April 2025

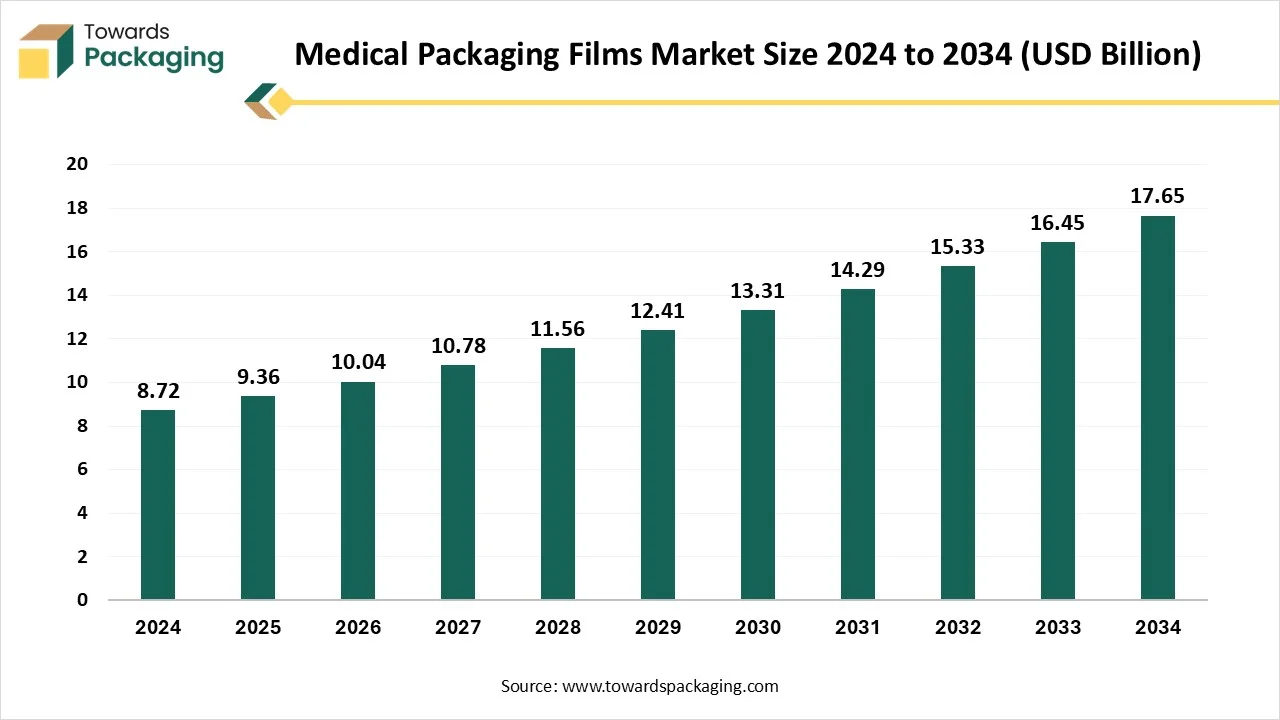

The medical packaging films market is forecasted to expand from USD 9.36 billion in 2025 to USD 17.65 billion by 2034, growing at a CAGR of 7.3% from 2025 to 2034. The growing chronic diseases, rising investment on healthcare sector, and the increasing inclination towards bioplastic resources enhance the usage of medical packaging films market. The growing concern for protecting pharmaceutical products from moisture, air, dust, and pollution has evolved this market to grow rapidly.

The medical packaging films market plays a significant role in the pharmaceutical industry as it helps to protect various products from adverse climate and help to store them for a longer period. The growing use of packaging films in the pharmaceutical industry is accredited to their properties such as lightweight, non-reactive with chemicals, and transparency influence the demand for this market. The major market players such as Parekhplast India Limited, AptarGroup, Inc., Uflex Limited, Honeywell International, Inc., and many others are continuously introducing innovation in this market has boosted the development of this market.

Products with such packaging can be stored, opened, handled, and released easily by the healthcare professionals. These films are generally manufactured from polyethylene, polypropylene, polyvinyl chloride, polyamide, and many others. These films are well known for their durability, flexibility, easy to customize option, and high-quality protection of products in adverse condition. Rising number of chronic diseases and developing healthcare facilities has influenced the demand for huge production of medical packaging films.

In the medical packaging films market, there is a huge impact on AI as it helps in identifying the materials used for the production of packaging films. Drug and patient safety is the major concern in the pharmaceutical companies which influence market players to innovate packaging which provide high safety to the products. Reinvention of smart packaging with the incorporation of AI tools to enhance the status of the pharma companies and also for the protection of the drugs. The incorporation of smart technologies helps to maintain the temperature requirement of the drugs and protect them from damage. It has proven the reliable tech to lead to the evolution in the packaging industry.

The growing demand for eco-friendly packaging has compel the market players to use renewable resources. Advanced technology help in customization of the packages with precise detailing to protect drugs from adverse climatic condition. AI-powered vision technology used high-operation to check labels, seals, and barcodes to decrease the human error.

For instance, in December 2024, the Internet of Things (IoT) healthcare market reached $128 billion in 2023 and is on track to surpass $550 billion in the next eight years according to industry research. Drug verification system has enhanced due to the incorporation of artificial intelligence in this industry.

Rising Healthcare Expenses and the Growing Chronic Diseases

The rising healthcare and medical sector expenditure and increasing rate of chronic diseases drive the demand for medical packaging films market. The increasing number of pharmaceutical companies has introduced innovation in this field which encourage the packaging sector to evolve which will enhance the protection of the drugs. The rising number of ageing population has raised the need for pharmaceutical products and growing admittance to healthcare services are influencing the demand for medical packaging of the products. Strict guidelines in the pharmaceutical sector have raised the standard of the packaging industry which are set by EMA and FDA to confirm the enhanced-quality packaging resources. It is to fulfil the efficiency and safety needs necessary for the drugs to maintain the integrity of the medicines.

Increasing Innovation in the Packaging Films

The advancement in technology has raised the innovation in this medical packaging films and increasing the potential of this market. Innovations such as child-resistant films, ultra-high barrier films, anti-counterfeiting features, senior-friendly packaging, and many others. Glass materials are continuously replaced by polyolefin materials for the packaging of the products. The major market players are continuously focusing towards protecting patients as well as planet at the same time. Most of the pharmaceutical companies are choosing vacuum packaging to preserve the integrity of the drugs and avoid contamination.

The growing demand for bioplastics due to rising commercial adoption, manufacturing, investment, and R&D in this sector has influenced the rising opportunities of the market. With the increasing demand for eco-friendly packaging of the healthcare products the manufacturing companies are adopting cellulose, sugarcane, and corn as a basic-resources for packaging film production.

Thermoformable films are the highly used resources for the packaging of the pharmaceutical films. The rise in sustainable packaging in the healthcare industry has contributed towards the generation of massive opportunities in the medical packaging films industry. The innovation of multi-layered films with enhanced barrier properties has developed the market exponentially.

Fluctuation in the Charges of Raw Materials

There is a huge fluctuation in the charges of the raw materials required for the production of the packaging films which is the major challenge among the major market players. This fluctuation in the raw material prices has fluctuated the charges of the packaging film which hinder the growth of the market and it has been a serious concern for the market players. There are several more factors such as fluctuating transportation charges, fuel costs, and several others.

The polypropylene segment dominated the market in 2024 due to its resistance, durability, and flexibility properties. These properties are highly preferred in the healthcare sector for manufacturing wraps, bags, and pouches. These are chemically non-reactive and provide sterility in packaging. These materials provide high resistance against heat while transporting to a longer distance. These are used to pack highly sterile products and enhancing the shelf life of the pharmaceutical products.

The thermoformable films segment dominated the market in 2024 due to its compatibility and cost-effectiveness properties. This material is considered as chemical-proof, water-resistant, and gas-proof which confirms the medical safety of the products. Such packaging maintains the integrity and sterility of the products. Its potential to withstand adverse climatic condition and affordable option in the packaging industry.

The bags segment dominated the market in 2024 due to the huge volume requirement for the packaging of the pharmaceutical products. These medical packaging bags have several advantages which attract a huge number of customers towards this market. As these are convenient for transportation, protect medical products, and provide platform for the promotion of the brands. These bags packaging are highly used for the packaging of liquid medicines. This segment required huge customization which increase the demand of this market.

The pharmaceutical segment dominated the market in 2024 due to the strict regulations of the governmental bodies such as EMA and FDA rules. In comparison to other medical department the pharmaceutical sector required the huge amount of packaging film. This type of packaging is important for various function in the pharma industry from maintaining the quality of the medicines to using eco-friendly packaging.

Asia Pacific held the largest share in 2024. This is due to several factors such as huge population in several countries, sustainability, and cost-effectiveness. In countries such as India and China there is a high number of populations living which include huge aged population and people suffering from chronic diseases. This result in high number of drugs packaging which boost the development of this market. The growing health facilities by the government has influence the demand for this market. For instance, as of 31st December 2024, 13.26 lakhs Ayushman Arogya Shivir have been conducted at AAM, with a footfall of 7.19 crore people. The growing demand for sustainable packaging in several companies has compelled the market players to bring innovation to this market.

North America is expected to grow at the fastest rate during the forecast period. This is due to the growing demand for using bioplastic packaging in the healthcare sector. The major concern on compliance and innovation with strict regulation in the packaging industry has influenced the growth of this market. In countries such as the U.S. and Canada the rising awareness about ecological issues has raised the demand for medical packaging films market.

By Type

By Material

By Application

By Region Covered

April 2025

April 2025

April 2025

April 2025