April 2025

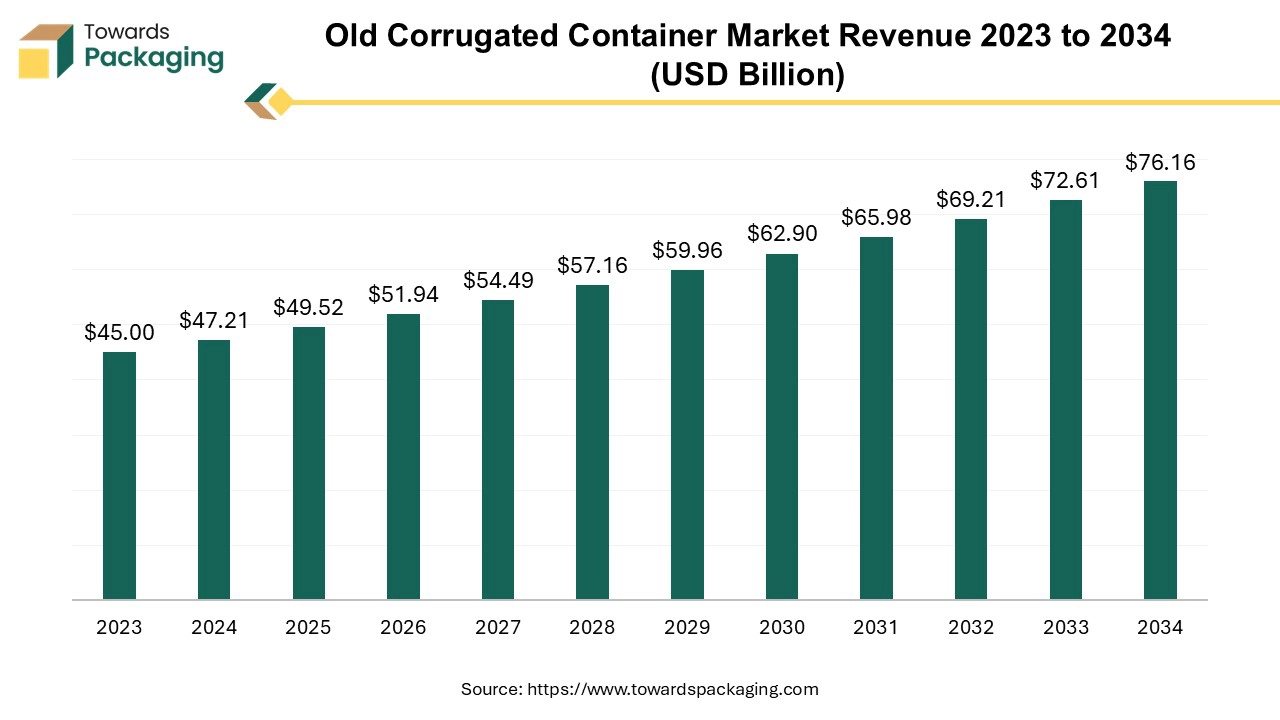

The global old corrugated container market size to hit USD 76.16 billion by 2034, growing from USD 47.21 billion in 2024, expanding at 4.9% CAGR from 2025 to 2034. The demand for old corrugated container market is growing because of its wide application in the rapidly rising food and beverage industry.

Unlock Infinite Advantages: Subscribe to Annual Membership

Growing environmental concerns and regulations are rising the demand for recycled materials, including old corrugated container, which is estimated to drive the global old corrugated container market over the forecast period.

Corrugated cardboard is strong, affordable, and manageable, it is a necessary component of packing and shipping in all industries. The old corrugated container refers to utilized cardboard boxes and packaging materials made from corrugated fiberboard. Due to its abundance of wood pulp fiber and ease of processing into new forms, it is also one of the most valuable commodities for the recycling sector.

Manufacturers, retailers, and logistics service providers save money on packing and shipping. It assists offices and companies in generating extra revenue by gathering and selling OCC to recycling facilities. Old Corrugated Container can be crushed and used as a packing or cushioning material, or it can be recycled into new paper, fiber, and packaging materials. The technique is quite straightforward as long as it is clean, dry, and devoid of pollutants like food, oil, wax coatings, and strong adhesives. The packaging industry size is estimated to grow from USD 1.20 trillion in 2022 to reach an estimated USD 1.58 trillion by 2032, growing at a 3.16% CAGR between 2023 and 2032.

Artificial intelligence (AI) systems that can differentiate between different types of paper and pollutants can increase the efficiency of OCC sorting. This expedites processing and improves the quality of the recycled material. AI can forecast maintenance requirements and equipment breakdowns in recycling operations, cutting downtime and increasing overall operational effectiveness. Artificial intelligence (AI) can evaluate data to estimate demand, manage inventories, and optimize transportation, which will improve old corrugated container collection and distribution. By keeping an eye on and guaranteeing the quality of recycled goods, machine learning algorithms can cut waste and maintain high standards.

AI-powered automation has the potential to increase productivity overall, save labor expenses, and expedite the recycling process. AI can help with strategic planning and product development by analyzing customer behaviour and trends to better understand and forecast the market for items made from recycled paper. The old corrugated container sector may improve its overall efficacy, efficiency, and sustainability by incorporating AI technologies.

Machine learning and AI-driven picture recognition systems can accurately detect AI analytics can offer insightful data on customer behaviour, market trends, and operational performance, assisting businesses in formulating wise strategic plans. Artificial intelligence (AI) systems are able to evaluate market data and client feedback in order to customize services, increase customer pleasure, and build stronger bonds and loyalty. The old corrugated container sector may progress recycling and trash management by integrating AI to increase efficiency, sustainability, and profitability.

Increasing environmental awareness and stricter regulations are encouraging higher recycling rates for old corrugated container, promoting its recycling and reducing waste. With rising emphasis on sustainability, businesses and consumers are opting for eco-friendly packaging solutions, fueling the demand for recycled corrugated materials. The key players operating in the market are focused on carrying out funding and investing activities for development of the old corrugated container which is estimated to drive the growth of the old corrugated container market over the forecast period.

The key players operating in the market are facing problem due to fluctuation in the prices of recycled paper, raw materials and quality issues which is estimated to restrict the growth of the old corrugated container market in the near future. Contaminants and low-quality old corrugated container can complicate the recycling process, reducing the efficiency and profitability of recycling operations. Economic slowdowns can reduce demand for packaging materials and recycling services, impacting the overall old corrugated container market. Fluctuations in the prices of recycled paper and raw materials can affect the stability and attractiveness of the old corrugated container market. Inadequate or outdated recycling facilities and technologies can hinder the effective processing and utilization of old corrugated container.

Growing corporate and consumer focus on sustainability and eco-friendly practices can drive increased use and recycling of old corrugated Container. Rapidly developing regions with increasing industrialization and urbanization present new opportunities for old corrugated container collection and recycling. Exploring new applications and uses for recycled old corrugated container, such as in construction materials or sustainable consumer products, can open additional revenue streams. The key players operating in the market are focused on adopting inorganic growth strategies such as Collaboration and partnership to develop and design new product application out of old corrugated container, which is estimated to create lucrative opportunity for the growth of the old corrugated container market over the forecast period.

The OCC 12 segment held the dominating share of the old corrugated container market in 2023. OCC 12 cardboard is made from recycled materials, reducing the need for virgin paper and decreasing deforestation, energy consumption, and greenhouse gas emissions. Corrugated cardboard, including OCC 12, is known for its strength and durability, making it suitable for packaging and shipping a wide range of products. OCC 12 cardboard can be easily customized for various packaging needs, including different sizes, shapes, and print designs. Companies and consumers are increasingly prioritizing sustainable and eco-friendly packaging solutions, which drives demand for recycled materials like OCC 12. The surge in online shopping increases the need for corrugated cardboard for packaging and shipping, driving higher demand for recycled OCC.

OCC 11 segment is estimated to grow at fastest rate over the forecast period. Corrugated containers are defined by industries (Grade 11 OCC) These are corrugated papers with kraft, jute, or test liner liners. The following traits are demonstrated in this type of work. It's a cost-effective choice for packaging and shipping because it's frequently less expensive than brand-new cardboard. Since OCC 11 is made of recycled material, less virgin paper is used, saving resources and lessening the impact on the environment. Given that OCC 11 is made to withstand significant weight and strain, it keeps its good strength and durability during handling, packing, and shipment.

OCC 11 is even ideal for a wide range of applications including boxes, packaging materials, and protective cushioning. It's highly recyclable, which supports sustainable waste management practices. Rising sale of the Fast-Moving Consumer Goods (FMCG) has increased the demand for the OCC 11 cardboard which is estimated to drive the growth of the segment over the forecast period.

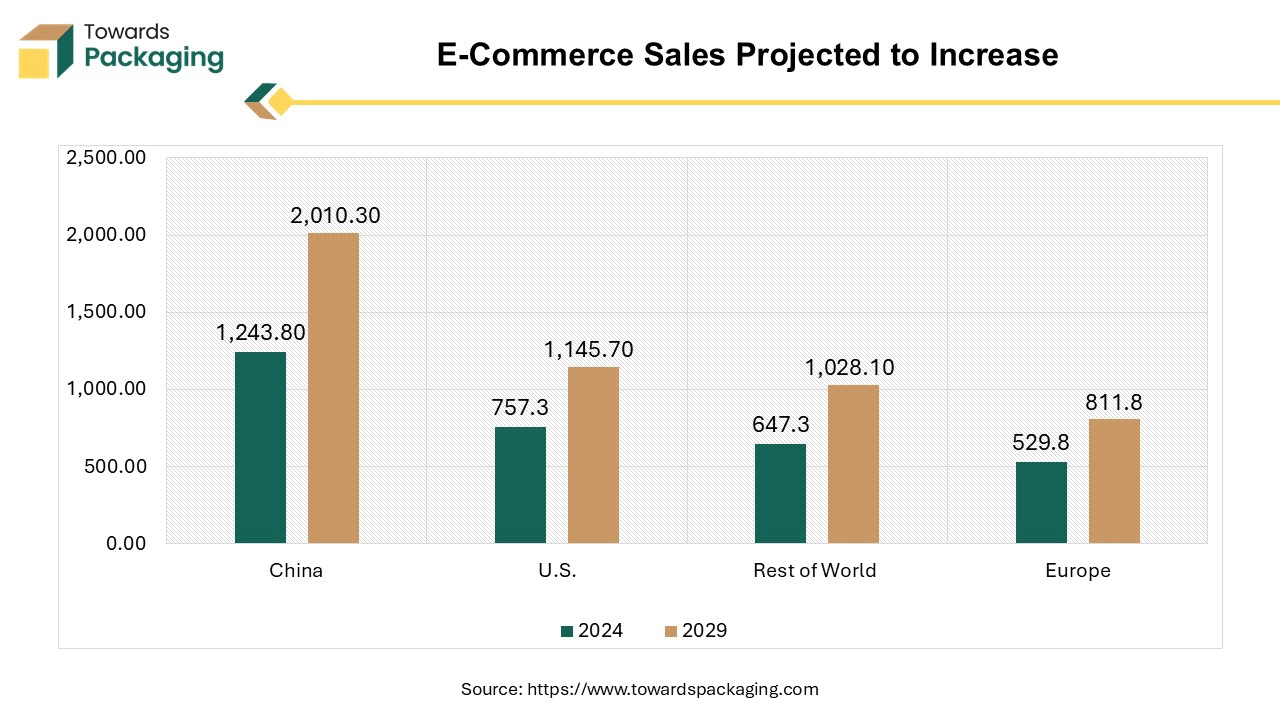

The increasing popularity of e-commerce has led to an increased need for packaging that guarantees safe delivery of goods to consumers. Durability and protection during transit are provided by old corrugated boxes. Since old corrugated boxes are comprised of recyclable materials, they support the retail industry's efforts to use less plastic and adopt more environmentally friendly practices. Old Corrugated containers are used by retailers as a branding tool. These boxes might have unique patterns and designs that improve brand awareness and offer a more tailored shopping experience. Though old corrugated boxes are made to withstand shocks and avoid damage, product quality must be maintained during handling and shipping. In comparison to other packaging materials, they provide an economical solution that strikes a balance between affordability and durability. The increased use of old corrugated boxes in retail is a result of these considerations.

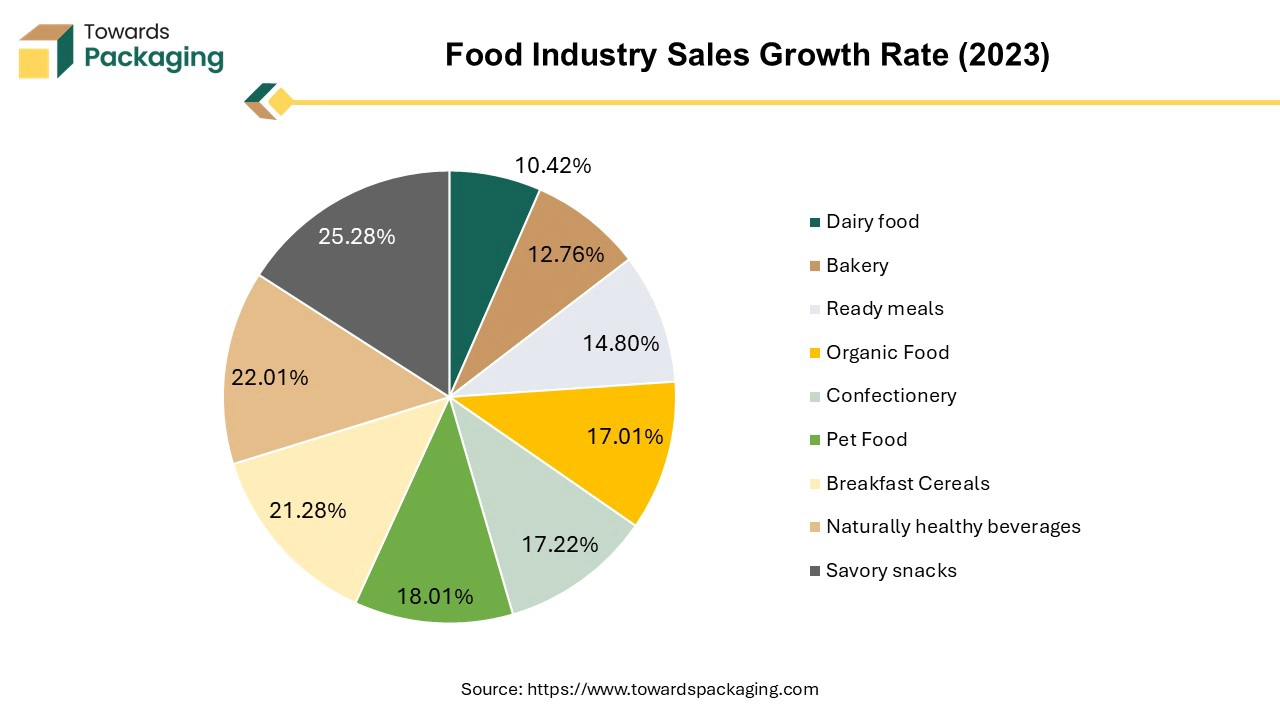

The food & beverages segment held the dominating share of the old corrugated container market in 2023. The food & beverages industry has expanded over few years due to rising population, a rapidly growing middle class, and developing suburban and urban markets. There is a growing trend among consumers to seek for natural, sustainable, and healthier solutions. This covers gluten-free goods as well as organic, non-GMO, and functional foods. The desire for quick, ready-to-eat meals, snacks, and drinks is also fueled by busy lives.

Product quality and efficiency have increased as a result of advancements in food processing, packaging, and distribution. For instance, businesses can now make synthetic meats out of proteins and add chemicals to prolong their shelf life. Growing urbanization, increasing affluence, and increased knowledge of healthy eating are some of the other factors fueling the food & beverage industry's expansion.

Increase in the launch of the food brands has risen the demand for the old corrugated containers for packaging as well as storing purpose, which is estimated to drive the growth of the segment over the forecast period.

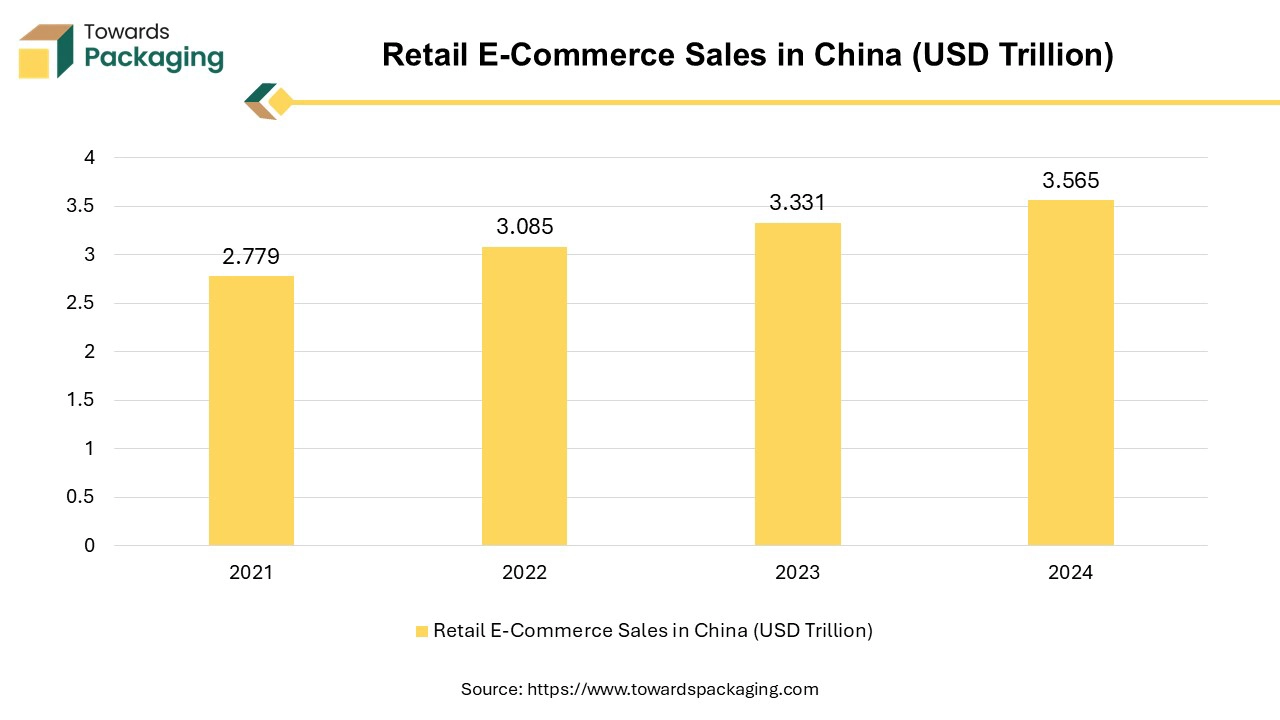

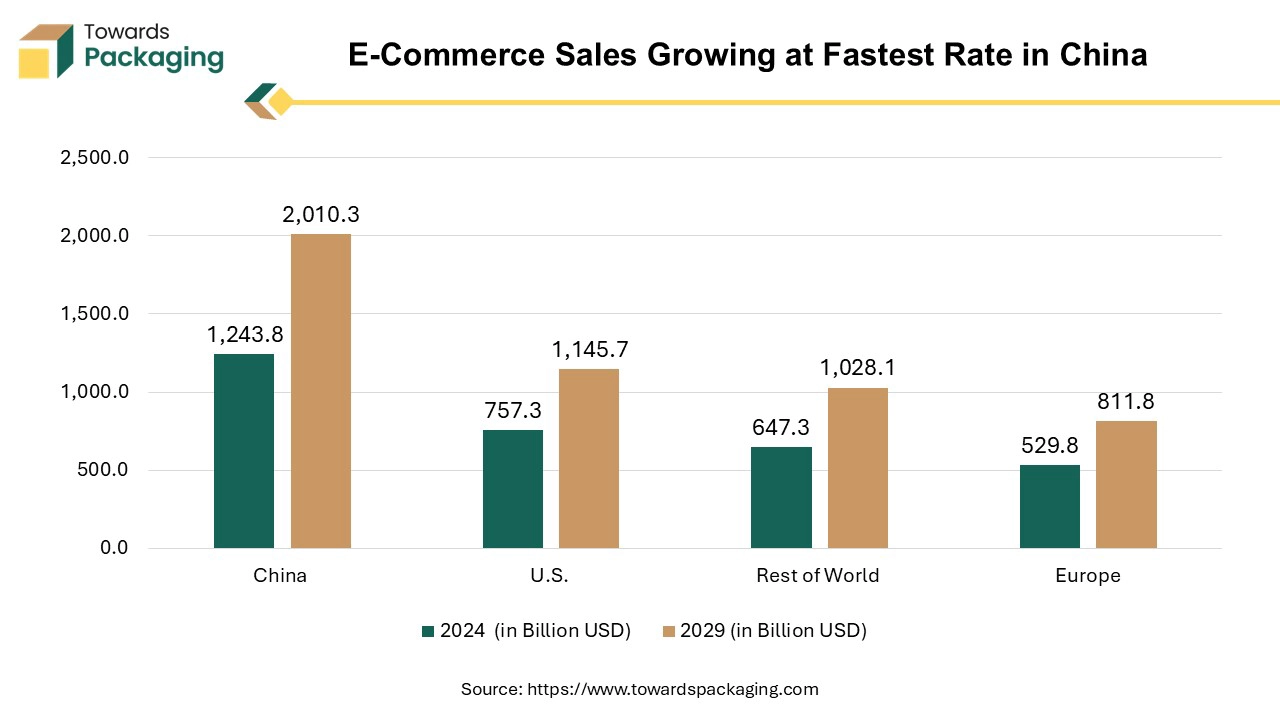

Asia Pacific held the largest share of the old corrugated container market in 2023. The swift growth of online shopping has resulted in an increased need for packing materials such as corrugated boxes. Online shopping is increasing the requirement for packaging, which means that used corrugated boxes need to be recycled. The need for old corrugated container is rising as companies seeking to cut expenses are resorting to recycled materials. The demand for old corrugated container is increased as more businesses implement recycling programs and strive to employ recycled materials. Reclaimed corrugated cardboard frequently costs less than newly made paperboard.

U.S. and Canada are the main countries in North America region. In U.S., there is a rising demand for sustainable packaging solutions that reduce usage of non-biodegradable materials. Consumers are increasingly checking and utilizing food packaging which is sustainable. Many efforts and initiatives are being taken by the U.S. Government and other agencies for minimizing the carbon footprint.

In Canada, there is an increased attention on recycling and sustainable packaging solutions which has increased the demand for old corrugated containers. As environmental concerns gain more and more traction, this country’s anticipated to witness a boost in demand for OCC packaging solutions. Rising awareness amongst consumers, government and other agencies are focusing on packaging solutions for industries like food and beverage to utilize recyclable or sustainable materials.

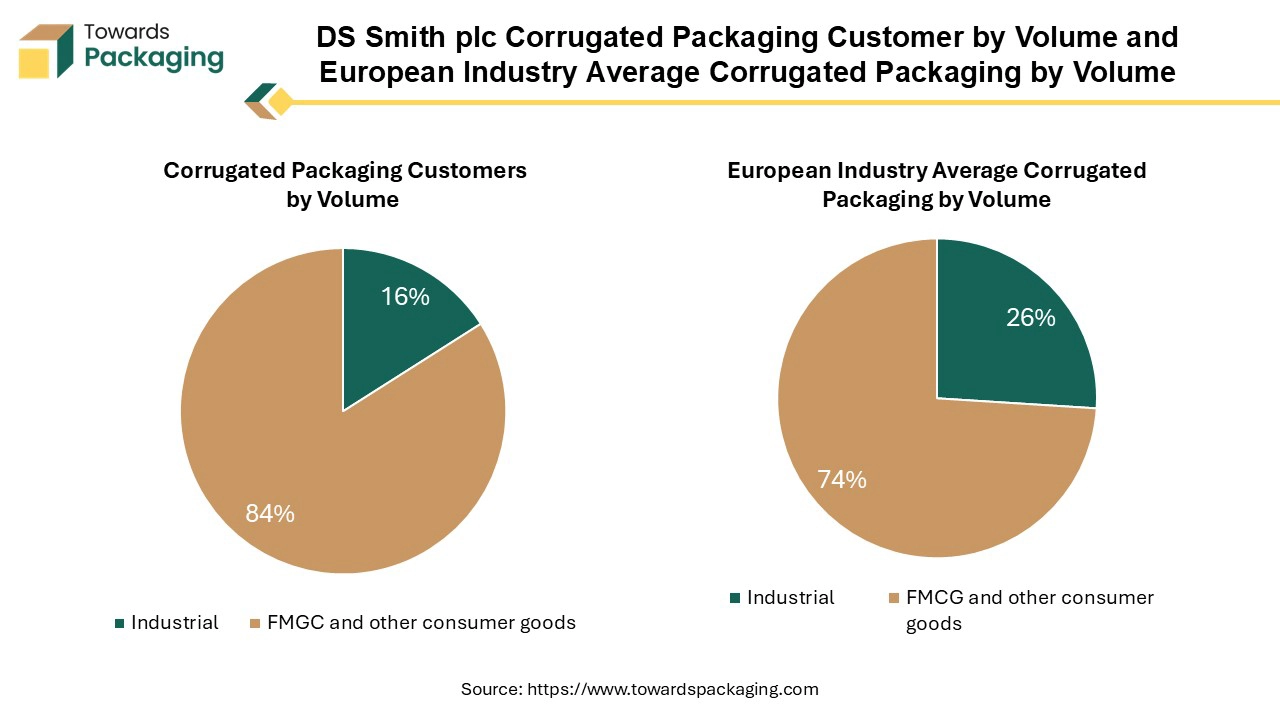

Europe is estimated to grow notably in the upcoming period. The key players operating in the Europe are focused developing and launching old corrugated container designing machines to meet the rising demand of the consumers, which is estimated to drive the growth of the old corrugated container market in Europe over the forecast period. In European region, countries like United Kingdom and Germany are expected to lead the growth of old corrugated container market. These countries are adopting sustainable practices on a wider scale, especially many initiatives taken by Germany’s government towards recyclability of food packaging.

By Grade

By Source

By End-use

By Region

April 2025

March 2025

March 2025

March 2025