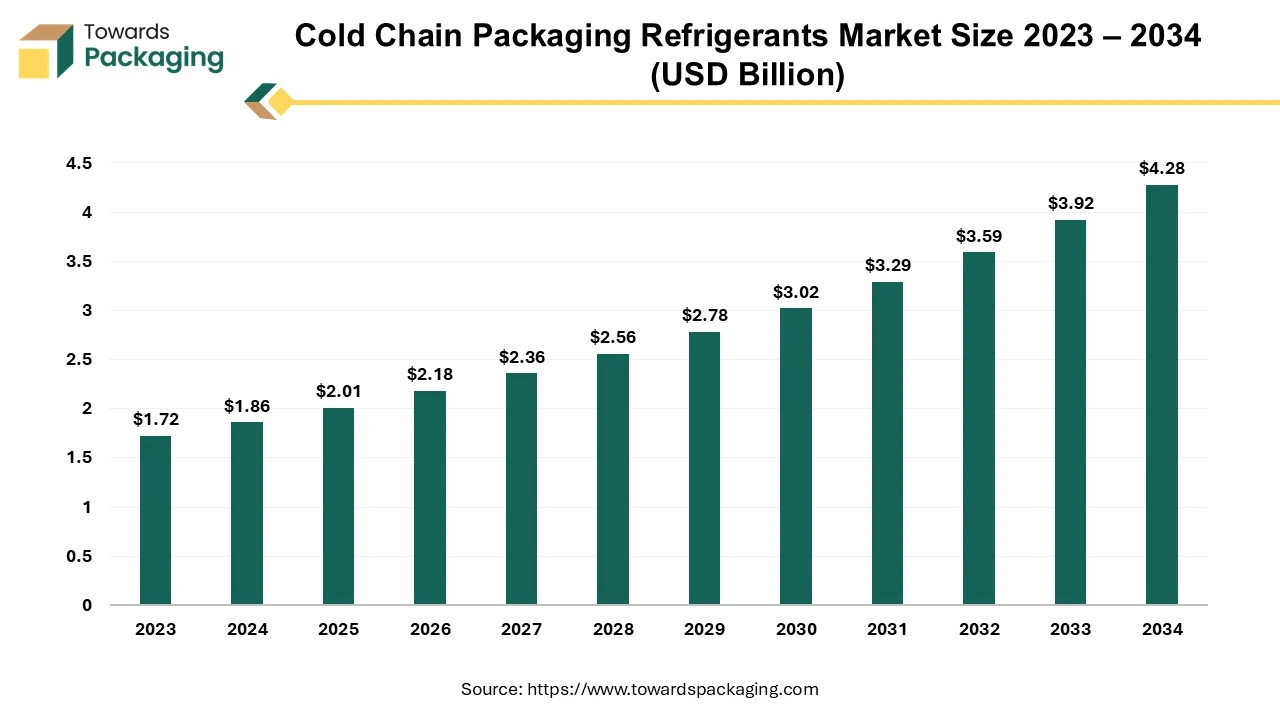

The cold chain packaging refrigerants market is projected to grow from USD 2.01 billion in 2025 to USD 4.28 billion by 2034, driven by a 7.7% CAGR. The market covers segments like Gel Packs, Dry Ice, and Foam Bricks, serving industries such as Food & Beverage, Pharmaceuticals, and Industrial. Key regional insights include North America's 37% market share in 2021, leading advancements in cold chain infrastructure and the shift towards sustainable refrigerants. Companies like Cold Chain Technologies, Sonoco Thermosafe, and Cryopak dominate this space.

Cold chain packaging refrigerants play a crucial role in preserving the quality and safety of temperature-sensitive products during transportation and storage. This term encompasses a range of materials and technologies designed to maintain a controlled temperature environment, ensuring that perishable goods such as food, pharmaceuticals, and biotechnological products remain within specific temperature ranges. The global market for cold chain logistics reached a substantial value of $266.81 billion in 2021, reflecting its vital role in various industries. Despite its undeniable importance, introducing cold chain practices presents environmental challenges, primarily due to the energy-intensive nature of refrigeration, a significant source of greenhouse gas emissions. The Global Food Cold Chain Council (GFCCC) indicates that the food cold chain alone contributes to about 20% of the global usage of hydrofluorocarbons, further emphasizing the environmental impact associated with this industry.

As businesses and industries recognize the necessity of cold chain logistics, the sector is expected to grow significantly. According to global cold chain Alliance assessments, 90% of surveyed companies involved in refrigerated warehousing and goods delivery anticipate business growth in the next two years, with 93% predicting overall industry growth during the same period. The environmental impact of cold chain technologies is multifaceted, with energy consumption being a key contributor to greenhouse gas emissions. These emissions include direct sources, such as refrigerant leaks, and indirect sources, from the energy required to operate refrigeration systems. Indirect emissions comprise over two-thirds of the total greenhouse gas emissions associated with cold chain activities.

Anticipated infrastructure expansion will lead to increased cooling needs, driving a surge in refrigerant demand. This demand is expected to be met through technologies primarily relying on compression for cooling, prompting significant capacity additions to accommodate the growing requirements for cooling systems. The demand for refrigerants is projected to increase fivefold, reaching approximately 10,000 metric tons by the fiscal year 2037-38. This projection reflects the substantial growth expected in the market, driven by the increasing need for cooling solutions due to ongoing infrastructure development. The cold chain packaging refrigerants market is poised for significant expansion, responding to the evolving demands of various industries reliant on temperature-sensitive logistics.

| Trends | |

| Shift Towards Sustainable Refrigerants |

|

| Advancements in Packaging Technology |

|

| Surge of Online Grocery Services |

|

| E-commerce and Last-Mile Delivery Impact |

|

| Focus on Energy Efficiency |

|

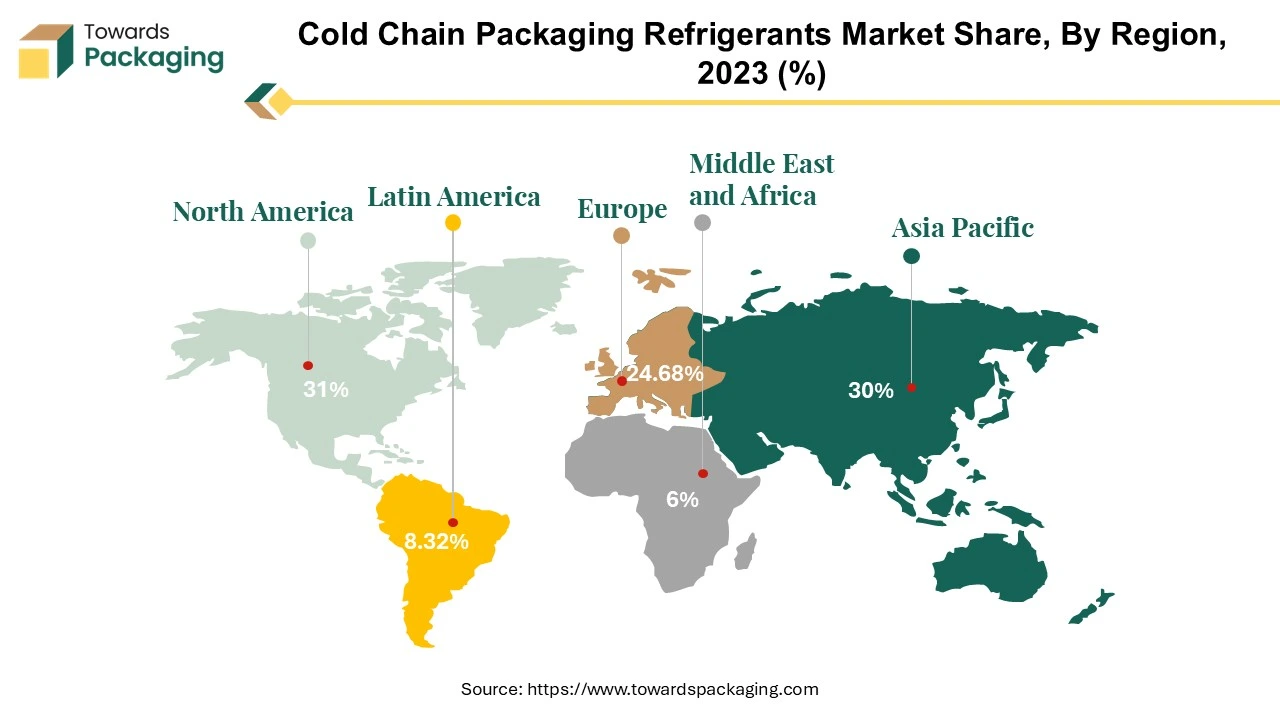

North America is a prominent leader in the cold chain packaging refrigerants market, substantially influencing the global landscape. In 2021, North America commanded a remarkable market share, representing approximately 37% of the worldwide market and boasting a staggering market value of around U.S. $99 billion. This dominance can be attributed to several key factors highlighting the region's pivotal role in shaping the industry.

First and foremost, North America's advanced and well-established logistics infrastructure is critical to its dominance. The mature and extensive cold chain networks within the region are tailored to meet the stringent requirements of various industries, including pharmaceuticals, food, and healthcare. This level of infrastructure sophistication positions North America as a vital player capable of catering to diverse and demanding market needs on a global scale.

Secondly, the surging demand for temperature-sensitive products, coupled with the increasing prevalence of online shopping and home deliveries, has fueled the need for efficient cold chain solutions. North America, boasting a significant e-commerce and retail sector, has experienced a pronounced uptick in the requirement for dependable cold chain packaging solutions. These solutions are indispensable for ensuring the safe and efficient delivery of perishable goods in an era where convenience and timely delivery are paramount.

Furthermore, the stringent regulatory standards and rigorous quality control measures enforced in North American industries, particularly in pharmaceuticals and food, contribute significantly to the reliance on advanced cold chain packaging solutions. Compliance with these stringent regulations necessitates the utilization of high-quality packaging materials and refrigerants to maintain precise temperature conditions.

North America's dominance in the cold chain packaging refrigerants market results from its robust logistics infrastructure, the increasing demand for temperature-sensitive products, and its commitment to stringent regulatory standards. The region's commanding 37% share of the global market in 2021, amounting to a staggering US$ 99 billion, underscores its pivotal role in shaping the industry and meeting the dynamic needs of diverse sectors.

Asia has emerged as a pivotal player in the cold chain and refrigeration industry, driven by a convergence of factors that solidify its significant role in this dynamic sector. The region's economic growth and its expansive and continually growing population have spurred an increased demand for temperature-controlled logistics, positioning Asia as a vital market for cold chain technologies. Notably, countries such as China and India have witnessed a surge in the need for efficient and reliable cold chain systems fueled by rapid industrialization and urbanization.

The economic prosperity in Asia has led to a rise in disposable income, triggering shifts in consumption patterns and preferences. This transformation has increased demand for perishable goods, encompassing pharmaceuticals, food products, and biotechnological materials. The adoption of advanced cold chain technologies has become imperative to address this demand while ensuring the quality and safety of these products.

In specific industries, such as pharmaceuticals, maintaining precise temperature conditions is critical to preserving the efficacy of medications and vaccines. Similarly, the food industry relies on cold chain logistics to prevent spoilage and maintain the freshness of products. The biotechnology sector also requires precise temperature controls for transporting and storing sensitive biological materials.

Continuous developments in infrastructure and logistics networks underscore Asia's strategic position in the global cold chain and refrigeration landscape. Governments and businesses in the region are actively investing in enhancing cold storage facilities, transportation systems, and distribution networks to cater to the evolving demands of various industries. This strategic investment aligns with the region's commitment to meeting the challenges of a growing and dynamic market.

While Asia's role in the cold chain packaging refrigerants market is undeniably substantial, determining its specific ranking among regions necessitates up-to-date information. Market conditions are dynamic and influenced by economic trends, regulatory changes, and technological advancements. For the most current and accurate insights into the second leading region in the cold chain packaging refrigerants market, industry reports, market analyses, or consultations with experts and organizations closely monitoring developments in this sector are recommended.

Gel packs have emerged as a leading segment in the cold chain packaging market, crucial in preserving the integrity of temperature-sensitive goods during transportation and storage. These packs, containing a specially formulated gel substance, have gained prominence due to their versatility and effectiveness in creating a controlled temperature environment. Their popularity is driven by their efficient heat absorption and release capabilities, providing a dependable solution for temperature regulation within packaging. Notably, the pharmaceutical and biotechnology sectors have widely adopted gel packs as a vital component of their cold-chain logistics. Given the stringent temperature requirements for transporting vaccines, medications, and biologics, gel packs have become an indispensable choice. Their adaptability to various product shapes and sizes enhances their applicability across a diverse range of products, contributing to their dominance in the market.

Cold chain solutions offers durable, reusable polymer ice packs known for providing temperature-sensitive protection while safely transporting food, pharmaceuticals, and medical products. Available in various sizes to accommodate diverse business needs, these food-grade, biodegradable gel packs maintain their shape while freezing, making them ideal for situations requiring a flat gel pack due to space constraints. Furthermore, the growing emphasis on sustainability and environmental awareness has fuelled the demand for gel packs. Many formulations are designed to be reusable and environmentally friendly, aligning with the global shift toward eco-friendly packaging solutions. This sustainability focus resonates with businesses aiming to reduce their carbon footprint and meet corporate social responsibility standards.

The gel packs segment is marked by continuous innovations, with manufacturers consistently refining formulations to enhance thermal performance and prolong shelf life. Customization options offered by suppliers enable businesses to tailor gel packs to specific temperature requirements, providing a tailored solution for diverse product portfolios.

As businesses navigate the complexities of global supply chains, the gel packs segment emerges as a reliable and adaptable choice for maintaining the cold chain, ensuring the quality and effectiveness of temperature-sensitive products throughout their journey from production to end-users.

Cold chain packaging refrigerants play a pivotal role in the food and beverage sector, where maintaining the integrity and freshness of perishable products during transportation is critical for global trade and the availability of food and health supplies worldwide. This sector encompasses a wide range of products, including fresh produce, dairy items, eggs, and frozen foods, all requiring specialized packaging to ensure they reach their destination in optimal condition. The significance of cold chain systems lies in their ability to control and regulate temperatures throughout the supply chain.

Global trade in perishable products, which amounts to about 208 million tons, heavily relies on refrigerated containers equipped with motors. These containers facilitate the transportation of perishable goods by generating cold and providing air circulation. Reefer containers offer flexibility in preparing and packaging perishables, allowing for varying shipment sizes, turnover frequencies, and intermodal transfers.

About 90% of perishable products are transported using these refrigerated containers, underscoring their crucial role in sustaining the global supply chain for food and beverages. The ability to regulate temperatures effectively ensures that products maintain their quality, safety, and freshness from production to consumption. As a result, cold chain packaging solutions are integral in supporting the growth of the food and beverage sector on a global scale, facilitating trade, reducing waste, and meeting the increasing demand for a diverse range of perishable goods.

The COVID-19 pandemic has spotlighted the critical role of cold chain packaging refrigerants in ensuring the safe and efficient distribution of temperature-sensitive medical supplies, particularly vaccines. The urgency to deliver large quantities of vaccines globally has heightened the importance of maintaining the integrity of these life-saving doses. Cold chain technologies have become indispensable in preserving the efficacy of COVID-19 vaccines, which often require specific temperature conditions for storage and transportation.

Cold chain packaging refrigerants play a vital role in this process by providing a controlled environment that prevents vaccines from being exposed to extreme temperatures that could compromise their effectiveness. Moderna and Pfizer-BioNTech's mRNA vaccines, for example, demand ultra-low temperatures for storage, highlighting the necessity for advanced refrigeration solutions. The deployment of these vaccines on a global scale involves intricate logistics, necessitating precise temperature controls from manufacturing facilities to distribution points.

The challenges posed by the pandemic have accelerated innovations in cold chain packaging refrigerants to meet the unprecedented demand for effective vaccine distribution. Governments, pharmaceutical companies, and logistics providers have collaborated to enhance existing cold chain infrastructures and develop new technologies to ensure the seamless transportation of vaccines across diverse geographic and climatic conditions.

In addition to vaccines, the pandemic has also underscored the broader importance of cold chain packaging in maintaining the availability and quality of other essential medical supplies, such as diagnostics and therapeutics. As the world continues to navigate the complexities of the pandemic, the role of cold chain packaging refrigerants remains a linchpin in the global effort to mitigate the impact of COVID-19 and safeguard public health through the reliable and secure distribution of temperature-sensitive medical products.

Several key players characterize the competitive landscape of the cold chain packaging refrigerant market. Some of the major companies operating in this market include Cold Chain Technologies, Blowkings, Sonoco Thermosafe, THERMOCON, Sofrigam, Creative Packaging Company, Nordic Cold Chain Solutions, Tempack, Cryopack, Coolways, and Pelton Shepherd Industries. These companies focus on strategies such as mergers and acquisitions, product innovations, and expanding their regional presence to gain a competitive edge. The market is also influenced by changes in regulatory requirements, refrigeration technology advancements, and consumer preferences shifts, driving the need for innovative and sustainable cold chain packaging refrigerant solutions.

By Product Type

By End Use

By Region

December 2025

December 2025

December 2025

December 2025