February 2025

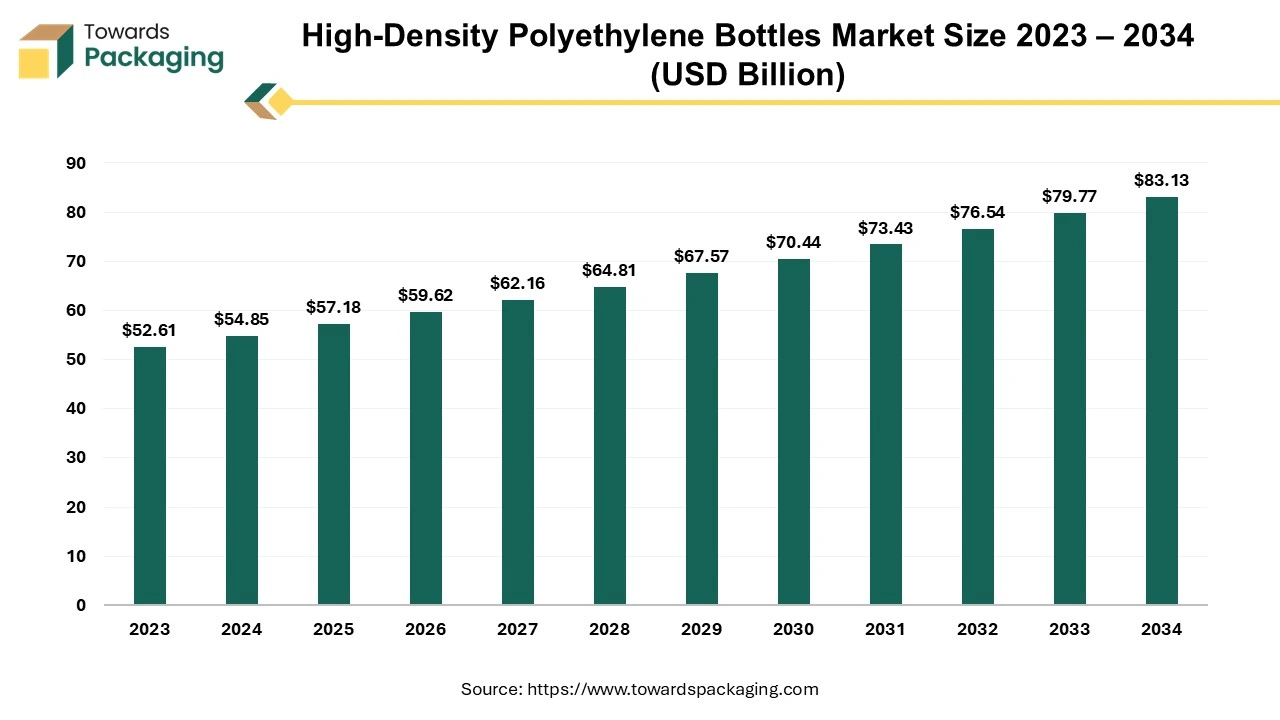

The high-density polyethylene bottles market is expected to increase from USD 57.18 billion in 2025 to USD 83.13 billion by 2034, growing at a CAGR of 4.26% throughout the forecast period from 2025 to 2034.

The high-density polyethylene bottles market is likely to register considerable growth during the projected period. HDPE, or high density polyethylene, is a petroleum-based thermoplastic polymer. HDPE plastic represents one of the most flexible plastics available and is utilized in many different products as well as bottles. HDPE plastic is well-known for its exceptional tensile strength, high melting point, high strength-to-density ratio and excellent impact resistance. These bottles are widely utilized across various sectors such as food & beverages, pharmaceuticals, personal care, household products and industrial applications owing to its strong properties. The majority of the bases, acids, aldehydes, alcohols, esters and aliphatic hydrocarbons are among the many scientific reagents for which high density polyethylene bottles offer excellent chemical compatibility.

The expansion of the food and beverage sector as well as the growing pharmaceutical and healthcare industries is expected to augment the growth of the high-density polyethylene bottles market during the forecast period. Furthermore, the rising e-commerce sector along with the increasing use of HDPE bottles in personal care and cosmetics is also anticipated to augment the growth of the market. Additionally, the growing awareness of plastic waste reduction coupled with the increasing demand for sustainable packaging is also projected to contribute to the growth of the market in the near future.

The growth in the food & beverage sector is projected to augment the growth of the market during the forecast period. This is owing to the evolving consumer lifestyles, greater inclination toward pre-packaged, ready-to-consume products as well as rapid urbanization and the rising consumer focus on healthy drinks. As per the United States Department of Commerce, Bureau of the Census's County Business Patterns, there were almost 42,708 food and beverage production facilities in the US in 2022. California had the most of these establishments, with 6,569, accounting for 15% of the total. The two states that produced the most food and beverages were Texas (2,898) and New York (2,748). This high concentration of food and beverage manufacturing facilities supports the constant need for packaging that complies with the food safety regulations and improves shelf life.

Since HDPE bottles have superior barrier qualities that shield the oil from air and light while maintaining its quality, they are frequently utilized to pack edible oils. Additionally, they are utilized for storing the dairy items like milk and yogurt as well as a various liquids like syrups, juices, sauces and more, offering a clean and safe storage choice. Furthermore, the growing pharmaceutical sector is also likely to support the growth of the market.

In 2023, the pharmaceutical products market was projected to reach a value of over $1 trillion USD worldwide. In the pharmaceutical sector, HDPE bottles are commonly utilized for storing the topical creams, liquid solutions and oral drugs. Due to their exceptional chemical resistance, the products are shielded from damage by exposure to light and moisture, maintaining their integrity and effectiveness. Furthermore, HDPE is compliant with stringent regulatory standards, making it a trusted choice for packaging in an industry where safety and compliance are paramount.

With increase in awareness of plastic waste and environmental degradation, both consumers and companies are inclined towards materials perceived as greener such as glass, aluminum and biodegradable plastics. Since glass bottles are impermeable, non-porous and non-toxic, they are extremely hygienic. Additionally, they can withstand both hot and cold temperatures. Glass does not react with its contents nor create any new particles. Glass bottles enable products to be kept for a very long period without losing their original flavor, color, consistency, scent, or nutritional content. Glass bottles are also completely recyclable. Glass is an important resource in the application of sustainable development plans since it can be reused endlessly. Recycling glass bottles is a closed-loop operation that produces no byproducts. It is also among the few resources that are capable of being recycled without losing quality, which greatly minimizes the adverse effects on the environment.

Another material that is gaining traction is aluminum. Due to the fact that aluminum is efficiently recycled, an established system for the collection and reuse of aluminum items has been developed over many decades. Therefore, even though aluminum manufacturing still requires an intrusive mining and extraction procedure, sustainability initiatives benefit greatly from aluminum's endless recycling potential. According to estimates, around 75% of the aluminum that was ever produced in the US continues to be in use today. A number of the world's largest beverage corporations have also made the decision to shift towards recyclable materials. For instance, Coca-Cola revealed that it will launch a new line of aluminum-cans Dasani brand water in the north-eastern United States. Thus, the growing preference for alternatives poses a major challenge and is likely to limit the growth of the market within the estimated timeframe.

The operators of recycling facilities have made investments in infrastructure projects that have an impact on several communities. Investments in the recycling facilities and advancements in sorting technologies have improved the efficiency and accessibility of HDPE recycling, enabling higher recovery rates and better quality recycled HDPE (rHDPE). Many projects recently marked openings or are almost finished. For instance:

Furthermore, there is a rising demand for the recycled HDPE. Recycled HDPE provides manufacturers with an opportunity to improve their market positioning and thus companies are now incorporating the consumption of the recycled plastics for manufacturing new products. For instance:

Companies that use rHDPE demonstrate not only their commitment to minimizing plastic waste, but also contribute to circular economy goals, increasing brand loyalty among the conscious consumers. Thus, the improved recycling infrastructure and growing demand for rHDPE is expected to offer a promising opportunity for the HDPE bottles market in the years to come.

The high-barrier segment held largest market share of 65.38% in 2024. High-barrier bottles are designed to withstand moisture, and oxygen, making them perfect for various applications. In the pharmaceutical sector, high-barrier qualities are important because they inhibit contamination and deterioration of the sensitive drugs and supplements that must comply with the severe regulatory standards. This demand is further fueled by the rise of the chronic illnesses, which has resulted in constant growth in the pharmaceutical packaging needs. Furthermore, high-barrier has a flexible, solvent-free, impermeable co-extruded structure that doesn't react with stored products like juices. This strict barrier, which is made-up of particular materials, also preserves the characteristics of the products such as their color, flavor, texture, scent, and taste. Thus, these factors are expected to favor the segmental growth of the market.

The food & beverage segment held the considerable market share in 2024. This is owing to the growing popularity of ready-to-drink beverages and bottled water across the globe. Based on the most recent data from the Beverage Marketing Corporation (BMC), the total volume of bottled water sold in the United States in 2022 was 15.9 billion gallons, which were a record high and the seventh consecutive year that it surpassed carbonated soft beverages. Sales in 2022 were close to $46 billion in retail dollars, up from $40.8 billion in 2021. In 2022, Americans consumed 46.5 gallons of bottled water on average, and 91% of them want bottled water to be accessible where other beverages are sold. The majority of the bottled water comes in completely recyclable HDPE packaging, which is among the most recycled material in the world and the one that customers recognize as recyclable. Additionally, HDPE’s lightweight yet durable nature makes it ideal for reducing the transportation costs while providing protection against contamination and spoilage.

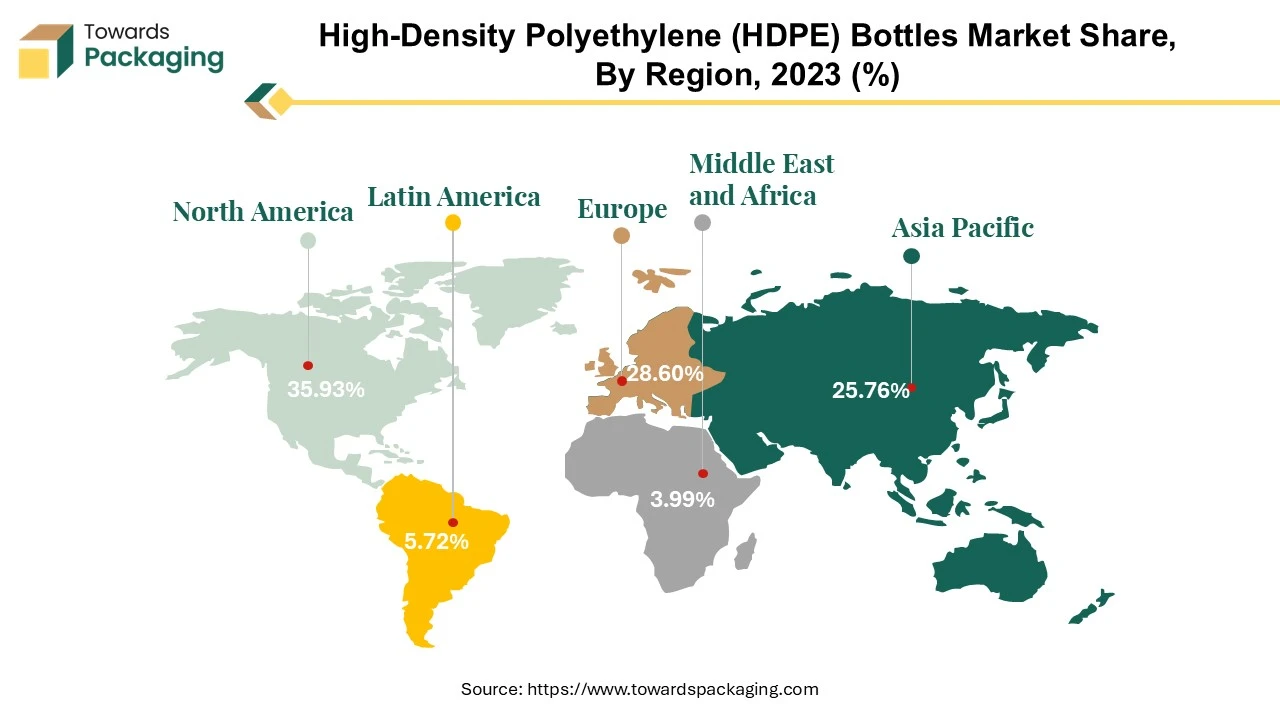

North America held the largest market share of 35.93% in 2024. This is due to the consumer preference for bottled beverages, sauces and condiments across the region. Also, the shift towards sustainability and recycling initiatives is further likely to contribute to the regional market growth. For instance, in September 2024, Republic Services-backed plastics packaging recycling collaborative plans to construct a new recycling plant in Buckeye, Arizona. The proposed 162,000-square-foot facility will promote eco-friendly packaging production. The Buckeye Blue Polymers factory will manufacture polypropylene (PP), which is commonly used in packaging like yogurt cups and margarine tubs, and recycled-content polyethylene (PE) like HDPE (high density polyethylene), which is utilized in milk containers and detergent bottles. Furthermore, the strong healthcare infrastructure and high pharmaceutical consumption is also expected to contribute to the regional growth of the market.

Asia Pacific is likely to grow at fastest CAGR of 6.24% during the forecast period. This is owing to the increasing urbanization and a large population base in countries like China and India. Furthermore, the growth of the middle class and higher disposable incomes as well as the rapid expansion of e-commerce is also expected to fuel the growth of the market in the region. B2C (Business to consumer) e-commerce sales of items increased by 8.6% in 2021 compared to 2022, according to Japan's Ministry of Economy, Trade and Industry's (METI) annual e-commerce industry Survey, which was issued in August 2022. The B2C e-commerce industry was estimated to be valued at $188.1 billion. Additionally, the increased awareness and demand for the personal hygiene and care products are also anticipated to support the growth of the market in the region in the near future.

By Cap Type

By Visibility

By Barrier Type

By End-User

By Region

February 2025

February 2025

February 2025

February 2025