April 2025

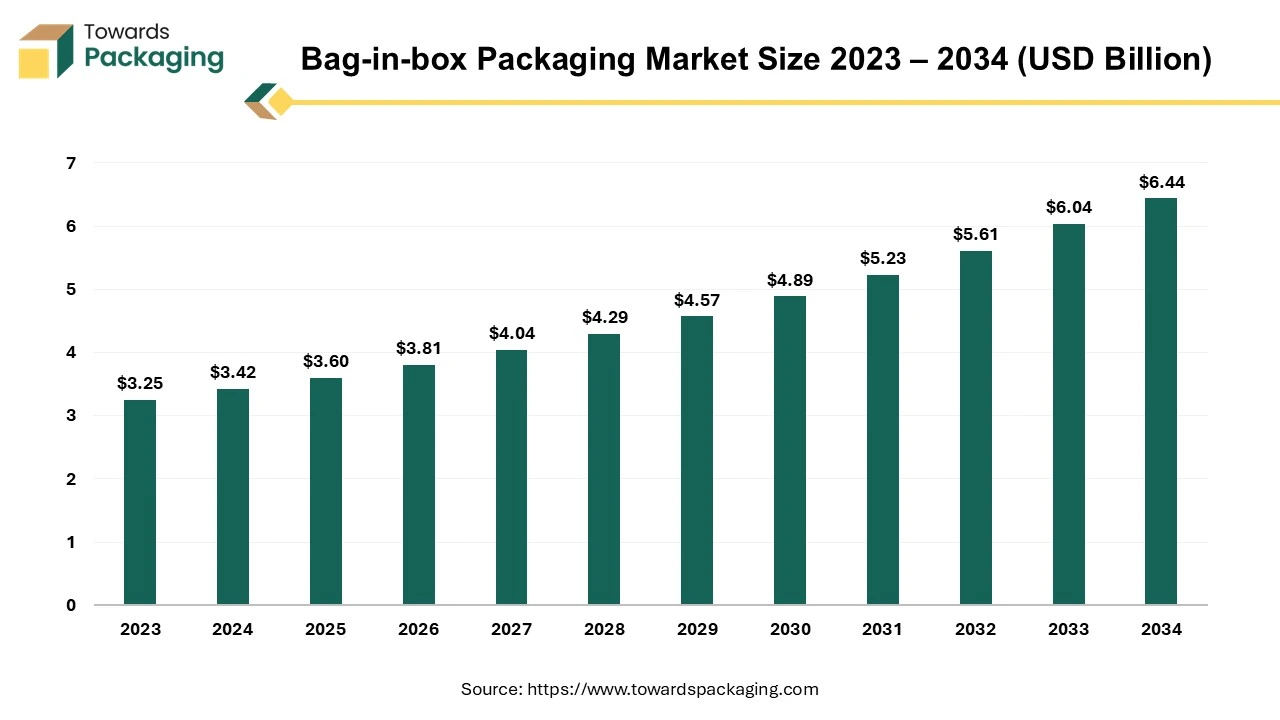

The bag-in-box packaging market is projected to expand from USD 3.60 billion in 2025 to USD 6.44 billion by 2034, growing at a CAGR of 6.54% during the forecast period.

Unlock Infinite Advantages: Subscribe to Annual Membership

The bag-in-box packaging market is likely to grow at a considerable CAGR in the near future. A bag-in-box packaging technique involves filling and sealing a flexible package, which is then placed within a carton. It is a fluid storage and transportation container. This high-strength laminated polyethylene bag is available in several capacities and may or may not have an aluminum layer. The bag in box packaging is made from high-quality materials that are utilized to make premium liquid packaging containers in the food sector. These containers are fully recyclable and safe to use. They are intended to increase the shelf life of industrial and food products that are liquid or semi-liquid. During transportation, solid board or corrugated cardboard offer superior protection.

The increasing consumer preference for sustainable and recyclable options along with the cost-effectiveness in transportation and storage as well as its ability to extend product shelf life by reducing oxidation is expected to augment the growth of the bag-in-box packaging market during the forecast period. Furthermore, the growing applications in beverages, food products and industrial liquids coupled with the increasing regulatory prominence on the eco-friendly materials is also anticipated to augment the growth of the market. Additionally, the rising awareness of environmental concerns as well as the rising demand in e-commerce due to its lightweight nature and the growing penetration in emerging markets is also projected to contribute to the growth of the market in the near future.

The shift towards at home consumption is anticipated to augment the growth of the bag-in-box packaging market during the forecast period. At-home drinking has grown in popularity among consumers in recent years. People are cooking their own meals and enjoying more time at home due to the last pandemic.

According to the consumer research by the International Wine and Spirits Record conducted in April 2023, approximately 60% of the consumers in North America as well as parts of South Africa, Europe and Australia reported decrease in their social activities and increased staying at home. When asked where they like to drink, consumers across all the regions indicated that they prefer to drink at home; this preference was weakest in Asia and strongest in Australia and South Africa. With respect to recalled consumption, 37% of consumers in the major markets mentioned the on-premise, whereas 58% of customers stated that their most recent alcohol use occurred at home.

This trend has increased customer demand for efficient and sustainable packaging such as BIB. Wine, juices, and liquid food products packaged in BIB forms are ideal for this purpose since they are lightweight, easy to store and have a longer shelf life due to reduced exposure to air and contaminants. Furthermore, cooking at home is becoming more and more popular as people seem to drink and eat healthier and save money, and family breakfasts have grown more popular as a way to start the day together.

Additionally, recent research shows that people are investing extra capital on beverages for consumption at home instead of going out to bars in order to escape rising inflation costs. Also, the rise in health-conscious consumers in 2024 has pushed beverage companies to reconsider their product lines and launch novel, wellness-focused beverages and this is further likely to increase the demand for bag-in-box packaging.

The competition from alternative packaging options is projected to impede the growth of the bag-in-box packaging market during the estimated timeframe. Packaging options such as plastic bottles, cans and glass containers remain popular due to their durability, established consumer trust and widespread availability. Glass bottles are among the oldest forms of packaging and have been used for ages. Glass continues to be commonly used in the production of beverages today, as organizations capitalize on consumers' nostalgia for vintage soda pop, record players, and mom-and-pop restaurants.

Glass is still a popular option among companies all around the world due to this. Glass is also a sustainable choice for the organizations searching for an eco-friendly packaging product since it is 100% recyclable. Apart from its environmental benefits, glass has numerous additional positive attributes.

Furthermore, cans are also widely utilized in the beverage segment and acts as another popular substitute. Cans are a stylish and long-lasting way to package everything from sparkling water to wine spritzers. Additionally, they are gaining popularity in alternative markets such as those that provide kombucha, coffee and different fitness elixirs, as well as in the health food sector. A can's extended shelf life and safe transportation are guaranteed by its high difficulty in being punctured. To keep every drink as fresh as possible, beverage manufacturers can also air-seal these cans and maintaining the product's carbonation.

Besides that, aluminum cans are the world's most recycled container. In addition, flexible pouches that are lightweight, cost-effective and highly portable are increasingly being adopted for various liquid and semi-liquid products. As alternative formats continue to evolve, they are expected to challenge the market penetration of the bag-in-box packaging within the estimated timeframe.

The growing global focus on the sustainability is expected to create substantial growth opportunity for the bag-in-box packaging market in the near future. As the governments as well as organizations implement strict regulations to combat the environmental challenges, the demand for eco-friendly packaging has surged. For instance, the United Kingdom has been taxing on the non-recycled plastic packaging effective from April 1, 2022.

The levy is for all the packaging manufactured in the UK or imported from other countries that does not have minimum 30% of the recycled plastic content. Bag-in-box packaging is appropriate for these trends owing to its low-waste design.

Bag-in-box packaging is substantially more eco-friendly in comparison to the plastic pails since it requires less energy. The majority of pails are composed completely of high-density polyethylene, a more hard plastic that is only recycled around 30% of the time, as reported by the Environmental Protection Agency. Petrochemicals are used as raw materials in the production of plastic, which results in greenhouse gas emissions during the process. Bag-in-box reduces the amount of plastic used, as well as emissions and waste, as only the bag portion is composed of plastic and it is a lower density variety.

Cardboard is 100% recyclable and biodegradable, making it one of the materials with the least negative effects on the environment. More precisely, corrugated cardboard deteriorates over the course of a year at most. A bag-in-box package is made up of more than 75% corrugated material that is completely recyclable, sustainable, and biodegradable.

The remaining 25% is made of plastic, whose ability to be recycled varies depending on the region and the infrastructure for collection, sorting, and recycling. Making the shift to bag-in-box reduces greenhouse gas emissions by 52% and production energy by 81%, owing to the sustainable production, reduced resources and utilization of more recyclable materials. With sustainability being an important decision-making factor for companies as well as consumers alike, bag-in-box packaging is well-positioned to capitalize on this opportunity and drive the market growth.

Across production, packaging and distribution, artificial intelligence (AI) has emerged as a dependable technology to drive the next development. Some of the main factors pushing the packaging sector to use AI consist of the growing customer demand for sustainable consumer goods and services, paper-based packaging, eco-friendly materials, as well as the circular economy. Companies in the market are utilizing AI to improve the operations and product innovation.

Similarly, an inventive facility called Design2Market Factory by Smurfit Kappa helps clients to test and modify their packaging on a small scale prior to going on sale. To meet particular needs, the user-driven prototypes are created in partnership with clients, combining technological expertise, creativity, and modern artificial intelligence (AI) models.

Furthermore, predictive maintenance driven by AI is another major example, in which sensors and algorithms assess machinery performance to identify breakdowns before they occur, reducing downtime and repair costs. These instances demonstrate how AI adoption is likely to transform the bag-in-box packaging market by increasing efficiency and sustainability.

The with tap segment held largest market share of 64.57% in the year 2024. The tap-like switch on the bag body makes it easy to open and remove. Products can be stored for longer time due to the special construction that facilitates liquid to flow out while keeping air out. The tap feature supports the easy and controlled dispensing of the liquids and eliminates the spillage as well as waste while maintaining the freshness of the product.

Taps need minimal effort to operate, making them attractive to a wide range of consumers like the homeowners as well as companies in the food service and hospitality industries. Their flexible form leads to precision, making them excellent for large-scale applications that require repetitive dispensing. Additionally, technological developments in the tap technology such as tamper-proof and spill-resistant designs, improve safety and use, adding to their attractiveness.

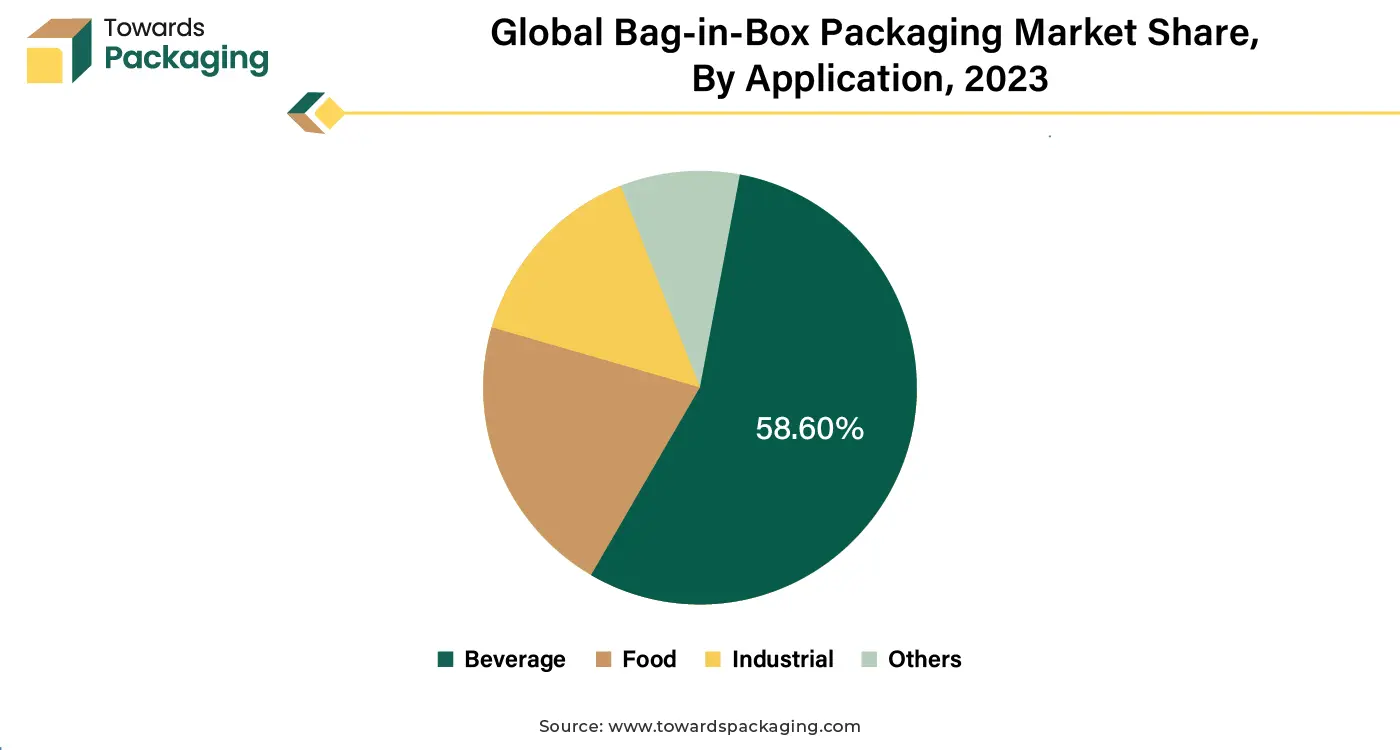

The beverage segment held the largest market share of 58.60% in the year 2024. This is owing to the surge in the popularity of wine, functional beverages as well as alcohol-free drinks across the globe. Furthermore, the rising demand for healthy and natural beverages along with the growing need for ready-to-drink (RTD) formats, portable packaging and on-the-go options is also likely to contribute to the growth of the segment within the estimated timeframe.

Additionally, the shift from lighter to fuller flavors coupled with the increasing focus of the brand owners on the products with higher ABVs is further expected to support the segmental growth of the market in the near future.

Asia Pacific is likely to grow at the fastest CAGR of 9.36% during the forecast period. This is due to the increasing urbanization and evolving consumer lifestyles in economies such as India and China. Also, the growing popularity of packaged beverages such as wine, juices, and non-alcoholic drinks are likely to contribute to the regional growth of the market. As per the India Brand Equity Foundation, in the calendar year 2020, 11% of India's US$88 billion packaged food and beverage market was health-oriented foods and beverages products.

This percentage is expected to increase to 16%, roughly $30 billion, by 2026. Also, the alcoholic beverage market in India is expected to reach to a value of US$64 billion over the next five years, according to a report published by the International Spirits & Wines Association of India (ISWAI). Furthermore, the expanding industrial sectors and high consumption of edible oils and liquid condiments is also expected to contribute to the regional growth of the market.

Europe held largest market share of 41.23% in 2024. Europe is one of the largest wine-producing regions globally, with countries like France, Italy, and Spain leading production. This type of packaging is widely adopted for wine due to its ability to preserve quality. Additionally, the growing sustainability awareness among consumers along with the surge in the online grocery and beverage sales is also expected to contribute to the regional growth of the market. Furthermore, the presence of advanced recycling systems as well as stringent environmental regulations is also expected to contribute to the regional growth of the market.

By Product Type

By Capacity

By Material State

By Application

By Region

April 2025

April 2025

April 2025

April 2025