April 2025

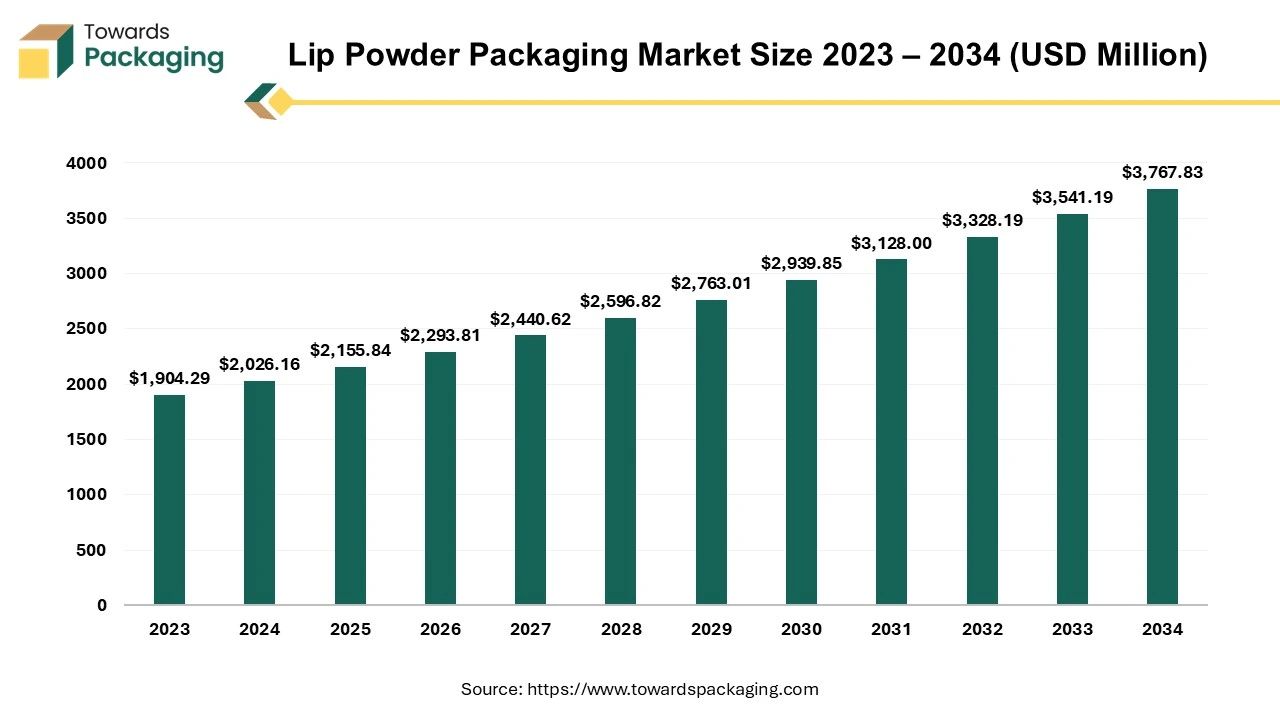

The lip powder packaging market is expected to increase from USD 2155.84 billion in 2025 to USD 3767.83 billion by 2034, growing at a CAGR of 6.4% throughout the forecast period from 2025 to 2034.

Lip powder is lipstick in powder form, with a different finish and texture than traditional creams, liquids, and stains. The lip powder packaging market is a dynamic section of the cosmetics and personal care industry, catering to global customers' changing preferences and needs. Lip powders have gained popularity in recent years thanks to their novel formulation, which provides a lightweight, long-lasting alternative to traditional lip treatments. This rising trend has prompted the creation of specialized packaging solutions designed to fulfil the specific needs of lip powders, including both practicality and aesthetics. Consumers are increasingly prioritizing sustainability and eco-friendliness in their shopping decisions. Hence, the lip powder packaging market has moved towards sustainable materials and designs. Manufacturers respond to this need by using recyclable materials, decreasing packaging waste, and introducing environmentally friendly manufacturing procedures.

Advances in technology and design have made it possible to create novel packaging solutions that improve the user experience and product performance. Packaging is essential for promoting ease of use and product performance, from stylish, portable compacts to easy applicator designs. Furthermore, branding and visual appeal continue to be important drivers of consumer engagement, with packaging serving as the primary means of expressing brand identity and product benefits.

The lip powder packaging market constantly evolves due to shifting customer preferences, technological improvements, and sustainability imperatives. As cosmetic manufacturers compete for market dominance and brand loyalty, significant investments in package innovation and design are expected to play a critical role in shaping the cosmetics sector's future.

For Instance,

North America is the largest market for lip powder packaging and is leading the way in the global personal care and cosmetics sector. North America, which is well-known for its inventiveness and customer-focused strategy, has a substantial portion of the market.

The region's vibrant consumer culture emphasizes quality and innovation, strong economy, and high discretionary incomes are significant factors. This wealth translates into a willingness on the part of North American customers to spend money on high-end cosmetics, such as lip powders, which fuels the need for creative and eye-catching packaging ideas.

North America has a thriving beauty sector, with numerous established and developing cosmetic firms vying for market dominance. This competitive environment creates an innovative mentality, causing manufacturers to constantly develop innovative package designs and materials to differentiate their products and catch consumer attention.

Consumer tastes in North America are increasingly turning towards sustainable and eco-friendly packaging solutions, owing to environmental awareness and legislative demands. As a result, producers in the region are investing in environmentally friendly packaging options, such as recyclable plastics or biodegradable materials, to meet changing consumer expectations. North America's significance in the lip powder packaging industry originates from its economic strength, consumer preferences for high-quality products, and innovative mindset. As the area prioritizes sustainability and consumer-centricity, stakeholders in the lip powder packaging business are well-positioned to capitalize on these trends, driving development and innovation.

For Instance,

The Asia Pacific region is a key player in the lip powder packaging market and has a considerable presence in the global personal care business. This popularity is primarily due to the region's growing population, which creates an ever-increasing need for personal care goods. With its large customer base, Asia Pacific commands a significant market share, making it a crucial player in influencing trends and driving innovation within the lip powder packaging industry.

The region's dynamic market landscape and diversified consumer preferences help to solidify its leading position, driving businesses to adjust their offers to Asian customers' specific demands and interests. Increasing urbanization and rising disposable incomes in Asia have fuelled demand for cosmetics and personal care products, including lip powders, propelling the packaging industry forward.

For Instance,

Stakeholders in the lip powder packaging market are well-positioned to take advantage of the prospects provided by this booming market as the Asia Pacific region continues to impose its influence on the world arena. To remain competitive and get a portion of the rapidly growing demand for creative packaging solutions in that area, it is imperative to make strategic investments in product development, marketing campaigns, and distribution networks.

For Instance,

Plastic has emerged as the most popular material for lip powder packaging due to its versatility, durability, and low cost. Polypropylene (PP) and polystyrene (PS) are popular polymers because of their superior barrier qualities, which help maintain the integrity and freshness of lip powder formulations. These lightweight materials are excellent for portable packaging solutions such as compacts and tubes, which cater to modern on-the-go lifestyles.

Plastic packaging offers a variety of design options, including varied forms, sizes, and colours, allowing firms to differentiate their products and increase shelf appeal. Furthermore, plastic packaging can be easily customized through printing, embossing, or labelling techniques, improving brand communication and product identification.

The plastic lip powder packaging industry is experiencing a change towards sustainability despite its extensive use; to reduce their adverse environmental effects, firms are using more recyclable or biodegradable polymers. The industry's emphasis on environmentally friendly packaging is a response to consumer desires for ethical and sustainable consumption, encouraging innovation in procuring raw materials and manufacturing techniques. Plastic remains the most often used material for lip powder packaging because it combines sustainability, style, and usefulness while allowing firms to adjust to changing consumer preferences and industry trends.

For Instance,

Lip powder sticks are the most popular type of lip powder packaging because of their simplicity, portability, and ease of use. They are often packaged in a small, cylindrical shape like lipsticks. Instead of a creamy or waxy texture, these sticks are made with finely milled lip powder compositions. One of the main benefits of lip powder sticks is that they are easy to apply. Sticks provide a more controlled and accurate manner to apply lip powder than loose powders or pots, which are prone to spillage and require additional equipment for application. The stick's solid format keeps the powder in place and allows it to be applied straight to the lips without brushes or applicators.

Lip powder sticks frequently include unique features like twist-up mechanisms or retractable forms for convenient distribution and storage. This makes them excellent for on-the-go use, as they fit perfectly into purses or pockets for quick daily touch-ups. Lip powder sticks provide a variety of coverage and finish options. They can be engineered to produce a sheer, buildable, or intense color payoff to suit various consumer tastes. The powder texture complements matte or velvet surfaces, allowing for lightweight and pleasant wear while maintaining durability.

Lip powder sticks are a popular product type in the lip powder packaging industry, providing consumers with a simple and adaptable alternative to traditional lip cosmetics. As demand for novel and user-friendly packaging solutions develops, lip powder sticks are expected to remain a popular choice among cosmetic consumers.

For Instance,

E-commerce has significantly expanded the market for lip powder packaging by providing a convenient platform for consumers to access a wide range of products and brands from the comfort of their homes. This digital marketplace has transformed the way consumers shop for cosmetics, including lip powders, by offering greater accessibility, convenience, and choice. The key benefits of e-commerce in the lip powder packaging market is its ability to reach a global audience. Online platforms allow consumers from diverse geographical locations to browse and purchase lip powder products from both local and international brands, thereby expanding market reach and driving growth opportunities.

E-commerce platforms offer a wealth of information and resources to consumers, enabling them to make informed purchasing decisions. Detailed product descriptions, reviews, and user-generated content provide valuable insights into the quality, performance, and packaging of lip powder products, empowering consumers to choose products that best suit their preferences and needs.

E-commerce facilitates direct-to-consumer (DTC) sales models, enabling brands to bypass traditional retail channels and establish direct relationships with their customers. This direct engagement allows brands to gather feedback, tailor product offerings, and optimize packaging designs based on consumer preferences and trends, fostering innovation and competitiveness within the market.

For Instance,

The competitive landscape of the lip powder packaging market is dominated by established industry giants such as Accupac (U.S), The Packaging Company (TPC) (India), buxom cosmetics (U.S.), CHANEL (London), Kindu Packing (China), World Wide Packaging (U.S.), LIBO Cosmetics (Taiwan), L'Oreal (France), Yuga (U.S.), Revlon (U.S.), Baoyu Plastic (China), Sephora (New York), Shiseido Company Limited (Japan) and The Estee Lauder Companies (U.S.) Inc. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

Sephora provides customization choices for lip powder packaging, allowing customers to tailor their purchases. This tactic, whether through engraving, color customization, or limited-edition container designs, adds uniqueness and perceived value to Sephora's lip powder products.

For Instance,

L'Oréal invests extensively in R&D to generate new lip powder formulations and packaging designs. By staying ahead of trends and consumer wants, the company produces new goods with distinguishing features and benefits, strengthening its competitive position.

For Instance,

By Material

By Product type

By Distribution

By Region

April 2025

April 2025

April 2025

April 2025