April 2025

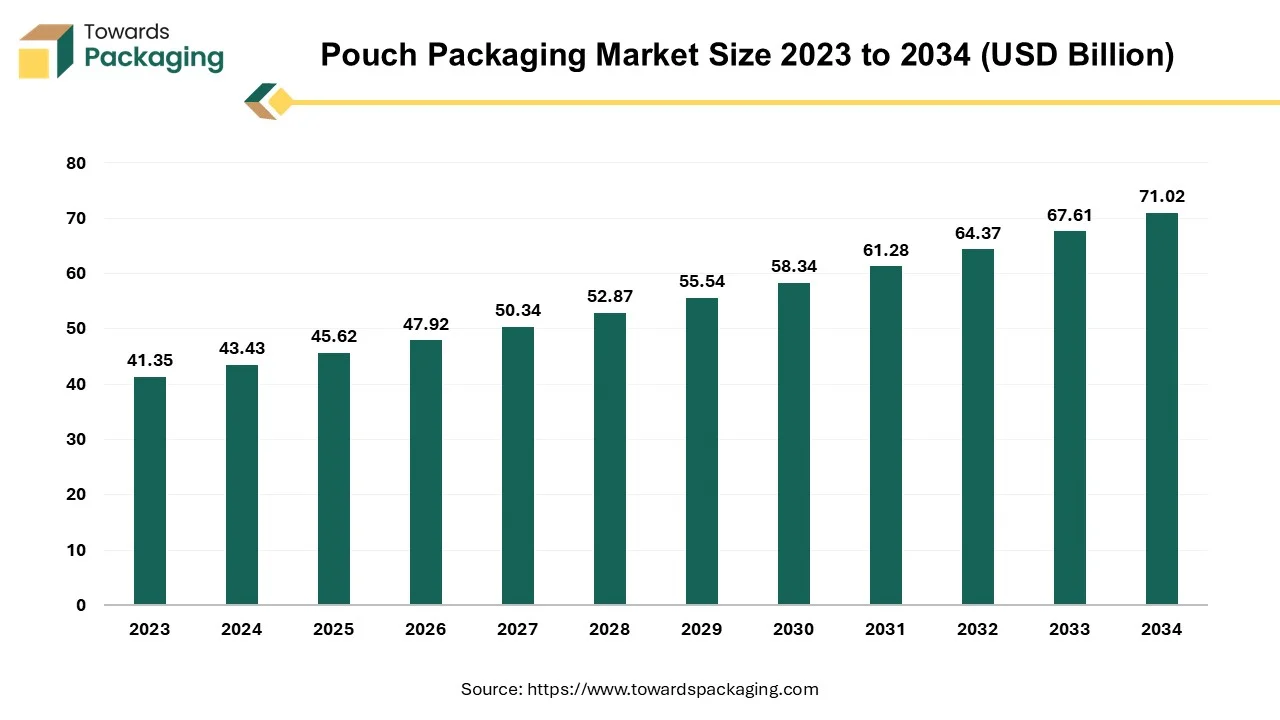

The pouch packaging market is forecasted to expand from USD 45.62 billion in 2025 to USD 71.02 billion by 2034, growing at a CAGR of 5.04% from 2025 to 2034.

The pouch packaging market has evolved and likely to witness significant growth during the forecast period. Packaging was never more attractive or unique than it is now and pouch packaging is one method that prominent companies differentiate themselves from the competition. Since pouch packaging has advantages over the other options in the market, brands are choosing it more and more frequently. Pouch packaging is beneficial for a wide range of applications and offers various customization possibilities, including materials, sizes as well as turnaround times. The packaging market size is estimated to grow in trillions by 2032.

The increasing demand for convenience and concerns about product safety and security coupled with the growing demand for bottled water is anticipated to augment the growth of the market within the estimated timeframe. Additionally, the growing consumption of packed food along with the rising demand for carbonated drinks is also likely to contribute to the market growth. Furthermore, the increase in focus by various manufacturers on sustainable pouch packaging is also likely to contribute to the growth of the market in the years to come.

Many advantages are provided by pouch packing, which meets the demands of contemporary consumers for portability, convenience and portion control. Due to their compact size, pouches are perfect for people who lead busy lives as they fit neatly into the handbags, backpacks and other bags. Easy opening and shutting is made possible by the customizable features, like spouts and zippers, which removes the necessity for additional accessories and tools. Pouches provide hassle-free accessibility in contrast to conventional metal cans, which can be difficult to open while traveling.

Additionally, they are the ideal traveling companions due to their lightweight and flexibility. In addition to guaranteeing food freshness, resealable function of the pouches offers portion control, giving customers the ability to regulate their intake as well as prevent overindulging. In fact, research showed that most consumers favored flexible packaging over non-flexible options, such as pouches.

Furthermore, one of the other factors influencing whether or not an item is bought is its packaging. The majority of customers explored new products after being drawn in by the packaging. Minimalism is currently the most popular packaging design trend when it comes to pouch packaging. Natural-looking product art that does not include clutter and intricate graphics is embraced by minimalism. The trend is to simplify elements, including the use of a single, powerful color and a strong typography across the packaging design.

Apart from employing good contrast features over clean, uncomplicated backgrounds, sporting minimalism can also involve incorporating distinct labeling and branding into the entire visual. Products with little packaging, such as pouches, draw customers in and assist them in making selections based on the inherent value of the product.

The pouch packaging industry is strictly governed by stringent regulatory standards that oversee various aspects of packaging materials, environmental impact, and safety. Governmental agencies, customers and environmental groups have been criticizing the industry due to the waste these businesses produce. A large majority of the materials are frequently non-recyclable. Packaging firms must consider designs which tackle environmental challenges, end-of-life disposal and the reduction of greenhouse emissions and water footprints in order to avoid being criticized by multiple stakeholders. This can turn out to be an expensive procedure.

In March 2024, a tentative agreement was made by the EU Parliament and the Council on revised regulations aimed at decreasing, reusing and recycling packaging, enhancing safety, and advancing the circular economy. By making all the packaging recyclable, minimizing the use of dangerous materials, cutting down on the needless packaging, increasing the use of recycled content and enhancing the collection and recycling, the new regulations seek to make packaging utilized throughout the EU less hazardous and more sustainable. The agreement stated that certain single-use plastic packaging formats would be prohibited by January 1, 2030. These formats included shrink-wrapping suitcases in airports, packaging of the fruit and vegetables that are fresh, packaging for foods and beverages that are filled and consumed in restaurants and cafes, individual portions and accommodation miniature packaging for the toiletry products.

In United States, aiming to reduce the plastic waste, federal representatives suggested legislation in 2020. A provision pertaining to extended producer accountability will be included in this act, compelling companies to recycle their packaging waste or accept it back. Producer responsibility legislation has been extended in around thirty nations globally. A multitude of the federal and state regulations provide standards for equitable product labeling and forbid the use of specific harmful or hazardous chemicals in packaging. These packaging requirements, combined with larger, stronger regulations in the horizon, make it increasingly difficult for companies to promote their products in several regions. Compliance necessitates that the brands explore new methods of packaging and product design. They must also use sustainable materials for both their product and shipping packaging.

Consumers are now more inclined towards nature-friendly lifestyle choices. Hence, industries have to adapt to sustainable ways of serving their needs and wants. With competitors who are rapidly taking the eco-friendly road, firms are always on the look-out for newer, more effective sustainable solutions – pouch films being the go-to option for most of them. Once the original content is used up, the pouches can be easily reused to store other products. Plus, the pouches layered with sustainable plastic like polyethylene films are easily biodegradable as well. Also, most of the manufacturers are now focusing on developing pouches using recyclable, reusable or compostable packaging material.

These new pouch packaging solutions will not only lower the non-fossil plastic use, but it will also help in reducing the carbon footprint making a world where packaging will never become a waste.

The plastic segment captured a significant market share of 60.80% in 2024. Plastic pouches are a usual kind of flexible packaging container that are used for a variety of purposes, including the transportation and storage of commodities like household items, beverages, food and medications, among others. High-density polyethylene pouches are lightweight, waterproof and temperature-resistant and are in great demand from grocery stores and restaurants. Whereas light-density polyethylene clear pouches are used for bulk storage of fresh produce and linear low-density polyethylene pouches are prominently used for freezing food products. Furthermore, plastic pouches are significantly used in pharmaceuticals and healthcare industry to package medical drugs such as antibiotics, analgesics, etc.

The food & beverages segment captured a significant market share of 53.40% in 2024. Consumers of today lead hectic lifestyles, particularly in the cities. They spend a lot of time in working and commuting and are constantly on the go. Ready-to-eat meals, packaged foods and snacking are therefore becoming more popular. The sector has experienced remarkable growth due to the factors such as rising disposable incomes and the cultural habit of snacking in between meals. In this industry, pouches are the preferred solution and are growing in popularity due to their inherent adaptability. The meals stay fresher for longer in these pouches with a resealable zip lock, three levels of safety and a bottom gusset that allows customers to eat at their own pace. Manufacturers are also working towards bringing food packaging solutions to improve sustainability.

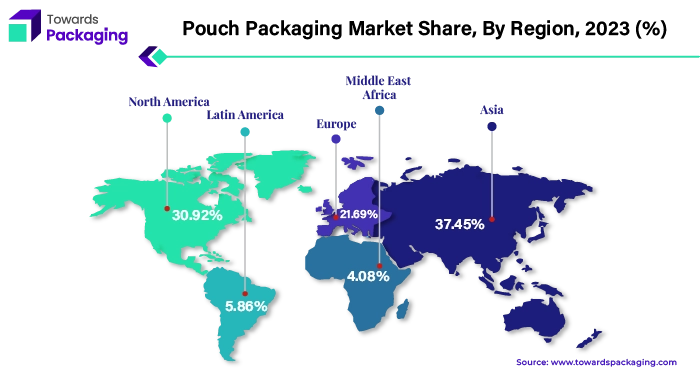

Asia Pacific held largest market share of 37.45% and is expected to grow at a fastest CAGR of 6.67% during the forecast period. China dominated the Asia Pacific market. This is owing to the expansion of the food and beverage industry supported by the increasing consumer spending on the packaged food items across the region.

Furthermore, growing demand for convenience packaging coupled with the rise in the consumption of packaged food and changes in lifestyle is likely to support the regional growth of the market. Additionally, growing environmental concerns as well as the regulatory push towards sustainable packaging is also anticipated to augment the growth of the market in the region. For instance, India established the Plastics Pact in 2021. By 2030, 100% of the plastic packaging must be recyclable or reusable, 50% must be efficiently recycled and 25% of all the plastic packaging must include an average of 25% recycled material. These are the goals set forth in the India Plastics Pact.

North America is expected to grow at a considerable CAGR of 4.59% during the forecast period. This is due to the growing demand for on-the-go beverages and snaking cross the region. Snacks are main part of the American eating habits, contributing to approximately one-quarter (22%) of the total energy consumed among adults. At present, over 90 percent of U.S. people report having more than one snack a day, with an average of 1.2 to 3.0 snacking incidences each day and about 70% of the customers consumes chips/pretzels in the country.

This increase in snacking is further expected to drive the demand for pouch packaging in the region in the near future. Furthermore, the increase in adoption of eco-friendly alternatives to traditional packaging materials is also expected to support the regional growth of the market in the years to come. For instance, in December 2022, Glenroy Inc. received recognition for its recyclable STANDCAP pouch, a fully recyclable polyethylene-based stand-up pouch.

By Material

By Type

By End-use

By Region

April 2025

April 2025

April 2025

April 2025