April 2025

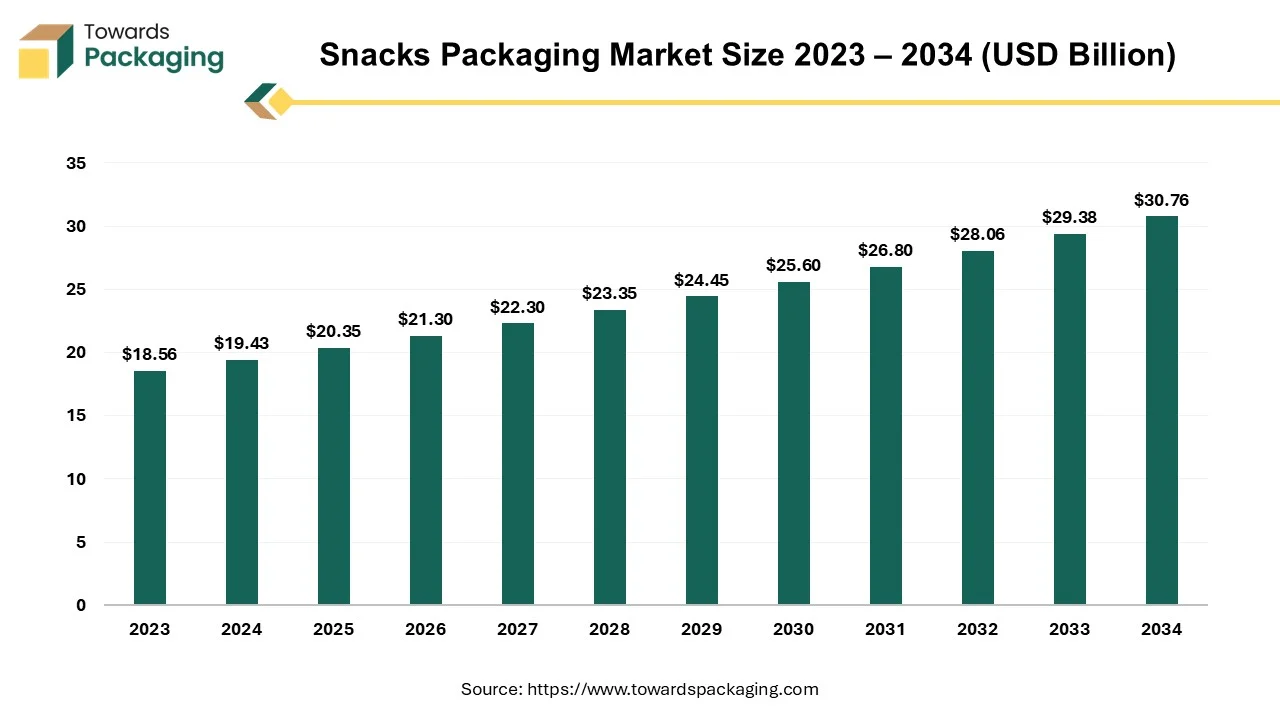

The snacks packaging market is expected to increase from USD 20.35 billion in 2025 to USD 30.76 billion by 2034, growing at a CAGR of 4.7% throughout the forecast period from 2025 to 2034.

The snack packaging industry is experiencing increased demand for packaging solutions catering to customer convenience and preferences. Snacks, being a popular choice for quick, informal, or on-the-go eating, necessitate packaging that is simple to open, keeps the product fresh, and is portable. Customers are willing to spend a 10-to-50 percent premium for packaging that fits these criteria. 2023, the global snack market will generate USD 1,220.9 billion in revenues. By 2022, the average income per capita for cookies and crackers had risen to $34.93, $11.42 for potato chips, and $20.32 for flips, tortilla chips, and pretzels.

| Total Snacks Market Revenue (In USD Billion) | |||||||

| Year | Total Snacks Market Revenue | Frozen & Refrigerated | Savory | Confectionary | Fruits | Bakery | Other |

| 2022 | 1,731.8 | 482.9 | 379.7 | 259.2 | 190.1 | 138.8 | 276.4 |

| 2023 | 1,652.4 | 471 | 363.3 | 247.8 | 182.2 | 132.8 | 264.5 |

| 2024 | 1,584.0 | 445.4 | 349.2 | 238.5 | 175.2 | 127.7 | 254.4 |

| 2025 | 1,530.8 | 429.4 | 337.6 | 230.6 | 169.4 | 123.5 | 245.7 |

| 2026 | 1,480.5 | 412.9 | 324.7 | 221.7 | 162.9 | 118.8 | 236.4 |

| 2027 | 1,436.6 | 402.8 | 315.9 | 216.3 | 158.8 | 115.8 | 230.1 |

| 2028 | 1,388.2 | 389.4 | 306.3 | 209.2 | 153.7 | 112 | 223 |

| 2029 | 1,331.3 | 372.7 | 294 | 200.2 | 147 | 1067.2 | 213.4 |

| 2030 | 1,262.5 | 354.8 | 278.8 | 190.5 | 140 | 102.3 | 203.2 |

| 2031 | 1,230.8 | 342.9 | 269.7 | 184.2 | 135.4 | 98.7 | 196.4 |

| 2032 | 1,174.8 | 329.8 | 259.4 | 177.2 | 130.2 | 94.9 | 188.9 |

Packaging is critical in maintaining the freshness of snack food, especially when subjected to high pressure and temperature during processing. This guarantees that the products are effectively wrapped, preserving their quality and extending shelf life. The packing procedure is strictly followed to protect producers and customers from problems.

Snack packaging frequently has two or more layers with high-barrier materials to ensure excellent preservation. Design considerations include low oxygen and water vapor permeability, resistance to heat adhesion, light protection, and a low coefficient of friction. Furthermore, there is an increasing emphasis on sustainability, focusing on using eco-friendly packaging materials.

For Instance,

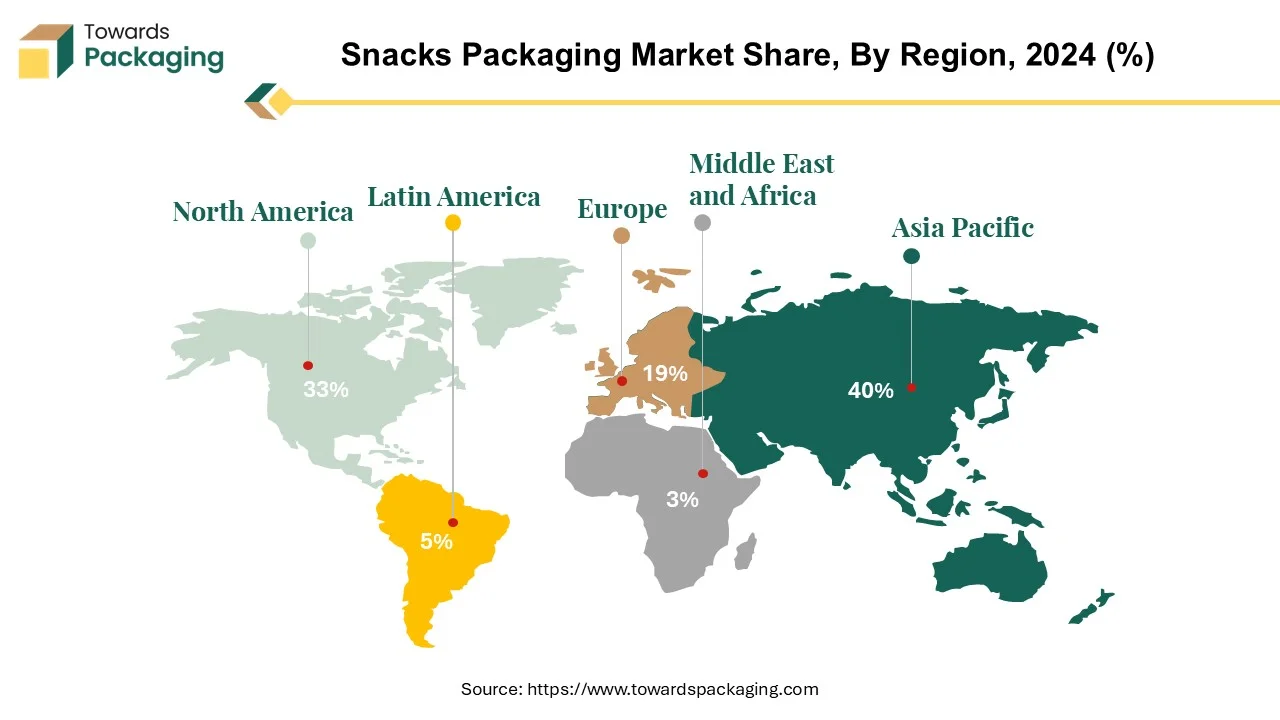

The snack packaging market, significant in the Asia Pacific region, has experienced substantial growth despite the obstacles presented by the pandemic and changes in the world economy. Countries in Asia Pacific are dealing with the inflationary consequences of the global environment as they emerge from the epidemic in 2023. The snack packaging market has demonstrated positive volume and value growth in 2023, with predictions of continuous expansion over the projected term, despite China experiencing rises in COVID-19 cases.

India, a prominent participant in the savory snack market that includes meat snacks, potato chips, nuts, and seeds, is positioned for significant growth. According to projections, India's demand for savory snacks will grow to around 13 billion dollars by 2026. The growth above highlights the growing need for inventive and effective snack packaging solutions that satisfy customer demands for freshness, portability, and consumption while on the go. The snack packaging sector in the Asia Pacific is dynamic, adjusting to meet the varied needs of markets as the area navigates economic transitions and changing consumer trends.

North America is the second-largest market for snack packaging, with various corporations and startups showing an increased interest in the region. This rising trend is characterised by substantial investments in the development of alternative packaging materials that prioritise recyclability, reusability, compostability, or biodegradability, hence reducing environmental impact.

Cookies emerged as the most popular snack option, with 59 percent of respondents indicating a regular fondness for these sugary comfort foods. Potato chips come in second, with 58 percent of snackers preferring them over healthier veggie options, which only appeal to 24 percent of customers.

Many snacking options, such as ice cream, candy, nuts, and dried fruits, are popular with Americans. In terms of consumption frequency, 51% of snack enthusiasts eat many times per week, while 25% eat every day, highlighting the pervasive and chronic character of snacking in North American culture. This consumer behaviour reflects an increasing awareness of flavour preferences and environmental concerns in the snack packaging sector.

For Instance,

Snack packaging is currently dominated by plastic, which is the most widely used and newest material on the market. A startling 40% of plastics made worldwide are used to package food and beverages. Consumer preferences are greatly influenced by the type of packaging material used; therefore, businesses must invest in protecting their products and creating eye-catching packaging designs. Ignoring these factors might cost you money and reduce consumer confidence in your brand's quality.

Priority Plastics manufactures snack food packaging that strikes a mix between toughness and style in order to allay these worries. Their clear PET containers provide strong protection on shelves, in distribution, and during transit.

Prominent companies such as Nestlé, PepsiCo, and Mars have pledged to meet sustainability targets by 2025. They promise to use only recyclable, compostable, or reusable packaging, with 26 percent made of recycled materials obtained from previous customer use. They also want to cut the amount of virgin plastic by 20%. These programmes are a part of an expanding industry-wide endeavour to reduce environmental damage and encourage ethical packaging.

For Instance,

Flexible and rigid packaging are the two main types of snack food packaging. Flexible packaging is lighter than rigid packaging because it is typically composed of bags or pouches sealed with heat or pressure and comprised of materials like plastic, film, foil, or paper. Customers enjoy snack bags and pouches that can hold many servings and have resealing technology since they keep food fresh and can be used for various occasions. Essential features in this category include zippers, hook-and-loop fasteners, and resealable stickers.

Flexible packaging has a significant presence on the shelf and many functions, giving companies a big chance to set themselves apart from the competition. Pouch packaging maximizes shelf space by holding more products than rigid packaging because of its slender shape. Because of their unbreakability and little weight, they are easy to handle, ship, store, and refill without breaking. Because pouches are easy to discard and take up less room when travelling or at home, consumers also profit from these features. These percentages also include plastic films, which make up about 2% of weight and 6% of turnover, that converters utilise for lamination and to produce flexible packaging.

For Instance,

Single-use containers, sometimes called "stand-up pouches," are pliable foil or plastic pouches intended to carry food or drinks. Snack food packaging has recently become increasingly popular due to the growing need for customized pouches that accommodate different snacks.

These resealable pouches are becoming increasingly popular because they don't harm the environment. Materials like cardboard, metal, and glass are gradually replaced by polyethylene terephthalate (PET).

For Instance,

They have various uses, such as cereal and energy drink packaging. Because pouches have a smaller carbon footprint than other packaging materials, they are becoming increasingly popular. Flexible pouches are an eco-friendly substitute for rigid containers, which generate substantial waste. Because of this feature, they are a better option for people who care about environmental preservation and sustainability.

For Instance,

The competitive landscape of the snack packaging market is dominated by established industry giants such as Graham Packaging Holdings, Bryce Corporation, Sonoco Products, Bemis Company, Swiss pack private limited, American Packaging, Sealed Air Corporation, Printpack, Inc., WestRock Company and Tetra Pak International S.A. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

Bryce Corporation offers chips, pretzels, or something completely new to the snack market; a cutting-edge package design will set the product apart. Engineered to maintain freshness and increase shelf life, your salty snacks will always be crisp and ready to eat, spearheading the snack industry's move from paper and cellophane to plastic packaging by pioneering extrusion lamination technology.

For Instance,

Sonoco Packaging, which communicates accessibility and ease, appeals to busy consumers who are short on time and need a simple and intuitive answer. Sonoco's packaging can be customized to meet product, process, merchandising, and customer goals, whether for chips, nuts, cookies, candies, trail mix, or cereal.

For Instance,

By Material

By Packaging Types

By Product Type

By Region

April 2025

April 2025

April 2025

April 2025