April 2025

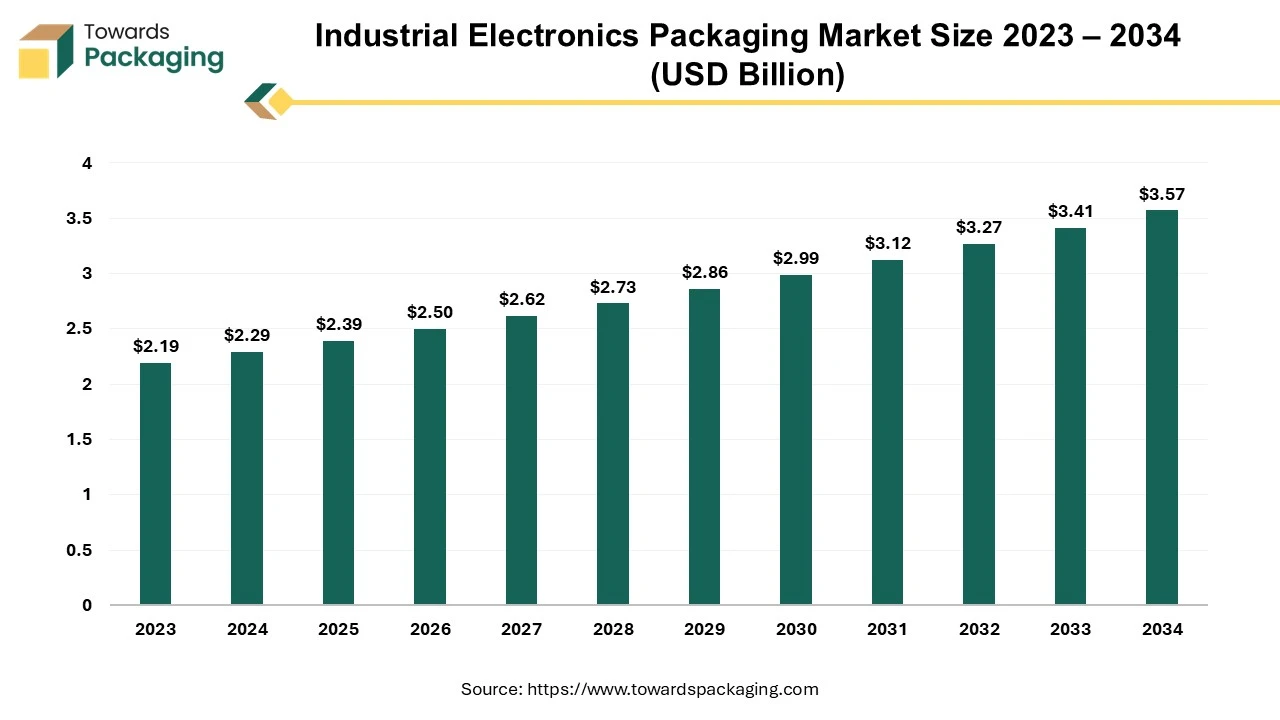

The industrial electronics packaging market is expected to grow from USD 2.39 billion in 2025 to USD 3.57 billion by 2034, with a CAGR of 4.54% throughout the forecast period from 2025 to 2034.

The industrial electronics packaging market is anticipated to augment with a considerable CAGR during the forecast period. Industrial electronics packaging deals with the packaging of components such as the sensors, meters, AC/DC drives, resistors and semiconductors, among others that are important in human-machine interfaces (HMIs), programmable logic controllers (PLCs) as well as the industrial robots. Package types can vary from basic plastic housings to specialist glass-to-metal or ceramic packing. Numerous aspects influence the packaging decision, such as the size and type of the component, the application, heat dissipation needs, electrical properties as well as the manufacturing method.

The rise of industrial automation and smart manufacturing coupled with the expansion of industrial sectors such as the automotive, energy and telecommunications is anticipated to augment the growth of the industrial electronics packaging market within the estimated timeframe. The advancement in technology, particularly in the field of electronics along with innovations in packaging materials like the development of advanced composites and anti-static films are also expected to support the market growth.

Furthermore, the integration of smart technologies into packaging, including IoT capabilities for real-time monitoring as well as the emerging markets in Asia-Pacific, Latin America, and Africa present significant opportunities for growth due to increasing industrialization and technological adoption is also likely to contribute to the growth of the market in the years to come. The global packaging market size is growing at a 3.16% CAGR.

The rise of industrial automation and smart manufacturing is expected to augment the growth of the industrial electronics packaging market during the forecast period. Industrial automation significantly improves the productivity of jobs, processes, and the enterprises with plants and on shop floors. A fraction of the working force is now required for processes that historically required armies of workers. The digital transformation of manufacturing, in particular the introduction of the Industrial Internet of Things, results in greater throughput and reduced downtime as machinery is more efficiently engaged and maintained. It is predicted that the use of sensors in machinery results in a 10% to 15% reduction in maintenance expenses. Digital automation solutions also reduce the environmental impact since the new plants control production, resources, and business operations in an eco-efficient approach by monitoring the property and operational details across numerous sites and the value chains.

Furthermore, smart factory usage is becoming more and more popular across the industries. Many businesses are aware of the potential advantages of adopting the Industry 4.0 technology, which include higher productivity, lower prices and better quality. A prime illustration of this is Mitsubishi Electric. Their prototype factory in Thailand, developed in partnership with True 5G and LERTVILAI, has autonomous mobile robots, VR and AR to improve production line performance, as well as fast data processing and examination of the production lines. Reliability as well as the effectiveness in packaging becomes important as manufacturing technologies and automated systems are used by businesses at an increasing rate.

Smart manufacturing and automation sometimes require complicated electronic systems that must perform properly in the challenging circumstances. Packaging needs to offer strong defense against the environmental elements including moisture, dust, and temperature changes, as well as against physical impacts to guarantee the longevity and functionality of these systems.

The numerous challenges in the packaging options are likely to hinder the growth of the industrial electronics packaging market within the estimated timeframe. Future packaging solutions will need to satisfy the 5% cost/pin reduction target annually while being far more complicated than those made possible by the existing technologies. The scaling zone array chip-to-package interconnect offers the number of input/output ports required for the tiny chip sizes required by handheld devices. It also delivers the current to the chip's interior and provides a large I/O count that is required by high-performance and the cost-performance products at a chip size that is reasonable.

For high-frequency applications, package designers have to deal with a number of obstacles such as the interconnects' inductance, the impedance of the communication lines on the packages, cross-talk interference between these lines and the positioning of decoupling capacitances on the PCB, in the package as well on the chip.

Furthermore, each electronic component may require specialized protection due to its size, shape and the environmental conditions it may face such as the temperature extremes, dampness, or the physical impacts. Precise customization is necessary, which complicates the design and manufacturing processes and frequently calls for cooperation between the manufacturers, engineers and designers to guarantee the peak performance.

Another significant difficulty is managing thermals for the growing future chip power in a system's constrained space. In order to meet these challenges, a large amount of research and development effort will need to be put into studying the thermal behavior, mechanics as well as the electrical efficiency of the newly developed materials in addition to the software tools needed to build and model these novel structures.

The growing electronics industry particularly in the emerging economies is expected to create a substantial opportunity for the growth of the industrial electronics packaging market in the years to come. The main factors driving the demand are the growing need for advanced semiconductors, especially from new sectors like electric vehicles (EV) and artificial intelligence (AI), as well as the acceleration of digitalization and industrial automation. The electronics sector is a creative, technologically advanced sector. Specifically, the semiconductor industry adds a great deal of value and offers manufacturers strong profit margins. Furthermore, a strategic goal for the US, EU, and Asia is the growing manufacturing of semiconductors. Recently, laws have been introduced to encourage the expansion of domestic manufacturing in each of the three regions.

Additionally, electronic components are becoming more and more in demand as smart factories, digital supply networks and the hyper-connected supply chains expand as they help in increasing the productivity up to 12%. While there are limitations to some aspects of the manufacturing, the integration of AI is helping to eliminate these limitations and many businesses are starting to realize the advantages of using the AI solutions. For example, AI Process Optimization facilitates the quality monitoring by assisting in the identification as well as removal of the faulty products before they waste more resources, time and energy.

Artificial Intelligence is expected to have a more significant role in the electronics manufacturing sector than it has in the past. As a result, the market for the industrial electronics packaging is expected to grow significantly due to the electronics industry's growth, which is being fueled by the emerging economies, digitalization as well as the increased semiconductor production. These developments require creative packaging solutions that are designed as per the changing technological needs and growing production capacities.

The plastics segment captured largest market share of 59.37% in 2024. Plastics provide an ideal combination of affordability, adaptability and flexibility that satisfies many requirements of the electronics packaging. As they are lightweight, manufacturers find them to be an appealing option because it minimizes handling and shipping expenses. Furthermore, plastics are easily molded into a wide range of sizes and forms, enabling modification to fit a variety of electronic components.

The large variety of electronics used in industrial applications requires this versatility. Plastics' dominance is partly a result of its durability, which offers good defense against environmental elements like the moisture, dust as well as the temperature changes. Moreover, improvements in the plastic materials' functionality and performance are owing to the developments like the moisture-barrier and anti-static layers.

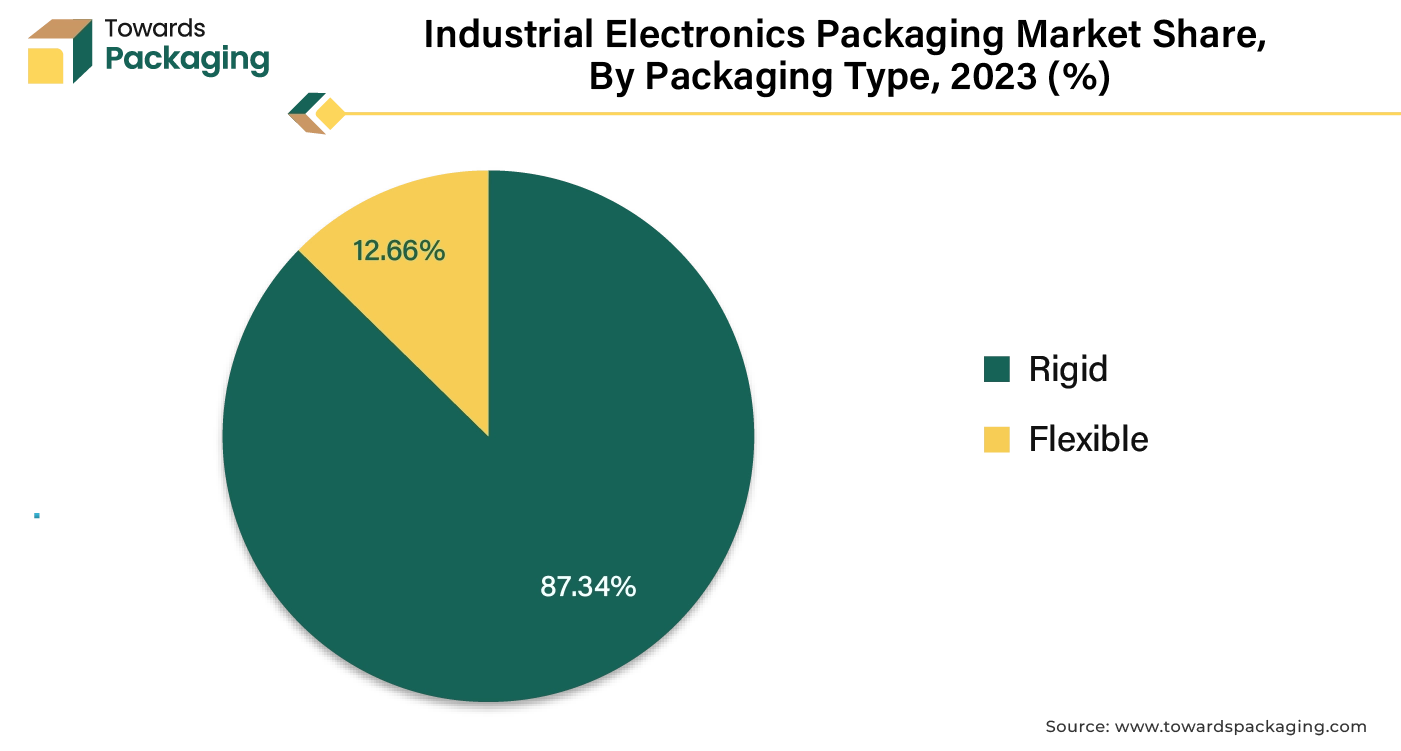

The rigid segment held largest market share of 87.34% in 2024. Tray is been widely used as the rigid packaging option. It is a typical method of packing electronic components, particularly printed circuit boards (PCBs). It pertains to dividing the trays into sections of equal size using rectangular walls and this division needs to match the designated cavities. There are two types of trays: hard trays and the floppy trays. In order to prevent the lead wires of the package body from being readily bent, hard trays are frequently utilized for packaging multi-pin, fine-pitch QTP components whereas the floppy trays are used to package common special-shaped chip components.

Packaging on trays is undoubtedly better for security during transit. Furthermore, Custom trays with cavities suitable for the components that require to be packaged can be produced in small to medium quantities at a minimal tooling expenditure. Small, lightweight mass-produced components like hardware, electronics, or other highly precise technical components are a good fit for this system. It is a great way to package products that are supplied in large quantities to OEMS. This also makes the handling and counting easier.

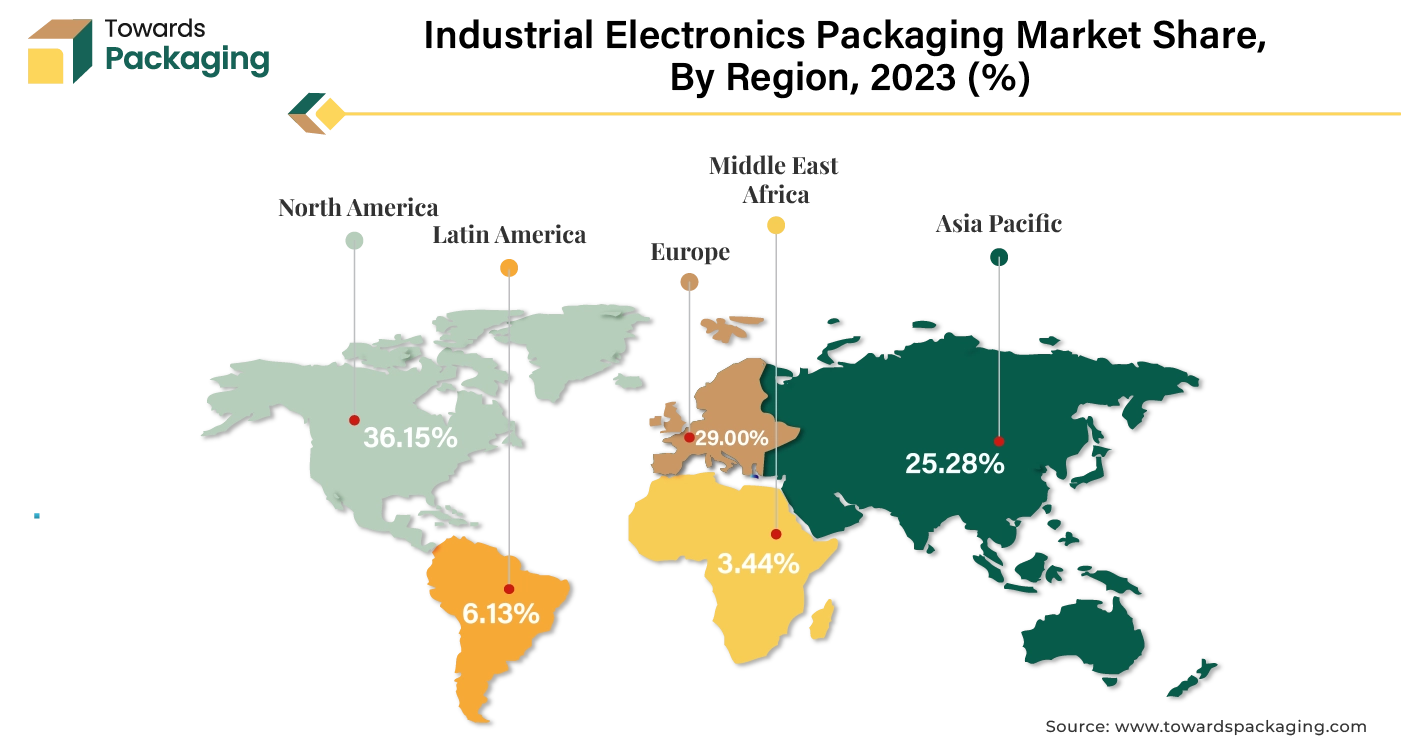

Asia Pacific is expected to grow at a fastest CAGR of 6.49% during the forecast period. This is owing to the rapid industrialization in countries like China, India, and Vietnam. Furthermore, the advancements in automation, smart manufacturing and electronic devices along with the high volume of electronics production are also likely to support the regional growth of the market. According to the data by the India Brand Equity Foundation, it is anticipated that by 2025, the electronics manufacturing sector in India will generate US$ 520 billion. The process of establishing manufacturing facilities in India has been made simpler by significant government efforts like "Digital India," "Made in India," along with supportive norms like a favorable FDI policy for the electronics manufacturing sector.

Also, in the initial four months of 2024, China's electronics manufacturing sector performed well due to a gradual increase in production and reviving domestic as well as international demand. According to the Ministry of Industry and Information Technology, from January to April, the total profits of the leading enterprises in the sector reached 144.2 billion Yuan, or roughly 20.3 billion US dollars, an annual increase of 75.8%. Additionally, growing investments in the infrastructure development is also expected to contribute to the growth of the market in the region.

North America held largest market share of 36.15% in 2024. This is due to the innovations in automation, AI, and advanced semiconductors across the region. Also, the diverse industrial base, including automotive, aerospace, and telecommunications and expansion of these sectors is further expected to support regional growth of the market in the years to come. Furthermore, the rise of smart manufacturing and Industry 4.0 technologies is also expected to support the regional growth of the market in the near future.

By Material

By Packaging Type

By Application

By Region

April 2025

April 2025

April 2025

April 2025