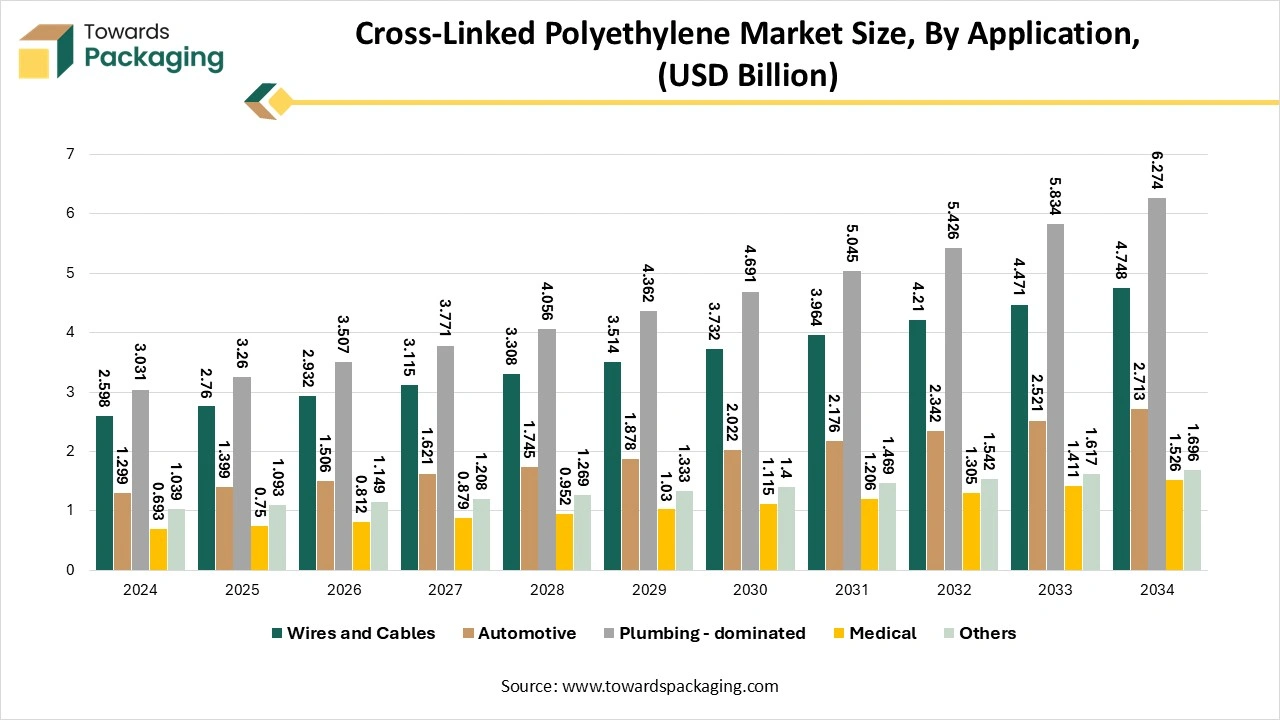

The cross-linked polyethylene market is anticipated to grow from USD 9.27 billion in 2025 to USD 16.96 billion by 2034, with a compound annual growth rate (CAGR) of 6.95% during the forecast period from 2025 to 2034.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing cross-linked polyethylene which is estimated to drive the global cross-linked polyethylene market over the forecast period.

Cross-linked polyethylene (commonly abbreviated as Cross-linked Polyethylene or PEX) is a type of polyethylene material that undergoes a cross-linking process to improve its properties. This process involves creating chemical bonds between the polymer chains, enhancing its structural integrity, thermal resistance, and chemical stability. Cross-linked polyethylene is widely used in various industrial and consumer applications due to its superior characteristics compared to conventional polyethylene.

The cross-linking process in Cross-linked polyethylene can be achieved through three primary methods which have been mentioned here as follows Peroxide Cross-Linking (PEX-a), Silane Cross-Linking (PEX-b), and Radiation Cross-Linking (PEX-c). The Peroxide Cross-Linking (PEX-a) method involves adding a peroxide compound to the polyethylene during the extrusion process. The material is heated to a specific temperature, initiating the cross-linking reaction.

Results in a high degree of cross-linking, providing excellent strength and flexibility. Cross-linked polyethylene can withstand higher temperatures compared to standard polyethylene, withstanding up to 120–140°C in continuous operation.

Electron beam cross-linking transforms polyethylene wire into a high-performance material ideal for renewable energy systems. This advanced process uses high-energy irradiation to generate free radicals, such as polyethyne, which initiate cross-linking reactions that enhance the material’s mechanical, thermal, and electrical properties. Unlike chemical methods, it eliminates the need for additional initiators, resulting in cleaner materials and improved electrical performance.

Cross-linked polyethylene (XLPE) wires are increasingly adopted for their excellent insulation properties, making them suitable for high-voltage power cables. Their reliability in wind and solar applications supports stable energy transmission and grid connectivity in high-voltage direct current (HVDC) projects. These advantages underscore the role of energy-efficient electron beam technology in delivering durable, high-performance solutions for the renewable energy sector.

Accelerated cross-linking also plays a key role in developing heat-resistant polymers that meet the demanding requirements of high-performance industries. By forming a three-dimensional network of interlinked molecules, it improves thermal stability, tensile strength, and overall material reliability. Sectors such as construction, automotive, and electronics rely on innovative cross-linking techniques to produce durable, lightweight, and heat-resistant components that meet specific performance needs.

AI integration can significantly drive the growth of the cross-linked polyethylene market by enhancing manufacturing efficiency, product quality, and market responsiveness. AI algorithms can analyze production data to optimize parameters like temperature, pressure, and curing time, reducing waste and energy consumption. The integration of AI-powered tools can predict equipment failures, minimizing downtime and improving production schedules. Integrating AI with robotics enables automation of repetitive tasks, such as extrusion and molding, increasing output and consistency.

AI can process sensor data in real time to detect and correct defects during production. Machine learning models can identify patterns in defects, helping to refine formulations and processes for better product performance. AI-driven simulations can predict the performance of new Cross-linked Polyethylene formulations under different conditions, speeding up R&D. Material CustomizationAI can help develop tailored Cross-linked Polyethylene products for specific applications, such as pipes, cables, or medical devices.

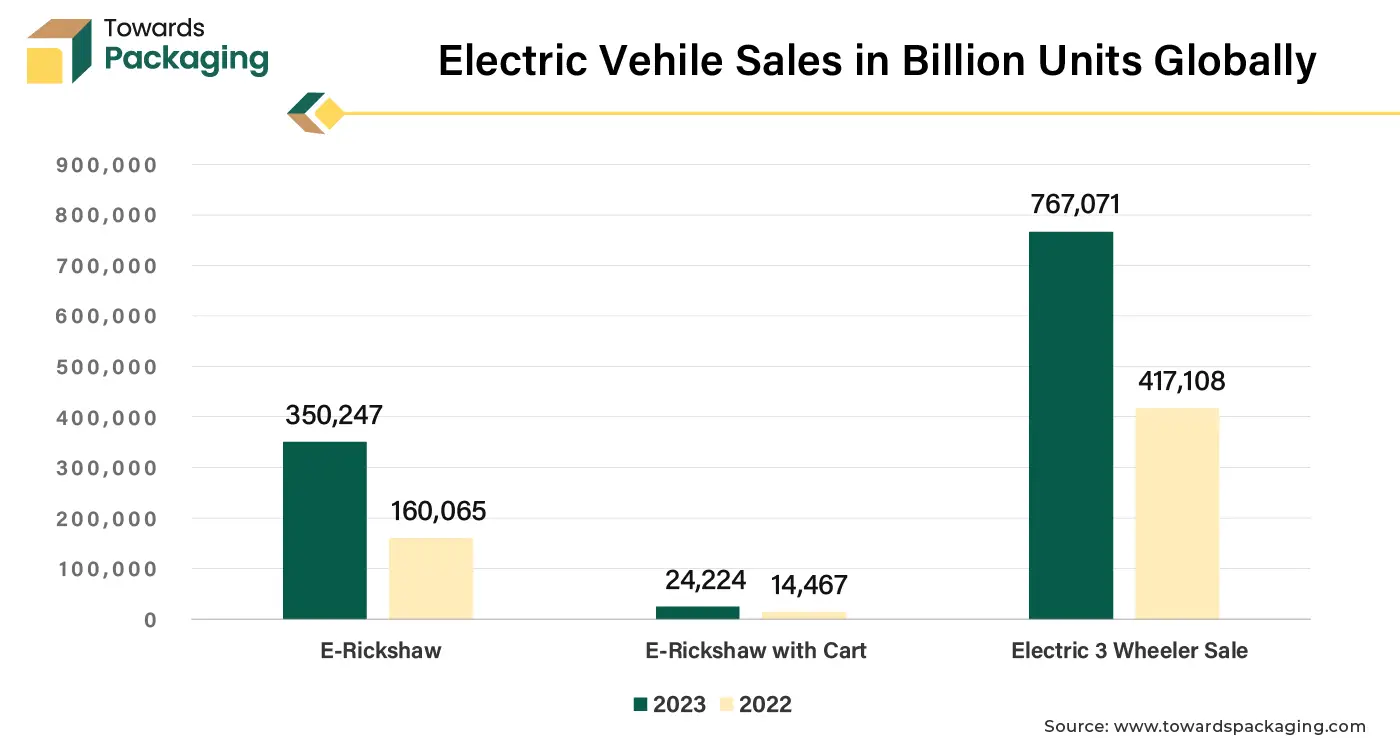

Cross-linked polyethylene is used in automotive fuel tanks, tubing, and wiring, contributing to vehicle weight reduction and improved fuel efficiency. The rise of electric vehicles drives demand for cross-linked polyethylene in high-performance battery cables and insulation materials. Hence, increase in demand and sale of electric vehicles drive the cross-linked polyethylene market over the forecast period.

Governments worldwide are putting laws and incentives into place to make the switch to electric cars more enticing and accessible. These initiatives to promote renewable energy and lower carbon emissions are opening the door for a large growth in the EV market. Because of this, the need for EV charging cables is rising in proportion to the number of electric cars on the road.

India had a 19% increase in EV sales to 836,621 units in the first half of 2024–2025. Nonetheless, monthly growth was only 1.22% higher than in August. With 462,890 deliveries in the third quarter of 2024, Tesla surpassed all other BEV manufacturers in the globe in terms of sales. The growing need for EV batteries is driving up demand for lithium, cobalt, and nickels. Lithium demand increased by 30% in 2023 over 2022.

The key players operating in the market are facing challenge due to regulatory issues and competition from alternative materials, which may restrict the growth of the cross-linked polyethylene market in the near future. The cross-linked structure makes it difficult to recycle using conventional methods, leading to environmental concerns. Disposal of cross-linked polyethylene waste poses challenges, especially with increasing regulatory scrutiny on plastic waste. The preference for more environmentally friendly and recyclable alternatives may hinder cross-linked polyethylene adoption in certain markets.

Materials like polyethylene (PE) and polyvinyl chloride (PVC) offer lower costs and easier recycling, posing competition to cross-linked polyethylene. The rising innovations in biodegradable and recyclable materials could reduce cross-linked polyethylene's market share. Cross-linked polyethylene production relies on polyethylene, a petrochemical derivative. Fluctuations in oil prices and supply chain disruptions can impact production costs and availability. Geopolitical issues or raw material shortages can cause delays and increase costs.

Cross-linked polyethylene is extensively utilized in plumbing, water distribution, and underfloor heating systems due to its corrosion resistance, flexibility, and durability. Its use in insulation for buildings, HVAC systems, and other thermal applications supports the energy-efficient construction trend. Hence, the expansion of the construction and infrastructure sector, has created lucrative opportunity for the growth of the cross-linked polyethylene market over the forecast period.

Cross-linked polyethylene's superior insulation properties make it essential for high-voltage power cables, especially as countries upgrade aging power grids and invest in renewable energy projects. The growth of solar and wind energy installations drives the need for cross-linked polyethylene-insulated cables for reliable and efficient energy transmission.

The HDPE segment held a dominant presence in the cross-linked polyethylene market in 2024. High-Density Polyethylene (HDPE) is a crucial material in the production of cross-linked polyethylene (PEX) due to several inherent properties and characteristics.

HDPE has a high molecular weight and dense crystalline structure, providing excellent mechanical strength and rigidity. These properties make it suitable as a base material for further chemical or physical cross-linking processes. HDPE is resistant to a wide range of chemicals, including acids, alkalis, and many solvents. This chemical stability ensures that the material can undergo cross-linking without degrading or reacting adversely.

The molecular structure of HDPE allows for effective cross-linking through various methods (peroxide, silane, or radiation). This adaptability makes it a preferred choice for manufacturing cross-linked polyethylene. HDPE provides good resistance to water and gas permeability, contributing to the performance of cross-linked polyethylene in plumbing, heating, and other applications where sealing and insulation are critical.

The plumbing segment registered its dominance over the global cross-linked polyethylene market in 2024. Cross-linked polyethylene (PEX) is widely used in the plumbing industry due to its unique properties and advantages over traditional materials like copper, standard polyethylene or PVC. Cross-linked polyethylene can withstand high temperatures (up to 200°F/93°C) and high pressures, making it suitable for both hot and cold-water systems.

Cross-linked polyethylene is highly flexible and can be bent around corners without the need for additional fittings. This reduces installation time, labor costs, and the potential for leaks at joint connections. The cross-linking process enhances the polymer's resistance to cracking, scaling, and pitting, ensuring it remains functional for decades, even in challenging conditions.

Unlike metal pipes, cross-linked polyethylene does not corrode, even in areas with highly acidic or alkaline water. This increases the lifespan of plumbing systems. Cross-linked polyethylene resists chemicals commonly found in water, such as chlorine, which can degrade other materials over time. Cross-linked polyethylene pipes are lightweight, easy to transport, and require fewer fittings. Installers can use specialized tools for quick and efficient connections, significantly speeding up the installation process.

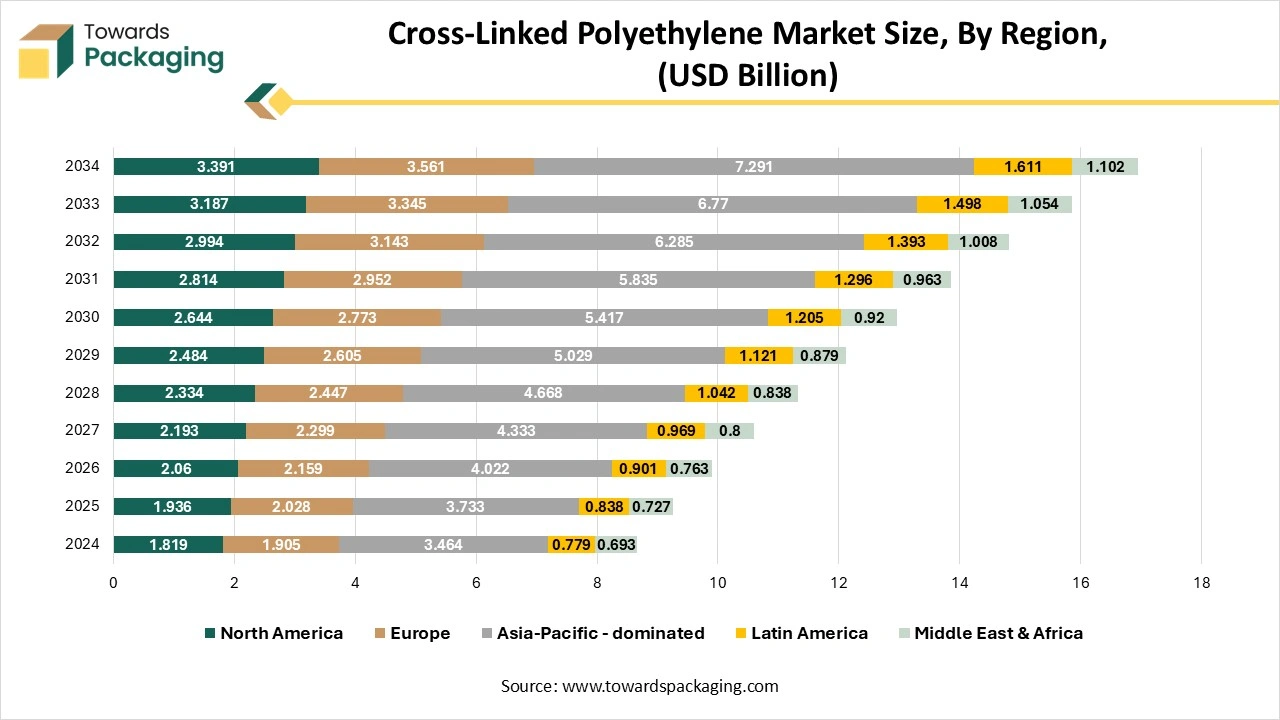

Asia Pacific dominated the global cross-linked polyethylene market in 2024. The Asia-Pacific region is experiencing significant urbanization, with millions moving to cities. This drives demand for reliable plumbing systems, including cross-linked polyethylene pipes, for residential and commercial buildings. Large-scale housing developments require efficient water distribution systems, where PEX pipes are preferred for their durability and flexibility. As economies in Asia-Pacific grow, construction of malls, hospitals, high-rise buildings and schools is surging, requiring advanced plumbing systems.

Governments in the region are heavily investing in smart city projects (e.g., India’s Smart Cities Mission, China’s urbanization plans). These projects prioritize advanced plumbing and energy-efficient systems, where cross-linked polyethylene plays a vital role due to its energy-saving properties. Many developing nations in Asia-Pacific are focused on expanding access to clean water and sanitation facilities, creating significant demand for durable and cost-effective piping solutions like cross-linked polyethylene. Government InitiativesLarge infrastructure investments in countries like India, China, and Southeast Asian nations—such as roads, airports, and public facilities—require reliable piping solutions.

North America region is anticipated to grow at the fastest rate in the cross-linked polyethylene market during the forecast period. The rapid adoption of EVs in North America has driven the need for advanced thermal management systems. Cross-linked polyethylene is used in battery cooling systems and other temperature control components due to its excellent thermal and mechanical properties.

North American governments and regulatory bodies have introduced stricter fuel efficiency and emission standards, driving the adoption of advanced materials like cross-linked polyethylene that can enhance vehicle performance. The automotive industry in North America is expanding due to strong domestic demand and exports. This directly increases the demand for advanced materials like cross-linked polyethylene in manufacturing.

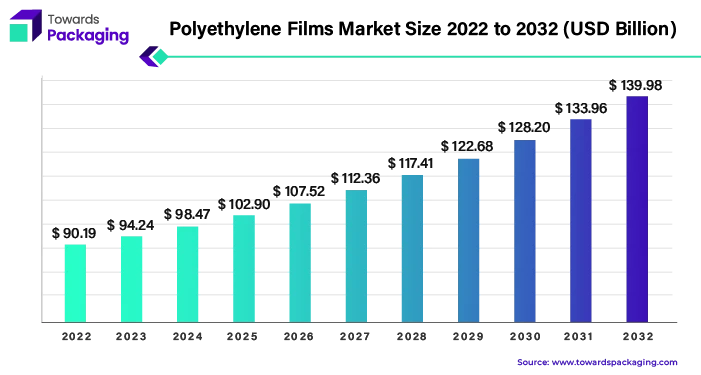

The polyethylene films market is expected to grow from USD 100.73 billion in 2025 to USD 149.69 billion by 2034, with a CAGR of 4.5% throughout the forecast period from 2025 to 2034.

The chemical ethylene, which is present in natural gas and petroleum, is the source of the polymer film that is called polyethylene (PE). considering its many uses, PE film is referred to by many different kinds of names, including plastic sheeting, polyethylene sheet, poly sheeting, and poly film. Despite over 100 million metric tonnes of PE resin generated annually, polyethylene has become the plastic material that is used the most globally. PE makes up nearly 34% of all polymer produced globally. The production of polyethylene is expected to be 22.67 million metric tonnes. An extensive selection of packaging materials, such as bags, wraps, pouches, and sacks, are able to be manufactured by moulding polyethylene films.

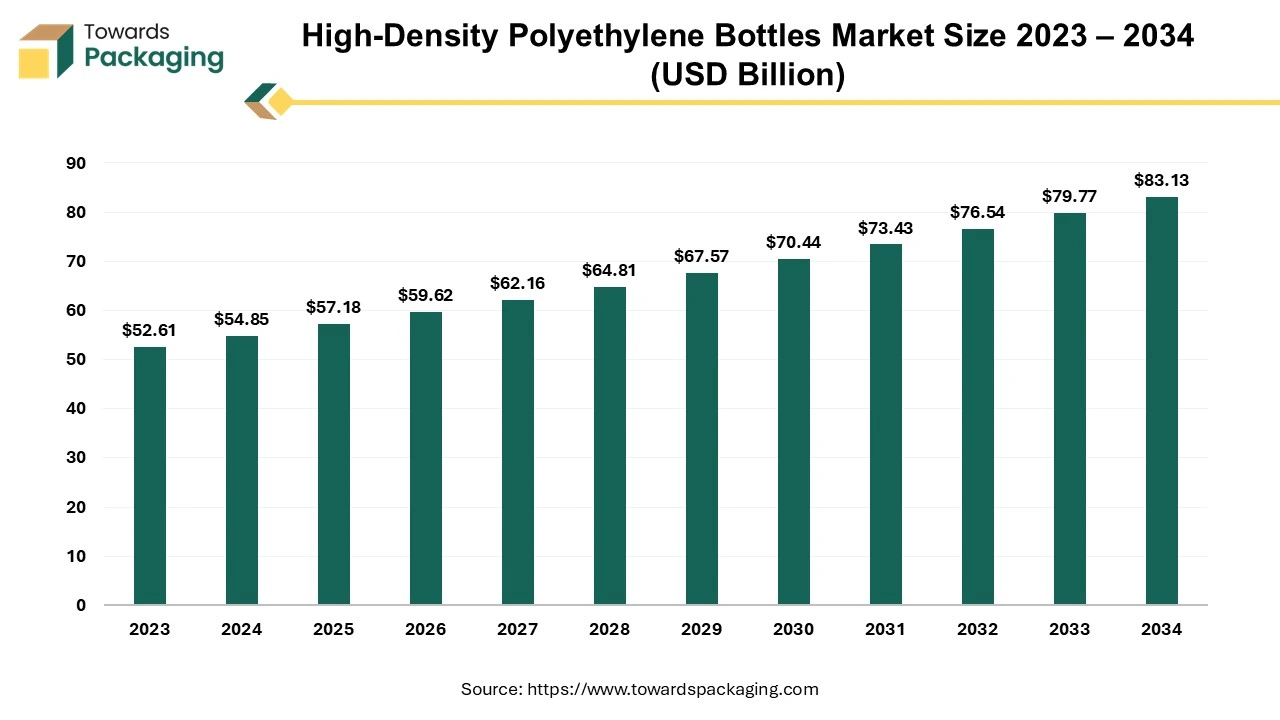

The high-density polyethylene bottles market is expected to increase from USD 57.18 billion in 2025 to USD 83.13 billion by 2034, growing at a CAGR of 4.26% throughout the forecast period from 2025 to 2034.

The high-density polyethylene bottles market is likely to register considerable growth during the projected period. HDPE, or high density polyethylene, is a petroleum-based thermoplastic polymer. HDPE plastic represents one of the most flexible plastics available and is utilized in many different products as well as bottles. HDPE plastic is well-known for its exceptional tensile strength, high melting point, high strength-to-density ratio and excellent impact resistance. These bottles are widely utilized across various sectors such as food & beverages, pharmaceuticals, personal care, household products and industrial applications owing to its strong properties. The majority of the bases, acids, aldehydes, alcohols, esters and aliphatic hydrocarbons are among the many scientific reagents for which high density polyethylene bottles offer excellent chemical compatibility.

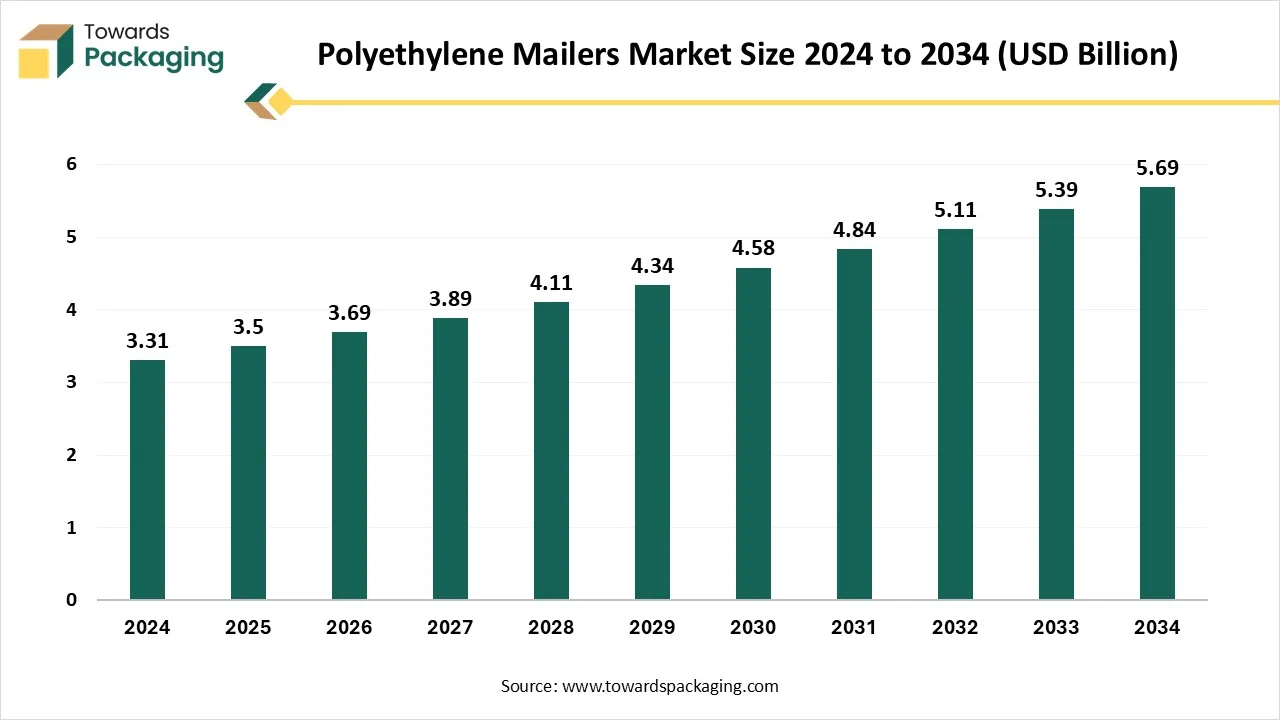

The global polyethylene mailers market is expected to increase from USD 3.5 billion in 2025 to USD 5.69 billion by 2034, growing at a CAGR of 5.54% throughout the forecast period from 2025 to 2034.The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing polyethylene mailers.

The polyethylene mailers market is driven by the rising demand for secure, lightweight, and cost-effective packaging solutions, particularly in e-commerce and retail sectors. These mailers offer durability, moisture resistance, and tamper-evident features, making them ideal for shipping documents, apparel, and small goods. Sustainability concerns are encouraging innovation in recyclable and biodegradable polyethylene variants. Additionally, the increasing adoption of digital printing for branding and product differentiation enhances their appeal. Growth is further supported by expanding logistics networks and the global shift toward online shopping and direct-to-consumer delivery models.

Polyethylene mailers are lightweight, durable shipping envelopes made from polyethylene, a type of synthetic plastic. Most commonly, they are produced using low-density polyethylene (LDPE), which offers flexibility and strength, although high-density polyethylene (HDPE) may also be used in some variants. These mailers are designed primarily for shipping soft, non-fragile items such as clothing, documents, and small accessories. They typically feature an opaque design to ensure privacy, with a self-sealing adhesive strip that makes them easy to close securely. Some versions also include a bubble lining for added protection, often referred to as bubble mailers.

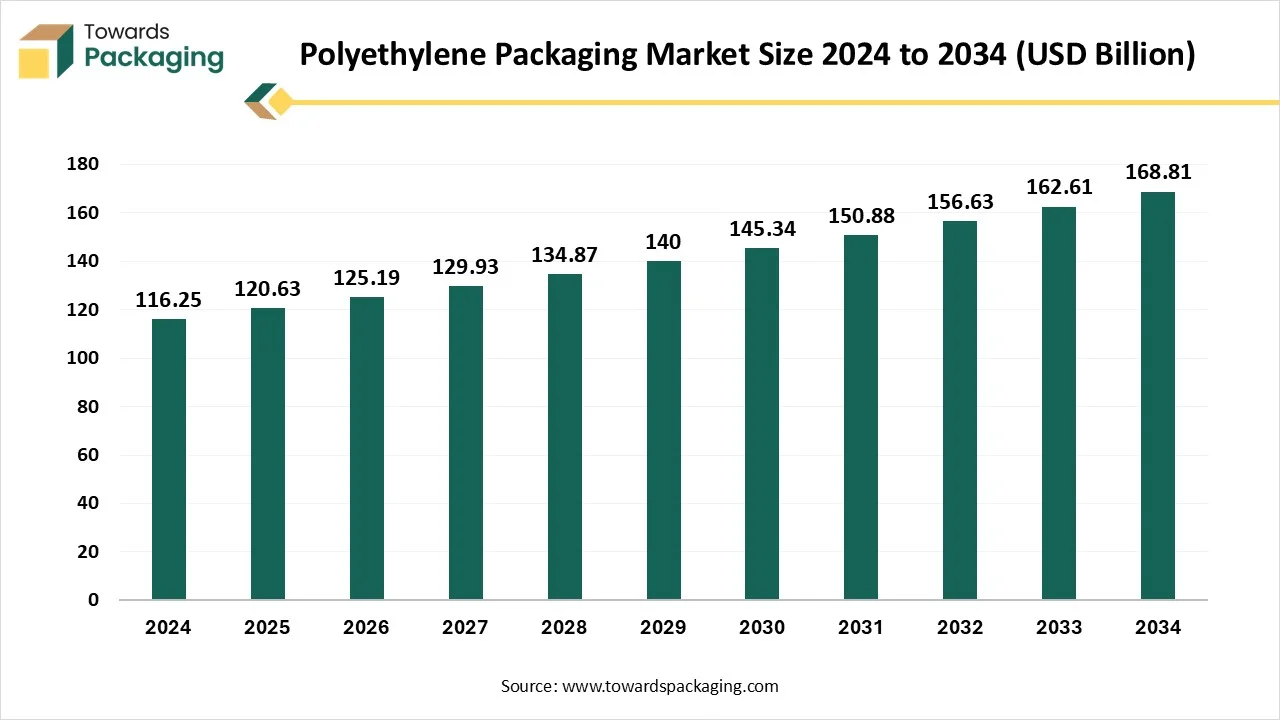

The polyethylene packaging market is expected to increase from USD 120.63 billion in 2025 to USD 168.81 billion by 2034, growing at a CAGR of 3.77% throughout the forecast period from 2025 to 2034.The growing concern towards food and beverage packaging to maintain the freshness of the products and rising ecological concern has influenced the demand for the polyethylene packaging market. The rapid growth in the automotive, food, healthcare, and electronics sectors has influenced the demand for polyethylene packaging.

Polyethylene packaging is widely used for the packaging of household products, and primarily in the online delivery of products. Polyethylene is a thermoplastic resin that is extracted from the polymerization of ethylene gas. This material is valued due to its lightweight nature, resistance to chemicals, and strength. It is available in various forms, comprising linear low-density polyethylene (LLDPE), low-density polyethylene (LDPE), and high-density polyethylene (HDPE), each with its own set of qualities and compensations. There are several benefits associated with this material, such as low shipping charges, safety, and durability. These packages provide enhanced protection, non-toxicity, and versatility, which makes them suitable and attract a huge variety of brands.

The French gas utility network operator GRDF constructed the world's first gas pipeline in Clermont-Ferrand using INEOS bio-based HDPE as part of a project to lessen the carbon footprint of the city. At the INEOS facility in Lillo, Belgium, the bio-based HDPE is manufactured. It is manufactured from paper industry wood processing leftovers as an alternative to feedstocks sourced from fossil fuels.

By Type

By Application

By Region

December 2025

October 2025

October 2025

October 2025