April 2025

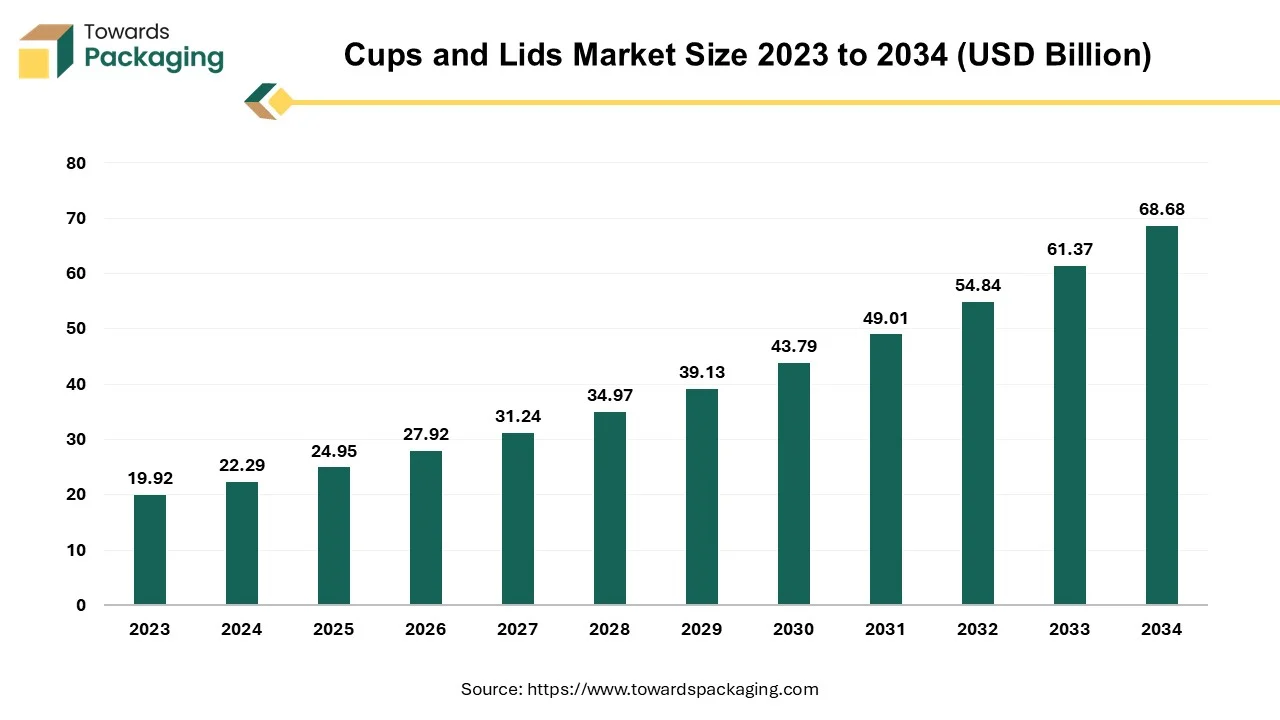

The global cups and lids market size reached USD 22.29 billion in 2024 and is projected to hit USD 68.68 billion by 2034, expanding at a CAGR of 11.91% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

Due to the increased set-up and installation of intelligent vending machines for beverages, the demand for cups and lids has risen, which is estimated to drive the growth of the global cups and lids market over the forecast period.

An open-top receptacle for holding liquids for pouring or drinking is called a cup. While primarily intended for drinking, it can also be used to hold solids (such as sugar, flour, grains, and salt) in preparation for pouring. A beaker lacks a handle or stem, but cups can be constructed of glass, plastic, china, ceramics, wood, metal, stone, bone, pottery, polystyrene, aluminum, or other materials. Cups are typically attached with handles or other adornments. Many cultures and socioeconomic classes use cups to relieve their thirst, and different types of cups might be used for different beverages or in different contexts.

Differently styled cups can be used for a variety of beverages or other meals (such as teacups and measuring cups), in a variety of settings (such as at water stations or during ceremonies and rituals), or simply as decorative pieces. A coffee cup is a mug used to serve coffee and other beverages containing coffee. There exist three primary categories: traditional cups accompanied by saucers, mugs served without saucers and single-use cups. Most mugs and cups have a handle. Take-out disposable paper cups are frequently used with an insulating coffee cup sleeve, while they can occasionally feature fold-out handles.

A lid, often known as a cover, is a component of a container that acts as a closure or seal, usually closing the object completely. Lids can be put on bigger lids for drums and open-head pails, as well as smaller ones for tubs. Certain lids feature a tamper-evident band or security strip to keep the lid firmly in place until the opening is required or approved. They typically imply that the container has been opened and is irreversible. They can be constructed from a variety of materials, such as metal or plastic. The global packaging market size to grow at a 3.16% CAGR between 2025 and 2034.

The rise in the demand for seasonal and specialized drinks has increased the need for cups & lids, which is expected to drive the growth of the global cups and lids market over the forecast period. In the packaging industry, the need for cups and lids has sharply expanded in recent years due to the growing demand for specialized drinks, such as coffee and milkshakes. The features of cup and lid goods, such as their cost-effectiveness, snap fit, ease of removal, leak-resistant applications, and lightweight, smooth rolling rims that are safe and comfortable to use on a pleasant surface, are significant drivers of market expansion.

The limitations for the use of plastic and increasing concerns about environmental safety can restrict the growth of the cups and lids market to a certain limit. The production of a single styrofoam cup emits roughly 33g of CO2. That represents the same as traveling around a tenth of a mile. As paper cups are waterproofed on the inside with a thin plastic covering, disposable paper cups are a common example of single-use plastic products. Paper cups usually wind up in landfills or are disposed of incorrectly, adding to the amount of (micro)plastic trash and perhaps contaminating the world's oceans.

Every year, the U.S. manufactures over 3 million tons of polystyrene. Additionally, 80% of it—including roughly 25 billion cups annually—ends up in the trash. This means that around one-third of the landfill space is occupied by the stuff. Polystyrene takes around 500 years to decompose into waste.

The U.S. produces about 21 million tons of CO2 annually from the production of polystyrene, which is roughly the same as the emissions from 4.5 million cars.

Globally, paper cups are consumed at an astounding rate; in the U.K. alone, 7 million cups are consumed every day, resulting in an annual production of 30,000 tonnes of waste paper cups.

The key players operating in the market are focused on launching biodegradable cups with concerns about saving nature from hazardous elements, which is estimated to create a lucrative opportunity for the growth of the global cups and lids market over the forecast period. Rising concerns about sustainability and environmental ability, the market players adopted advanced technology to introduce biodegradable plastic-free cups in the market.

The plastic segment held the largest share of the cups and lids market in 2024 on account of the increasing launch of reusable plastic cups to meet the rising demand for alternative solutions to single-use packaging. Polypropylene plastic (PP) is commonly used to make reusable plastic cups. Naphtha oil, which is produced from a small amount of raw oil, is the main ingredient in plastic. These fractions are created when oil is refined and separated into fractions containing hydrogen, naphtha, and other carbons. It is better for the environment to use reusable cups. Disposable cups frequently wind up in landfills due to inadequate recycling. It is healthier for your health to use reusable cups. Frequently, the reusable cup lids are composed of plastic. Reusable coffee cups have advantages beyond cost and convenience for the individual user. Accepting these eco-friendly substitutes can help you take an active role in cutting down on waste, preserving resources, and lessening the environmental damage that single-use cups generate.

The paper segment is estimated to show significant growth in the cups and lids market over the forecast period due to the increasing launch of new paper cups, which are decomposable in nature and less hazardous to the environment. Furthermore, new emerging market players for manufacturing paper cups are also responsible for the growth of the segment over the forecast period.

The packaging cups & other cups (portion cups and food cups) segment is expected to grow at a significant rate in the cups and lids market during the forecast period. Ready–to–drink coffee and tea, energy drinks, and other drinks that can be consumed anytime and anywhere consumers need a boost are among the convenient and useful drinks that they often grab. Thus, busy customers may be drawn to non-alcoholic drinks that provide useful and practical advantages while maintaining a reasonable level of health and naturalness. Brands can target fatigued consumers by incorporating electrolytes, vitamins, minerals, and other natural substances with energy-boosting properties into new product formulations. Increasing initiatives by the key market players to launch new packaging cups for food and beverages to meet the rising demand are estimated to drive the growth of the segment over the forecast period.

The food & beverage segment dominated the cups and lids market in 2024. There is an imminent likelihood of global expansion for the quick-service restaurant industry over the forecast period. The two main factors driving segment expansion are rising staff counts and shifting consumer preferences. Over one-third of customers visit malls specifically for meals, not for shopping. For both hot and cold beverages, the majority of quick-service restaurants use disposable paper cups. As a result, the demand for cups is rising quickly all across the world. The enormous demand for ready-to-eat food and quick meals has led to major fast-food businesses, like McDonald's, KFC, Domino, Starbucks, and Pizza Hut, opening new locations across the globe. Moreover, the key players operating in the market are focused on the launch of plastic-free food service packaging.

The food service industry segment is expected to witness significant growth in the cups and lids market over the forecast period due to the increasing launch of new food service centers, which are indirectly increasing the demand for cups & lids.; everyday essentials and meal ideas; food-to-go and sandwiches; flowers, Fairtrade products, chilled beers, and award-winning wines; ready meals, pizzas, and free-from, vegan, and plant-based products. Online home delivery is even available at the Grand Union, which is eventually raising the demand for food cups & lids.

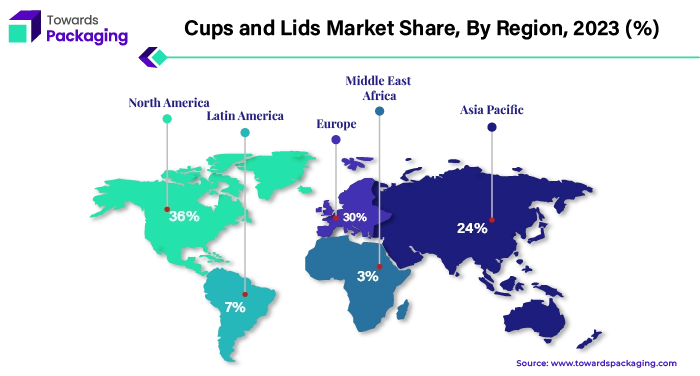

North America dominated the global cups and lids market by 36% in 2024. The key players operating in North America are focused on launching new design cups, which are expected to drive the growth of the global cups and lids market over the forecast period. In addition, the evolution of American coffee culture has been impacted by the widespread distribution of popular, youth-oriented chains like Starbucks. They are the drink's biggest consumers. In April 2024, Starbucks Corporation, a multinational chain of coffeehouses and roastery reserves based in North America, unveiled the introduction of the newly innovated, more sustainable Starbucks cold cups, which are manufactured with up to 20% less plastic.

The United States' booming coffee culture is driving greater demand for coffee cups and lids. Other factors fueling market expansion in this region include the fast-changing eating habits and lifestyles of people, as well as the growing need for convenient single-serve packaging. Furthermore, the key players and the food retailers operating in Canada are experimenting with the use of new materials for manufacturing cups & lids, which is expected to drive the growth of the cups and lids market over the forecast period.

Asia Pacific is expected to grow at a significant rate in the cups and lids market during the forecast period. A growing number of customers are spending more time outside of their homes, traveling to social venues, taking advantage of the weather, and going to sporting events as a result of the rise in urbanization. The online food service companies based in the region are leveraging their policy to deliver valuable services to customers, which is expected to drive the growth of the cups and lids market over the forecast period.

Material Insight

End-use Insight

Regional Insight

April 2025

April 2025

March 2025

February 2025