April 2025

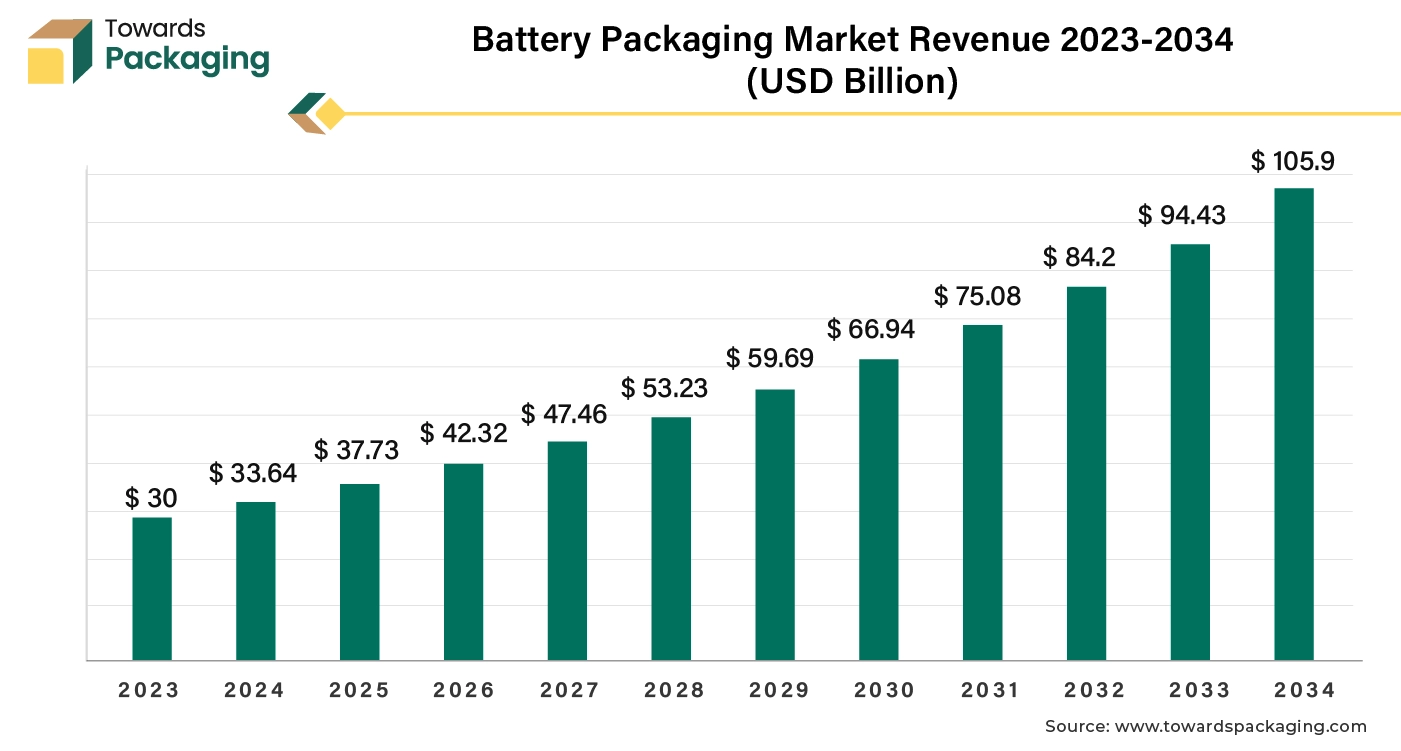

The battery packaging market is projected to reach USD 105.9 billion by 2034, growing from USD 37.73 billion in 2025, at a CAGR of 12.15% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

Heightened awareness about battery safety and performance among consumers is driving demand for packaging solutions that ensure product integrity and reduce risks. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing battery packaging which is estimated to drive the global battery packaging market over the forecast period.

Battery packaging refers to the materials and design used to encase batteries for protection, safety, and functionality. This includes outer casings, insulation, and any additional components that prevent leakage, damage, or short circuits. Proper packaging is crucial for ensuring that batteries are safe to transport, store, and use, especially considering their chemical and electrical properties. Battery packaging encompasses the design and materials used to encase batteries, playing a critical role in ensuring safety, performance, and longevity. Battery packaging is a critical aspect of battery technology that impacts safety, performance, and environmental sustainability. As battery applications continue to grow, the importance of effective packaging solutions will only increase, driving innovation and regulatory developments in the field.

The primary function of battery packaging is to safeguard the battery from physical damage, moisture, and contaminants. This is crucial in preventing leaks and ensuring operational integrity. Effective battery packaging minimizes risks associated with battery usage, such as short circuits, overheating, or explosions, particularly in lithium-ion batteries. Proper battery packaging facilitates safe transport and storage, complying with regulations that govern hazardous materials. It also aids in handling and organizing batteries. The global packaging market size is growing at a 3.16% CAGR.

Artificial Intelligence (AI) help to improve battery packaging by assisting in design optimization. AI algorithms can analyze performance data to optimize packaging designs for weight, material use, and structural integrity, leading to safer and more efficient packaging solutions. AI can assist in researching and developing new sustainable materials by simulating interactions between different substances, leading to eco-friendly packaging solutions. AI can enhance logistics by optimizing routes and managing inventory levels, ensuring timely delivery of packaging materials while reducing costs. AI can forecast demand trends and inventory needs, allowing manufacturers to manage resources better and reduce waste, leading to cost savings and improved supply chain efficiency.

AI-powered image recognition and machine learning can be used for real-time monitoring during the manufacturing process, detecting defects and ensuring high-quality standards in packaging. AI can analyze historical safety data to predict potential failures in packaging under various conditions, enabling proactive measures to improve safety features.

Implementing AI-driven automation in production lines can increase efficiency, reduce human error, and enable faster turnaround times for packaging. AI tools can analyze consumer feedback and market trends, helping companies tailor their packaging strategies to better meet customer preferences and regulatory demands. By leveraging AI technologies, the battery packaging industry can improve efficiency, safety, and sustainability, ultimately leading to better products and enhanced market competitiveness.

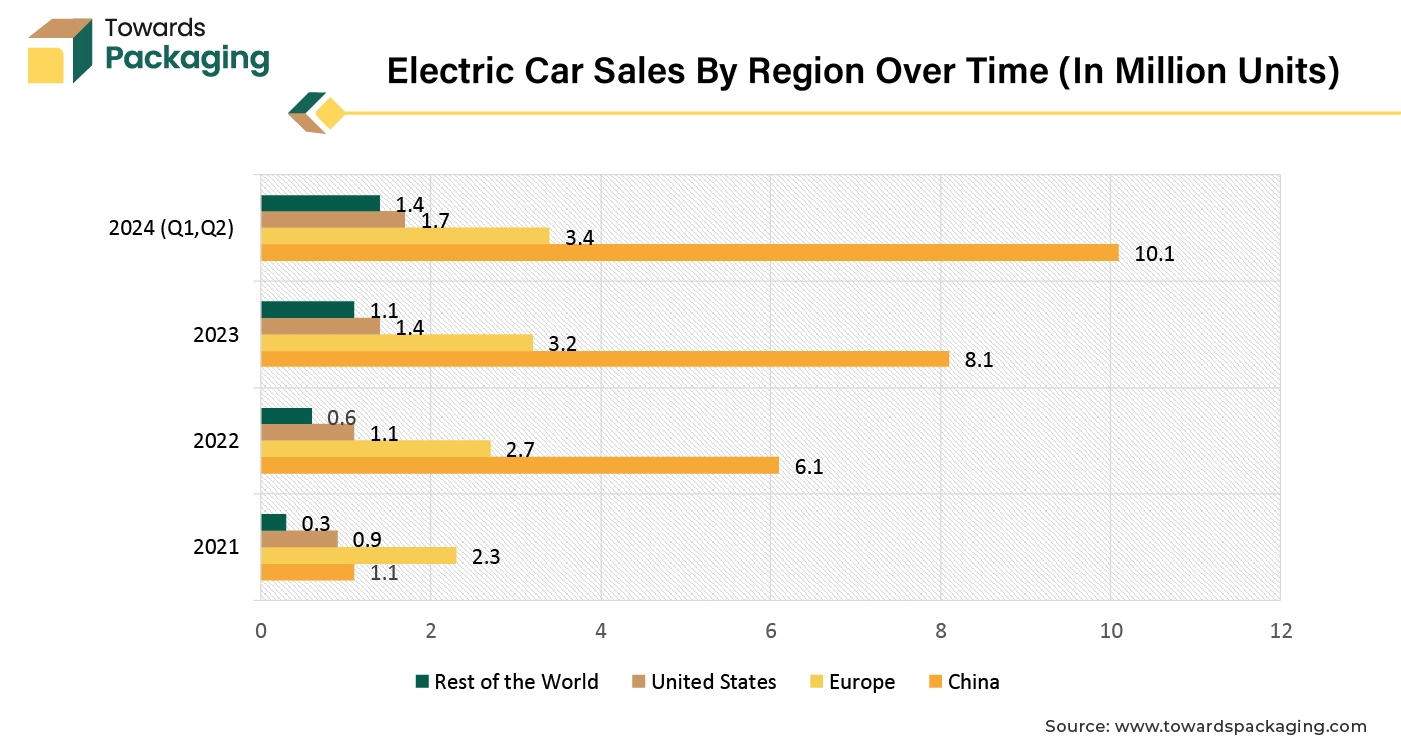

The expansion of the electric vehicle market requires advanced battery technologies, which in turn drives the need for specialized packaging to ensure safety and performance during transportation and operation. More EVs on the road necessitate higher production volumes of batteries, leading to greater demand for packaging solutions to safely transport and store these batteries. As battery technology advances, regulations around transporting lithium-ion batteries become stricter. This creates a need for specialized, compliant packaging that ensures safety during transit.

As manufacturers develop new battery types (like solid-state batteries), the packaging must adapt. This drives innovation in packaging design and materials to meet specific battery requirements. With a focus on sustainability, there’s a demand for eco-friendly packaging solutions. Companies will seek sustainable materials for battery packaging as they align with overall green initiatives. As electric vehicles adoption grows, there will be a need for replacement batteries and recycling processes, increasing the overall packaging requirements in the aftermarket. Overall, the growing EV market stimulates various aspects of the battery packaging market, driving demand for innovative, safe, and sustainable solutions.

Nearly 1.2 million light-duty electric vehicles were registered in California in 2023, about a million more than in second-place Florida and third-place Texas, according to figures released by the World Electric Vehicles Association. California leads the country not only in the percentage of electric vehicles but also in the total number of automobiles, accounting for almost 36% of all vehicles on the road. Furthermore, General Motors (GM) has claimed record-breaking EV sales, with an amazing 21,930 electric vehicles sold in the second quarter of 2024.

The key players ae facing challenges in procuring appropriate raw material and meeting the regulatory challenges, which is estimated to restrict the growth of the battery packaging market growth in the near future. High costs associated with advanced packaging materials and technologies can limit investment and adoption, especially for smaller manufacturers. Strict regulations regarding the transportation and storage of batteries can complicate packaging requirements, leading to delays and increased compliance costs.

Rapid advancements in battery technology may outpace the development of compatible packaging solutions, causing mismatches in supply and demand. The availability and performance of suitable packaging materials can be limited, particularly for new battery technologies that require specialized solutions. Intense competition among packaging suppliers can lead to price wars, reducing profit margins and discouraging innovation.

Increasing demand for eco-friendly packaging may strain manufacturers who need to balance performance and environmental concerns. Global supply chain issues can affect the availability of raw materials, impacting production schedules and costs. Addressing these challenges is essential for the battery packaging market to grow and meet the rising demand driven by the electric vehicle sector and other applications.

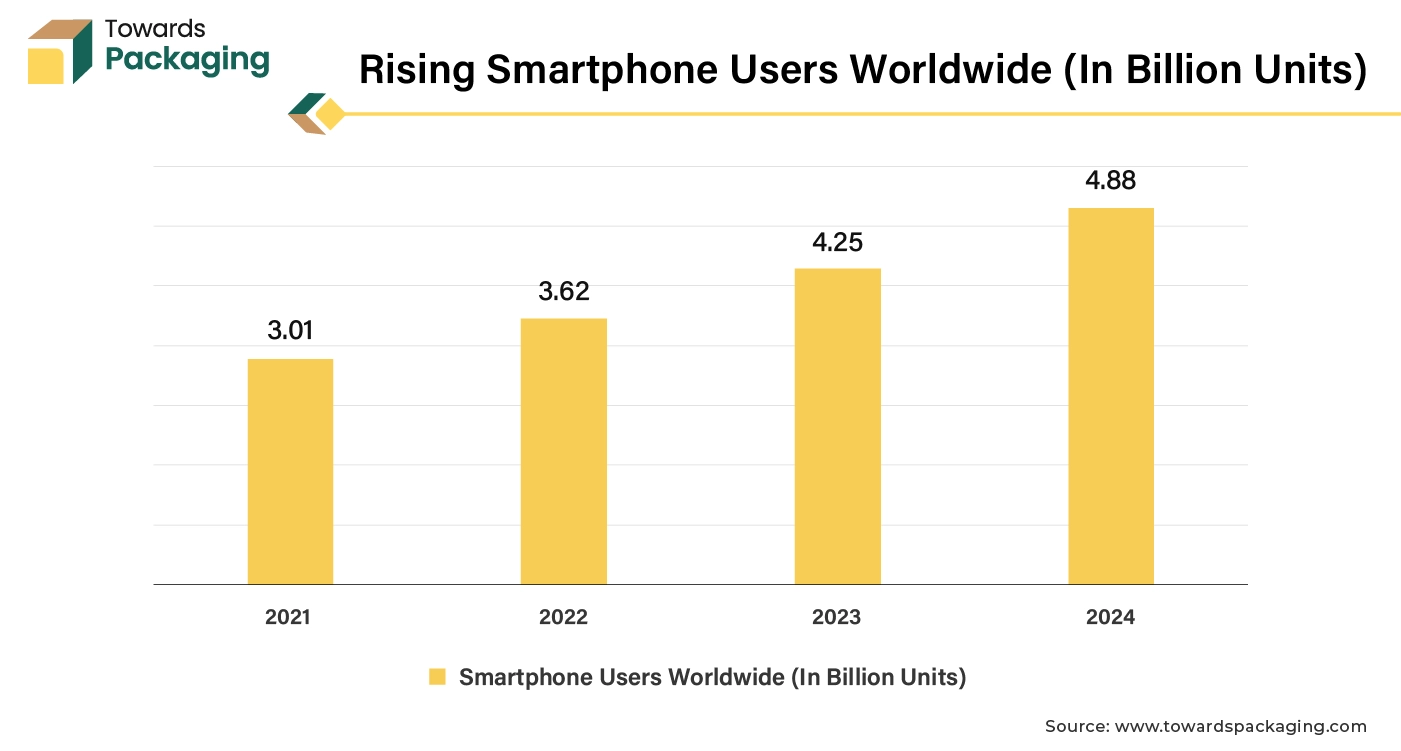

The rising usage of smartphones, laptops, and other portable devices has fueled the demand for efficient and safe battery packaging solutions. Innovations in battery technology, such as lithium-ion and solid-state batteries, necessitate improved packaging solutions that enhance safety, efficiency, and lifespan.

According to the data published by The Mobile Association (TMA), internet and mobile association, it is anticipated that between 2024 and 2029, there will be 1.7 billion more smartphone users, totalling 6.2 billion by that year. For smartphone users, this would be a new high. Global smartphone shipments are expected to reach 1.23 billion units in 2024, up 5.8% from the previous year, according to the International Data Corporation (IDC). Utilizing smartphones and spending time in front of screens Tweens from homes with annual incomes under US$35,000, according to Common Sense Media, spend five hours and forty-nine minutes on screen media each day on average. That screen usage decreases to 3 hours and 59 minutes for those making over US$100,000 annually.

As stated by the Electronics Technicians Association, International, Inc., in November 2023, an estimated 4.88 billion individuals will own smartphones by 2024. That represents a rise of 635 million additional smartphone users in just the last year (2023–2024). Global smartphone usage has increased by 2.15 times since 2020, with 2.61 billion new users coming online over that period.

The lithium ion segment held a dominant presence of 42.0% in the battery packaging market in 2024. They store more energy per unit weight compared to other battery types, making them ideal for portable electronics and electric vehicles. Lithium-ion batteries have a relatively long lifespan, allowing for many charge and discharge cycles without significant capacity loss. Lithium-ion batteries can be charged quickly, which is essential for consumer electronics and electric vehicles. They can be produced in various sizes and configurations, accommodating a wide range of applications from small gadgets to large energy storage systems.

They retain their charge well when not in use, leading to less frequent recharging. Their lightweight nature makes them suitable for applications where weight is a critical factor, such as in mobile devices and aerospace. While they still have environmental impacts, lithium-ion batteries are generally less toxic than some other battery types. These factors combined make lithium-ion technology a preferred choice across various industries, from consumer electronics to renewable energy storage.

Increasing launch of the lithium-ion battery for the automotive industry due to rise in demand for electric vehicle is estimated drive the growth of the segment over the forecast period.

For instance,

The cell and pack packaging segment accounted for a significant share of 66.0% in the battery packaging market in 2024. The cell and pack packaging is advanced packaging techniques streamline manufacturing processes, reducing costs and time. The cell and pack packaging technique is a better packaging solutions allow for higher energy density, increasing the overall performance and lifespan of batteries. The cell and pack packaging offer enhanced designs improve thermal management and reduce the risk of short circuits, leading to safer battery operation. Cell and pack packaging enables modular designs, facilitating easier upgrades and replacements in electric vehicles and other applications. The rise of electric vehicles and renewable energy storage solutions has spurred demand for efficient battery systems.

For instance,

The corrugated packaging segment registered 74.0% over the global battery packaging market in 2024. Corrugated packaging allows for better air circulation, minimizing the risk of overheating and potential leakage. Corrugated material offers superior protection against physical impacts, vibrations, and moisture, which is essential for sensitive batteries. Corrugated packaging is often more economical to produce and transport compared to blisters, especially for bulk packaging. It is generally more recyclable and environmentally friendly, appealing to manufacturers and consumers focusing on sustainability.

Corrugated packaging can be easily tailored to fit different battery sizes and shapes, ensuring a secure fit. The design of corrugated boxes allows for efficient stacking and storage, optimizing space in warehouses and during transportation. These factors make corrugated packaging a practical choice for safely packaging batteries.

The cylindrical segment led share of over 58.0% in the global battery packaging market in 2024. The battery packaging is basically done in cylindrical shape to provide strength and resistance to external pressure, enhancing durability. This shape allows for even distribution of internal pressure, reducing the risk of rupture or deformation. Cylindrical designs maximize space efficiency in both packaging and storage, allowing for compact arrangements. Cylindrical shapes can facilitate better heat dissipation, crucial for battery performance and safety. Cylindrical batteries are easier to handle and transport, fitting well into various devices and fixtures. The production of cylindrical casings is often streamlined, leading to cost-effective manufacturing processes.

The prismatic segment is projected to host the fastest-growing battery packaging market in the coming years. Prismatic packaging can be easily tailored to fit various device dimensions and shapes, ensuring a snug fit. The flat, rectangular shape allows for efficient use of space, making it ideal for slim and compact devices. Prismatic packaging provides good structural support, protecting fragile components during transport and storage. The shape allows for efficient stacking and organization in warehouses and retail spaces. However, because prismatic casings are widely used to package batteries used in consumer devices like laptops, tablets, and smartphones, they are anticipated to experience significant increase in the near future.

The cardboard segment held share of over 64.0% in the battery packaging market in 2024. Cardboard material is affordable in price and too easy to produce and purchase compared to other materials. It reduces shipping costs and makes handling easier. It offers adequate cushioning and protection against impacts and moisture. Being recyclable and biodegradable, it appeals to environmentally conscious consumers. Cardboard can be easily printed on and designed to fit various products, enhancing branding and marketing.

Compared to alternative materials like plastics or metals, cardboard is a more affordable and easily obtainable option for battery packing. Furthermore, cardboard provides an excellent surface for printing logos, labels, and product information, enabling businesses to communicate crucial information and meet legal requirements. In contrast, plastics are easily thermoformed, molded, or extruded into the many sizes and forms needed for battery packing. The ability to manufacture a wide range of packaging options for various battery kinds and sizes is made easier and more affordable by the flexibility of manufacturing methods.

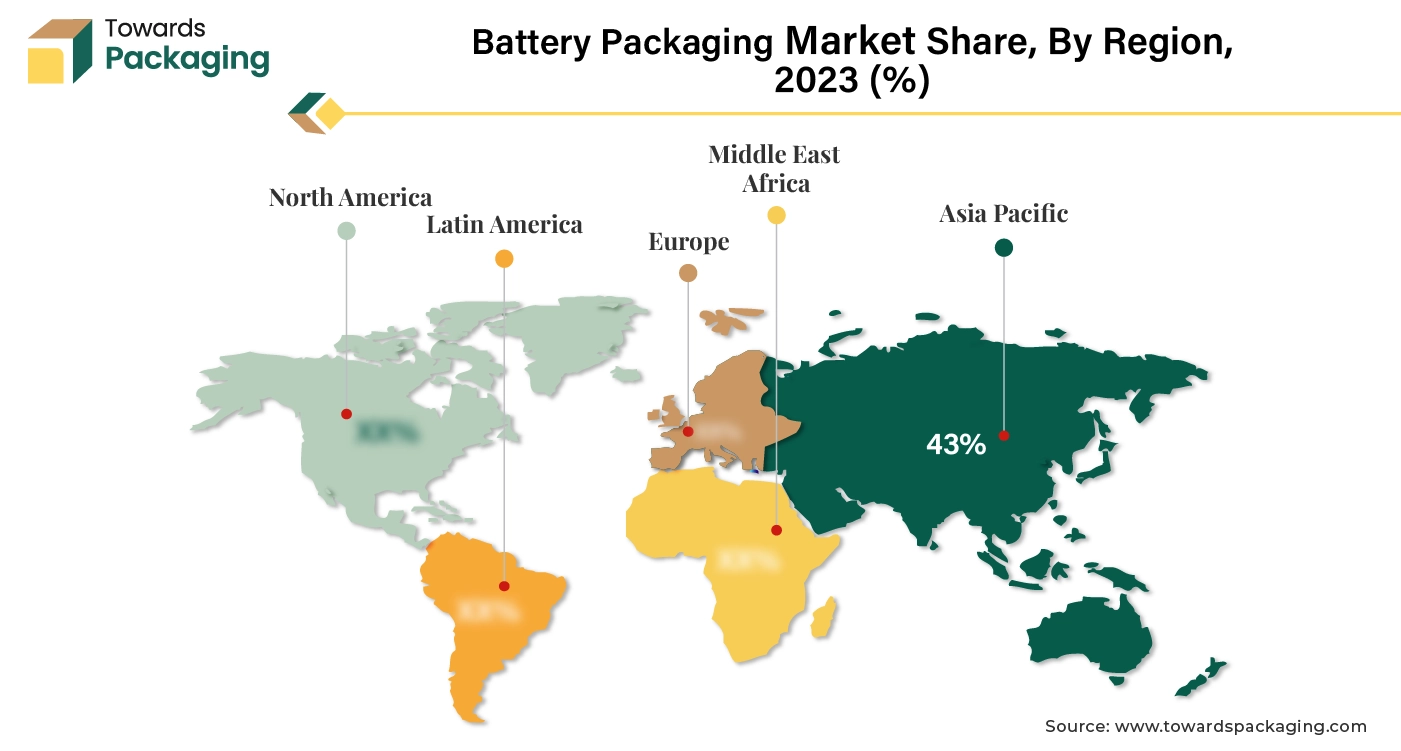

Asia Pacific region dominated the global battery packaging market share of over 43.0% in 2024. Countries like China, South Korea, and Japan have advanced battery manufacturing capabilities and established supply chains, which has risen the demand for the battery packaging. Lower labor and production costs contribute to competitive pricing in the global battery packaging market. Major manufacturing facilities or headquarters of several prominent battery manufacturers, including Panasonic, Samsung SD1, LG Chem, Contemporary Ampere Technology Co. Limited (CATL), and Samsung, are located in the Asia Pacific area. These businesses need cutting-edge battery packing options to safeguard their goods while they are being stored and transported.

China is major hub for battery packaging market as electric vehicle (EV) production surges in China, effective battery packaging is crucial for safety, efficiency, and performance. Overall, as China continues to lead in battery production and consumption, the demand for innovative and sustainable battery packaging solutions is expected to grow. Increasing launch of the electric vehicle in Asia Pacific region is rising demand for battery packaging, which is estimated to drive the battery packaging market in Asia Pacific region.

For instance,

North America region is anticipated to grow at the fastest rate in the battery packaging market during the forecast period. The North America has the well-equipped environment for carrying out innovations for battery and consumer electronics development. Advanced infrastructure for manufacturing and distribution supports the scale-up of battery and electronics production. A highly skilled labor force is available in engineering and technology fields contributes to innovation and quality in production in North America. The key players operating in the North America market are focused introduction of innovative battery packaging, which is estimated to drive the growth of the battery packaging market in North America region.

SME's electrification-specific training program is tailored to meet the requirement of personnel with or without prior experience packaging and assembling EV batteries. It includes essential learning goals to adequately prepare learners for both scenarios. Lithium battery handling and safety, high-energy batteries, battery management systems, testing and assessment of batteries, recycling, and disposal are just a few of the subjects covered.

By Battery Type

By Level of Packaging

By Type of Packaging

By Casing

By Material

By Region

April 2025

April 2025

April 2025

April 2025