April 2025

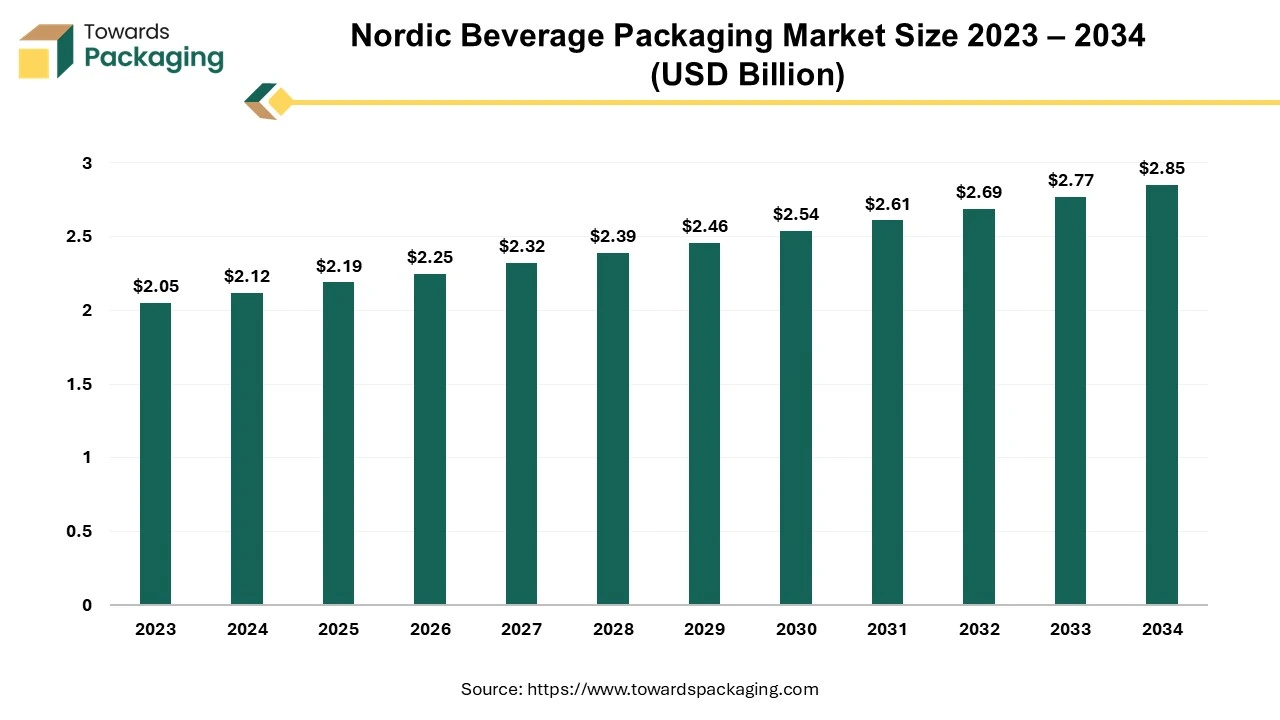

The Nordic beverage packagingmarket is projected to reach USD 2.85 billion by 2034, growing from USD 2.19 billion in 2025, at a CAGR of 3.05% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The rising demand for carbonated fruits and vegetable juices and their packaging will influence the market to grow significantly during the predicted period. These beverage packaging are highly preferred due to their ability to prevent chemical deterioration, alter the products' flavour, and avoid leakage. The growing e-commerce industry and innovation in the packaging industry have boosted market demand.

The Nordic beverage packaging market is thriving due to growing customer demand for convenient and sustainable packaging explanations. The main market drivers comprise growing health awareness, a rising preference for on-the-go ingesting, and strict ecological guidelines. Prospects flourish in the investigation of advanced materials and arrangements, such as plant-based resealable and bioplastics pouches. Current trends specify a modification in the direction of lightweight and biodegradable packaging, as well as the incorporation of smart technologies that improve product shelf life and customer suitability.

These progressions will remain to shape the Nordic beverage packaging industry, contributing abundant opportunities for development and invention. Some of the major players in this sector have been undertaking the attainment of small and medium-sized corporations as their main development plan. The rising demand for non-alcoholic beverages worldwide has been growing steadily over the past few years. Spiralling demand for soft drinks has been completely affecting the overall requirement for non-alcoholic beverages in the Nordic region. Moreover, the growing ingesting of vegetable and fruit juices is enhancing the development of the Nordic beverage packaging sector.

The integration of AI plays a significant role in the development of the beverage packaging market by introducing innovation, improving sustainability, enhancing efficiency, and several other factors. The design and quality of packaging have influenced market growth due to artificial intelligence. With the help of this, there is a low risk of poor quality or defective packaging products which helps to build the trust of a brand among its users.

AI helps to analyse the information gathered from the data and conclude the demand for the packaging in specific regions. These protect against excess production of packaging which helps companies to use fewer resources with good quality. Artificial intelligence-based systems help to track the details of the supply chain, reduce labour charges, influence effective packaging, and several other ways to satisfy the changing market demand.

The rising consciousness of ecological sustainability is influencing the demand for environment-friendly packaging resolutions in the Nordic region. Customers are progressively choosing products that are packaged in decomposable, recyclable, or compostable resources. This trend is predicted to endure in the upcoming years as governments apply firmer guidelines on plastic waste and customers become more ecologically aware. The Nordic beverage packaging market is predicted to observe an important upsurge in demand for supportable packaging resolutions, such as bioplastics, glass bottles, and paper-based cartons.

The quick expansion of the e-commerce industry is generating new openings for the Nordic beverage packaging industry. As many customers purchase beverages from online platforms, the requirement for packaging solutions that can guard products during transport and management is growing. Beverage producers are retorting to this inclination by capitalizing on advanced packaging patterns that are both tough and cost-operative. The Nordic beverage packaging market is anticipated to help from the sustained development of the e-commerce division as more customers turn to online platforms to buy their beverages.

The rising health and wellness consciousness is enhancing customer fondness for beverages. Customers are progressively looking for healthier beverage choices, such as low-calorie, low-sugar, and organic drinks. This trend is generating openings for beverage producers to grow new packaging solutions that provide to these customer demands. The Nordic beverage packaging market is anticipated to see an amplified demand for packaging solutions that support the health and wellness profits of beverages. The Nordic beverage packaging market has stringent attention to environment-friendly and sustainability packaging capitals.

With a guarantee of low pollution to the environment and less carbon footprint, the Nordic beverage sector of packaging has high resolutions that reduce waste, use renewable materials, and are recyclable or biodegradable. This innovation towards developing sustainable packaging has resulted in the extensive acceptance of resources such as cartons, paperboard, and bio-based plastics for packaging beverages, as well as advanced initiatives such as reusable and refillable packaging process.

The cartons Nordic beverage packaging market is important in this sector during the predicted period. Customer requirements for environment-friendly packaging products rising rapidly, and beverage companies are working progressively to produce carton packaging for Nordic beverages which are convenient to use and functionally suitable. Cartons are biodegradable and renewable sources of packaging which are suitable alternatives to plastic bottle packaging. Several companies are working towards introducing recyclable packaging products such as producing wood fiber cartons for beverage packaging. The incorporation of advanced technology assists in producing energy-efficient, and lightweight packaging. Additionally, the revolution in liquid packaging board (LPB) allows enhanced recyclability, confirming that cartons can be handled effortlessly at recycling services. The incorporation of tamper-evident services, multi-layer patterns and resealable caps also improves the consumer practice, contributing both functionality and comfort of use.

Conventional beverage packaging is leading the material segment of the Nordic beverage packaging market in the predicted period due to the rising demand for aluminum, Polyethylene terephthalate, and glass packaging for beverages. There is a huge shift towards sustainable solutions in such conditions as the conventional packaging segment remains robust because of its extensive acceptance and practical assistance.

The rising e-commerce sector has highly influenced the packaging quality as well as affordability of the product which ultimately boosted the development of the Nordic beverage packaging market. Aluminum is highly preferred by companies due to its lightweight and cost-effective nature in carbonated beverages. Due to several benefits associated with packaging materials like glass and aluminum many brands choose these as conventional packaging for beverages.

Non-alcoholic beverage packaging is leading the material segment of the Nordic beverage packaging market in the predicted period due to the rising demand for healthy drink options such as flavoured water, juices, and functional beverages. Due to the huge shift in customer preference, there is a need for innovation in the beverages as well as their packaging pattern.

There is an upsurge in the demand for enhanced quality packaging which can improve product shelf life and increase the availability of ready-to-drink non-alcoholic beverages. It is highly taken care of utilising resources that do not react with the product packed inside such as glass beverage packaging. The healthy packaging for such beverages which are needed to be stored for a long span.

The Sweden beverage packaging market dominated the market due to customer awareness of eco-friendly packaging and the huge set-up for recycling infrastructures. There is a huge demand for such beverages which need good packaging for enhanced shelf life. Several brands choose eco-friendly packaging resources to attract huge customers' attention and increase their brand value.

Major countries influencing the growth of this market are Norway, Finland, Denmark and Iceland. With constant innovation in the beverage packaging market for both alcoholic and non-alcoholic beverages, these countries are contributing significantly to this market. The presence of top market players in these countries and continuous investment in this sector has influenced the production of high-quality packaging materials. The growing demand for a variety of ready-to-drink beverages has grown the packaging industries in these countries.

Recent Developments

By Product Type

By Material Outlook

By End User

By Region Covered

April 2025

April 2025

April 2025

April 2025