March 2025

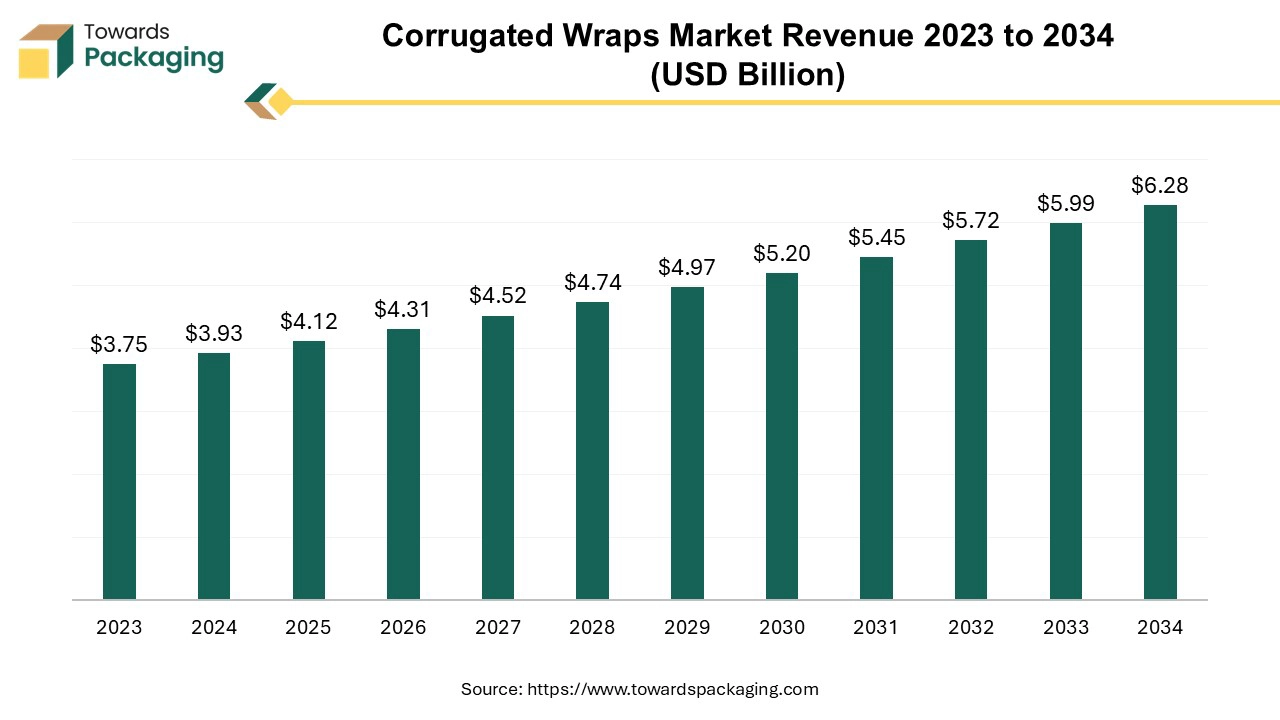

The corrugated wraps market is projected to reach USD 6.28 billion by 2034, growing from USD 4.12 billion in 2025, at a CAGR of 4.80% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

Increasing concerns by the consumers about the product safety has risen the demand for the corrugated wraps which is estimated to drive the growth of the corrugated wraps market over the forecast period.

Corrugated wraps are primarily used for packaging and protecting products during shipping and handling. Their durability and cushioning properties make them ideal for safeguarding items from damage caused by impacts or rough handling. They are also used to provide insulation and support for products, helping to maintain their condition until they reach their destination. Corrugated wraps packaging refers to a type of packaging made from corrugated cardboard material designed to protect and cushion products during transit and storage.

Corrugated wraps are commonly used for shipping a variety of goods, including those in bulk, to provide extra protection during transport. Corrugated wraps assists in organizing and protecting products in warehouses or during long-term storage. Corrugated wraps can be customized in terms of size, shape, and print, allowing for branding and product-specific requirements.

AI can assist in creating innovative and efficient corrugated wrap designs by analyzing material properties and performance metrics, leading to better protection and reduced material usage. AI-driven automation can streamline production processes, from cutting and folding to printing and assembling, improving efficiency and reducing labor costs. AI-powered inspection systems can detect defects or inconsistencies in real-time, ensuring high-quality wraps and minimizing waste. AI can forecast demand and optimize inventory management, reducing excess stock and ensuring timely production and delivery. AI can analyze consumer data and preferences to offer customized and personalized wrapping solutions, enhancing brand differentiation and customer satisfaction. AI can improve logistics and supply chain management by predicting demand patterns, optimizing routes, and managing supplier relationships more effectively.

AI can analyze data to generate optimized designs for corrugated wraps packaging, improving strength, reducing material usage, and enhancing protection during shipping. AI-powered vision systems can detect defects in real-time during the manufacturing process, ensuring higher quality and consistency of the final product. AI algorithms can optimize corrugated wraps inventory management, demand forecasting, and logistics, reducing costs and improving delivery times. By integrating AI, the corrugated wraps industry can achieve greater efficiency, cost-effectiveness, and adaptability in meeting market demands.

It promises to maximize shock absorption and safeguard fragile things during storage and transportation because of its lightweight and flexible construction. Paper bubble wrap is considered to be superior than alternative paper-based solutions in this regard, such as honeycomb structures or embossed paper, however FIS notes that the latter is occasionally useful as additional protection between delicate objects, such plates. It is believed that the product will complement the growing emphasis on sustainability in the packaging business.

As evidence of this desire from significant industrial players, FIS cites Amazon's collaboration with the US Department of Energy's BOTTLE Consortium, an initiative designed to recover and recycle materials from mixed waste streams and guarantee that wayward elements biodegrade in the natural environment.

The use of corrugated wraps has expanded as a result of the surge in online shopping, which has raised demand for packaging solutions that guarantee speedy and safe delivery. Corrugated wraps, which are manufactured from renewable resources and are widely recyclable, are becoming more and more popular as packaging materials due to the trend toward eco-friendly and recyclable materials. Because they are very cheap to make, corrugated wraps provide an affordable option for shipping and packaging.

Corrugated wraps offer superior protection for goods during handling and transit, lowering the possibility of damage and making them appropriate for a variety of sectors. New developments in the corrugated wrap industry, like increased strength and customizable options, boost the product's usefulness and commercial attractiveness. The key players operating in the market are focused on developing and launching paper – based sustainable option in replacement of plastic and bubble wraps, which is estimated to drive the growth of the corrugated wraps market over the forecast period.

The market players are facing the issue related to collection of raw material for manufacturing the corrugated wraps due to this the supply chain is getting disturbed, which is estimated to restrict the growth of the corrugated wraps market in the near future. Price fluctuations for paper and cardboard, the main raw materials used to make corrugated wraps, can have an effect on the cost of production and final product. The market for corrugated wraps may be affected by the introduction and acceptance of substitute packaging materials, such as plastic wraps or biodegradable alternatives.

Corrugated wraps are recyclable, although in certain places there may be contamination or a lack of infrastructure for recycling, making recycling operations difficult. The availability and price of corrugated wraps might be impacted by problems like supply chain interruptions or delays in transit. Even while technology is advancing, there may be obstacles to the creation of fresh, enhanced corrugated wrap options. The high degree of market saturation in developed regions, such those in North America and Europe, can restrict prospects for expansion.

As shipping goods directly to customers is a common aspect of online shopping, there is an increased need for sturdy packing options like corrugated wraps to guarantee product safety. Corrugated wraps can provide the protection, branding options, and efficient handling that e-commerce businesses and webistes need in their packaging. The substantial need for packing materials is driven by the large number of orders placed by internet retailers. Because they are affordable and can be used for a wide range of product shapes and sizes, corrugated wraps are a popular option.

Being recyclable and derived from renewable materials, corrugated wraps support the eco-friendly objectives of many online retailers who are dedicated to sustainability. Online businesses aiming to improve their customer experience and brand visibility can benefit from the ease with which corrugated wraps can be personalized with branding and promotional material. The government supports the manufacturing of the paper based corrugated wraps by adding more tax on it as packaging made out of paper is eco-friendly than plastic and caused less harm to environment.

The paper segment held the dominating share of the corrugated wraps market in 2024. There is a growing emphasis on eco-friendly packaging solutions. Paper and corrugated wraps are biodegradable and recyclable, aligning with the increasing consumer and regulatory focus on sustainability. The expansion of e-commerce has boosted the need for effective, protective packaging. Corrugated paper wraps offer excellent protection for goods during shipping and handling, making them popular for online retail.

Consumers are increasingly favouring products with minimal environmental impact. Paper wraps are perceived as more sustainable compared to plastic, which drives their demand. Companies are adopting eco-friendly packaging to enhance their brand image and appeal to environmentally conscious consumers. Corrugated paper wraps offer a cost-effective solution for packaging, combining durability with affordability. The key players operating in the market are focused on developing and launching corrugated paper wraps in the market to meet the rising demand for sustainable and eco-friendly packaging, which is estimated to drive the growth of the segment over the forecast period.

The plastic segment is estimated to grow at fastest rate over the forecast period. Plastic corrugated wraps are highly durable and provide excellent protection against moisture, chemicals, and physical damage, making them ideal for various applications, including transportation and storage. They are lightweight compared to traditional materials, which reduces shipping costs and handling efforts, making them a cost-effective option for many businesses.

Plastic corrugated wraps are often reusable, which aligns with sustainability goals by reducing the need for single-use packaging materials. Plastic corrugated wraps can be more economical in the long run due to their durability and reusability, offering a good balance of cost and performance. In sectors such as food and pharmaceuticals, plastic wraps offer superior hygiene and are easier to clean and sanitize compared to other materials. They are resistant to various weather conditions, which makes them suitable for outdoor storage and transportation. These benefits contribute to the increasing adoption of plastic corrugated wraps across various industries.

The retail store segment led the market in 2024. The enhanced packaging helps protect products during shipping and handling, reducing damage and returns. Attractive and informative packaging can boost brand visibility and appeal, influencing consumer purchasing decisions. Proper packaging can aid in organizing and managing inventory, improving logistics and efficiency in the supply chain. Packaging often needs to meet regulatory requirements for safety, labeling, and environmental standards, especially for food and health products.

The rise in online shopping has led to higher demand for packaging solutions that can protect products during shipping and handling. Corrugated wraps are ideal for this purpose due to their durability and cushioning properties. As products become more diverse and delicate, the need for effective protection during transit and on the shelves increases. Corrugated wraps provide a strong, protective layer that reduces damage. With growing emphasis on environmental responsibility, retailers and consumers prefer packaging materials that are recyclable and made from recycled content. Corrugated wraps meet these sustainability criteria.

Corrugated wraps are relatively affordable compared to other packaging materials, making them a practical choice for both small and large-scale operations. Corrugated wraps can be designed to fit various product shapes and sizes, improving inventory management and supply chain efficiency. Corrugated wraps are widely used in retail products packaging to enhance presentation and offer additional protection. The ecommerce is driving the retail sales due to various offers and deals are been allowed on cosmetics as well as clothing brands which results in rise in sales by attracting customers.

Warehouse segment is estimated to grow at fastest rate over the forecast period. Corrugated wraps are used in protect goods from dust, moisture, and physical damage during storage and transit. Corrugated wraps help stabilize and secure items, reducing the risk of shifting or tipping over. The corrugated material is strong and resilient, making it ideal for handling heavy or delicate items. Corrugated wraps are relatively inexpensive compared to other protective packaging materials. They can be easily cut and shaped to fit various products and sizes, offering flexibility in packaging.

Corrugated wraps are often made from recycled materials and can be recycled again, making them an environmentally friendly option. Corrugated wraps provide excellent protection for goods against damage, dust, and moisture during handling and storage, reducing the risk of product loss. They help stabilize and secure items on pallets or shelves, preventing shifting and potential damage. Corrugated paper wraps are relatively inexpensive and offer a good balance between cost and performance, making them an attractive option for many warehouses.

With growing emphasis on sustainability, corrugated wraps are often made from recycled materials and are recyclable, aligning with green practices. Corrugated wraps can be easily adapted to various sizes and shapes of products, offering flexibility in packaging solutions. Corrugated wraps are simple to apply and remove, streamlining warehouse operations and improving efficiency. These factors collectively contribute to the rising demand for corrugated paper wraps in warehouse settings.

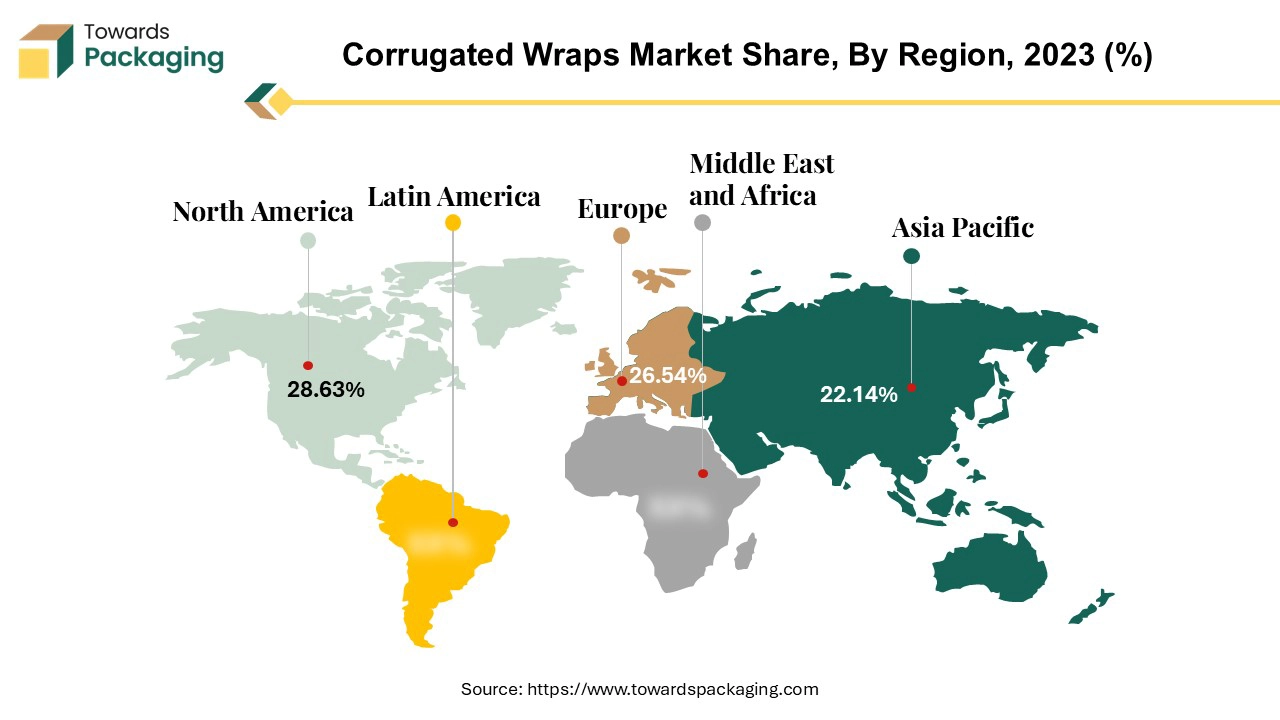

Asia Pacific to grow at a fastest CAGR during the forecast period. The growing industrial activity in the region particularly in nations like China and India is boosting the demand for effective packaging solutions. Asia-Pacific's e-commerce and online retail expansion is driving up demand for packing materials that guarantee quick and secure delivery. The need for packaged goods is growing as a result of increased consumer expenditure brought on by growing urbanization and disposable incomes in Asia Pacific region.

Corrugated wraps are a common alternative for packaging that is more recyclable and sustainable as environmental consciousness rises. The demand for a range of packaged goods, including those made using corrugated wrap, is rising in the area due to the robust economic expansion and growing middle class income in countries of Asia Pacific. Together, these elements are propelling the Asia-Pacific corrugated wraps market growth over the forecast period.

The key players operating in the Asia Pacific market are focused on developing and installing new corrugated paper & cardboard manufacturing machines in the Asia Pacific business to meet the rising demand of the consumers in the region, which is estimated to drive the growth of the corrugated wraps market in the Asia Pacific region.

North America is observed to led the corrugated wraps market in 2024. North America is experiencing rapid urbanization and change in lifestyle which is supporting all the online business from the food delivery app to consumer goods. The rise of online shopping in the North America has increased the demand for efficient and sustainable packaging solutions, driving the use of corrugated wraps for shipping and protection. There is a growing preference for eco-friendly packaging materials.

Corrugated wraps are recyclable and made from renewable resources, aligning with environmental regulations and consumer preferences for sustainable options. Businesses in North America are increasingly adopting corrugated wraps for their ability to provide excellent protection while being lightweight, which helps reduce shipping costs.

Innovations in corrugated wrap manufacturing have improved their durability, customization options, and functionality, making them more appealing to a wide range of industries. North American regulations and policies promoting the use of recyclable materials and reducing plastic waste further support the growth of the corrugated wraps market. The key players in North America are focused on development of the sustainable packaging solutions which is estimated to drive the growth of the corrugated wraps market in the North America over the forecast period.

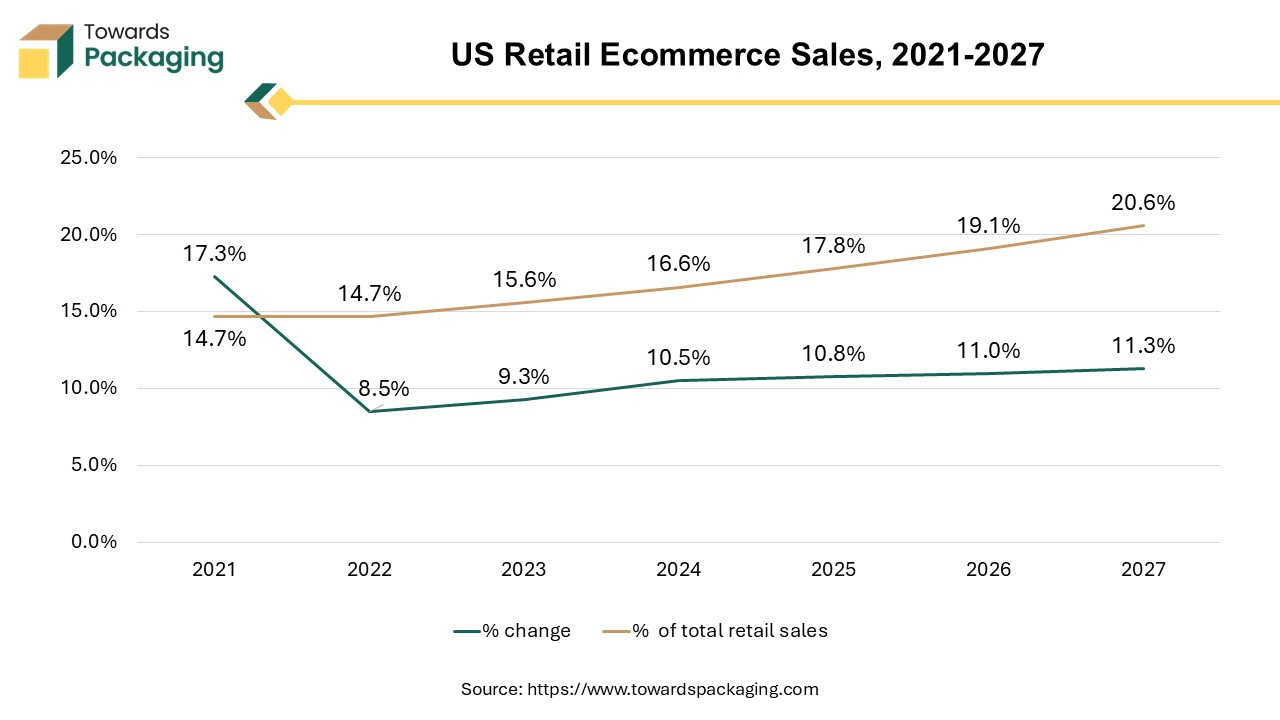

U.S. corrugated wraps market is estimated to witness the significant growth due to rise in the retail Ecommerce sales which has risen the demand for the corrugated wraps for effective packaging which is the estimated to drive the growth of the corrugated wraps market during the forecast period.

Material Type

End Use

Region

March 2025

March 2025

March 2025

March 2025