April 2025

The liquid IBC market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034, driving a revolution in sustainable transportation. The liquid IBC market is projected to experience consistent growth over the forecast period.

A liquid Intermediate Bulk Container (IBC) is a reusable, industrial-grade container designed for the safe storage and transportation of the bulk liquids. Usually made-up of the materials like high-density polyethylene (HDPE) and enclosed in a protective metal cage or rigid outer structure, these containers provide a practical solution for handling large volumes of the liquids such as chemicals, food, beverages and pharmaceuticals. Their standardized sizes, durability as well as the stackable design make them highly efficient for the logistics, reducing the packaging waste and transportation costs. Liquid IBCs are utilized in a variety of industries as they are reusable, easy to handle, and comply with the international safety norms.

The rising demand for efficient bulk liquid storage and transportation across industries such as chemicals, pharmaceuticals, and food & beverage is expected to augment the growth of the liquid IBC market during the forecast period. Furthermore, the increasing industrialization and globalization with the higher production and trade volumes along with the growing environmental awareness and the push for the sustainable options are also anticipated to augment the growth of the market. Additionally, the technological advancements in the design and materials as well as the stringent safety and regulatory standards in industries handling hazardous liquids coupled with the expansion of the e-commerce and global supply chains is also projected to contribute to the growth of the market in the near future.

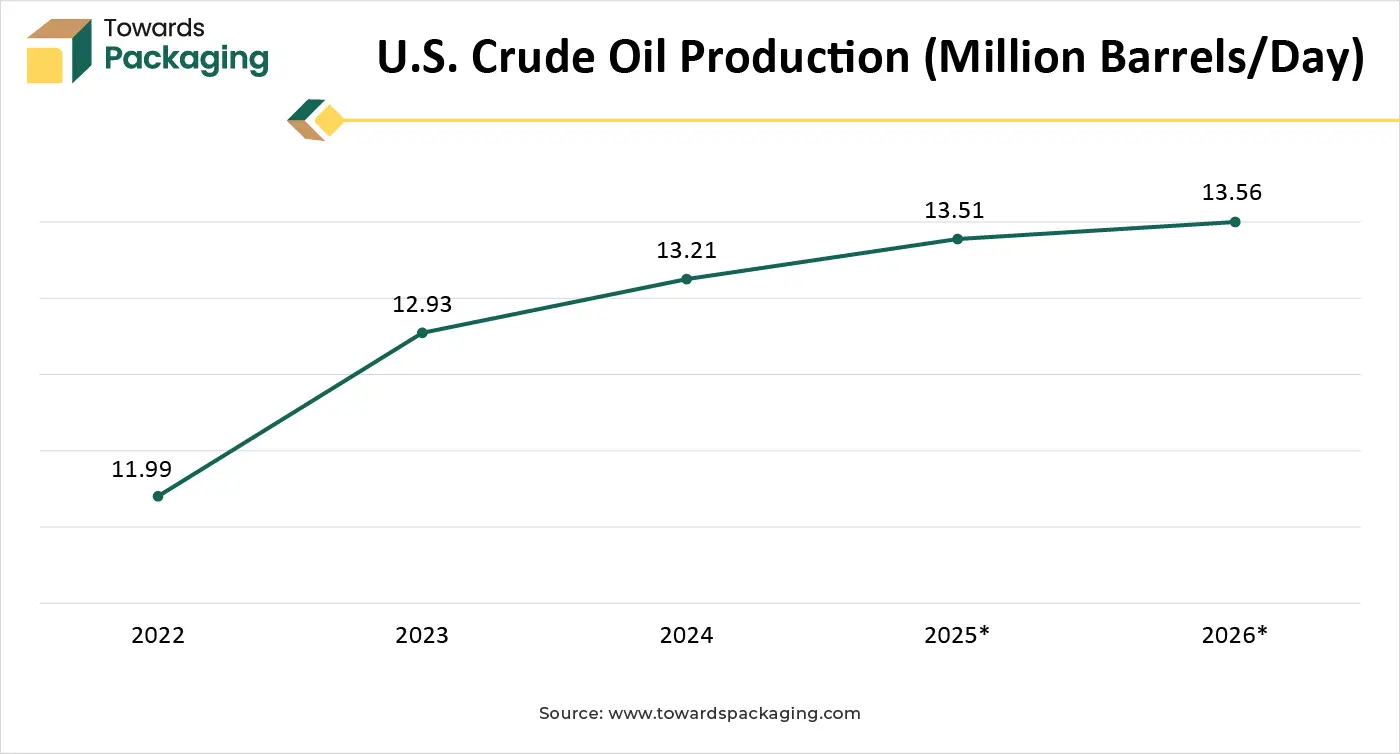

The rise in the global oil production and demand due to the industrialization, urbanization and energy needs across developed and developing nations is anticipated to support the growth of the liquid IBC market during the estimated timeframe. According to the U.S. Energy Information Administration, Short-Term Energy Outlook, April 2025, in 2024, the average amount of crude oil produced in the United States increased by 270,000 b/d (barrels per day) to 13.2 million b/d. With 48% of all crude oil production in the United States in 2024, the Permian region located in the western part of Texas and southeast New Mexico generated a greater quantity of oil compared to any other region. Nearly all of the growth in the year 2024 was attributed to the Permian region, as production increased by 370,000 barrels per day (b/d) to an average of 6.3 million barrels per day after 2023.

Furthermore, as per the data from the Oil Market report by the International Energy Agency, the worldwide oil demand is expected to increase in 2025, from 840 kb/d in 2024 to reach 1.1 mb/d, bringing total consumption to 103.9 mb/d. Also, globally oil supply increased by 130 kb/d month on month to 103.4 mb/d in November 2024, up 230 kb/d year on year. Liquid IBCs are utilized in the oil industry for handling a variety of fluids such as lubricants, hydraulic oils and cleaning agents, among others. These containers provide a practical option due to their strength, thus making them excellent for industrial situations. As the energy sector develops across economies, the need for the effective liquid handling will continue to grow. This trend positions the oil and gas industry as an important contributor to the growth of the global liquid IBC market over the forecast period.

The potential risk of the leakage or contamination is likely to hinder the growth of the liquid IBC market within the estimated timeframe. Liquid IBCs are mostly utilized to store as well as transport hazardous sensitive liquids such as chemicals, solvents, oils and pharmaceutical ingredients. Any breach in the container’s structure due to poor material quality, wear and tear, incorrect stacking and rough handling—can result in spillage and product contamination. This poses serious challenges from a product loss standpoint and also in terms of the health, safety, and environmental consequences.

In regulated industries like chemicals and pharmaceuticals, even minor contamination can make the entire batch unusable and lead to substantial financial losses and compliance issues. Also, the release of the harmful corrosive compounds may harm workers and transportation staff. If such incidents occur, companies may face regulatory penalties, damage to reputation as well as legal action depending on the depth of the breach.

Furthermore, continuous utilization of IBCs without proper cleaning and maintenance increases the risk of cross-contamination, specifically if the containers are reused for various liquids. In many cases, insufficient staff training on proper handling methods and a failure to inspect IBCs before reuse contribute to this risk. These issues illustrate the importance of the quality control, regular inspections, adequate maintenance as well as the compliance with the safety standards. While IBCs are a cost-effective and environmentally friendly option, these challenges must be addressed properly to guarantee product integrity and user safety throughout the supply chain.

Market Opportunities:

The increasing shift towards sustainable options due to the growing environmental concerns, strict government regulations and the increasing consumer awareness about the negative impact of the plastic waste as well as the carbon emissions is expected to create immense opportunities for the growth of the liquid IBC market in the years to come. Thus, industries across the globe are actively seeking eco-friendly alternatives to the traditional packaging methods. Companies are also jointly developing and promoting reusable IBC made-up of sustainable materials. For instance:

In March 2024, Mauser Packaging Solutions and RIKUTEC PACKAGING formed an exclusive agreement to produce and market sustainable IBC solutions on an international level. Through this strategic partnership, Mauser Packaging Solutions will be able to provide RIKUTEC PACKAGING IBC solutions. Both companies are eager to introduce a brand-new, the best, heavy-duty, sturdy, 1,000-liter IBC. The new Mauser Poly IBC MT Series, made-up of recycled plastic and specifically intended for multi-trip usage, eliminates the need for the single-use packaging while fully complying with the CO2 emission regulations, adding a new level of sophistication to the customers' circular economy initiatives.

Furthermore, governments and international organizations are implementing stricter regulations regarding packaging waste, especially single-use plastics, which have accelerated the adoption of reusable containers. In addition, the rise of reusable packaging pooling systems and IBC rental services is supporting the sustainable use of these containers on a large scale. This trend creates new business opportunities for service providers and encourages wider market penetration. As sustainability becomes a global priority, the demand for liquid IBCs is expected to grow steadily, presenting a strong and long-term opportunity for market players.

In a market that is traditionally driven by material strength and logistical efficiency, artificial intelligence (AI) is anticipated to emerge as a silent disruptor, redefining how liquid IBCs are manufactured, utilized and managed across industries. No longer limited to just storage and transport, IBCs are becoming smarter and more responsive, due to the AI technologies. AI enables predictive maintenance through processing the data from smart sensors embedded in containers—monitoring temperature, pressure as well as potential contamination risks in the real time. This proactive approach reduces the downtime and extends the lifespan of the containers. On the production side, AI is improving the manufacturing precision via automating the quality checks and optimizing the mold designs based on the performance analytics, resulting in a fewer defects and improved customization.

In case of the supply chain operations, AI tools analyze the historical data and real-time logistics to optimize the deployment of IBC, reduce transportation costs and prevent delays. AI is also likely to support the IBC market with sustainability goals. It helps with the circular economy strategies through predicting the reuse cycles, identifying recyclable materials as well as streamlining the waste management. These insights are expected to assist the manufacturers and end-users to reduce their environmental footprint. As organizations automate their packaging and transportation processes, AI is becoming a key driver of innovation and productivity in the liquid IBC industry. Its role is anticipated to grow even further, changing data-driven information into a competitive advantage throughout the value chain.

The 500–1000 liters segment held substantial share in the year 2024. This capacity range provides the ideal balance between volume and manageability. Containers in this size bracket are large enough to store as well as transport bulk quantities of liquids, reducing the frequency of refills and shipments, yet compact enough to be easily handled with the standard material handling equipment like forklifts and pallet jacks. This range also fits seamlessly into the logistics systems, as 1000-liter IBCs are designed to maximize the space utilization in the trucks and shipping containers. IBCs of this range are frequently utilized by industries such as chemicals, pharmaceuticals and oil and gas because they fulfill regulatory standards while guaranteeing product safety throughout storage and transportation. Also, this segment promotes cost-effective supply chain operations through reducing labor, transportation and packaging expenses.

The chemicals segment held considerable share in the year 2024. This is due to the rising demand across various industries such as pharmaceuticals, agriculture, construction, automotive and electronics. Furthermore, the innovations in chemical manufacturing processes, sustainability initiatives as well as the increased investment in the research and development of new materials is also likely to support the growth of the segment in the global market. Additionally, the global push for cleaner energy, water treatment coupled with the environmentally friendly products is expected to contribute to the segmental growth of the market during the forecast period.

Europe held considerable market share in the year 2024. This is due to the presence of stringent packaging waste and recycling regulations such as the EU Packaging and Packaging Waste Directive as well as the strong consumer and industry demand for eco-friendly choices. Furthermore, the increasing trade of pharmaceuticals is also expected to support the regional growth of the market. According to the data by Eurostat, in 2024, the pharmaceutical and medical product imports surged by €1 billion and the exports surged by €37 billion as compared to 2023. The trade surplus soared from €58 billion in 2014 to a record-high level of €194 billion in 2024 as a result of exports growing faster than imports. While exports increased by 148% within 2014 to 2024, imports increased by 74%. Additionally, the growing adoption of circular economy practices is also further expected to contribute to the regional growth of the market.

Asia Pacific is likely to grow at a fastest CAGR during the forecast period. This is due to the growth in pharmaceutical manufacturing as well as the expanding chemical and petrochemical industries in the region. According to the Ministry of Industry and Information Technology (MIIT), the major business revenues of China's pharmaceutical industry have grown at an average annual rate of 9.3 percent since the start of the fourteenth Five-Year Plan period (2021-2025). Also, as per the National Bureau of Statistics of China, during the first 11 months of 2024, the nation's chemical raw material and product manufacturing sector expanded by 9.5%. Additionally, the presence of the cost-effective manufacturing base is also expected to contribute to the regional growth of the market. Furthermore, the increased trade and logistics operations along with the industrial growth in countries like India and China are likely to contribute to the regional growth of the market.

By Material Type

By Capacity

By Design Type

By End-Use Industry

By Region

April 2025

February 2025

February 2025

January 2025