April 2025

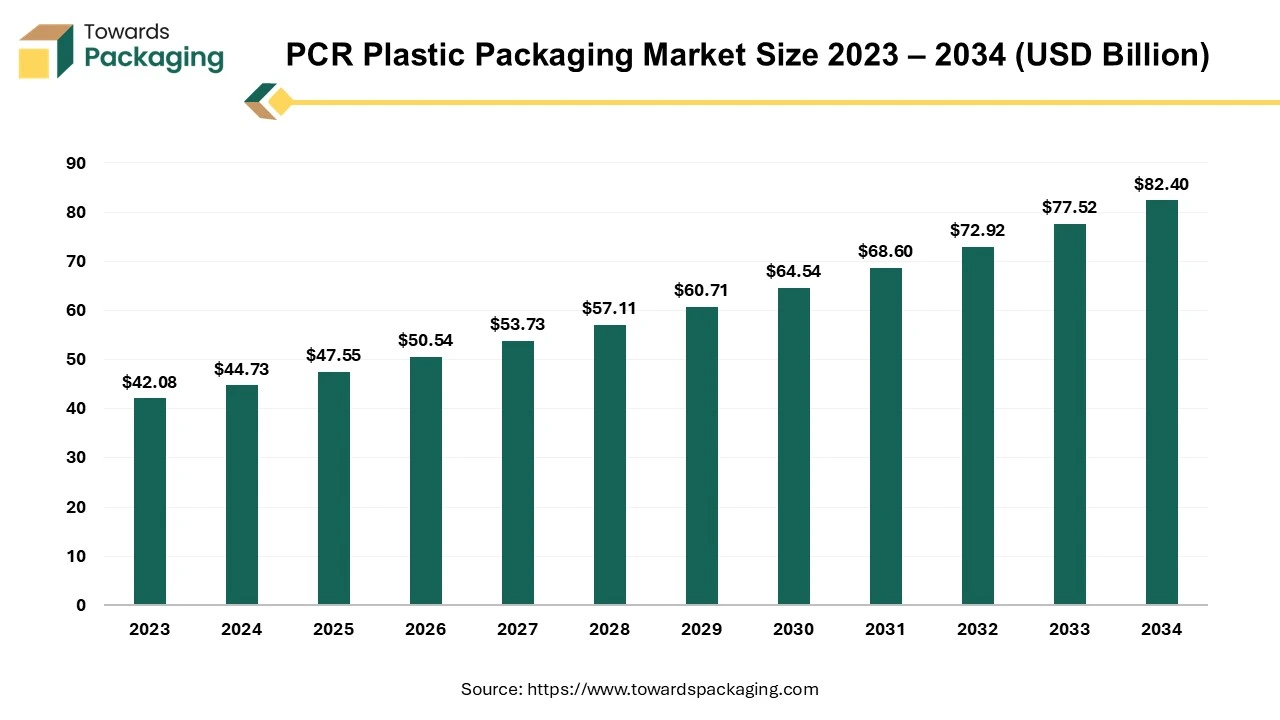

The global PCR plastic packaging market size was valued at USD 42.08 billion in 2023 to reach USD 82.40 billion by 2034, increasing at a CAGR of 6.3% between 2024 and 2034.

PCR, also called post-consumer recycled material, is a phrase used to describe plastics, such as PP, PET, and HDPE, that are extensively recycled before being processed again to create a resin that is utilized to develop new packaging. Simply put, it refers to used plastic packaging or other crushed materials and given a second chance at life.

Plastic makes PCR plastic an economically and environmentally beneficial material. Manufacturers get an economical choice for their packaging by utilizing what we already find challenging to discard to safeguard the environment. They are reprocessing current polymers, reducing energy and fossil fuel consumption. Producer can still create a modern, robust plastic bottle while sparing the environment from excessive pollution and resource waste. PCR is a material that is easily accessible and offers a multitude of ways to enhance community recycling initiatives while ensuring a consistent flow of recycled goods.

A popular resin material used in the production of some plastic stock packaging is polypropylene (PP). Still, there is a need for more sustainable alternatives to traditional plastics, given the continuous changes in the sector, particularly the rising participation of younger consumers. Recycling plastic resin from sorted, sterilized, and reprocessed conventional plastic materials is called post-consumer resin (PCR). It provides an environmentally beneficial alternative by being remanufactured to satisfy plastic packaging needs. The industry's current goal is to increase the percentage of Post-Consumer Recycled (PCR) plastic used in plastic packaging worldwide to at least 25% by the end of 2025. This calculated action addresses the increasing environmental concerns related to plastic trash. Over 10 million tonnes of garbage made of post-consumer plastics have been submitted for recycling in recent years; of those, over 5.5 million tonnes have been used to reintroduce post-consumer recycled plastics back into the economy.

Global plastics output totalled 362.3 million tonnes, with fossil-based sources accounting for the vast majority (90.2%). However, the trend towards sustainability is clear, with post-consumer recycled plastics and bio-based/bio-attributed plastics accounting for 8.3% and 1.5% of global plastics production, respectively. This change demonstrates a desire to reduce dependency on fossil-based plastics while embracing recycled and bio-based alternatives. The drive for more significant usage of Post-Consumer Recycled (PCR) plastic is a step towards a more sustainable plastic packaging industry. It satisfies consumer demands for environmental responsibility and advances international efforts to lessen the impact of plastic waste on the environment.

For Instance,

Many governments and regulatory bodies worldwide are implementing stricter regulations to reduce plastic waste. Policies like Extended Producer Responsibility (EPR) and mandates for recycled content in packaging are pushing companies to adopt PCR plastics.

Increasing awareness about plastic pollution and environmental sustainability has led companies and governments to prioritize the use of recycled materials. PCR plastic packaging helps reduce waste and reliance on virgin plastic, aligning with sustainability goals.

Brands are under pressure to meet consumer demand for more sustainable and eco-friendly products. Using PCR plastic packaging helps companies demonstrate their commitment to reducing their environmental footprint, which can improve brand reputation and consumer loyalty. There is an increasing preference among consumers for products packaged in environmentally friendly materials. This shift is encouraging brands to adopt sustainable packaging solutions, including PCR plastics. The push toward a circular economy, where materials are reused and recycled, has contributed to the demand for PCR plastic packaging as part of a broader effort to reduce waste and resource consumption. The key players operating in the market are focused on adopting inorganic growth strategies like partnership to develop PCR plastic to meet the rising consumers demand which is estimated to create lucrative opportunity for the growth of the PCR plastic packaging market in the near future.

PCR plastic packaging has evolved as an essential technique in combating the plastic waste crisis, notably in Europe, where plastic recycling has become a cornerstone of environmental mitigation. The European plastics manufacturing business is transforming, with a growing recognition of recycled plastics as a viable alternative to virgin plastics. The use of recycled materials not only reduces Europe's dependency on natural resources but cuts CO2 emissions by an impressive 90%. This compelling environmental impact has sparked renewed interest in plastic recycling, promoting it as a sustainable and environmentally friendly answer to the growing volume of plastic garbage. With large expenditures, continual innovation, and technological improvements, plastic recycling has made significant progress.

These efforts have resulted in the development of high-quality recycling methods, allowing recycled plastic products to resemble the features and attributes of virgin plastics closely. The success of these initiatives is seen in the exponential growth of plastic recycling, which has increased by more than 65% in just four years, representing a significant shift over the last two decades.

For Instance,

The rising emphasis on plastic recycling is more than just a trend; it reflects a fundamental change toward recognizing recycling as a critical, ecologically conscientious strategy for controlling plastic waste. Plastic recycling has advanced to the point where it can produce high-end goods comparable in performance to virgin plastics. Even with these developments, there are still problems because, in Europe, only thirty percent of plastics are now gathered for recycling. The leftover plastics will either be disposed of via landfilling, incineration, or in the worst situation, being thrown outside. Improving sustainability in the plastics sector still requires addressing this disparity in recycling rates.

The total production of PCR (post-consumer recycled) plastic packaging in the European market reached overall 58.7 million tonnes. It is worth noting that market share of bio-based/bio-attributed plastics and post-consumer recycled plastics accounted for 3.1% and 11% of this manufacturing, respectively. This demonstrates a notable change towards sustainable practices, showing that much of Europe's plastic production is shifting away from traditional fossil-based resources and towards ecologically friendly alternatives, such as bio-based and recycled plastics. Fossil-based plastics, commonly identified as conventional plastics, are polymers synthesized from petrochemical feedstocks. In contrast, bio-based plastics are derived from renewable plant-based sources, notably starch and cellulose. The findings show a rising commitment to environmentally friendly practices in the region's plastic industry.

The European plastics industry (EU27-27 European Countries) has seen a positive trade balance totalling 14.4 billion euros in terms of economic consequences. This highlights the environmental advantages and the financial sustainability of introducing PCR plastic packaging into the production process. PCR plastic packaging symbolizes a paradigm shift towards sustainable operations, where economic success and environmental stewardship coexist harmoniously. Waste streams for PCR plastic are processed into fresh material and sourced from all over Europe, with a capacity of 10,000 tonnes per year and a goal of doubling the amount. Previously, these waste flows were exported extensively from Europe to Asia.

For Instance,

North America has a significant influence in adopting post-consumer recycled (PCR) content in packaging, as evidenced by its position as the second-largest region in the PCR plastic packaging industry. In the US, a focused strategy is in place to improve sustainability; plastic packaging is expected to be recycled at 50% or composted at 50%. PCR mandates have been implemented to promote market demand for postconsumer content actively. This calculated action aligns with Target 2 objectives, which call for 100% compostability, recyclability, or reuse by 2025. The emphasis is on making PCR or sustainably obtained, biobased content a top priority, particularly on materials that present the fewest obstacles. Due to its capacity to meet strict food safety regulations and be suitable for high and optimal PCR use, rigid plastic packaging emerges as a leading contender.

The increasing proportion of PCR content in CPP (Circular Plastics Policy) partner packaging demonstrates the dedication to using PCR in packaging. Although the target is to attain an average of 30% recycled content in all plastic packaging types, technical modelling carried out by Eunomia on behalf of CPP indicates that this target could need to be modified shortly. Reaching the intended recycled content levels is hampered by the scarcity of high-quality PCR resins in Canada, especially for food-grade applications and resins other than PET and HDPE.

North America's position as the second-largest area in the PCR plastic packaging market indicates an industry-wide push to promote sustainability. The region's commitment to increasing the usage of post-consumer recycled content is consistent with overall environmental aims. It exhibits a proactive approach to managing material availability issues and meeting desired recycled content levels in the short term.

For Instance,

PET (Polyethylene Terephthalate) is one of the industry's most collected and recycled polymers. Recycled PET (rPET) accounts for approximately 25% of overall PET demand. Recycling capacity has increased significantly by 30% over the last two years. PET is integral in producing beverage bottles and food trays, with more than 90% of virgin PET used. As the demand for sustainability rises, there is expected to be a progressive increase in the recycling of PET-to-PET trays, indicating a promising trend in using recycled PET in various packaging formats. PET recycling is primed for growth, fueled by new legal regulations expected to determine the industry's future. To satisfy these regulatory requirements, at least 1.1 million metric tonnes (Mt) of rPET must be used in beverage bottles by 2030, demonstrating a commitment to promoting sustainable practices.

A minimum recycling rate of 50% is required for PET non-bottle rigid packaging, emphasizing the need for significant recycling for these specific packaging designs. In today's recycling infrastructure, PET and HDPE bottle recycling rates have the potential to approach 40%. Projections indicate that with the growing quality of waste, driven in part by enhanced separate collecting mechanisms, such as deposit return schemes, utilization of rPET could reach up to 55% of the entire PET demand by 2030.

PET is at the forefront of polymer recycling initiatives, meeting a sizable demand through recycled content. Legislative regulations and recycling rate targets show the industry's commitment to sustainability, indicating a trend towards improved recycling capacity, the use of recycled content, and the overall progress of eco-friendly practices in the PET packaging landscape.

For Instance,

PCR plastic bottles are the market's premier sustainable packaging solution, exhibiting a dedication to environmental preservation. Post-consumer recycled (PCR) content, including ocean-bound plastic, demonstrates a commitment to ecological conservation. This recycled material is used to make new bottles, and bottle-grade PET and HDPE are very popular and valuable. Integrating PCR material into packaging improves sustainability and appeals to retailers and customers. The long-term goal is to attain an average of 20% PCR in bottles, representing a considerable opportunity for investment in PCR bottling and packaging supplies.

Various industries, including beauty product manufacturers and fast-moving consumer products companies, drive the demand for PCR packaging. The beverage industry, particularly producers of sodas and bottled beverages, strongly demands environmentally responsible packaging. This dedication is shown in the recycling watermarks on beverage-grade plastic bottles. Cosmetic product manufacturers, pharmaceutical businesses that require plastic packaging for injection vials, and the medical industry are all looking for environmentally responsible packaging options.

The demand extends to various sectors, including the military and the automobile industry, demonstrating the widespread recognition and acceptance of PCR plastic goods. The obvious benefits of employing recycled plastics and global acceptance by end users and consumers highlight the positive impact of introducing PCR content into packaging across various industries.

For Instance,

PCR plastic packaging has become a popular alternative in the food and beverage industry because of the high quality and safety standards connected with PCR plastics. Plastic is the most used material in the beverage industry, owing to its convenience and superior protective properties. Plastic as a packaging material is motivated by its capacity to preserve and protect the products in the package. In the food and beverage business, PCR plastic packaging is highly reliable in achieving safety and quality standards. The inherent properties of PCR plastics make them ideal for the demands of packaging in the food and beverage industry, where protecting the integrity of the contents is crucial.

The ease and practicality of plastic packaging, including PCR plastics, are essential considerations in the beverage sector. Plastic containers are lightweight, robust, and flexible, making them suitable for various beverage items. Furthermore, the protective qualities of plastic packaging play an essential role in maintaining the freshness and quality of beverages, ensuring that consumers receive products that meet the highest standards. the widespread use of PCR plastic packaging in the food and beverage industry demonstrates its capacity to meet the most severe safety, quality, and convenience standards. As a preferred material, PCR plastics help product packaging effectiveness, keeping with the industry's goal to provide high-quality and secure packaging solutions.

One of the main trends in the UK soft drink market is the growing need for packaging, especially in PCR (post-consumer recycled) plastic packaging for beverages. This increase is linked to the growing appeal of several drinks, such as carbonated soft drinks, fruit juices, still and juice drinks, bottled water, sports and energy drinks, and more. A few driving forces behind the rise are affordability and easy access to raw materials and commodities. PCR plastic packaging aligns with environmental concerns as consumers choose sustainable options. This is indicative of a more significant industry shift towards packaging solutions that are responsible and eco-friendly.

Sustainable packaging materials are highly valued in the UK, with PCR (post-consumer recycled) plastic packaging receiving particular attention. Plastic, a frequently used material, is changing to become more recyclable. Using recycled plastic and reducing its influence on ecosystems, PCR plastic packaging addresses environmental issues. Aluminium cans and other metal packaging are becoming increasingly popular since they are lightweight and recyclable. Because cardboard and paper-based packaging are biodegradable and recyclable, they support the environmental trend. Glass is recyclable; however, its weight and shipping cost present difficulties. With PCR plastic at the forefront, the packaging sector in the UK is generally navigating a change towards more environmentally friendly options. In October 2023, Arnold Bread, a division of Bimbo Bakeries USA, launched new bread bags that contain 30% post-consumer recycled (PCR) content.

Researchers found several reasons why manufacturers struggle to use post-consumer recycled (PCR) plastics. These include supply shortages, higher costs compared to new plastics, quality concerns, strict regulations, and negative consumer perceptions.

Other suggestions included government procurement rules, research and development support, consumer education, and industry-led initiatives.

The competitive landscape of the PCR plastic packaging market is characterized by established industry leaders such as Transcontinental Inc., Amcor plc Mondi plc, Genpak LLC, Sonoco Product Company, ePac Holdings, LLC, ALPLA Group, IDEALPAK, Anchor Packaging Inc and Spectra Packaging Solutions Ltd. These giants face competition from emerging direct-to-consumer brands, leveraging digital platforms for market entry. Key factors influencing competition include innovation in product offerings, sustainable practices, and the ability to adapt to changing consumer preferences.

TC Transcontinental packaging introduces an innovative packaging solution built from 30% post-consumer recycled plastic. This invention demonstrates a dedication to sustainability by employing recycled materials to solve environmental issues and contribute to a more environmentally friendly packaging landscape.

Genpak promotes sustainability by including post-consumer recycled (PCR) content into their precision Hinged Deli products. This plan entails using almost 14 million pounds of post-consumer resin exclusively for APET products. In response to the growing need for eco-friendly packaging, Genpak's pledge to use recycled materials is consistent with the industry's shift toward meeting demand while prioritizing environmental responsibility.

Amcor is committed to raising its sustainability profile, emphasizing increasing the percentage of post-consumer recycled (PCR) content in its packaging. This dedication is mainly focused on stiff PET packing. Amcor seeks to contribute to a more ecologically friendly approach by prioritizing using recycled materials, which aligns with the growing need for sustainable practices in the packaging business.

Transcontinental Inc., Amcor plc, Mondi plc, Genpak LLC, Sonoco Product Company, ePac Holdings, LLC, ALPLA Group, IDEALPAK, Anchor Packaging Inc and Spectra Packaging Solutions Ltd.

By Material

By Product

By End Use

By Region

April 2025

April 2025

April 2025

April 2025