April 2025

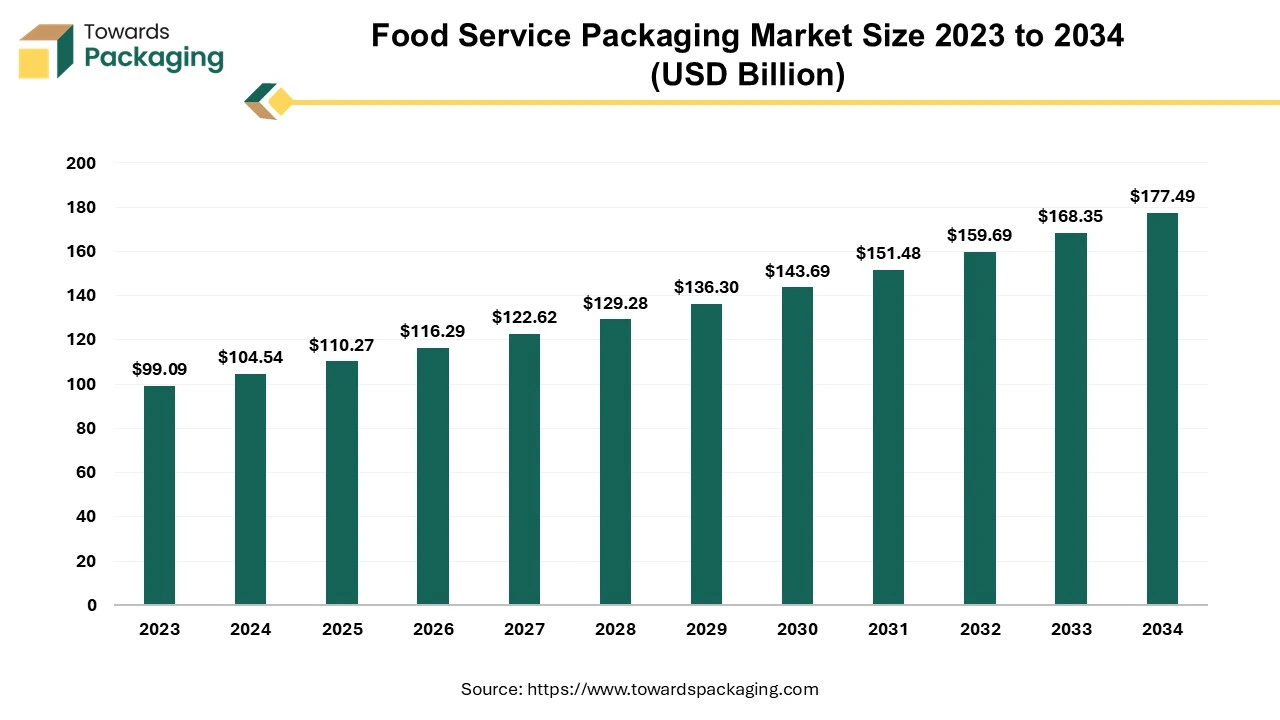

The global food service packaging market is forecasted to expand from USD 104.54 billion in 2024 to attain a calculated USD 177.49 billion by 2034, growing at a 5.5% CAGR between 2025 and 2034.

The production and distribution of packaging solutions designed for the storage, transportation, and presentation of food and beverages within the hospitality and catering industry is called food service packaging market. The food service packaging market is a vibrant and significant food industry segment commited to offering cutting-edge and environmentally friendly packaging solutions to various food service outlets.

This market meets the packaging requirements of fast-food chains, restaurants, catering companies, and other companies that handle the production and delivery of food. Ensuring food products' freshness, safety and integrity during storage, transportation, and delivery is one of the main goals of food service packaging. Packaging materials are made to fulfill certain specifications, like controlling temperature, withstanding moisture, and shielding against outside impurities. Nonetheless, the sector has experienced a radical upheaval recently, with a growing focus on sustainability.

The food service packaging market is a dynamic and ever-changing arena where businesses must negotiate a challenging terrain of changing consumer preferences, shifting regulatory requirements and advancing technology. This industry is positioned to play a significant role in determining the direction of food packaging methods due to its continuous dedication to sustainability and flexibility in response to shifting market conditions.

| Product | Description | Loading Port | Unloading Port | Country of Origin | Quantity | Weight (kg) |

| Paper and Paperboard | Coated on one or both sides with kaolin (China clay) or other inorganic substances. | Shanghai, China | New York/Newark Area, Newark, NJ, USA | Japan (JP) | 108 Rolls | 49,734 |

| Plastic Packaging | Plastic packaging. | Liverpool, UK | New York/Newark Area, Newark, NJ, USA | United Kingdom (GB) | 542 Cartons | 15,664 |

| Metal Packaging | Metal packaging on 24 pallets. | Genoa, Italy | New York/Newark Area, Newark, NJ, USA | Italy (IT) | 1,056 Packages | 3,147 |

| Plastic Packaging | Plastic packaging. | Valencia, Spain | Savannah, GA, USA | Spain (ES) | 2,678 Boxes | 19,562 |

| Plastic Packaging | Plastic Packaging | Liverpool, UK | New York/Newark Area, Newark, NJ, USA | United Kingdom (GB) | 1 Package | 93 |

| Paper and Paperboard | Coated on one or both sides with kaolin (China clay) or other inorganic substances. | Pusan, South Korea | New York/Newark Area, Newark, NJ, USA | Japan (JP | 102 Rolls | - |

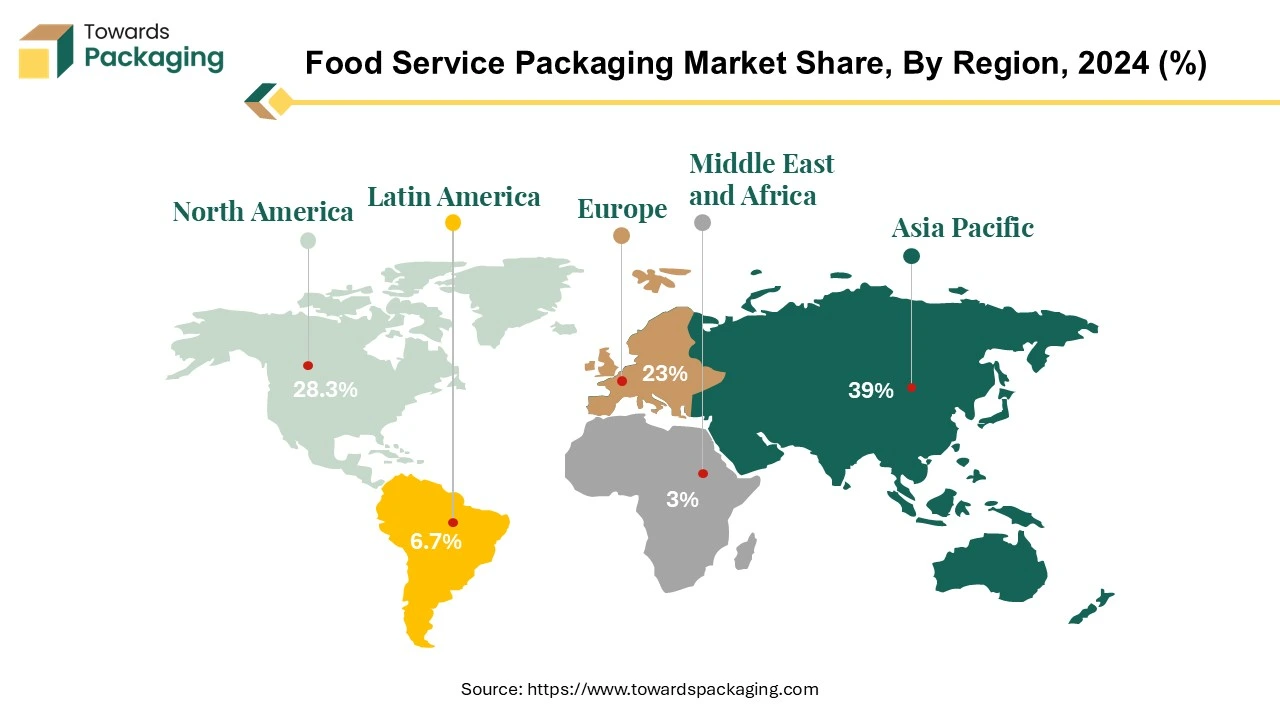

The Asia Pacific (APAC) region commands the global food service packaging market, boasting 45% of the total market share. This significant share underscores the region's dominance and potential for investors in the food service packaging market. Experiencing a robust expansion, the compostable food service packaging market in the Asia-Pacific area is on an exciting growth trajectory. Projections indicate further substantial growth in the coming years, fueled by factors such as the proliferation of food service establishments, unique architectural designs, enticing new cuisines, and the industry's commitment to visually appealing and sustainable packaging solutions.

Cafés and restaurants are increasingly using food service packaging, which includes trays made from PET material, cups and plates crafted from PE material, cutlery designed from PP material, clamshells, bowls and pouches and sachets. The compostability and sustainability of this type of packaging, which coincide with consumers' increasing desire for eco-friendly habits, are the main forces supporting this acceptance. It is projected that this trend, which reflects a larger cultural movement towards eco-conscious choices in the food service industry, will drive the market ahead significantly throughout the forecast period.

The proactive involvement of numerous regional governments is one of the elements that has contributed to the Asia Pacific region's rapid expansion. Acknowledging the packaging industry's critical role in economic growth and environmental sustainability, several governments are launching programs to promote its achievements. Government assistance not only fosters packaging innovation but also helps the overall resiliency and evolution of the Asia Pacific food service packaging sector. Regarding food service packaging, the Asia Pacific area is leading the world, and compostable packaging is expanding at an impressive rate. The region is positioned for significant market expansion due to the convergence of variables such as a rise in food service establishments, aesthetically pleasing building designs, a diversity of cuisines, and a dedication to sustainable packaging. The region's commitment to promoting developments in the packaging business is further demonstrated by government efforts, which bolster the region's standing as a significant participant in the global food service packaging scene.

North America's food service packaging market is growing significantly, with the Full-Service Restaurant model holding a 41% share. With a chain penetration rate of 55%, this area stands out as having the highest. To address environmental issues, the U.S. Environmental Protection Agency (EPA) has set an ambitious aim of reducing food waste by 30% by 2030. The growing use of composting techniques, such as compostable packaging, is one way to help achieve this aim. This packaging can be composted with food waste in various contexts, such as homes, grocery stores, and food service establishments. Food service packaging techniques have changed significantly due to the shifting lifestyles of consumers, the impact of big retail chains, and the food service sector.

The layout of food service packaging is frequently customized to improve operational efficiency and productivity in distribution centers and kitchens, especially for vertically integrated chain restaurants. A key component of supply chain optimization is how packaging complements the activities of suppliers, such as [facilitating easy storage and transportation and ensuring product safety and quality].

A trend toward sustainability is also seen in the Full-Service Restaurant format, which dominates the market growth in North America and has a high chain penetration rate. With compostable packaging emerging as a workable solution, composting methods have gained attention in response to the EPA's aim of decreasing food waste by 2030. A strategic commitment to enhancing overall operations, distribution, and kitchen productivity is also shown in chain restaurants' adaption of food service packaging, which aligns with evolving customer expectations and industry standards.

Quick-service restaurants (QSRs) emerge as the largest segment in the food service industry, with an estimated $119.2 billion in growth by 2025. This growth is diven by changing consumer tastes for dining out, brand loyalty, and the increased availability of new restaurants and various cuisines in the quick-service arena. As the quick-service industry generates many packaging materials, stakeholders such as manufacturers, food service providers, and customers must consider packaging choices' cost, form, function, and environmental impact. The convenience and safety of food for consumers are greatly enhanced by packaging. Proper packaging and labelling allow food preparers to identify the food source, the appropriate holding temperature, and the cooking requirements.

Quick-service Restaurants face an added issue in factoring travel times for their meals, especially with the rise of delivery services such as Grubhub and Uber Eats. The fact that food may sit in its packaging for more than 30 minutes before reaching the consumer highlights the importance of packaging that is not only long-lasting but also capable of maintaining the proper temperature, keeping hot food hot and cold food cool. Recognizing the importance of aligning with consumer preferences and addressing environmental issues, major participants in the quick-service restaurant sector, such as McDonald's, Wendy's, and Burger King, are aggressively promoting sustainability. This transition indicates a broader commitment throughout the industry to adapt to consumers' cultural and environmental demands in the current scenario 2023. Upgrading packaging procedures is both a response to consumer demands and a strategic step to remain competitive and environmentally responsible in the rapidly changing quick-service restaurant sector.

The global food service market demonstrates varying performance across consumption types, with delivery emerging as the frontrunner. Among the key metrics—delivery, takeaways, and on-site dining—delivery consumption takes the lead, asserting its dominance in the global market. This trend underscores the evolving consumer preferences, where convenience and accessibility play pivotal roles. The surge in delivery services reflects a shift in how people access and enjoy food, emphasizing the importance of efficient and streamlined delivery options in the overall food service industry. As a result, businesses within the sector are strategically adapting to meet the growing demand for convenient, at-home dining experiences.

Corrugated boxes and cartons are the most common materials used in food service packaging, owing to the rapid rise of takeaways, food delivery systems, and quick-service restaurants. Cardboard and paper, the critical components of these packaging materials, have outstanding recycling rates of over 80% and can assist sustainable forestry practices when acquired from certified sources. However, it is essential to note that their recyclability is limited, and they may be rejected and sent to incineration or landfill if contaminated. The Confederation of Paper Industries advises that surface staining of paper is OK, but the presence of free-moving food or '3D residue' adhering to the surface is considered unsuitable.

Companies like Domino's promote their attempts to utilize 100% recyclable cardboard for pizza boxes as part of their environmental initiatives. However, practical issues occur since not all recycling facilities can handle food-marked products. This constraint emphasizes the need for improved infrastructure and solutions to meet the complexities of recycling packaging with food residue. The complexity of sustainable packaging options is highlighted by examples such as McDonald's decision to replace plastic straws with paper ones. Despite its environmental intentions, the change drew criticism when it was discovered that the paper straws were not being recycled adequately. This sparked widespread outrage, with over 50,000 customers joining a petition to return to plastic straws, citing problems with the functionality of paper substitutes.

While corrugated boxes and cartons dominate food service packaging due to their versatility and convenience, the challenge lies in ensuring these materials are recycled correctly, significantly when contaminated with food waste. The incident at McDonald's underscores the importance of choosing sustainable materials and implementing effective recycling processes to reap the environmental benefits.

The food service sector is experiencing a significant shift propelled by technological advancements such as Artificial Intelligence (AI) and the Internet of Things (IoT). In this evolving landscape, these innovations are gaining increasing importance, prompting industry operators to actively pursue innovative solutions that boost efficiency and competitiveness while upholding high service standards and profitability. Particularly noteworthy is the rising adoption of self-service kiosks and the expansion of online reservation systems by food service providers. This strategic move not only streamlines operations but also enables the collection of valuable consumer data, offering insights into preferences and needs, further enhancing the overall dining experience.

A recent survey highlights a significant increase in the acceptance of compostable packaging by full-scale food waste composting facilities in the United States. The percentage of facilities accepting such materials has risen from 58% in 2018 to 71% today, indicating a growing confidence in compostable packaging as certification bodies and field-testing services become more recognized.

The survey, which included 105 facilities, revealed that 14 new facilities have begun accepting food waste between 2020 and 2023. This growth reflects the expanding infrastructure and commitment to managing food waste more sustainably.

Additionally, the survey collected data from 141 facilities regarding the types of compostable food-contact packaging they accept. Notably, 83% of these facilities accept food-soiled paper and pizza boxes. A majority also reported accepting certified compostable liner bags, foodservice ware, and kraft paper bags. Molded fiber containers are accepted by just under half of the respondents, while bioplastic-coated paper products are accepted by 31%.

The authors of the survey emphasized the increasing scale of composting capacity across the country, noting an 8% growth in the number of full-scale food waste facilities since 2018. They also called for more funding and additional data collection on composting practices through legislative measures to further support this growing sector.

The food service packaging market is integral to ensuring food safety, convenience, and sustainability in the food industry. Key components of this market include packaging materials, types, and technologies. Materials such as paper, plastic, glass, and metal are commonly used, each offering distinct advantages for different types of food service applications. Packaging types include containers, cups, trays, wraps, and bags, all designed to meet specific needs in food preparation, serving, and storage.

Companies play a significant role in shaping this market by providing innovative packaging solutions. For example, companies like Amcor and Berry Global are leaders in producing versatile and sustainable packaging materials that enhance food preservation and reduce environmental impact. International Paper and Huhtamaki focus on eco-friendly and biodegradable packaging options, aligning with the growing demand for sustainable solutions.

Additionally, firms like Crown Holdings and Sealed Air offer specialized packaging technologies that ensure food safety and extend shelf life. With advancements in smart packaging and temperature control, these companies contribute to improving the efficiency and functionality of food service packaging. Together, these components and industry leaders drive the development of packaging solutions that meet the diverse needs of the food service sector while addressing environmental concerns.

The competitive landscape of the food service packaging market is characterized by established industry leaders such as Amcor PLC, Berry Global Inc, Huhtamaki Oyj, Sonoco Products Compan, Novolex Holdings LLC, Pactiv Evergreen Inc., B&R Plastics Inc., Genpak LLC, Amhil North America and Dopla S.P.A. These giants face competition from emerging direct-to-consumer brands, leveraging digital platforms for market entry. Key factors influencing competition include innovation in product offerings, sustainable practices, and the ability to adapt to changing consumer preferences. Additionally, the sector sees dynamic collaborations, acquisitions, and strategic partnerships as companies strive to capture market share in this highly competitive and evolving industry.

By Product

By End-User

By Region

April 2025

April 2025

April 2025

April 2025