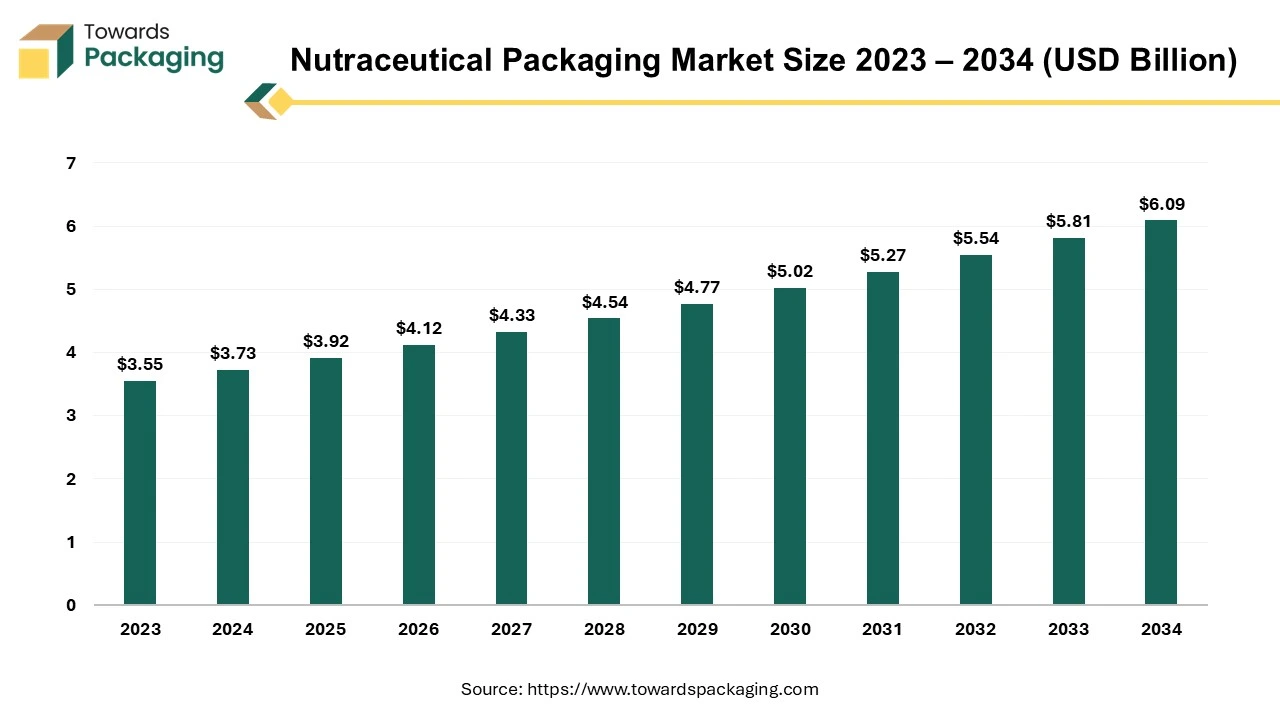

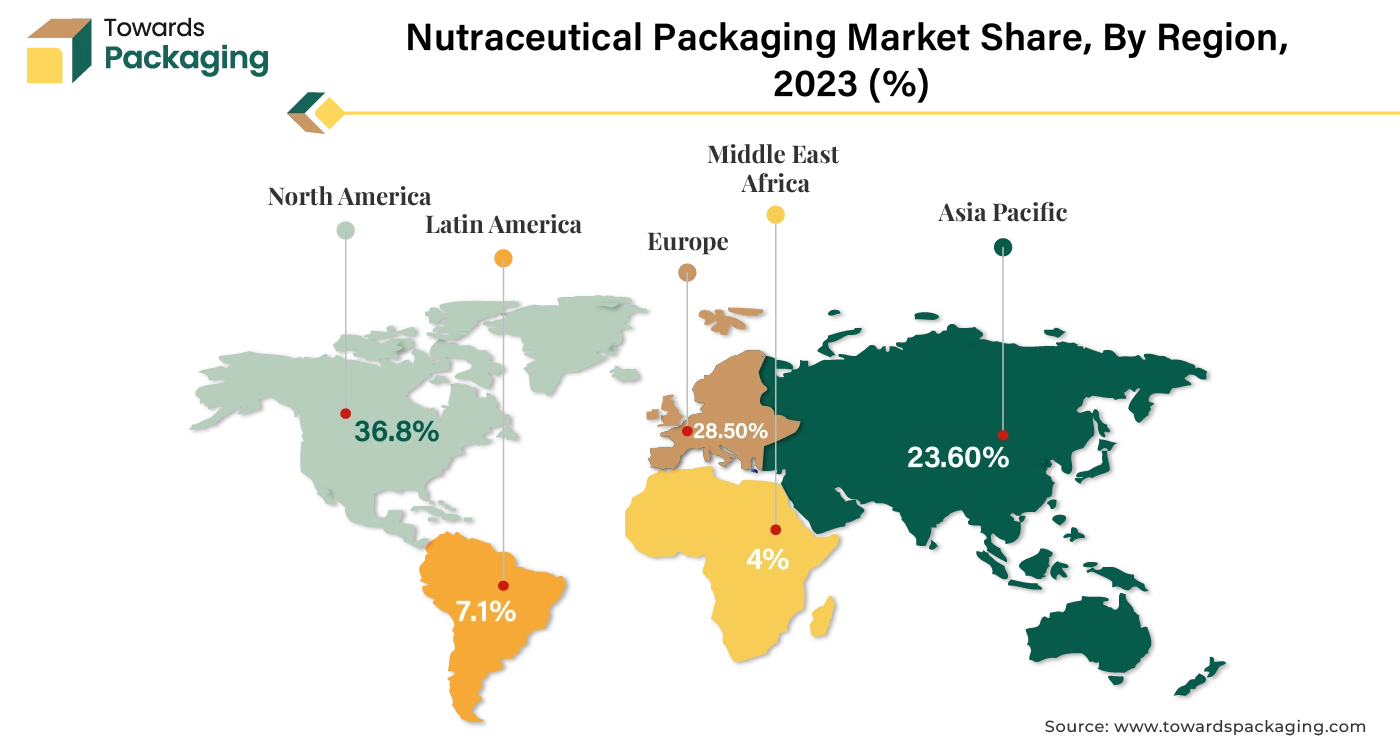

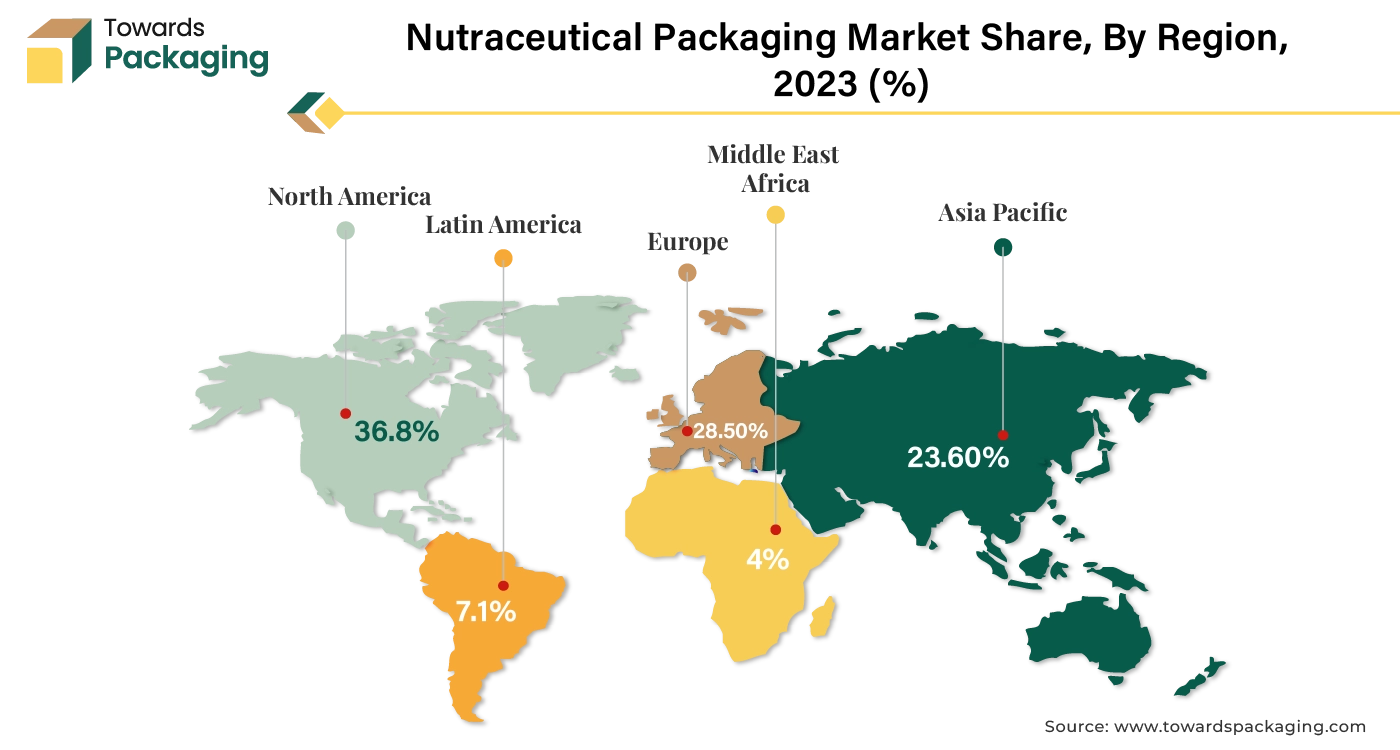

The nutraceutical packaging market is forecasted to expand from USD 4.12 billion in 2026 to USD 6.45 billion by 2035, growing at a CAGR of 5.1% from 2026 to 2035. This growth is driven by the increasing demand for packaging solutions in dietary supplements, functional foods, and sports nutrition. North America leads the market due to the rising demand for wellness products and technological innovations in packaging, while Europe also experiences growth driven by health-conscious consumers.

Plastic packaging dominates the market, although eco-friendly solutions are gaining momentum. Key players include American Nutritional Corporation, Arizona Nutritional Supplements, and Comar. The market spans several packaging types, including bottles, pouches, jars, and blisters, with materials such as PET, HDPE, and biodegradable plastics.

The nutraceutical packaging market plays a key role in the maintenance of the efficacy and potency of these products that include supplements, sports nutrition, as well as functional foods. Important tendencies are ecology, convenience, customization, and transparency. The regions of North America and Europe demonstrate substantial increase due to the want of people to stay in good shape and healthy. Plastic Packages become the More Adaptable and Cheaper, but the concerns rise about Sustainability. Bottles are the favorite option due to their asepticity, while vitamins are powering the growth of the industry worldwide. The main strengths involve creativity, sustainability, and taking care of client preferences to stay competitive.

Nutraceutical packaging is a bag-in-box and pouch packaging offer eco-conscious solutions, ensuring the safety and freshness of nutraceuticals from filling to end-use. Utilizing aseptic technology, these products remain shelf-stable and free from preservatives, eliminating the need for refrigeration.

Nutraceuticals, which are obtained from food, can give additional health benefits than just basic nutrition. Packaging is a key factor in protecting these products, particularly moisture as the major problem because of its possible bad effect on the product's performance. The choice of materials and techniques is critical, as it determines the durability and performance of the product.

Nutraceuticals comprise a wide range, including dietary supplements, sports nutrition, functional foods, beverages, and herbal extracts. They have many components including vitamins, minerals, amino acids, omega fatty acids, probiotics, and prebiotics, which require particular packaging to keep each part intact.

The market for nutritional supplements is booming worldwide and is being driven by the desire of consumers to lead a healthier and longer life. The business, Acend, provides the equipment with versatile packaging needs including bottles, blister packages, and stick packs. It is an indicator that customers are growing more and more conscious about the relationship between health and wellness which ultimately leads to increased demand for products that give nutrition and health benefits.

Nutraceutical packaging is not just about holding, but more of maintaining their potency and efficacy. With the growth of the industry, innovative packaging solutions will still play a vital role in providing consumers with quality, safe, and effective products in their effort to achieve better health and wellness.

For Instance,

| Metric | Details |

| Market Size in 2025 | USD 3.92 Billion |

| Projected Market Size in 2035 | USD 6.45 Billion |

| CAGR (2026 - 2035) | 5.1% |

| Leading Region | North America |

| Market Segmentation | By Products, By Material, By Packaging, By Distribution Channel and By Region |

| Top Key Players | American Nutritional Corporation, Arizona Nutritional Supplements LLC, Comar |

Sustainability and Eco-Friendly Solutions

Smart and Digital Packaging

Functional Features

Personalized and Clean Label Packaging

Adoption of Advanced Manufacturing Technologies

As the nutraceutical industry grows, the volume of products such as dietary supplements, functional foods, and beverages increases, requiring more packaging materials. Manufacturers seek diverse packaging solutions for capsules, tablets, powders, and liquids, boosting the packaging industry's demand.

The competitive nutraceutical market requires packaging that enhances brand recognition and communicates product benefits effectively. This creates opportunities for innovative packaging designs, including custom shapes, vibrant graphics, and premium materials.

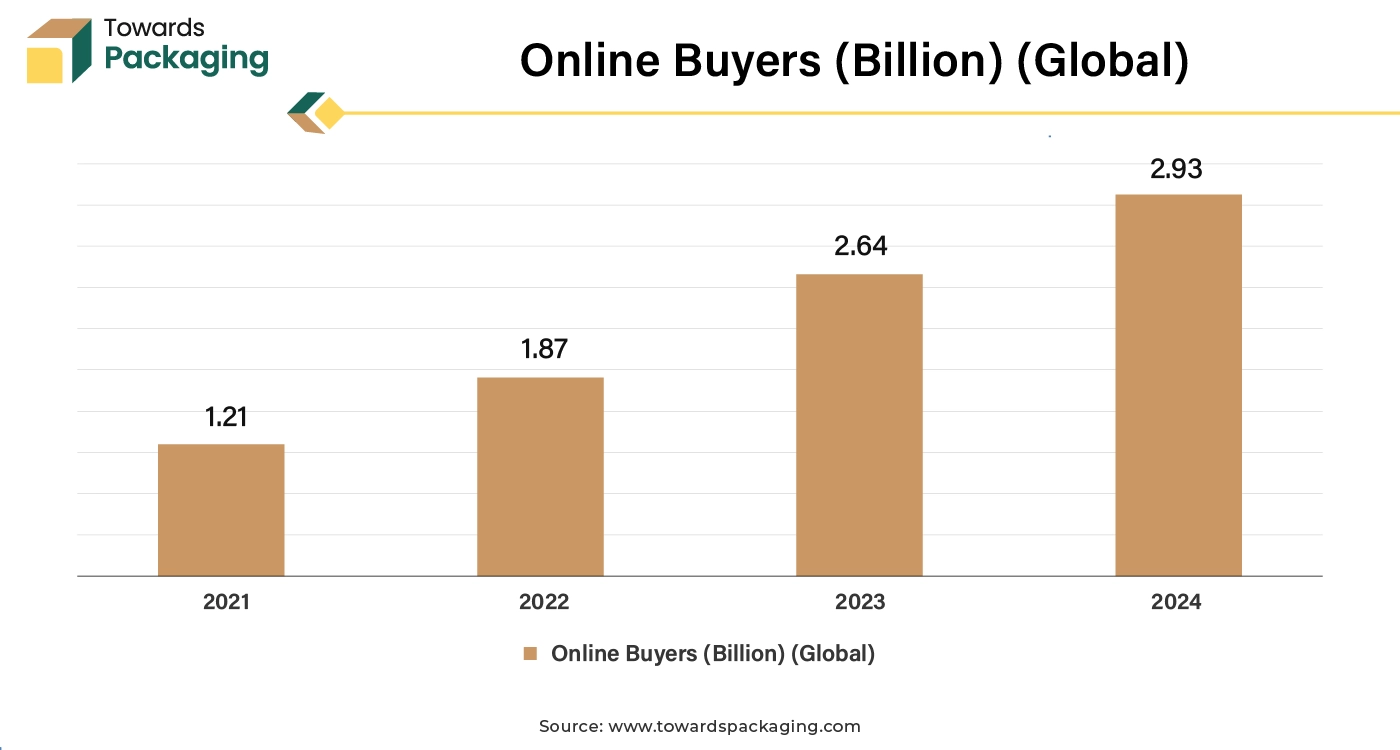

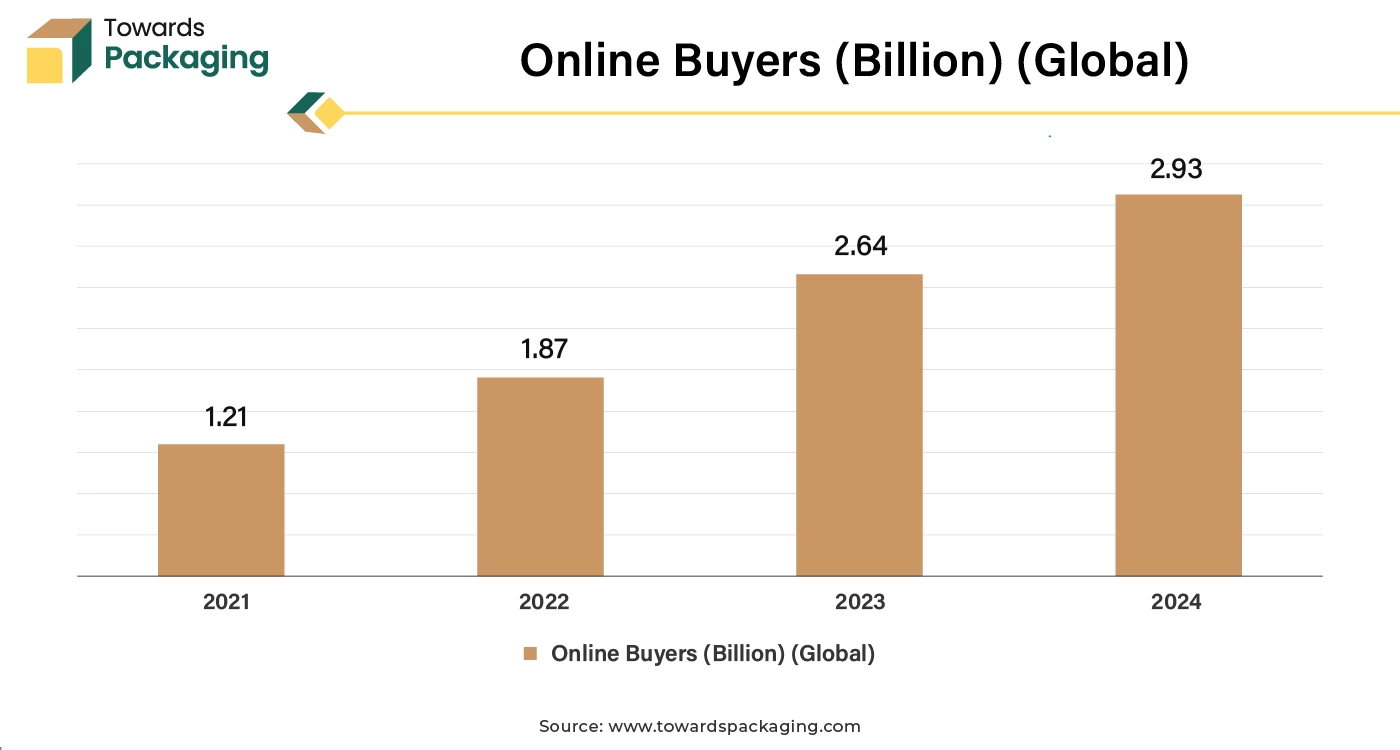

Increase in online shopping has increased the need for packaging that ensures product safety during transit while maintaining aesthetic appeal. Flexible and lightweight packaging, such as pouches, is gaining popularity. Online sales of nutraceutical products are growing, necessitating packaging that is durable for shipping and attractive to consumers browsing online platforms. This trend fuels innovation in lightweight, protective, and visually appealing packaging solutions.

The North American nutraceutical packaging market is registering a positive trend since there is an increasing measure of interest from consumers on how to stay on top of the health and well-being game and, consequently, the demand for nutraceutical products is mounting. Consequently, the market for such manufacturing is determined by the need for adept packaging techniques, which have been designed to uphold quality and efficacy of those goods.

The region is seeing a rise in the trend of preventive medicine practice, and customers are, now, interested in products that can keep their overall well-being intact or even can enhance their current health status. "Nutraceuticals" are foods, which are being taken as medicines so as to give more health benefits than just nutrition. Their popularity growth is a fuel for specialized packaging industry.

55% of Americans acknowledge the fact that they are habitual supplement takers. 72% of Americans and 83% of dietary supplement users say that they trust the dietary supplement business, a level of trust that has been either fairly equal or equally stable for the past few years. 92% of the remaining group agree if we say the role of dietary supplements are indispensable in ensuring their health status. This has now jump to 66% of supplement user are sure of the quality and safety of the sports nutrition supplement they are using, and up five percentage points significations increase. North American nutraceutical packaging market is about to experience an impressive rise, that is fueled by consumer expense increase, technology development and creation of laws.

North America dominated the nutraceutical packaging market in 2024. The segment growth in the region is attributed to the rising smart packaging technologies, including QR codes, increasing emphasis on sustainable packaging solutions, increasing convenient packaging. The U.S. and Canada re dominating countries driving the market growth, driven by increasing need for health and wellness products.

This supplement is designed for wellness and nutraceutical brands seeking scalable, sustainable and premium solutions.

European nutraceutical market is witnessing the growth which is attributed to specific factors within the region. The other noticeable trend is the preference of food and drinks as a functional supplement rather than taking pills. Probiotic yoghurt and probiotic squeezed juices are most popular among the European consumers. This preference determines the need for packaging designed for such specific formats that include convenience, freshness, and the integrity of the product.

The market for dietary elements containing vitamins and minerals which have been characterized for their great nutrients is steadily increasing. This demand is particularly persistent in the most important markets, like the United Kingdom, France, Germany and Italy. These countries are the most important markets for natural food supplements and plant-based products since the consumers are increasingly prioritizing their health and well-being.

The international nutraceutical industry and the infrastructure for imports which are already well-built are among the significant factors driving the expansion of the European nutraceutical packaging market. More and more consumers are looking for products that are not only nutritious but also contain beneficial health ingredients; thus, innovative packaging solutions become a dependable tool in catering for such ever changing needs.

One of the driving forces of nutraceutical packaging market in Europe is the growing demand for functional food goods in the region, increasing demand for specific ingredients, and the presence of highly developed and mature industry infrastructure supporting both import and export of nutraceutical products.

Europe is expected to grow fastest during the forecast period. The market is witnessing rapid growth due to the increasing sustainable packaging, rising health expenditure, strict regulatory requirements, increasing geriatric population and increasing consciousness related to health and wellness.

With revenues reaching €469 million, reflecting a 43% year-on-year growth as the CDMO continues to expand its capabilities and presence across Europe, this investment follows a record-breaking year for the company.

For Instance,

The growth of nutraceutical dietary supplements segment is rooted in multiple reasons. there is now an increasing knowledge in consumers, related to optimal health and well-being to which they pay more attention, and therefore the consumption of dietary supplements also grows. These dietary supplements, of which vitamins, minerals, herbal extracts, and other active ingredients are an integral part, are usually in different forms such as capsules, pills, soft gels, and powders.

The population in many regions is aging which will boost the demand for dietary supplements since seniors want to confront age-related issues and remain active. like hectic schedules, poor dietary habits, and stress, lifestyle factors are one of the most common reasons for people to turn towards dietary supplements as they often find dietary supplements as easier ways of meeting their nutritional needs. 35.9% of men under 40 use supplements, but that goes up to 67.3% over 60. 49% of women under 40 using supplements increases to 80.2% of women over 60.

Dietary supplements are consumed for a broad collection of reason from general health to sports nutrition, weight management, joint health or cognitive function. Each product application in particular needs the efficient packaging solutions to maintain the desirable integrity of the product, safety and efficacy.

The dietary supplements product segment is trending upward in the nutraceuticals packaging industry because of the changing consumer trend toward better health and the ever-growing applications of dietary supplements for the maintenance of general health as well as specific health requirements. Imaginative packaging options will be vital in serving this thriving segment of the market.

For Instance,

The plastic materials have a great significance in the nutraceutical packaging market as a result of the fact that they can be adapted, they are durable and they are cheaper. Regularly used plastics in nutraceuticals packaging include polyethylene terephthalate (PET), high-density polyethylene (HDPE), polypropylene (PP), and polystyrene (PS). PET is one of the most used for the manufacture of transparent bottles and container especially where the transparency, barrier properties to oxygen and moisture are required. The globe produces 141 million tonnes of packaging plastic. HDPE is preferred for its strength and chemical resistance and hence it is a suitable option for bottles and containers used for powders and liquids. The PP is characterized by its flexibility as well as heat resistance which are desirable features for its utilization in the manufacturing of blister packs and pouches. PS is frequently applied to packaging supplements as tray and clamshell designs.

The nutraceutical packaging market is on the upswing, along with the rising preference for food supplements worldwide. Factors including increased health consciousness, aging populace and lifestyle changes leading to the necessity of preventive healthcare are among other factors for this growth. the plastic packaging's convenience as well as affordability makes it an appealing choice for both manufacturers and consumers. There are environmental challenges associated with the increasing use of plastics as well. Therefore, green alternatives, such as biodegradable plastics and recycling strategies, have been gaining popularity among nutraceutical manufacturers.

For Instance,

The predominant packaging decision for nutraceuticals is a bottle because of its versatility and protective qualities. Suit well for drugs in the forms of liquids, capsules, tablets, soft gels, and gummies; they provide a strong, solid casing that protects the contents from any moisture, oxygen, pests, and physical damage. Plastic bottles are the most common type of plastic bottles in the market. PET, white or colored HDPE, and PP plastic are chosen owing to the durability and cost-effectiveness. Glass bottles have also increasingly become popular to meet consumer demand for products that are stylish and transparent and allow them to verify the quality of the drink.

The demand for the development of nutraceutical bottles is seeing a stable growth, with the consumption of plastic bottles expected to reach approximately half a trillion every year as early as 2022. This exponential rise is triggered by the escalating worldwide demand for nutraceuticals which is a result of the growing health consciousness, the fact the populations are aging and the fact that preventive care is the in-trend nowadays. The choice of bottles is due to their adaptability and availability of them, they, in turn, are main factors of the market growth. The advancements in product design and material that emerged in order to meet the ever-evolving consumer trends are certain to contribute to the development of the bottling market over the following years.

For Instance,

The nutraceutical packaging market is witnessing a strong growth due to two diversified channels of distribution, offline and online. Through the offline distribution channels, including retail stores, pharmacies, drugstores, health and wellness centres and direct sales, there is a bulk demand for nutraceuticals ’packaging. They satisfy different consumer needs, being at the disposal of customers in terms of nutraceutical products from all segments of the market.

The role of nutraceutical packaging is a key element in which products are kept safe during the process of transportation and are beautifully displayed in the outlets. Packaging design is the emphasis on safe product transportation, packaging aesthetics, and regulatory policies which are the mandatory guidelines for all retailers. Packaging materials is chosen to ensure quality, freshness, and shelf progression of the item during the shipping process.

The nutraceutical packaging market is growing at a higher rate as manufacturers and suppliers are understanding the package as the first attracting system, assurance of consumers products safety, and to maintain an advantageous position in the fast-changing environment of health and wellness products.

For Instance,

The competitive landscape of the nutraceutical packaging market is dominated by established industry giants such as American Nutritional Corporation, Arizona Nutritional Supplements LLC, Comar, Flex-pack, CSB Nutrition Corporation, ALPLA Werke Alwin Lehner GmbH & Co KG, Graham packaging company, Law Print & Packaging Management Ltd., Medifilm AG, Moluded Packaging Solutions Limited, Nestlé Health Science, Nutra Solutions USA, Orgin Pharma Packaging, PontEurope, Wasdell Packaging Group, as Glanbia, Plc, Abbott Laboratories, Amway, Bayer AG, Vantage Nutrition, Alpha Packaging, Container & Packaging Supply Inc.. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

American Nutritional Corporation Ltd. specializes on supplying vendor appropriate solutions customized to the client, putting emphasis on high quality and novel e-marketing concepts necessary for customers with their nutraceutical products.

For Instance,

The utilized sustainable packaging solutions, adopted environmentally tackling material and practice measures, by Arizona Nutritional Supplements LLC LLC do not only address their nutraceutical packaging needs but also reduce environmental impact.

For Instance,

Comar stands out for its high-end, comprehensive packaging solutions in the nutraceutical niche, which include a broad selection of materials (such as bottles, tubs, caps, and closures), as well as an array of fully customizable design services.

For Instance,

Flex-pack employs latest tech and flexible package industry to cope up with the fast-changing dynamics of the nutraceutical market, thereby catering to the need of clients who are looking to get an improved efficiency and reduced cost of packaging solutions that also bring for the products more visibility and shelf attractiveness.

For Instance,

According to Sara Lesina, General Manager, SIRIO Europe & Americas, Sirio Pharma company’s teams bring incredible experience, spanning over 30 years, and by completing everything from R&D to final packaging on a single site, the company offer significant advantages to our customers, who benefit from pharma-grade quality at every phase of production of even nutraceuticals.

Nutraceutical packaging leading market players are ALPLA Werke Alwin Lehner GmbH & Co KG, American Nutritional Corporation, Arizona Nutritional Supplements LLC, Comar, CSB Nutrition Corporation, Flex-pack, Graham packaging company, Law Print & Packaging Management Ltd., Medifilm AG, Moluded Packaging Solutions Limited, Nestlé Health Science, Nutra Solutions USA, Orgin Pharma Packaging, PontEurope, Wasdell Packaging Group, as Glanbia, Plc, Abbott Laboratories, Amway, Bayer AG, Vantage Nutrition, Alpha Packaging, Container & Packaging Supply Inc.

By Products

By Material

By Packaging

By Distribution Channel

By Region

March 2026

March 2026

February 2026

February 2026