April 2025

The global skin packaging market was valued at USD 11.94 billion in 2024 to achieve USD 19.30 billion by 2034, increasing at a 4.95% CAGR between 2024 and 2034.

Skin packaging is a tempting substitute to standard blister packaging because it employs vacuum sealing to create a thin film over a product on a master sheet. This film is then accurately cut into individual cards, adding features like key slots, rounded corners, and internal die cuts as needed. Skin packaging creates an ideal and secure fit by enclosing the product within the film, allowing even multi-component products to be cleanly separated and confined within the container.

This technique, also known as "skin pack" or "skin film packaging," is tightly wrapping a translucent plastic film around an object to form a second skin that precisely conforms to its shape. After positioned, the film is sealed onto a tray or backing board, creating a vacuum-sealed package that closely follows the product's curves. In along with improving the product's appearance, this painstaking procedure reduces the possibility of damage occurring during handling, shipping, and storage.

Skin packaging stands out as a flexible and effective solution in the constantly shifting industry of product packaging. The benefits include protection from harm, sustainability, and visual appeal. Skin packaging is predicted to grow increasingly significant in determining the direction of product packaging strategies as both producers and consumers place a higher priority on innovation and environmental integrity. With its ability to offer both protection and visual appeal, skin packaging aligns with the evolving needs and expectations of today's markets. Its adaptability makes it suitable for various industries, from food and consumer goods to electronics and healthcare products. As businesses seek to optimize their packaging solutions for both practical and environmental considerations, skin packaging is positioned to remain a prominent and influential player in the packaging industry landscape.

As consumers and businesses are becoming more eco-conscious, there is an increasing demand for sustainable and recyclable materials in packaging. Companies are focusing on biodegradable films, recyclable plastics, and reducing plastic waste to meet regulatory requirements and consumer expectations.

Skin packaging offers superior product visibility, which is driving its popularity in the food and retail sectors. The ability to create clear, sleek, and attractive packaging that enhances product presentation is appealing to consumers. It is particularly favored in industries such as food (especially fresh produce and meats), electronics, and consumer goods.

There is a growing trend towards customized skin packaging solutions, allowing brands to differentiate their products in the marketplace. The flexibility of skin packaging allows for unique shapes and sizes, tailored to specific products, which helps in improving brand recognition and consumer appeal.

The integration of smart packaging features like QR codes, NFC (Near Field Communication), and sensors with skin packaging is becoming more common. These features allow for enhanced product tracking, consumer engagement, and real-time freshness monitoring, aligning with the growing trend of connected devices.

Innovations in skin packaging technology are making the process automated and more efficient and cost-effective. For instance, advancements in thermoforming and vacuum technology allow for better packaging precision and faster production times. Additionally, improvements in sealing technology are enhancing the overall performance of skin packaging, including the longevity and integrity of the product.

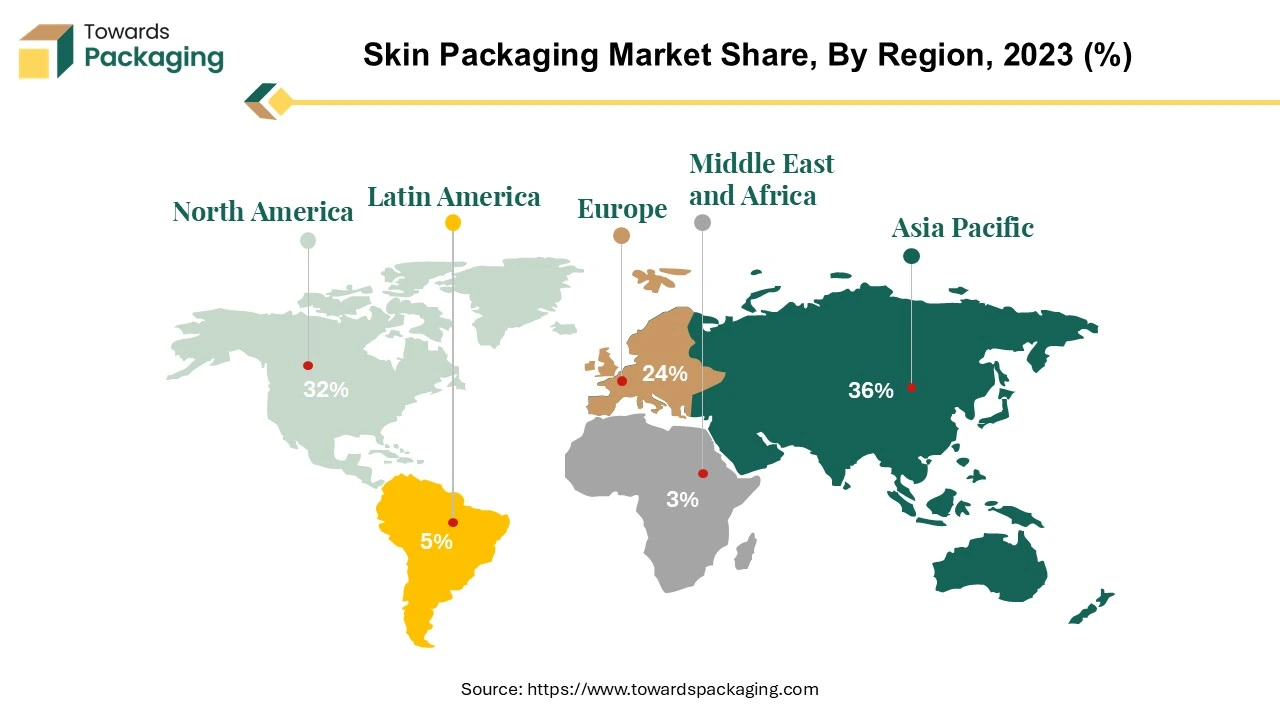

Asia Pacific is estimated to observe the fastest expansion. The dominant growth of Asia Pacific in the skin packaging market can be attributed to various compelling factors. This robust market share is driven by the flourishing manufacturing sectors, particularly in nations like China, India, and South Korea, which exhibit a heightened demand for packaging solutions that are not only cost-effective but also versatile.

Skin packaging aligns perfectly with this requirement, emerging as the preferred choice for a wide spectrum of products emanating from these vibrant economies. Furthermore, the thriving e-commerce landscape in the Asia-Pacific region has accentuated the necessity for packaging that combines both protective qualities and visual appeal, where skin packaging has emerged as a leader. Its remarkable adaptability to a diverse array of product shapes and dimensions further bolsters its prominence within this dynamic marketplace.

Rising adoption of the inorganic growth strategies like collaboration or partnership by the key players operating in the Asia Pacific region for developing sustainable skin packaging, is estimated to drive the growth of the skin packaging market in the region.

In May 2024, Amcor plc., packaging company, in collaboration with Avon, cosmetics company, announced the innovation and introduction of the AmPrima Plus refill pouch for the AVON Little Black Dress shower gels in China.

The skin packaging market in North America is a competitive and dynamic environment that is defined by a blend of established industries and innovative developments. The area has a well-established retail industry and a wide range of consumer preferences, which fuel demand for different skin packaging applications in a number of different businesses. The food industry in North America is one prominent use for skin packaging. A common method for preserving and showcasing perishable foods like cheese, pork, and seafood is skin packing. Retailers and customers alike favour it because of its capacity to prolong product shelf life while preserving freshness and aesthetic appeal. The average American consumes 224.6 pounds of meat (beef, hog, broilers, and turkey) annually, according to the USDA. In America, meat consumption hit all-time highs. Skin packaging improves food safety and customer confidence with its tamper-evident and leak-resistant characteristics.

Skin packaging is used by North American consumer goods industries to improve the appearance and security of goods like hardware, cosmetics, and electronics. The clear film provides protection from damage and manipulation while allowing customers to view the product and examine it before making a purchase.

Skin packaging is utilised in the pharmaceutical, medical device, and sterile product packaging industries in the healthcare sector. Skin packaging's hermetic sealing qualities contribute to the preservation of sterility and product integrity while guaranteeing adherence to strict regulatory standards. Eco-friendly skin packaging materials and procedures are becoming more and more popular in North America as a result of the growing trend towards sustainable packaging solutions. With consumers being more aware of environmental issues, producers are looking at recyclable films and less packaging waste. The flexibility of the North American skin packaging market allows it to serve a broad range of applications in the consumer goods, healthcare, and food industries. The region still presents a lot of potential for innovation and expansion in the skin packaging sector because of the continuous improvements in materials and technology as well as the growing focus on sustainability.

For Instance,

Plastic film is the main material used to construct the protective second skin around products in the skin packaging market. Typically, this film is composed of a variety of plastic polymer types, each of which has unique qualities that make it suitable for a particular use in the packaging sector. Polyethylene terephthalate is a typical plastic film used in skin packaging (PET). PET films are renowned for their strength, flexibility, and clarity. They are ideal for packaging a variety of products, such as consumer goods, electronics, and food items, since they have superior barrier qualities against moisture, gases, and odours.

Polyvinyl chloride is a different typical plastic film (PVC). PVC films are prized for their cost, toughness, and flexibility. They are frequently used in skin packaging applications, like retail display packaging for hardware and consumer goods, where excellent clarity and product visibility are crucial. Because polyethylene (PE) films have good sealing qualities and are resistant to punctures, they are often used for skin packaging. PE films are available in many formulations, such as low-density polyethylene (LDPE) and high-density polyethylene (HDPE), which gives producers the freedom to create packaging solutions that are specifically suited to the needs of their products.

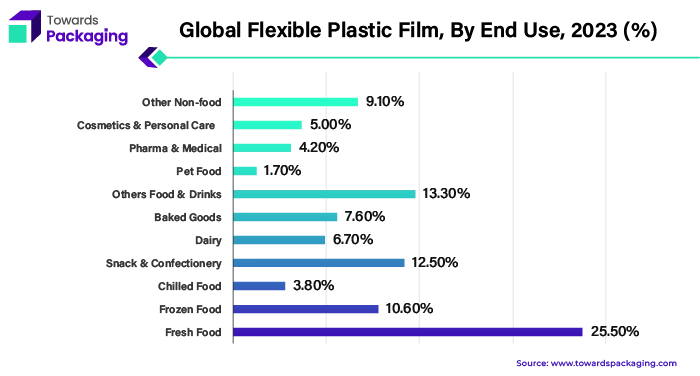

Plastic film is used in many different sectors for skin packaging. Fresh meat, poultry, shellfish, and cheese are packaged in plastic films in the food industry to prevent contamination and prolong shelf life. Plastic film packaging is used in the consumer products industry to improve product visibility and security for electronics, hardware, toys, and cosmetics. Plastic films are also used in industrial products, pharmaceutical packaging, and packaging for medical devices, where product presentation, hygiene, and safety are crucial considerations.

Plastic film is essential to the skin packaging industry because it provides producers with a flexible and efficient way to present, preserve, and protect a wide range of products for use in a variety of sectors. Plastic films continue to develop as a result of continuous improvements in material science and sustainability programmes, offering creative answers to the shifting demands of the packaging industry.

For Instance,

Skin packaging is essential for maintaining freshness, improving product presentation, and assuring food safety in the food and beverage industry. Fresh meat, poultry, seafood, and cheese packaging is one of the main uses of skin packaging in this sector. Skin packaging forms a protective barrier that helps perishable goods last longer on the shelf, minimising food waste and improving product quality by tightly fitting the product's contours.

With a volume of over 3 billion euros, the demand for meat products worldwide accounts for nearly 19% of the whole food industry. Skin packaging is frequently used for convenience foods, deli items, and ready-to-eat meals, providing customers with practical, portion-controlled packaging options. Not only does this kind of packaging preserve the freshness of the food products, but it also makes handling and storage simple.

Skin packaging is used in the beverage industry to package single-serve beverages like energy drinks, smoothies, and juices. The product visibility provided by the transparent film used in skin packaging enables customers can plainly view the contents and evaluate quality prior to purchase.

In the food and beverage industry, skin packaging provides manufacturers with an adaptable and effective packaging solution that tackles important issues including product protection, shelf-life extension, and consumer convenience. Skin packaging is still a popular option for packaging a variety of food and beverage products as consumer preferences continue to shift towards sustainability and convenience.

For Instance,

Skin packaging is a flexible and efficient way to present items, make stores more appealing, and guarantee product protection in a retail setting. In retail settings, one of the main uses of skin packaging is the packaging of consumer items like toys, electronics, hardware, and cosmetics. Skin packaging uses transparent film to protect products from tampering and damage while allowing for conspicuous display. This draws customers' attention and promotes impulsive buying. In retail display packaging, when products are organised neatly on shelves or hanging displays, skin packaging is frequently used. The vacuum-sealed film clings tightly to the goods, making for an eye-catching display that makes the most of shelf space and enhances awareness of the brand.

Skin packaging gives retailers the freedom to alter package designs to meet particular needs for products and brand strategy. To improve product differentiation and draw attention to key selling aspects, features like internal die cuts, round corners, and key holes can be added.

Retailers can use skin packaging as a useful and effective packaging option to draw in customers, boost sales, and preserve the integrity of their products on the shelves. It is a admired option for many different retail goods due to its adaptability and visual appeal.

For Instance,

Amcor, a leader in the world of packaging solutions, bases its skin packaging strategy on sustainability and innovation. The organisation allocates resources towards research & development in order to produce pioneering skin packaging solutions that satisfy changing consumer demands while reducing environmental effect.

For Instance,

Bemis Company Inc. bases its skin packaging strategy on a customer-centric methodology. The company's mission is to satisfy each customer's individual demands with creative, superior packaging solutions. Bemis aims to establish enduring relationships with clients by providing all-inclusive packaging solutions, encompassing design, production, and transportation services.

For Instance,

Berry Global Inc.'s skin packaging strategy places a strong emphasis on expanding its market reach and offering a diverse range of products. The company offers a wide range of skin packaging solutions across numerous industries and countries by leveraging its global presence and significant manufacturing capabilities.

For Instance,

The skin packaging strategy of Sealed Air Corporation is based on innovation. The organisation allocates resources towards research and development in order to generate state-of-the-art skin packaging solutions that offer consumers enhanced performance and value.

For Instance,

Nancy Mahon, chief sustainability officer of the Estée Lauder Companies states that the company has a chance to advance its package innovation by sticking to sustainability standards that enable it to provide "elegant solutions" for its customers while being environmentally conscious. ELC claims that its in-house R&D labs and packaging development teams are committed in producing goods that prioritize inclusivity and sustainability. The company stated that its 2020 packaging sustainability guidelines offer a "roadmap," highlighting tactics including cutting back on the use of packaging materials, creating for reuse, and boosting recycled content. These recommendations support the integration of sustainability concepts at the center of its packaging choices, in conjunction with specially created tools and industry practices such third-party reviewed life-cycle evaluations. By weight, 71% of the packaging produced by the Estée Lauder Companies (ELC) is available in recyclable, refillable, reusable, recyclable, or recoverable.

By means of industry-leading partnerships and creative solutions, ELC hopes to establish new benchmarks for sustainability in the beauty sector. For instance, the Aveda brand created regionally recyclable, paper-based packets for product samples. This sachet's manufacturing uses at least 36% less water and produces 37% fewer greenhouse gases than its plastic counterparts, demonstrating ELC's commitment to using innovation to satisfy customer demands. Offering refillable choices or switching from plastic to glass packaging, ELC's array of brands demonstrates how luxury and sustainability go hand in hand. For instance, the relaunch of Estée Lauder's well-known Revitalizing Supreme+ Moisturizer Youth Power Creme, which includes a refillable pod to assist reduce package weight, was facilitated by the company's usage of glass packaging to further its luxury and sustainability design strategy.

By Material

By End User

By Distribution Channel

By Region

April 2025

April 2025

April 2025

April 2025