April 2025

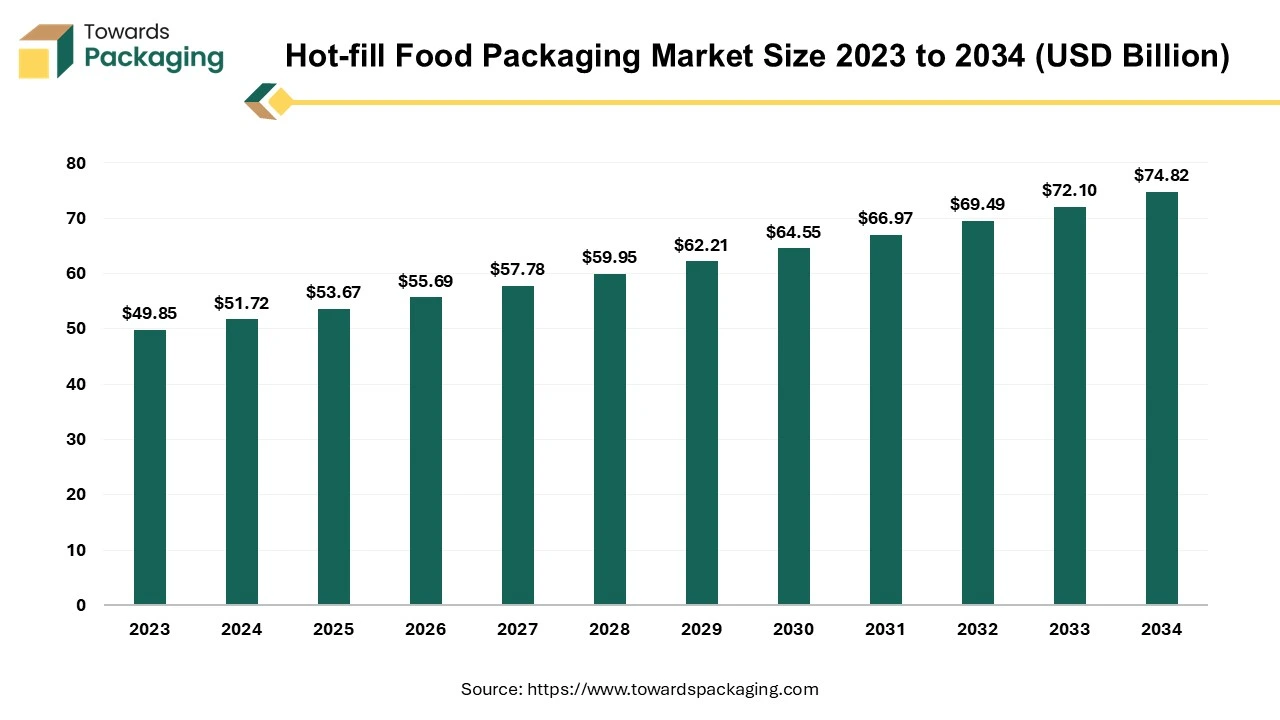

The hot-fill food packaging market is projected to reach USD 74.82 billion by 2034, growing from USD 53.67 billion in 2025, at a CAGR of 3.76% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The hot-fill food packaging market is anticipated to augment with a considerable CAGR during the forecast period. A variety of packaging techniques are used by the food and beverages sector to maintain, preserve and increase the life span of the products that are consumed. Hot fill packing is among the most widely used methods for sterilizing the products like sauce, juice, or spread. With the use of heat and no preservatives, hot fill packaging extends the shelf life of the highly acidic foods and beverages under non-refrigerated environments. This aids in stopping the growth of the harmful bacteria that could ruin the products.

The rising consumer demand for ready-to-eat and convenient food products coupled with the increasing emphasis on food safety and hygiene is anticipated to augment the growth of the hot-fill food packaging market within the estimated timeframe. The advancements in packaging materials, particularly those offering enhanced barrier properties along with the trend towards sustainability is also expected to support the market growth. Furthermore, the growing concerns of food borne microbial outbreaks which demands the use of packaging with anti-microbial effects as well as the demand for the retention of food quality is also likely to contribute to the growth of the market in the years to come. The global packaging market size is growing at a 3.16% CAGR.

The growing need for effective food preservation techniques due to the increase in food waste globally is anticipated to augment the growth of the hot-fill food packaging market during the forecast period. The wasting of the food is a worldwide problem. According to the data by the UN Environment Programme, 1.05 billion tons of food waste (that includes inedible components) was produced in 2022, or 132 kilos per person and nearly one-fifth of all food that was available for consumption. Sixty percent of all the food waste in 2022 occurred in the households, with food services accounting for twenty-eight percent and retail for the twelve percent. The quantity of data points at the home level nearly doubled globally.

Also, food loss and waste take up the equivalent of over a third of the world's agricultural land, contributing 8–10% of yearly worldwide emissions of greenhouse gases (GHG), nearly five times more than the aviation industry. This also results in a major loss of biodiversity. It is estimated that food loss and waste cost the world economy around $1 trillion.

Thus, in addition to ensuring the product's quality and safety, preservation methods and techniques along with the barrier material structures which assist in the safe and healthy preservation of food products for extended shelf lives can also contribute to the effort to reduce the food waste and spoilage. Hot-fill processing is one such type of food packing and processing technique used to increase the shelf life of food items.

Food spoiling can be caused by various factors, but one of the main ones is the development of the microorganisms like mold, bacteria and yeast that cling to and feed on the food products, eventually turning them bad. Increasing the shelf life of a product by using a combination of the sterilizing methods and creating barrier structures that are specifically designed to preserve the quality of the container and, in turn, the food product.

In the hot-fill packing and processing method, heat is applied for sterilizing the food product and, later, the interior surface of the package as it is being filled. This method is widely employed in the food packaging sector for a number of products, including applesauce, dips, and sauces. The primary goal of using the hot fill packaging method is to deliver a product devoid of germs and bacteria that can grow at room temperature. As a result, there is less food waste and a "economically sterile product" with a prolonged shelf life of up to 12 months (depending on the barrier and application).

The availability of alternative packaging technologies is expected to impede the growth of the hot-fill food packaging market within the estimated timeframe. More advanced packaging technology such as aseptic packaging, cold fill, intelligent or smart packaging and active packaging makes strong substitutes for hot-fill packaging. Aseptic packaging is a specific manufacturing method wherein the packaging and food have been sterilized independently.

After that, the container's contents are added in a sterile setting. This process utilizes extreme temperatures to make sure the contents are free of microbes and to preserve their freshness. Milk, soup, tomatoes, pudding and a number of other food items and drinks are among those that are packaged aseptically. Retort packaging is another substitute which involves filling pouches with the partially or fully cooked food, sealing them and then sterilizing them to produce food pouches that don't require refrigeration or preservatives and can last up to 18 months.

Furthermore, the ambient fill method is also used considerably. This technique kills bacteria by using cold. Additionally, the food stays chilled till it's time to fill the containers. The reason cold filling is so popular is that it protects the food without requiring the use of the preservatives or the additional food additives. Food items with dairy as a primary ingredient are packed using cold filling. Consequently, food that has cream or milk as its foundation can be frozen and canned.

Additionally, another common alternative is active packaging. The objective of creating active packaging was to meet the demand of customers for organic, biodegradable, and recyclable packaging materials. By changing the state of the food, active packaging increases the level of food safety and extends the storage life. The use of active packaging has replaced traditional methods of food processing. The presence of these wide varieties of other packaging options means businesses can readily switch if they find a better value proposition.

The demand for the artificially preserved food products is decreasing. This shift is driven by the concerns over potential health risks associated with the long-term consumption of the synthetic preservatives and a broader preference for the natural and the organic food options. Retailers in the food sector believe that the consumers need foods that are fresh, convenient, free of preservatives, with a clean label, unblemished and viewed as healthful. Customers desire foods that do not harm them and at the same treat a variety of conditions like memory loss, osteoporosis and heart disease.

According to the Confederation of Indian Industry (CII) survey conducted in 2022, 72% of the Indian diners prefer fresh, locally produced ingredients while dining out, suggesting that there is a growing pressure on the hotels to stop using preservatives. It seems that consumers are searching for the products that are both affordable as well as nutritive.

Furthermore, consumers are examining the Nutrition Facts panel when it comes to the labeling. They are reading labels to look for preservatives, artificial colors and flavors, natural and organic components and unwanted elements. The food processor companies are being greatly impacted by the consumers' pursuit of wellness. Food producers now have fewer options when it comes to preservation techniques because consumers are becoming less tolerant to the conventional chemical preservatives. Food processors are investigating innovative technologies for processing and preservation in order to get a technological advantage in the market.

Some of these technologies include hot fill packaging, high-pressure and aseptic processing, among others. Hot fill technology enables the manufacturers to utilize minimal or no preservatives in their products. With this technology, food manufacturers can assure consumers with the safety as well as the quality of their preservative-free products, tapping into this expanding market segment. Hot-fill packaging can also help brands build trust and credibility, as it supports the production of healthier and more natural food products.

The plastic segment captured largest market share of 62.18% in 2024. Plastic is an excellent material choice for hot fill type of packaging owing to its strong impact resistance and lightweight nature. Polypropylene (PP) is an excellent choice for hot fill packaging since it is a form of plastic that can tolerate high temperatures naturally and doesn't require heat treatment. Due to its better performance, polypropylene (PP) is more sustainable throughout the entire production process in addition to being recyclable (even in high-barrier formulations).

Also, owing to its lightweight characteristics, producers can achieve or surpass sustainability standards since its downstream sustainability benefits, which include reduced carbon dioxide, lesser solid waste as well as lower consumption of fuel and pollutants than other materials. Another common material for hot fill is polyethylene terephthalate (PET), which is preferred for its clear as well as the non-streaky texture. The heat-set procedure needs to be applied to the PET bottles in order for them to withstand greater temperatures without collapsing. In certain instances, this plastic can withstand temperatures as high as 185° F (85° C) without losing its clarity or form, depending on the kind of heat treatment that was applied.

The juices segment held considerable market share in 2024. This is owing to the modern busy lifestyle which has resulted in an increased preference for convenient and on-the-go food and beverage options. RTD juices provide a quick, nutritious, and refreshing solution without the hassle of preparation. Furthermore, the growing awareness of health and wellness among consumers has boosted the demand for natural, preservative-free juices. The contemporary consumer is aware of the connection between the health advantages of eating bioactive chemicals found in the fruits and their consumption.

As a result, there has been a consistent increase in popularity of the juices produced from the fresh fruits and vegetables that have undergone little processing and include no added sugar. Additionally, juices are also becoming more popular among the millennials due to their artisanal quality, and portability. Although millennials are price-sensitive in general, they will pay an extra amount for higher-quality products if they believe them to be healthy.

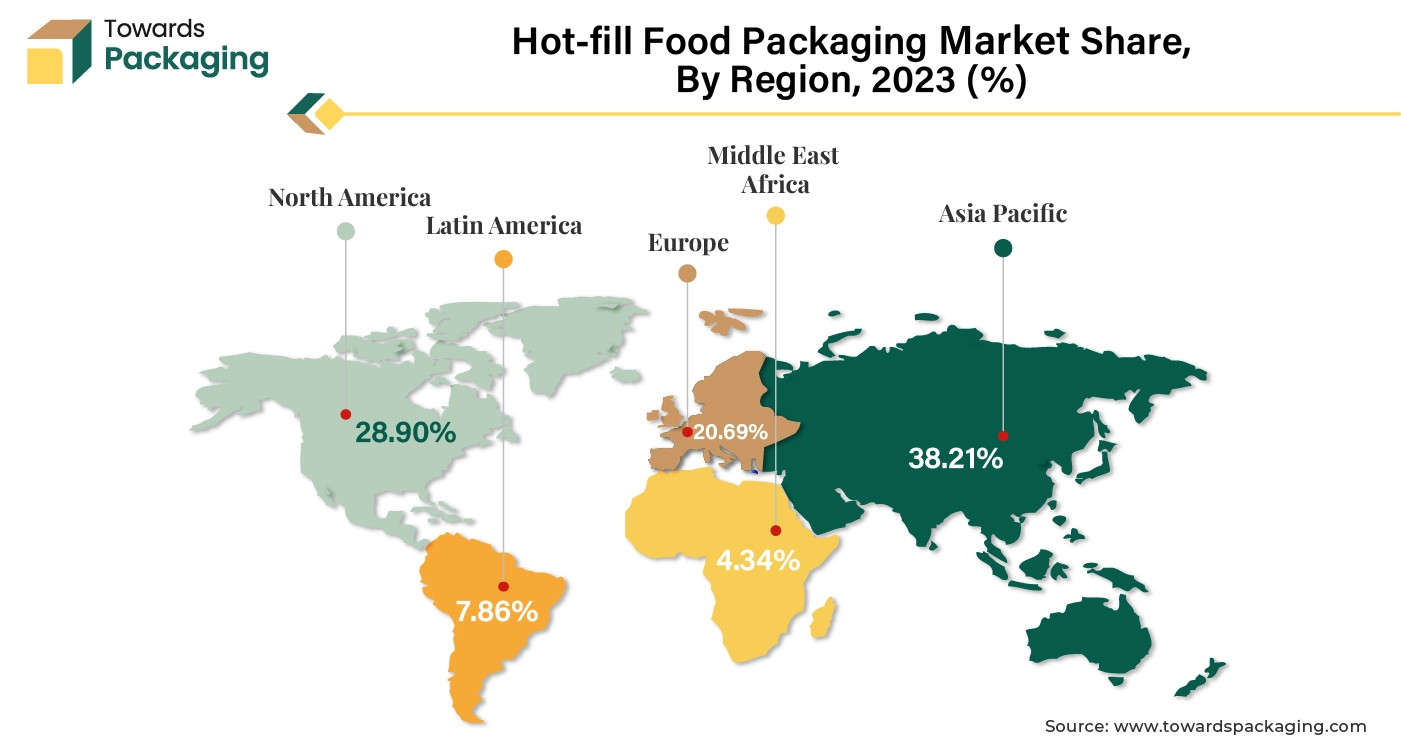

Asia Pacific held largest market share of 38.21% in 2024 and is expected to grow at a fastest CAGR of 5.37% during the forecast period. This is owing to the rapid growing middle class with higher disposable incomes. This demographic shift has increased the demand for convenient, ready-to-eat, and ready-to-drink products.

Furthermore, the increasing demand for natural, preservative-free, and safe food products and a growing interest in premium juices is also likely to support the regional growth of the market. Additionally, the growth of retail sectors, including supermarkets and convenience stores and the expansion of the food and beverage industry is also anticipated to contribute to the regional growth of the market during the forecast period.

North America is expected to grow at a substantial CAGR of 2.46% in 2024. This is due to the advances in hot-fill packaging techniques, including improved barrier materials and lightweight packaging options, enhance product quality and shelf stability. Also, the well-established beverage industry and the presence of strict food safety regulations are further expected to support regional growth of the market in the years to come. Furthermore, the rising demand for organic and natural food as well as the growing consumer preference for premium and high-quality products is also expected to support the regional growth of the market in the near future.

By Material

By Product Type

By Application

By Region

April 2025

April 2025

April 2025

April 2025