerous major market players such as Saverglass, Ball Corporation, Orora Ltd, Gerresheimer AG, Owens-Illinois, Verallia, O-I Glass, and many others which contribute significantly to the growth of this market. The demand for alcoholic beverage glass packaging in North America is determined by the rising craft breweries' influence, which highlights authenticity, quality, and exclusive packaging. Moreover, the trend in the direction of eco-friendly packaging and the growing popularity of special alcoholic beverage brands further push the market to grow in this region.

By type, the 250 ml segment led the alcoholic beverage glass packaging market in 2024. 250 ml bottle is widely used in several celebrations in offices, residents, and various other sectors. As these are considered to be appropriate for the consumers.

By application, the beer segment led the alcoholic beverage glass packaging market in 2024. These are highly preferred by the commercial sector celebration which eventually enhances the demand in the market. As alcoholic beverage glass packaging helps to maintain the quality of alcohol hence, these are preferred by brands as well as consumers.

By Type

By Application

By Region

April 2025

April 2025

April 2025

April 2025