April 2025

.webp)

Principal Consultant

Reviewed By

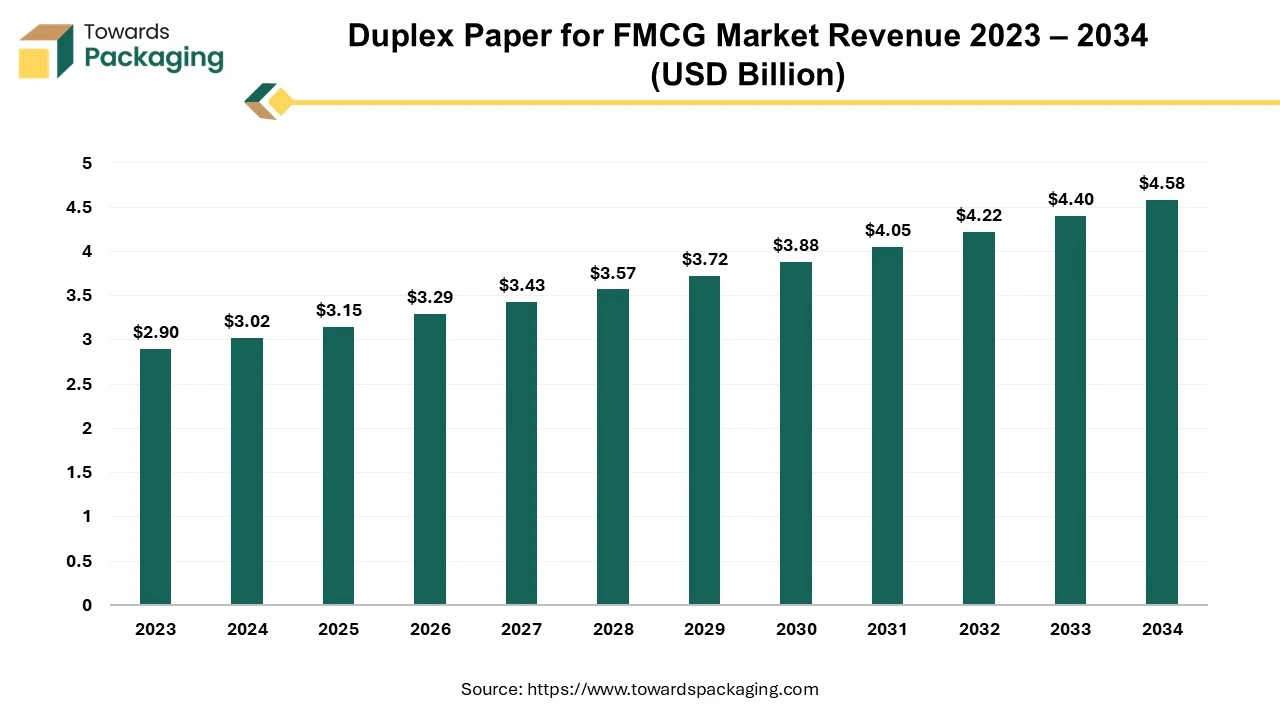

The duplex paper for FMCG market is anticipated to grow from USD 3.15 billion in 2025 to USD 4.58 billion by 2034, with a compound annual growth rate (CAGR) of 4.25% during the forecast period from 2025 to 2034.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing duplex paper for FMCG which is estimated to drive the global duplex paper for FMCG market over the forecast period.

Duplex paper in the context of FMCG (Fast-Moving Consumer Goods) is a type of paper that has a coated surface on one side and an uncoated surface on the other. This paper is often utilized for boxes, packaging, and labels due to its sturdy nature and ability to hold vibrant prints. The coated side supports for high-quality graphics, while the uncoated side can provide better adhesion for labels or other finishes. It's popular in FMCG for developing appealing packaging that enhances product visibility and branding. The global packaging industry size is growing at a 3.16% CAGR between 2025 and 2034.

The duplex paper is available in various weights (measured in grams per square meter, or GSM), typically ranging from 200 to 400 GSM. The thickness offers durability for packaging. The coated finish allows for sharp, vibrant printing, making it suitable for high-quality graphics and text. The rigidity of duplex paper makes it suitable for structural applications like boxes and cartons, ensuring that products are well-protected during transport and storage.

It is often manufactured from recycled materials, duplex paper is an environmentally friendly option, appealing to sustainability-conscious brands and consumers. The duplex paper is extensively utilized in the FMCG sector for various packaging solutions such as boxes and cartons, labels and tags, for display packaging and for flexible packaging. In some cases, duplex paper can be used in combination with other materials to create flexible packaging solutions.

Increasing trend of online shopping necessitates durable packaging that can withstand shipping. Duplex paper’s strength and structural integrity make it suitable for e-commerce applications. Due to profitable offers available on ecommerce platform for the FMCG, the sale of it has increased through e-commerce platform. The overall expansion of the FMCG sector, driven by urbanization, changing lifestyles, and rising disposable incomes, boosts demand for effective packaging solutions. The rise in sales of personal care and cosmetics products through online as well as retail platform has increased the demand for the duplex paper for FMCG which is estimated to drive the growth of the duplex paper for FMCG market over the forecast period.

Consumers are becoming more conscious of environmental issues and are actively seeking products with eco-friendly packaging. Duplex paper, often made from recycled materials, aligns with these consumer values. Duplex paper is highly recyclable, allowing consumers to dispose of it responsibly. This aligns with the circular economy model, promoting a reduction in waste and environmental impact. There is a significant shift toward sustainable packaging solutions. Brands are increasingly using duplex paper due to its recyclability and reduced environmental impact.

Compared to other premium packaging materials, duplex paper offers a good balance of quality and affordability, making it an attractive option for FMCG companies looking to optimize costs. Governments and organizations are increasingly promoting sustainable packaging initiatives, providing incentives for the adoption of eco-friendly materials like duplex paper, which is estimated to drive the growth of the duplex paper for FMCG market over the forecast period.

Advances in coating technologies are enhancing duplex paper's barrier properties, making it suitable for a wider range of products, including those sensitive to moisture and gases. Shifts in consumer preferences towards brands that prioritize sustainability and responsible sourcing encourage FMCG companies to adopt duplex paper as part of their packaging strategy. Emerging markets and trends for duplex paper for FMCG s is expected to drive the growth of the global duplex paper for FMCG market over the forecast period.

As consumers increasingly prefer eco-friendly options, companies that adopt duplex paper can attract environmentally conscious customers and enhance their brand image. Offering customizable duplex paper products can meet specific brand needs, allowing FMCG companies to create unique packaging that stands out on the shelf. The key players operating in the market are focused on adopting organic strategies like marketing to enhance the presence of the duplex paper market as well as sales of the same, which is estimated to create lucrative opportunity for the growth of the duplex paper for FMCG market over the forecast period.

In an effort to capitalize on business opportunities with attendees and other exhibitors, companies and organizations from a wide range of packaging-related sectors, including procurement/production, logistics, distribution, consumption, waste disposal, and recycling, participate in the event by showcasing a variety of packaging materials and machinery from various industries.

The key players operating in the market are facing issue in fulfilling the regulatory guidelines and disruption in supply chain, which is estimated to restrict the growth of the duplex paper for FMCG market in the near future. Disruptions in the supply chain, whether due to global events or logistics challenges, can affect availability and pricing. High competition in the market can lead to price wars and reduced profitability. Prices of raw materials, such as wood pulp, can vary significantly, impacting production costs and profit margins. Shifts toward minimalistic or innovative packaging solutions may require adaptation and redesign of existing products, which requires high amount of investment. These factors attribute to the restriction of the duplex paper for FMCG market in the near future.

Asia Pacific region held a significant share of the duplex paper for FMCG market in 2024. Rapid urbanization and rising disposable incomes in countries like China and India are increasing the demand for FMCG products, which in turn boosts the need for packaging materials like duplex paper. The Asia Pacific region is a major manufacturing center, with many FMCG companies setting up production facilities to cater to both local and export markets. This drives the demand for cost-effective and high-quality packaging solutions.

There’s a growing emphasis on sustainable packaging solutions in Asia Pacific region. Duplex paper is often seen as an eco-friendlier option compared to plastic, appealing to environmentally conscious consumers and companies. The key players operating in the market are focused on developing sustainable solutions and taking initiatives for the same, which is estimated to drive the growth of the duplex paper for FMCG market in the Asia Pacific region in the near future.

For instance, in October, 2024, Three M Paper Boards Limited, paper manufacturing and sustainable solutions providing company, revealed the plan to raise fund up to US$ 47,57,724.7 (Rs. 40 Crore) through its SME IPOs (small and medium enterprises initial public offerings). The business has been given permission to start its public offering on BE Ltd's SME platform (BSE SME). The company's coated duplex papers are an environmentally beneficial option for packaging a range of FMCG and pharmaceutical products because they are entirely biodegradable and composed of recycled wastepaper.

North America region is anticipated to grow at the fastest rate in the duplex paper for FMCG market during the forecast period. North America region benefits from advanced manufacturing technologies that improve the efficiency and quality of duplex paper production. Increasing consumer awareness and preference for sustainable and responsible packaging influence FMCG companies to adopt duplex paper. There’s a strong push toward sustainable packaging solutions in North America. Many companies are transitioning to eco-friendly materials, which drives demand for duplex paper. A robust FMCG sector in North America, with major brands prioritizing high-quality packaging, fuels demand for duplex paper products. These factors collectively attribute to the region's accelerated growth in duplex paper for FMCG market.

The high-weight coated segment held a dominant presence in the duplex paper for FMCG market in 2024. The high-weight coating enhances the surface smoothness, resulting in vibrant colors and sharp images, which are crucial for branding and marketing in the competitive FMCG sector. This type of paper is more robust, offering better resistance to wear and tear during handling, shipping, and shelf life, which is essential for FMCG products.

High-weight coated duplex paper can be used for various packaging applications, including cartons, boxes, and labels, making it a versatile choice for different FMCG items. Many high-weight coated duplex papers are recyclable and made from sustainable sources, aligning with the growing demand for eco-friendly packaging solutions. Despite its high-quality features, it can be a cost-effective option compared to other premium packaging materials, allowing FMCG companies to maintain profitability while enhancing product appeal. Certain formulations provide better barrier properties against moisture and grease, which is important for protecting food and other sensitive products. These characteristics of the high-weight coated duplex paper for FMCG makes it extensively used for FMCG packaging.

The food & beverages segment registered its dominance over the global duplex paper for FMCG market in 2024. The food and beverage industry requires extensive packaging solutions to protect products, ensure freshness, and comply with safety regulations, driving significant demand for duplex paper. Packaging plays a critical role in marketing. Duplex paper provides excellent print quality, allowing brands to create attractive, eye-catching packaging that enhances product visibility. With increasing consumer awareness around sustainability, many food and beverage companies are opting for eco-friendly packaging materials. Duplex paper is often recyclable and biodegradable, aligning with these values.

Duplex paper can be used for a variety of packaging formats, including cartons, boxes, and wrappers, making it suitable for diverse food and beverage products. Certain duplex papers can be treated to improve barrier properties against moisture and fats, crucial for preserving the quality and safety of food items. The food and beverage sector is heavily regulated, and duplex paper can meet safety and hygiene standards, making it a reliable choice for manufacturers. These factors collectively contribute to the strong dominance of the food and beverage segment in the duplex paper market for FMCG.

By Type

By Application

By Region

April 2025

April 2025

April 2025

April 2025