April 2025

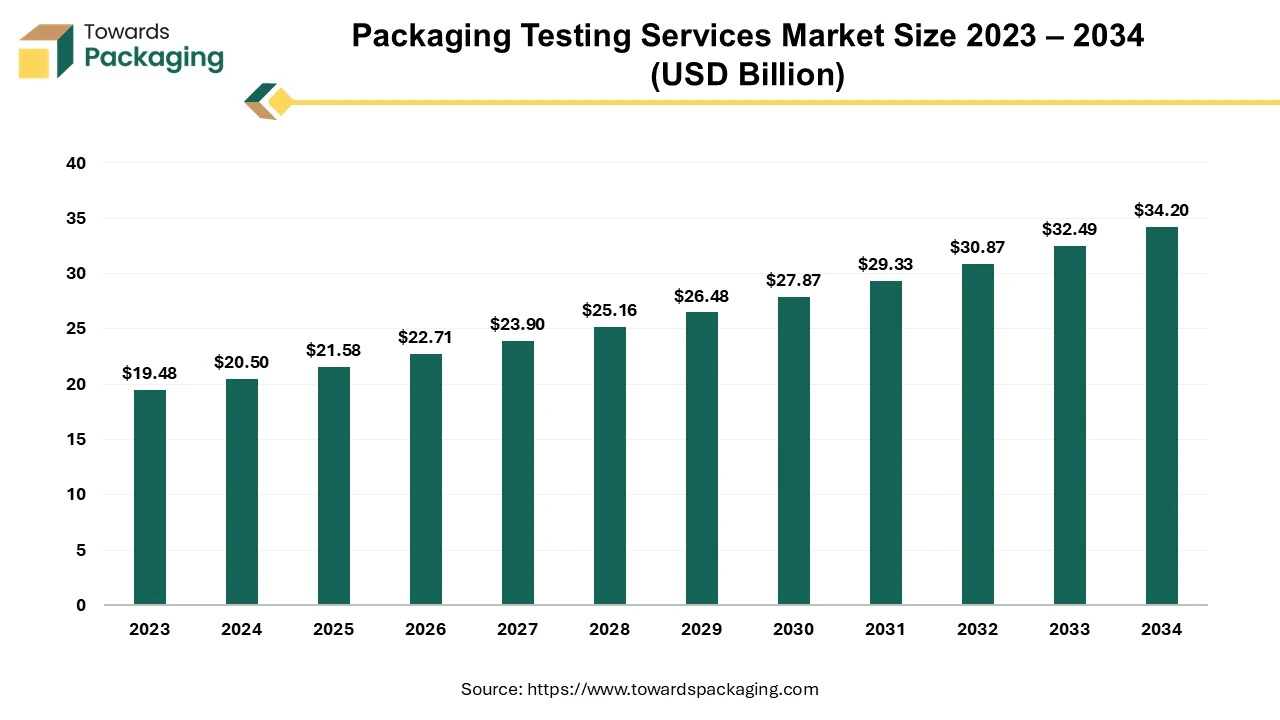

The global packaging testing services market reached $20.50 billion in 2024 and is expected to grow to $34.20 billion by 2034, expanding at a CAGR of 5.25% from 2025 to 2034. Driven by increasing demand for quality assurance and sustainable packaging,

Unlock Infinite Advantages: Subscribe to Annual Membership

Packaging testing services refer to the evaluation processes used to determine the durability, performance, and safety of packaging materials and systems. These services ensure that packaging meets industry standards, regulatory requirements, and customer expectations. They help identify potential weaknesses or failures in packaging, ensuring that products are protected during storage, transportation, and handling.

The key aspects of packaging testing services are durability testing services, safety testing services, compliance testing services, functionality testing, and sustainability testing. Assessing the strength and resilience of packaging under different conditions, such as pressure, weight, and environmental factors. The packaging testing services ensures that packaging materials do not pose health risks, particularly for food, pharmaceuticals, and other sensitive products.

Rising demand for sustainable packaging materials that are recyclable, biodegradable, or manufacture from renewable resources. Regulatory pressure and consumer awareness of environmental issues are driving companies to adopt eco-friendly packaging, necessitating rigorous testing to ensure performance and compliance.

The rapid growth of e-commerce requires packaging that can withstand shipping and handling stresses. The requirement for robust, protective packaging solutions that ensure product integrity during transportation is fueling demand for packaging testing services.

Stricter global regulations on packaging, especially for food, pharmaceuticals, and hazardous materials. Companies must ensure their packaging complies with regulatory standards, increasing the need for comprehensive testing services.

Development of new materials, such as smart packaging, bio-based plastics, and lightweight composites. These innovations require extensive testing to verify their effectiveness, durability, and safety, driving demand for specialized testing services.

Heightened consumer awareness and demand for safe, high-quality products with secure packaging. This drives manufacturers to invest in rigorous packaging testing to ensure products are safe and meet consumer expectations.

Post-pandemic focus on health, hygiene, and safety in packaging, particularly for food and medical supplies. Ensuring packaging meets hygiene and safety standards has become a critical factor, leading to increased testing for contamination resistance and sterility.

AI integration can significantly enhance the packaging testing services industry by providing automated testing and quality control, personalization, efficiency, sustainability and material optimization. AI can analyze images and videos of packaging to detect defects such as tears, misprints, or inconsistencies with higher accuracy and speed than manual inspection.

AI ensures consistent application of testing protocols, reducing human error and variability in results. AI algorithms can predict potential points of failure in packaging materials or design by analyzing historical data, allowing proactive improvements. AI can predict when testing equipment might require maintenance, minimizing downtime and improving efficiency. AI can process large volumes of data from testing processes in real time, providing instant feedback and insights.

AI can assess the environmental impact of packaging throughout its lifecycle, helping companies make eco-friendlier choices. AI-driven testing ensures higher quality and safer packaging, enhancing customer satisfaction. AI enables quicker turnaround for testing results, allowing companies to respond swiftly to market demands or issues. By integrating AI, the packaging testing services industry can achieve greater accuracy, efficiency, and innovation, ultimately delivering better outcomes for manufacturers and consumers alike.

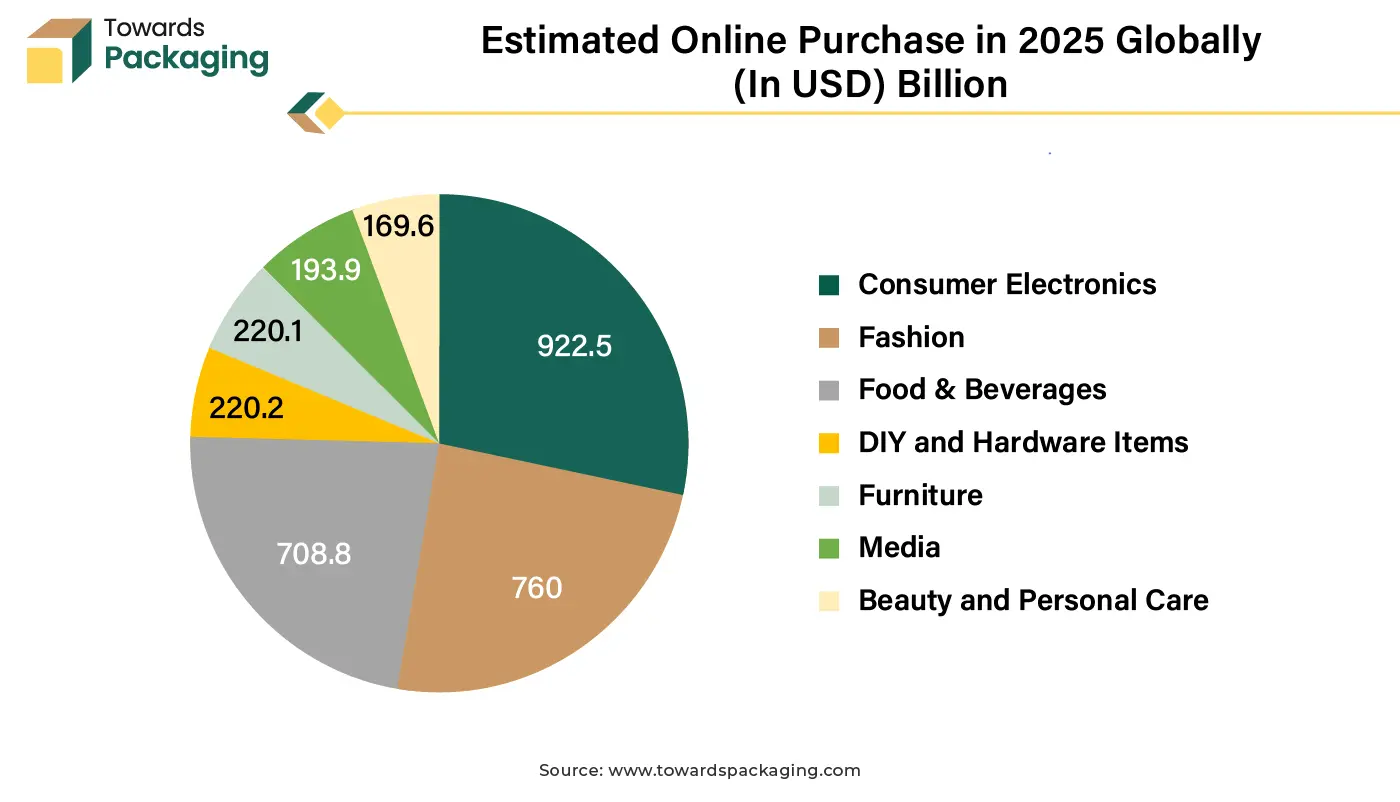

The rapid expansion of e-commerce has led to a surge in demand for packaging that can withstand the rigors of shipping, prompting increased testing for durability and performance. Sectors like food & beverages, cosmetics, pharmaceuticals, and personal care are gaining attention on online platform are experiencing growth, leading to increased demand for specialized packaging testing services to cater to their unique requirements. E-commerce involves shipping products directly to consumers, often over long distances and through multiple handling points. This increases the demand for packaging that can withstand various stresses such as compression, impacts, and environmental conditions, necessitating thorough testing.

E-commerce platforms sell a wide variety of products, from fragile items like electronics and glassware to perishable goods. Each product type requires specific packaging solutions, driving the need for customized packaging testing services. Many e-commerce products, especially in sectors like cosmetics, food, and pharmaceuticals, must comply with regulatory standards for packaging. This drives demand for packaging testing to ensure compliance and avoid legal issues.

E-commerce companies face pressure to utilize sustainable packaging solutions. Testing services help assess the environmental impact and performance of eco-friendly materials, supporting the shift towards sustainable packaging practices. E-commerce businesses often explore innovative and customized packaging solutions to enhance customer experience and branding. Testing services are crucial to ensure these innovative designs are practical and durable.

The key players operating in the are facing issue due to material shortages or logistics challenges and competition from in-house testing, which can restrict the growth of the packaging testing services market in the near future. The cost of advanced testing equipment and technology can be prohibitive for small and medium-sized enterprises, limiting their ability to adopt these services. Economic downturns can reduce consumer spending and demand for packaged goods, indirectly impacting the demand for packaging testing services.

Increasing environmental regulations and the push for sustainable packaging can require significant changes in testing protocols, which may be costly and time-consuming. Some large companies may prefer to develop in-house testing capabilities rather than outsourcing, reducing the demand for external testing services.

Rising industrialization, growing disposable incomes, and increased consumer awareness in emerging markets create a demand for quality packaging, boosting the need for testing services. With stricter regulations on packaging safety, particularly in industries like food, pharmaceuticals, and cosmetics, companies are increasingly relying on testing services to ensure compliance.

For a long time, the federal government has controlled consumer goods' ingredients and packaging to reduce the possibility of health risks associated with their usage. In the past, this was accomplished by directly banning the use of specific chemicals and materials that had a clearly detrimental impact on a given product. Many governments have recently focused on the alleged harm to the environment caused by high turnover consumption habits and the trash that results from an increasing number of worldwide consumers. The trend to watch for 2024 is initiatives to regulate completed consumer goods and their packaging through an environmental protection lens.

By creating and designating broad categories of substances like "plastic manufactured items" (PM) and "per- and polyfluoroalkyl substances*" (PFAS) as substances to be added to the List Bill S-5, Strengthening Environmental Protection for a Healthier Canada Act, the federal government has changed its approach to the List of Toxic Substances in 2023 years. The List was repealed and replaced with a new Schedule I to CPA.

The federal and provincial governments took action to establish a Canadian right to repair in the fall of 2023. According to federal bills C-244 and C-59, the Competition Act will be amended to allow the Competition Tribunal to require suppliers to provide "means of diagnosis and repair for their products, respectively," and the Copyright Act will be amended to permit the circumvention of technological protective mechanisms for the diagnosis, maintenance, and repair of software-driven electronic products. Information, technological upgrades, diagnostic tools or software, any associated paperwork, and service components are all included in a "means of diagnosis and repair.

The physical segment held a dominant presence in the packaging services market in 2024. Physical testing methods, such as compression, drop, vibration, and tensile tests, help evaluate the strength and durability of packaging materials to ensure they can withstand the stresses of handling, storage, and transportation. Physical testing is often required to meet regulatory and industry standards, ensuring that packaging complies with safety, performance, and quality guidelines. Physical testing methods are generally cost-effective and can be performed relatively quickly, making them a practical choice for routine quality control and assurance processes.

Physical tests provide tangible data and insights into the packaging's performance, helping companies maintain consistent quality and reliability in their packaging solutions. Physical testing methods can be easily customized to simulate various environmental and handling conditions, making them versatile for different types of packaging and industries. By subjecting packaging to physical stress, potential weaknesses or design flaws can be identified and rectified before the product reaches the market.

The plastics segment accounted for a significant share of the packaging testing services market in 2024. Plastics are utilized extensively across various industries, including pharmaceuticals, food, beverages, and consumer goods. Each application has specific requirements, making testing essential to ensure suitability. Plastics must meet regulatory standards for safety, especially in food and pharmaceutical packaging, to prevent contamination and ensure consumer safety. Plastics are often utilized for their barrier properties against moisture, gases, and contaminants. Testing ensures these properties are adequate for preserving product quality and shelf life.

Plastic packaging is exposed to various environmental conditions like humidity, temperature, and UV light. Testing evaluates how these factors affect the material's performance over time. Plastic is often chosen for its cost-effectiveness, and testing ensures that the packaging provides value without compromising quality or safety. Many companies are looking to reduce the weight of their packaging to lower costs and environmental impact. Testing ensures that lightweight plastics still meet performance and safety standards.

The glass segment is expected to grow at the fastest rate in the packaging testing services market during the forecast period of 2024 to 2034. Glass is inherently fragile and prone to breaking or cracking. Testing ensures that the packaging can withstand various stresses during handling, transportation, and storage. Glass containers are often used for food, beverages, pharmaceuticals, and cosmetics, where maintaining the integrity of the product is crucial. Testing ensures that the packaging preserves the product's quality, prevents contamination, and maintains shelf life.

Glass containers need to endure various conditions during transportation, such as vibrations, impacts, and stacking pressures. Packaging testing simulates these conditions to ensure the containers remain intact. High-quality, durable packaging enhances customer satisfaction by ensuring that products reach consumers in perfect condition. This reduces the risk of returns and complaints. Overall, packaging testing services are essential for ensuring that glass containers meet the necessary durability, safety, and performance standards.

The food & beverages segment registered its dominance over the global packaging testing services market in 2024. As the food and beverages industry grows, there is a higher demand for safe and reliable packaging to ensure the quality, safety, and shelf-life of products. Packaging testing services help verify that materials and designs meet safety standards. Food and beverage products are subject to strict regulations to ensure consumer safety. Packaging testing is essential to comply with these regulations, ensuring that materials do not contaminate the product and meet specific safety criteria.

The food and beverages industry continuously seeks innovative packaging solutions to enhance product appeal and functionality. New materials and designs require rigorous testing to ensure they perform as intended. There is an increasing emphasis on sustainable and eco-friendly packaging. Testing services ensure that these new, often biodegradable or recyclable materials, maintain product integrity and comply with environmental regulations. With growing awareness of health and safety, consumers demand high-quality, safe packaging. Food companies rely on testing services to meet these expectations and maintain food brand trust.

North America region dominated the global packaging testing services market in 2024. Strict guidelines for pharmaceutical packaging set out by the USA Food and Drug Administration in CFR Title 21 stress the significance of guaranteeing product efficacy, quality, and standard compliance. High requirements for packing materials and procedures are required by these stringent laws in order to guarantee that there is no contamination during the handling, storage, and transportation of the items following manufacturing.

Pharmaceutical companies therefore like having physical, chemical, and microbiological testing services validate these drug packaging methods. This is due to the fact that these testing services assist in ensuring that the packaging solution is free of defects and that it is compatible with all drug formulations while also shielding them from microbiological risks.

The Federal Trade Commission (FTC) intends to publish its revised Green Guides, 16 CFR US$260, which provide guidance to businesses on how to make environmental marketing claims about their goods. Although businesses are not required to follow the Green Guides, the Federal Trade Commission (FTC) may use them as a guide when executing its general enforcement authority.

The United States will implement new pharmaceutical packaging laws in 2024, which will include new requirements for elastomeric materials and metallic packaging. Additionally, Maine and Oregon have passed new Extended Producer Responsibility (EPR) legislation.

Asia Pacific region is anticipated to grow at the fastest rate in the packaging testing services market during the forecast period. As governments in the Asia-Pacific region implement stricter regulations on packaging, especially for food, pharmaceuticals, and hazardous materials, there is a greater need for testing services to ensure compliance with these standards. The Asia-Pacific region is a significant hub for exports. To meet international standards and avoid product recalls, exporters invest in packaging testing services to ensure their products are safely transported and delivered. The rapid expansion of e-commerce in the Asia-Pacific region has led to increased demand for secure and efficient packaging solutions, further driving the need for comprehensive testing services to prevent damage during shipping.

In order to create and introduce ProActive Intelligence Moisture Protect (MP. 1000), Aptar CSP Technologies, a division of AptarGroup, Inc. and a pioneer in active material science, partnered with ProAmpac, a pioneer in material science and flexible packaging. Aptar CSP's unique 3-Phase Activ-Polymer technology and ProAmpac's flexible blown film technology are combined in this next-generation platform technology to create a patent-pending moisture-adsorbing flexible packaging solution.

By Testing Type

By Material

By End User

By Region

April 2025

April 2025

April 2025

April 2025