April 2025

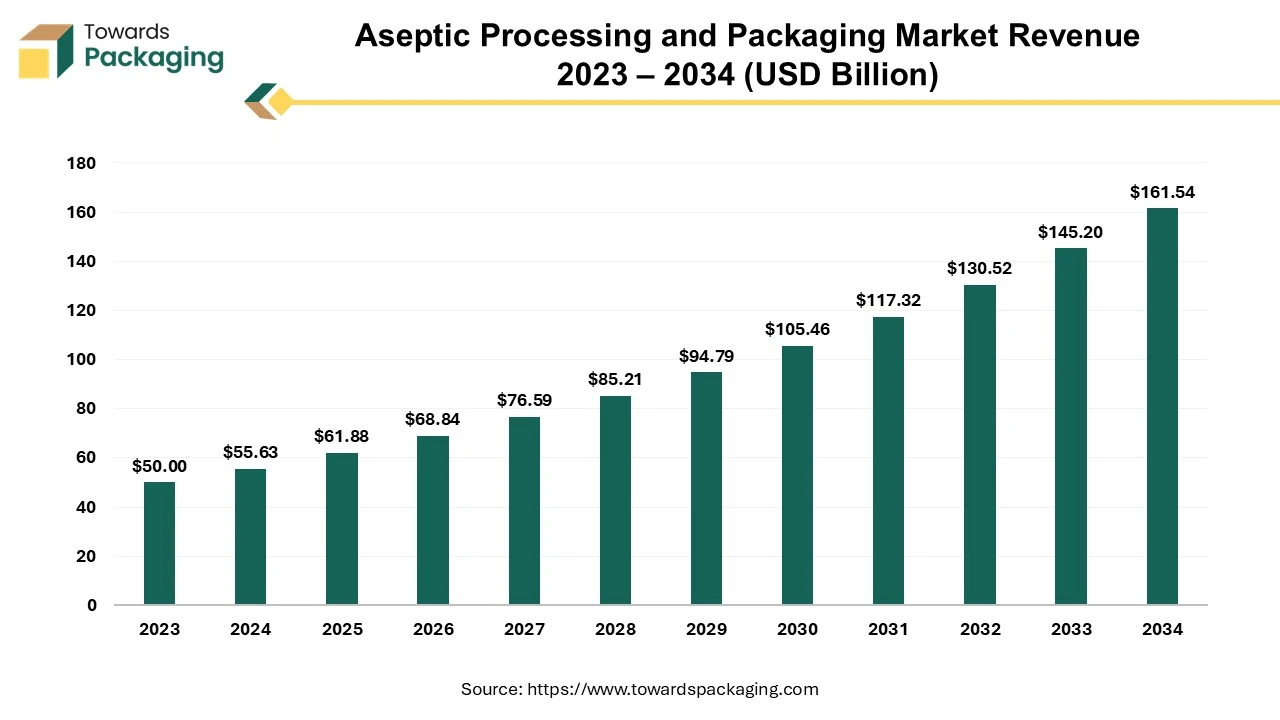

The aseptic processing and packaging market is anticipated to grow from USD 61.88 billion in 2025 to USD 161.54 billion by 2034, with a compound annual growth rate (CAGR) of 11.25% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The global aseptic processing and packaging market is growing steadily, and as the demand for convenient, clean food increases, so will new food products. Although the industry has been slow to adopt aseptic processing for foods with multiphase or different nutrients, consumers are demanding more aseptically processed foods in the future.

The global aseptic processing and packaging market is growing rapidly as aseptic packaging allows products to be processed and stored at room temperature (ambient) without the need for preservatives during the processing of organoleptic properties. This means that the taste, smell, color, texture, and nutritional value remain the same for a long time. Aseptic processing and packaging refers to the processing and packaging of sterile products in sterile containers and then sealing them with sterile seals to prevent any viable microbiological recontamination with living organisms.

Aseptic processing and packaging are different from canning the food is placed in the can, sealed, and heat processed in that order. Compared to other shelf-stable products produced using traditional methods such as cans, products produced with aseptic technology are generally better due to the shorter processing time, which reduces the package size and configuration. Since sterile products can be packaged in different types and sizes, it ensures customer satisfaction and provides good flexibility to the processes.

The aseptic processing and packaging market is observed to experience significant growth due to increasing consumer awareness of environmental safety and government regulations that reduce climate impact. Aseptic packaging uses recycled materials such as paper and boxes to meet the increasing demand for environmentally friendly products. As consumers become more concerned about their environmental orientation, manufacturers are taking steps to meet these preferences. In addition, aseptic processing, which involves sterilizing food and beverages separately from their containers, strengthens market development by ensuring the safety and quality of consumer packaged goods. The combination of environmental responsibility and food safety has made aseptic packaging important in the growing food technology.

Aseptic processing and packaging solutions allow companies to maintain high food safety standards while minimizing product waste. Aseptic packaging also provides efficient and effective transportation because it does not require refrigeration or storage and can reach customers in many remote areas, contributing to the growth of the global aseptic processing and packaging market.

Aseptic packaging is a significant innovation in the packaging industry aimed at extending the shelf life of products while maintaining their sterility.

The integration of robots into the cleanroom environment is still in its early stages and offers significant opportunities for the aseptic processing and packaging market. As robotic systems become more efficient and customizable, their adoption is increasing, especially in small-scale procedures such as drug discovery. This change is based on the industry’s focus on reducing human intervention in aseptic processes and thus improving product quality during manufacturing. Furthermore, the increasing demand for good and affordable medicines and monitoring patient safety are driving companies to develop advanced technologies. These innovations have not only strengthened and stabilized the production of sterile products but have also paved the way for the market to grow to meet the changing needs of consumers and management.

For Instance,

The growth of the aseptic processing and packaging market is hampered by several major constraints, primarily related to capital expenditures and operational complexity. The high cost of sterile equipment has a significant impact on small companies that may have difficulty obtaining the necessary financial resources. The precision requirements in this process are also significant; Upgrading or rebuilding existing production lines also requires significant time and financial resources, which creates additional problems. In addition, operating aseptic systems necessitates specialized training, which increases overall operating costs and limits access to small businesses, thus limiting the growth of the business when there are increasing regulatory expectations.

The Asia Pacific held the largest share of the aseptic processing and packaging market and the region is observed to sustain the position during the forecast period as the packaging of sterile products into sterile containers under aseptic conditions and sealing of the containers from recontamination in the Asia Pacific region. The food and beverage industry is one of the largest consumers of durable packaging among all other industries in this region.

Use eco-friendly materials and recycling to reduce waste and reduce carbon emissions associated with packaging, transportation, and disposal of the product. The food processing industry has innovated in packaging. The eco-friendly food packaging industry is classified based on the choice of material, application, type, and technology, leading to the growth of the aseptic processing and packaging market.

For Instance,

North America is observed to grow at the fastest pace in the aseptic processing and packaging market with regional insights as exploring the transformative power of AI-powered digital twins in manufacturing, unlocking the potential level of performance and efficiency. In recent manufacturing, integrating modern technology is essential for competitiveness and improved performance. Environmental Monitoring Systems (EMS) help prevent sterilization in North America by deploying clean rooms, monitoring products, and more. The United States Pharmacopeial Convention sets guidelines for containers described in many drug monographs in Pharmacopeia/National Formulary (USP/NF). Additionally, government initiatives to reduce plastic packaging and promote sustainable manufacturing are driving innovation in the packaging industry. Sustainable packaging will become even more important by 2024 as more businesses recognize the need to reduce their environmental impact.

For Instance,

In June 2024, Bora Pharmaceuticals expanded its North American presence with the acquisition of an 87,000-square-foot sterile manufacturing facility in Baltimore, Maryland, formerly owned by Emergent BioSolutions. Nonviral, aseptic fill/finish services are available on four filling lines, which the company says include lyophilization, vial filling, and prefilled syringe filling.

By type, processing segments constitute the aseptic processing and packaging market as it involves longer shelf life, larger packages, wider packaging sizes wider container materials, and enhanced nutritional and sensory properties than canned products. Whereas packaging segments are fastest growing in the aseptic processing and packaging market as it is portable and lightweight, the process ensures that food products are protected from harmful bacteria and less energy is used to heat and sterilize products and containers.

In terms of application, the food and beverages segment is dominated aseptic processing and packaging market as aseptic packaging of food is the process of pre-sterilized food product is filled and hermetically foods into sterile packaging materials. The pharmaceutical segment fastest growing in the aseptic processing and packaging market as sterile drugs are used in most vaccines, biologics, other injectable drugs, cancer drugs, ear drops, nasal sprays, and eye drops. Sterile production, also known as fill-finish production, reduces the risk of bacteria and viruses being transmitted to the body during the administration of medication.

By Type

By Application

By Geography

April 2025

April 2025

April 2025

April 2025