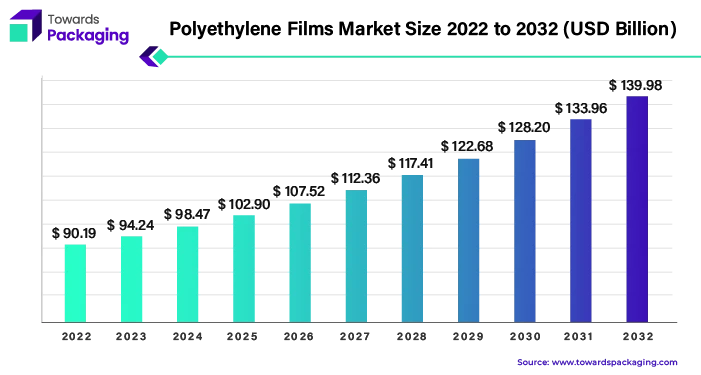

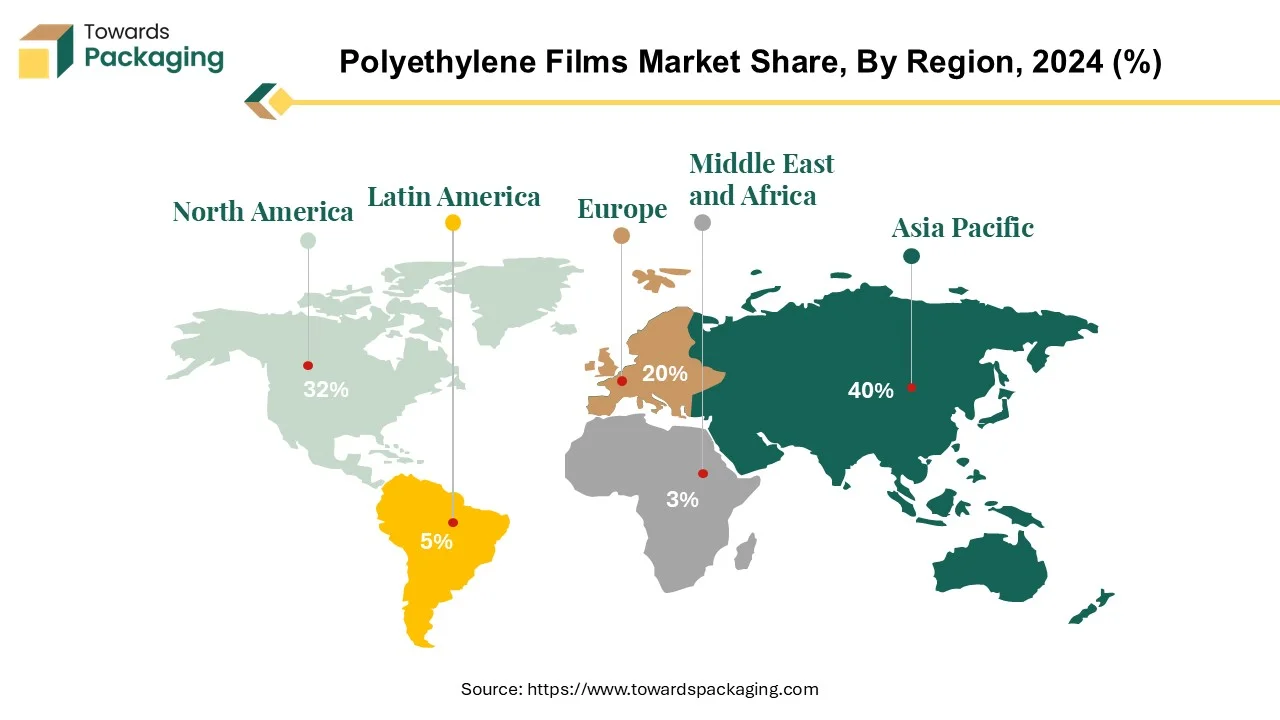

The polyethylene films market is valued at USD 100.73 billion in 2025 and projected to reach USD 149.69 billion by 2034 at a CAGR of 4.5%. It covers material segments such as LDPE, LLDPE, HDPE and bio-PE; product types including stretch and shrink films; and packaging formats such as bags, pouches, boxes, sachets, stick packs, wraps and labels. The report provides an in-depth regional outlook, with Asia Pacific accounting for 40.2% and leading global LDPE consumption (over 39% in agriculture). It analyses North American production, EU plastic consumption (9–9.3 million tonnes flexible packaging usage), LDPE/LLDPE production trends (6.1–8 million tonnes in EU), and PE recycling rates (23% in 2018). Competitive profiling covers major players such as Amcor, Berry Global, Sealed Air, Avient, Winpak, Sigma Plastics, Novolex, and others, along with value chain structures, trade flows, supply–demand balances, and manufacturer-level insights.

The chemical ethylene, which is present in natural gas and petroleum, is the source of the polymer film that is called polyethylene (PE). considering its many uses, PE film is referred to by many different kinds of names, including plastic sheeting, polyethylene sheet, poly sheeting, and poly film. Despite over 100 million metric tonnes of PE resin generated annually, polyethylene has become the plastic material that is used the most globally. PE makes up nearly 34% of all polymer produced globally. The production of polyethylene is expected to be 22.67 million metric tonnes. An extensive selection of packaging materials, such as bags, wraps, pouches, and sacks, are able to be manufactured by moulding polyethylene films.

PE film is used in many different applications because the material is inexpensive to produce, highly flexible, lightweight, and protective. It has the capacity to produce solid, crystalline shapes. It is the polymer that is actually utilised throughout the globe. A number of companies use polyethylene to produce their labels because it is the least cheapest labelling material available. Although polyethylene labels are strong, flexible, long-lasting, and have exceptional resistance capabilities, they are excellent for a wide range of applications.

The film can take ages for this procedure to take place since polyethylene degrades naturally. Due to its affordable price, simplicity of manufacturing, and lightweight nature, film made from polyethylene is used in virtually all industries. The environment could benefit from it also once it is employed on objects like containers for shipping in water. Annual production of plastic bags is projected to be 380 billion in the United States exclusively. Yet the recycling rate for plastics remains approximately 5%. The residual material eventually ends up in rivers, landfills, and the ocean, where it may pose a threat to the environment.

The detrimental effects on the environment of polyethylene films can be significantly reduced if someone is vigilant about reusing and recycling the material. Many companies have already developed strategies to accelerate polyethylene's biodegradation, and as the general understanding of the environment's vulnerability increases, one might anticipate seeing more initiatives in this field. PE film is one of the most frequently employed labels due to its benefits and ability to be recycled.

For Instance,

The polyethylene films market is growing steadily due to rising demand from packaging, agriculture, and industrial applications. Expansion of e-commerce, food packaging, and protective materials continues to drive consistent market growth.

Manufacturers are increasingly focusing on recyclable mono-material films, downgauging, and higher use of recycled content. Regulatory pressure and brand sustainability goals are accelerating the shift toward circular and low-impact film solutions.

Startups are emerging with innovations in biodegradable materials, advanced recycling, and performance-enhancing film technologies. Collaboration with established players is helping scale sustainable solutions.

The market for polyethylene films is becoming more sustainable due to downgauged films, recyclable mono material structures, and increased use of post-consumer recycled content. Films are being redesigned by manufacturers to use less plastic without sacrificing performance or strength. Innovation in low-carbon, recyclable, and bio-based polyethylene film solutions is being accelerated by growing regulatory pressure and brand commitments to circular economy goals.

With governments tightening regulations on plastic waste recyclability and the use of recycled content, the market for polyethylene films is becoming more and more shaped by regulatory changes. Manufacturers are being forced to use recyclable-compliant film designs by laws that support extended producer responsibility (EPR), prohibit non-recyclable plastics, and require sustainability labeling. The shift to environmentally friendly production techniques and circular materials is being accelerated by these regulations.

The chart shows that flexible packaging plastics use in Europe increased steadily between 2010 and 2020.

Key trends:

The data shows the trend in production and use of LDPE and LLDPE-the main polymers used in flexible packaging films in the EU28+2 region over the past decade. Production levels remained relatively stable between 6.1 and 6.7 million tonnes, except for 2017, when production peaked at 8 million tonnes before returning to typical levels in 2018. Net demand for LDPE and LLDPE stayed steady between 6.5 and 7.1 million tonnes, exceeding production by about 0.5 million tonnes in 2018, which had to be covered through imports.

In 2018, the total demand for PE flexible films was estimated at 8.5-9 million tonnes, of which 1.2-1.3 million tonnes came from recycled material. When including other polymers such as PP, multilayer materials, PET, PVC and biodegradable plastics, the overall flexible film market reached 13–15 million tonnes. PP and multilayer films each accounted for 2-2.5 million tonnes.

(Values based on PRE market estimates and polymer purity assumptions: Household 70%, Commercial 85%, Agricultural 50%) Polyethylene (PE) flexible films such as packaging films, agricultural films, and commercial wrapping are widely used, but recycling performance varies greatly depending on their source.

In 2018, about 8.5 million tonnes of PE flexible films were placed on the market across Europe. Out of this, 2.6 million tonnes of sorted film bales were collected and sent to recycling facilities. However, due to contamination and the presence of non-PE materials, only 2.01 million tonnes of actual PE content reached recyclers resulting in an overall recycling rate of just 23%.

Recycling efficiency differs by sector:

This data highlights that improving collection systems, reducing contamination, and designing mono-material packaging will be key to increasing recycling rates.

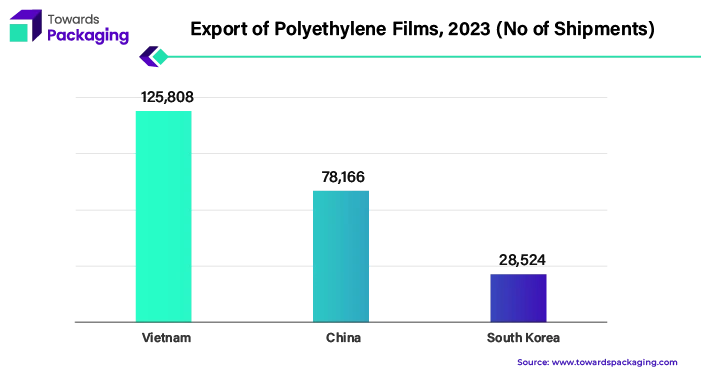

Asia pacific region contributes to the highest share in polyethylene film market. With the market share of 40.2%, this rapidly growing stronghold attracted by increasing middle class in developing countries such as India and China. These countries are the leading in production of polyethylene films. Major part of these films incorporated in food and beverage packaging. India, China, Vietnam and other Asia countries has largest food and beverage network packaging market. the Asia-Pacific Region will lead the world in terms of LDPE (Low-Density Polyethylene) consumption, the agricultural sector of this region will account more than 39% of the world's total LDPE consumption.

Plastic industry in India, especially, contributes a lot to the national economic index, where the country is listed amongst the world's leading markets. The land touts an advanced manufacturing sector and is a major exporter of polyethylene films as well as other type of plastics. Among the key factors that account for India's leading role in this industry are the country's vast manufacturing capacities, strategic location, and increasing skill set on plastic manufacturing techniques.

The Polyethylene Films Market in the Asia-Pacific has a high accelerated growth potential and increasing demand triggered by factors like urbanization, industrialization, and the large consumer base. The dynamism of the region's economic turf combined with the favour of government reforms and allocation of infrastructure enhance quick expansion of the polyethylene films industry. The countries like Vietnam, India, and China are the main suppliers of the polyethylene (PE) films. Those countries are good at manufacturing and exporting, which enable them to export PE films that are required by the world market.

The Asia-Pacific region, especially China and India, will keep the lead in contributing to the field of shaping the global environment of the polyethylene films market landscape in the forthcoming years.

For Instance,

North America is home to the largest polyethylene manufacturing operations. The US, in specific, accounts for 21% of world plastic consumption and 19% of the world's plastic output. The survey-based sector information gathered for the American Chemistry Council (ACC) by an impartial third party serves as the foundation for plastic manufacturing and consumption by North America's key markets. The ranging geographic bounds for the ACC data follow the manufacturing sites of the survey respondents e.g., production of polyethylene represents the United States and Canada, but production of polypropylene and polystyrene represents the United States, Mexico and Canada.

Sales of resin and production in North America may involve imports by resin producers. In less than six months, PE prices in the US rose from $1,200 per metric tonne to $2,200. The discontinuity was caused by two main factors: a decrease in the local supply and an absence of practical import alternatives. Considerable PE production was stopped in Texas due to the arctic vortex in February, which resulted in power outages and drained stockpiles. This decreased US producer exports.

LDPE manufacturing is mainly driven by the USA as well as Canada, where countless producers run. These makers make use of innovative innovations as well as manufacturing procedures to fulfill the expanding need for LDPE in The United States and Canada as well as past. The continual need for polyethylene movies is driven by variables such as manufacturing capability developments, technical developments and also the extensive intake of plastic items throughout different markets.

For Instance,

LDPE films possess a wide array of desirable properties thus becoming an all-round application polymeric material. Such a material may be heat-sealed, be chemically inert and have no odor at all. LDPE changes its shape with the effect of temperature increase and this can be beneficial in certain areas. Although it has very low water vapor permeability, LDPE has high gas barrier which makes it proper for ensurance packaging. But at the same time, it is accepted as being oil soluble and odor resistance is poor.

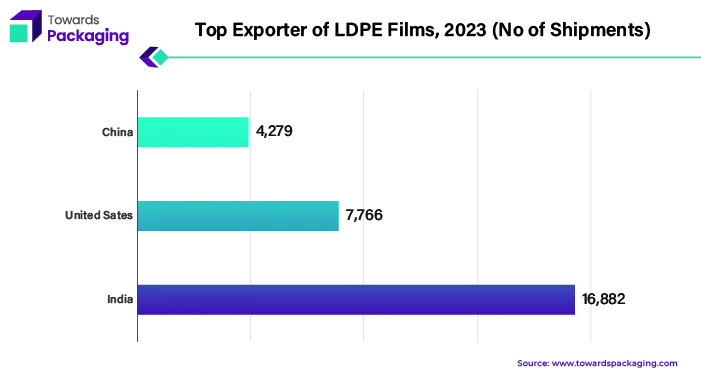

LDPE films are major exporters of China, United States, and India. These countries have on their side expertise in manufacturing as well as well-established export infrastructure channels which enable them to sell LDPE films in the global market at a relatively low cost. Modifications of LDPE can be developed for different uses and specific end products by adjusting its properties. To explain, the low-slip properties are ideal for the safe stacking, at the same time the high- slip properties are suitable for the easy packing into the outer containers. LDPE's cost-effectiveness is the reason for its wide use in production of various products like transparent pouches, bags, papers and boards coatings, laminates as well it is often applied as copolymer component of tubs and trays. LDPE resins that have been developed to be used for specific applications such as dry cleaner bags, bread bags, paper towel overwrap and shipping sacks.

In 2022, LDPE accounted for about 22 % of the total PE demand, with LDPE and LLDPE taking together roughly 56 % of the demand. LLDPE, due to its great characteristics, is widely used across traditional markets for polyethylene materials. It is widely employed in film and fabrication industry with a broad spectrum of uses ranging from agricultural plastics, cling wrap, to bubble wraps and multilayered composite films. The multipurpose nature and adaptability of LDPE and LLDPE enable them to be an essential element in different market sectors, thus increasing the popularity of polyethylene films market.

For Instance,

One of the most rapidly growing packaging items is the polyethylene stretch film, which is defined as a flexible and elastic packaging material that is both widely and efficiently used for keeping and protecting items in transportation and storage. They are normally manufactured from polyethylene or similar materials by an extrusion process, which involves creating thin sheets that also undergo stretching in two directions to deliver higher strength and stretchability characteristics. Wrapping of the materials in this manner yields a bundle that prevents the good from getting dusty, wet and other contaminants.

Considering the fact that polyethylene stretch films often face approximately 80% production costs emerging from raw materials, resulting in toughness, tearing, and load stability, we are confident that the integrity of packed objects can be guaranteed. As expected, they are implemented almost everywhere in logistics, retail, as well as manufacturing where they are widely used for palletizing products, bundling and unitizing.

PE Stretch Film is particularly indented for a wrapping of packages, pallets, and boxes in preparation, transit, and delivery. The repetitive process of carrying goods from one means of transportation to another significantly increases the chances of scuffs, dirt, and contaminated surfaces. Although the multiple layers of stretch films can create a tenacious external barrier and can prevent the hardening of the package contents. The demand for polyethylene stretch films is still emerging, mostly because people understand that these films play a significant role in keeping the products safe and secure while in transit. As technology improves, the level of knowledge concerning film stretch grows, and the use of this product is expected to expand in a variety of sectors in the near future.

For Instance,

Bags feature prominently amongst polyethylene films market players with an existing presence in a wide range of sectors. Particularly, the polyethylene bags are popular with people because of the variety of their uses, their robustness and their low price. These sacks are made by using a polyethylene resin through manufacturing techniques such as extrusion or blown film extrusion. Nowadays in market you can find polyethylene bags of different kinds and dimensions in order to fit different packaging needs. It occupies a broad sector which goes with packaging and transport by providing a shield from dust, moisture and pollutants. Main types of polyethylene bags are grocery bags, garbage bags, zipper bags, and bagging for businesses.

The polyethylene films industry is found to be quite robust, which is a key driver for shopping bags used by consumers that are based on the increasing demand of convenience and the flourishing industrial and online shopping sectors. Furthermore, as the eligible item of recycling of plastic bags is also right with the ecological initiatives, this product sticks out even more.

Polyethylene bags still made-up significant percentage on the global Polyethylene Films Market by performing multitude of tasks in the retail, food and beverage, pharmaceuticals and agriculture spheres. With the passage of time, Bag designs, production techniques and brand contact are predicted to be more useful and desirable on the customer ratings.

For Instance,

Food and beverages have become a leading area in the polyethylene films market where polyethylene films are indispensable. For these films, there are many options of packaging which meet different needs and necessities. Polyethylene films are the most popular among food and beverage industries because of their high moisture-resistant, barrier-protective, flexible, and sealable properties.

Films may serve to extend the life of these already short-lived products through their protection from moisture, oxygen, and other outside contaminants. They are accountable to ensure food safety and hygiene, making sure that the food is free of contamination during the storage and transportation phases. PE film has high tensile strength, low moisture absorption and dimension stability in different temperature limits. It is useful for plastic packaging for carbonated drinks, bags, snack food wrappers, bottles, jars, and tubs.

PE film manufacturers are, generally, located worldwide, with the main regions being USA, Canada, India and China. The growth of the demand of these films in the market depends on the food and beverage industry, as they provide moisture resistance and barrier properties, and hence, drives the growth of the group of manufacturers. This increase in demand for PE films in the food and beverage sector is anticipated to continue in the future. This expansion is fuelled by several factors which include the continuous demand for packaging material that is convenient and sustainable, the rise of e-commerce as a shopping method, and technological developments in the film making industry.

Polyethylene films enable many kinds of innovations in packaging design, for example, those with easy-open features, portion-packaging, and sustainability being increased by means of using recyclable and biodegradable materials. The flexible nature of polyethylene films provides scope for the development of specific packaging to different food and beverages, which in turn has preference to the industry. the food and beverage industry are driven by rising demand which translate to large scale growth for the polyethylene films market with the polyethylene films set to play a critical role in meeting new packaging requirements of this dynamic sector.

For Instance,

The competitive landscape of the polyethylene films market is dominated by established industry giants such as Amcor PLC, Berry Global Group, Sealed Air Corporation, Avient, Reynolds Consumer Products, Inteplast Group, Novolex Holdings, Sigma Plastics Group, Printpack Holdings Inc., Winpak, Dunmore Corp., Nova Chemicals Corp., SINGHAL Industries Private Limited, Qingdao Kingchuan Packaging, and TECHNOLOGIA JSC. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

Amcor has two main business segments: Rigid Plastics and Flexible Packaging. It provides services to a wide range of markets in the Americas, Asia Pacific, Europe, Africa, and the Middle East. Amcor's packaging knowledge meets a range of customer demands, such as pet food, fresh produce, dairy, and snack packaging, as well as beverage containment.

For Instance,

Among Berry's illustrious clientele are well-known international brands including Nestle, Procter & Gamble, and Coca-Cola. Berry's growth strategy is further distinguished by its track record of making profitable acquisitions, adding firms such as RPC Group to its portfolio. In addition to a wide variety of straws, drink cups, lids, and films, Berry also offers products specifically designed to meet the needs of the cannabis sector.

For Instance,

Vacuum skin packaging, food equipment bagging systems, and several protective packaging options are among the various products offered by sealed air. In addition to producing basic medical films, Sealed Air also makes recyclable bubbles, inflated pouches, and cushioning systems for a range of uses, demonstrating its position in the healthcare industry.

For Instance,

One of the top suppliers of specialty polymer materials, solutions, and services is Avient. The 8,700 employees of this company are dedicated to environmental responsibility. Their main goals are to lessen the usage of phthalate plasticizers and heavy metals while also encouraging recycling and energy efficiency.

For Instance,

Polyethylene films rely on ethylene derived from oil and natural gas. To manage cost volatility, producers are increasing the use of recycled and bio-based raw materials while diversifying sourcing regions.

Key Players: Major companies include Dow Inc., ExxonMobil Chemical, SABIC, LyondellBasell, BASF SE, Berry Global, and Amcor plc.

Governments and airlines use polyethylene films for packaging, medical supplies, and cargo protection. Demand favors lightweight, recyclable, and regulation-compliant film products.

Producers offer customization, technical support, and upgrades such as UV protection, anti-static properties, and recycled content integration to enhance film performance.

Key Players: Sealed Air Corporation, ProAmpac, Innovia Films, and regional converters are key providers.

By Material

By Product Type

By Packaging Type

By End Use

By Region

December 2025

December 2025

December 2025

December 2025