April 2025

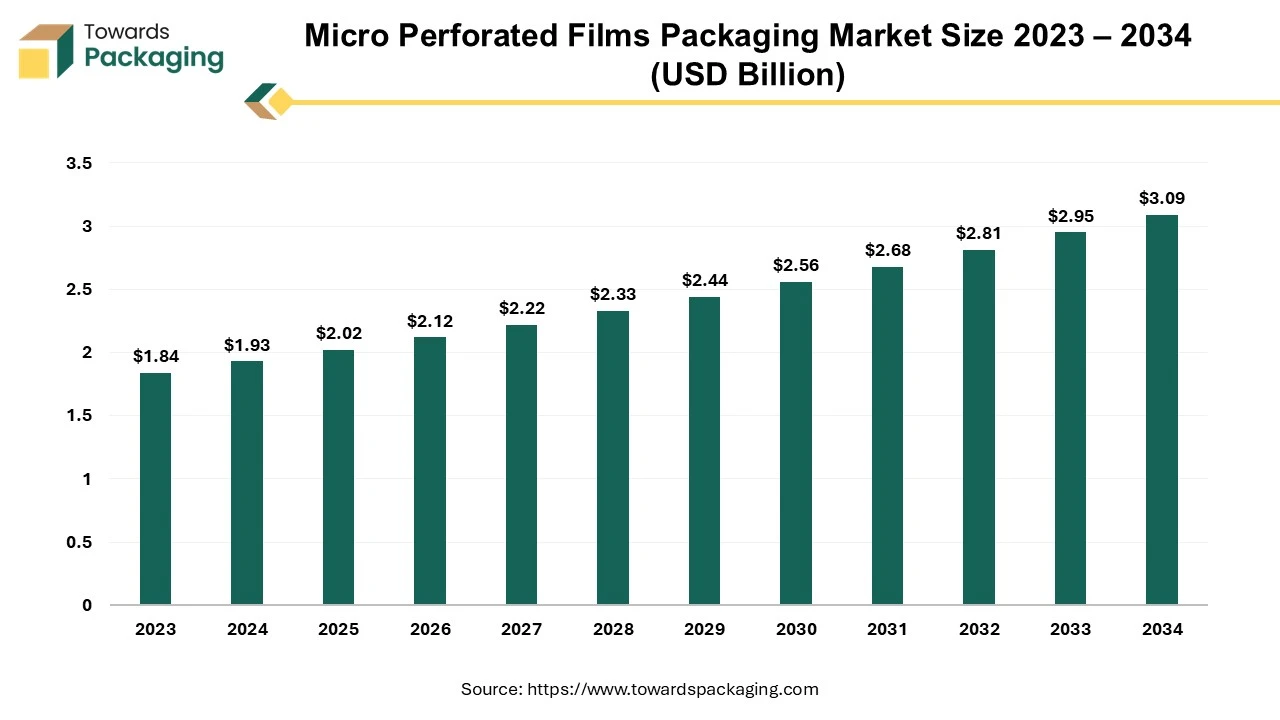

The micro perforated films market is projected to reach USD 3.09 billion by 2034, growing from USD 2.02 billion in 2025, at a CAGR of 4.80% during the forecast period from 2025 to 2034.

The micro perforated films packaging market is set to grow prominently during the forecast period. Micro-perforated film is a packaging sheet material with micro-holes designed to enable air to penetrate and keep the respiration rates constant. The holes in the film are created by a hot, cold needle, or laser procedure and their diameters vary from 1 to 2 mm. Food waste can be decreased by utilizing the micro perforation, which has been created to improve product freshness as well as the shelf-life. Materials such as the films and bags that are utilized for packaging fresh baked goods, fruits and vegetables frequently feature the micro perforations.

The increasing consumer demand for fresh and minimally processed food products and rise in global urbanization and busy lifestyles has fueled the demand for convenience foods are expected to augment the growth of the micro perforated films packaging market during the forecast period. Furthermore, the growth of the e-commerce sector, especially in the food and grocery segment coupled with the expansion of the food retail sector in emerging markets is also likely to support the growth of the market.

Additionally, stringent food safety regulations, predominantly in North America and Europe as well as the increasing focus on reducing food waste, both by consumers and governments is also projected to contribute to the growth of the market in the years to come. The packaging market size is growing at a 3.16% CAGR.

The increasing demand for the fresh food is projected to support the growth of the micro perforated films packaging market during the forecast period. The drive to maintain a healthy lifestyle is a current trend that has resulted in the higher prices of the fresh foods. Fresh produce like fruits and vegetables has a greater market value due to its rich nutritional value.

Additionally, nearly one third of the Americans usually eat the fresh vegetables every day and more than half (58 percent) say they do so at least four or five days a week. 72% of the consumers said they usually or always serve the fresh veggies with their dinner. Customers also expect that the produce in their neighborhood supermarkets will be crisper and fresher. Likewise, as consumers seek to lead healthier lives, they are also showing a growing interest in selecting more environmentally friendly options.

While cost is undoubtedly a major factor when purchasing the fresh produce, customers are also more interested in the supply chain as well as the sustainability-related information. Fresh food's popularity is growing since the customers believe in its health benefits like lowering the probability of the chronic illnesses and diseases along with helping people lose the weight. Since the Food Safety Modernization Act (FSMA) Section 204 went into effect in 2023 and mandated that the FDA establish traceability standards for certain fresh food categories, transparency in the sourcing of fresh goods has become ever more important.

Consequently, there is a growing need for the micro-perforated film packaging as it helps meet the consumer expectations by controlling the respiration rates of fresh produce and preserving the texture, freshness and the nutritional value of the fruits, vegetables and other perishable goods.

The availability of alternative packaging options like the modified atmosphere packaging (MAP) and vacuum packaging is likely to hamper the growth of the micro perforated films packaging market within the estimated timeframe. Both of these packaging types are recognized widely. MAP preserves the taste, flavor and appearance of items while keeping them fresh. The products that are frequently packed using MAP include the fresh-cut produce like pre-packaged salads and fruit as well as other products like snacks, pasta, baked goods, cheese, sandwiches and processed meats. Extra MAP prolongs food shelf life eliminating the need for food additives, lowers oxygen levels to prevent food from deteriorating during transportation, keeps food products as fresh as possible as well as lowers the waste in the supply chain and the carbon footprint of the packaging.

Similarly, there is demand for vacuum packaging for food preservation. Food is preserved by vacuum packaging as it keeps food from decaying by removing oxygen. The absence of the oxygen hinders the growth and multiplication of the spoiling bacteria and fungus, so prolonging the food's shelf life. Aerobic organisms cannot proliferate in this anaerobic environment. When the vacuum packaging is sealed, it also serves as a strong barrier against the moisture, dust as well as other environmental impurities, protecting the food from outside elements.

Furthermore, these technologies could prove more appealing to the companies trying to minimize their packaging costs due to their lower cost and the proven efficiency. This competitive pressure could hinder the market penetration and expansion of the micro-perforated films by restricting their acceptance, especially in areas where cost plays an important part in purchasing decisions.

The growing focus on reducing food waste is expected to create opportunities for the growth of the micro perforated films packaging market in the near future. As per the UN Environment Programme (UNEP) report, food waste amounted to 1.05 billion tonnes in 2022, or 132 kg per person and about one-fifth of the food that was available for consumption. Sixty percent of all food waste in 2022 occurred in households, with food services accounting for twenty-eight percent and retail for twelve percent.

Also, recent data shows that food loss and waste account for 8–10% of yearly worldwide emissions of greenhouse gases, which is over five times more than the aviation industry. It also greatly decreases biodiversity, occupying up the size of nearly a third of the world's agricultural area. An estimated $1 trillion is the cost of food loss and waste to the world economy.

Furthermore, governments across the economies are focusing on reducing the food waste by implementing strategies. For instance, in June 2024, the National Strategy for Reducing Food Loss and Waste and Recycling Organics was unveiled by the U.S. Department of Agriculture (USDA), the U.S. Food and Drug Administration (FDA), the U.S. Environmental Protection Agency (EPA) and the White House as part of President Biden's thorough approach to solve environmental justice, tackling climate change, feeding the nation and advancing a circular economy.

Packaging options that support the food waste reduction programs are projected to become more popular as governments as well as organizations put these initiatives into action. Micro perforated films reduce food waste and increase the shelf life of produce. They also have an economic benefit as they cut down on the number of times that spoilt goods need to be purchased. This trend positions the micro-perforated films market as a major player in the global drive to combat the food waste and improve the food security, offering it a significant growth opportunity.

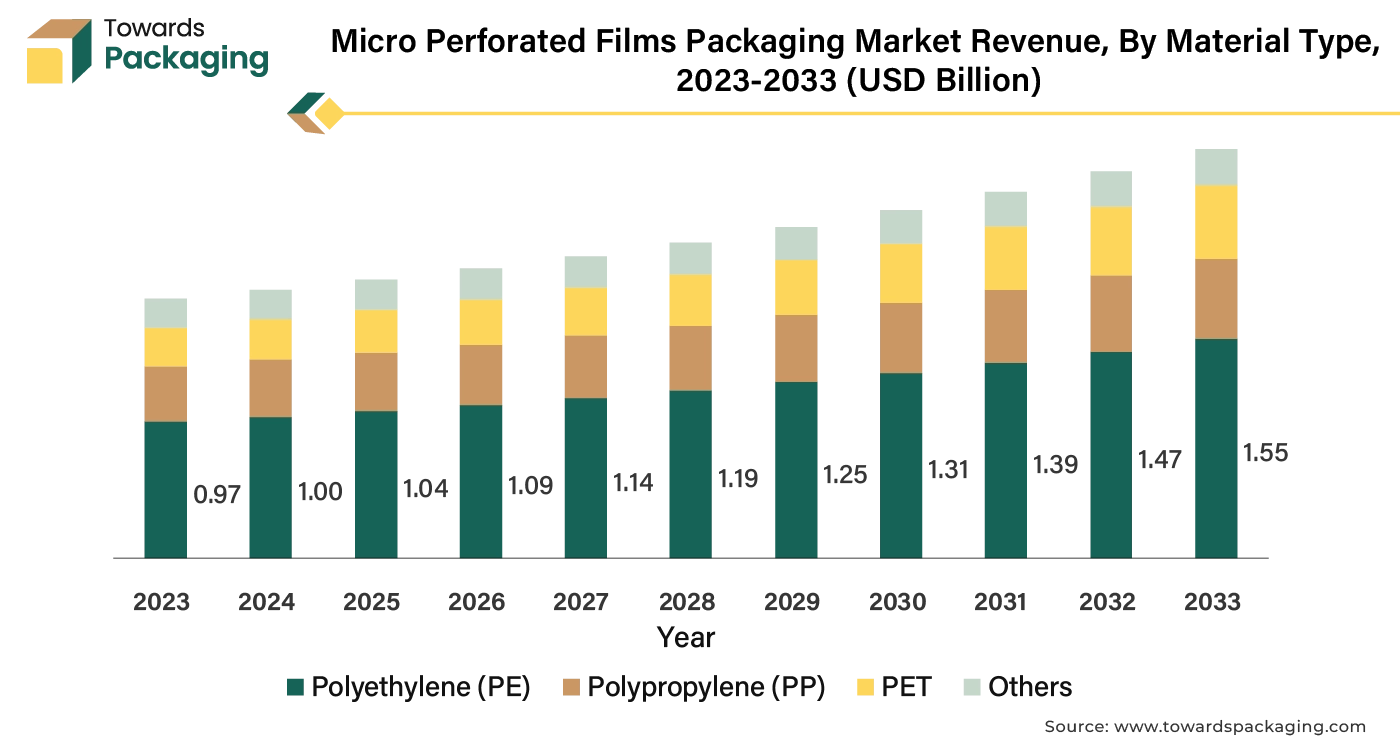

The polyethylene (PE) segment captured largest market share of 52.64% in 2024. PE is light in weight and printing information on it is simple. The films also offer good ability to process (can be transformed into films, bags, bottles) and may be recycled and reused. Since polyethylene is non-polar, it has no attraction to water. PE packaging films serve as excellent moisture barriers owing to this characteristic. This is especially vital in the food packaging industry since moisture creates the perfect environment for the growth of microorganisms and physical damage. Polyethylene prolongs the lifespan of packed foods and perishables by blocking the absorption of moisture.

Furthermore, Polyethylene has already been certified by the FDA, the international regulatory agency for the safe manufacturing and storage of the medications and food. PE films are approved by the FDA for use in the food packaging due to their tendency to remain stable over a broad temperature range.

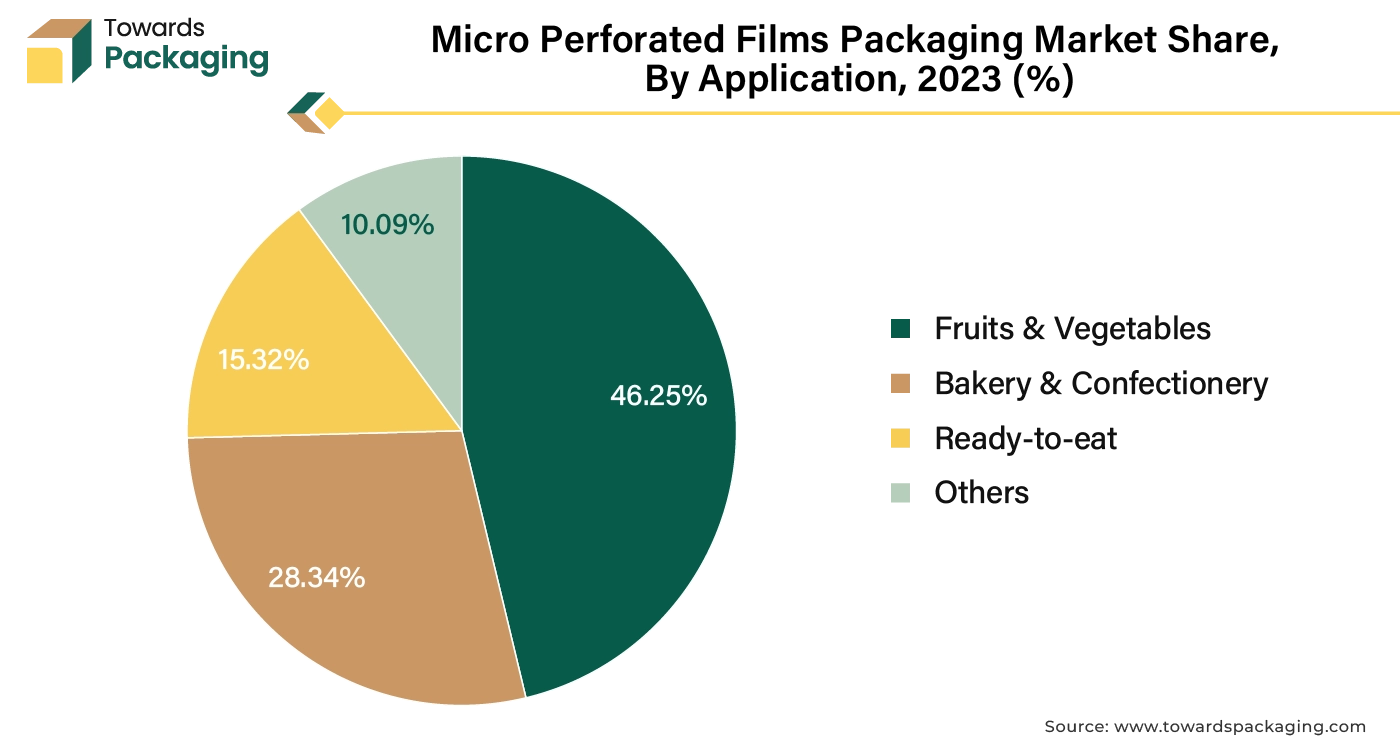

The fruits and vegetables segment held largest market share of 46.25% in 2024. This is owing to the increasing health-conscious among the consumers and the growing awareness of the benefits of a diet rich in fresh fruits and vegetables. These foods are packed with essential vitamins, minerals and antioxidants that contribute to overall health and help prevent chronic diseases such as the obesity, diabetes and heart disease. Furthermore, the growing global movement towards plant-based diets due to the concerns over health, sustainability and animal welfare is also likely to support the segment growth of the market. Fruits and vegetables have a longer shelf life due to the micro-perforated films, which also maintain the food's quality when stored within.

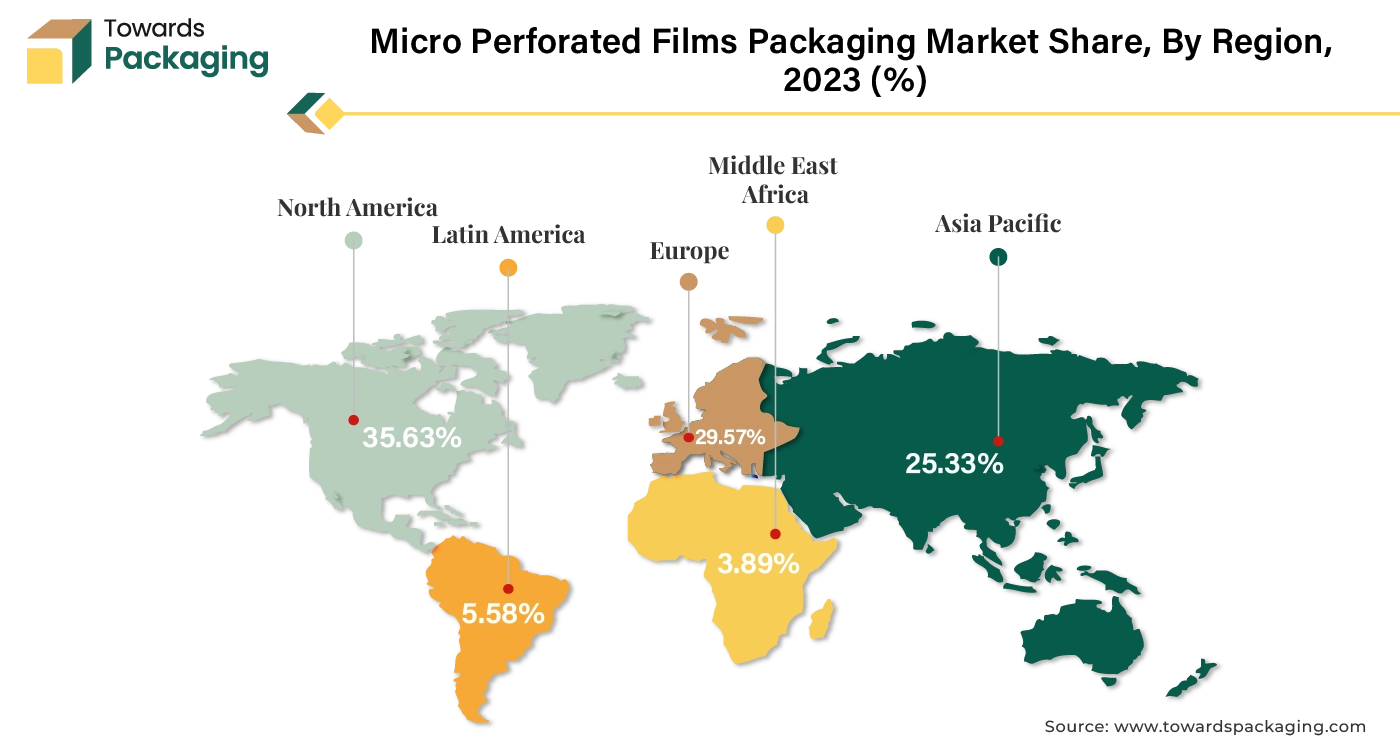

Asia Pacific is likely to grow at fastest CAGR of 6.92% during the forecast period. This is owing to the growing middle class and the increasing disposable incomes across the region. Furthermore, the growing food industry in emerging economies such as India and China is also likely to support the growth of the market in the region. As per the NRAI IFSR 2024, the Indian food services industry is estimated to be valued USD 67.84 billion as of FY24. It is predicted to reach USD 92.49 billion (about Rs 776,511 crores) by FY28, growing at an overall CAGR of 8.1% and a 13.2% CAGR for the organized sector. After Brazil, India's food services industry is expanding at the second-fastest rate in the world. By 2028, it is projected to surpass Japan as the third-largest food services market. Additionally, the increasing population along with the rising bakery and confectionery industry are also anticipated to promote the growth of the market in the region in the years to come.

North America held largest market share of 35.63% in 2024. This is due to the increasing demand for fresh and organic produce and the growing demand for the convenience foods such as the pre-cut vegetables, ready-to-eat meals and packaged salads across the region. Also, the stringent food safety regulations as well as the growing government initiatives to reduce the food wastage are further expected to support regional growth of the market in the years to come. Furthermore, the growth of e-commerce and online grocery shopping along with the growing focus on reducing the environmental impact is also expected to support the regional growth of the market in the near future.

By Material Type

By Technology

By Application

By Region

April 2025

April 2025

April 2025

April 2025