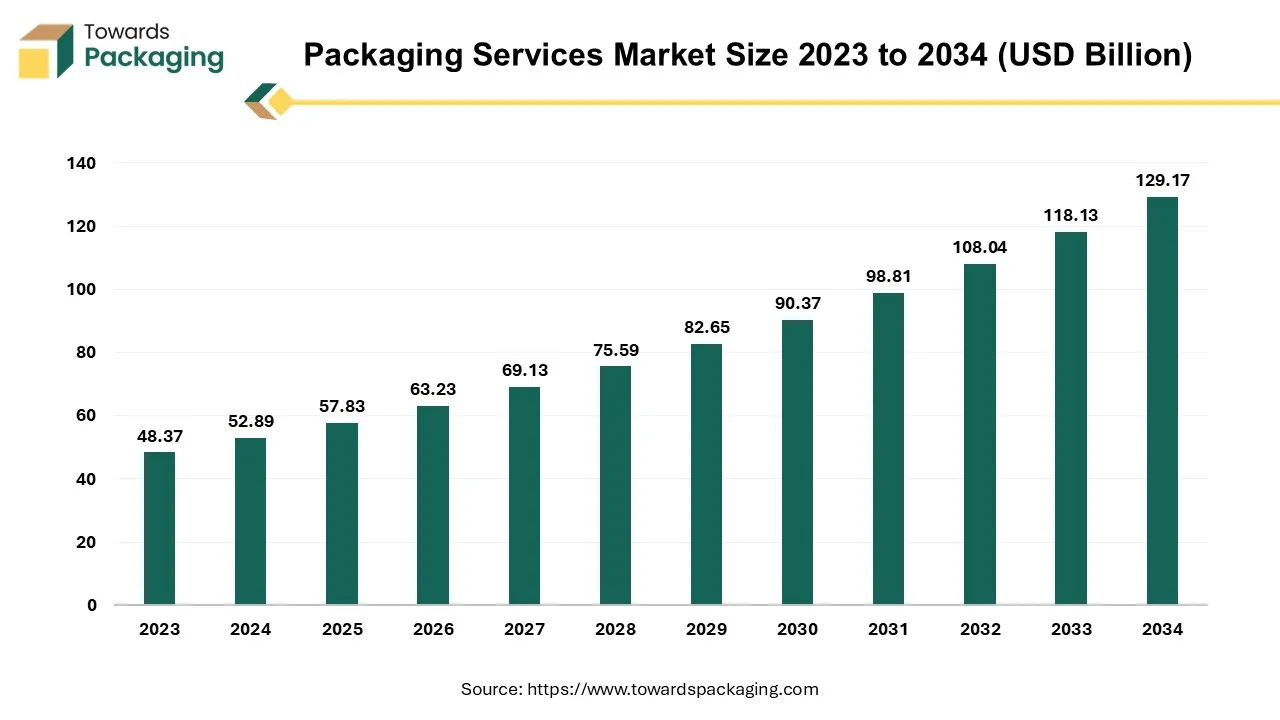

The packaging services market is forecasted to expand from USD 63.23 billion in 2026 to USD 141.24 billion by 2035, growing at a CAGR of 9.34% from 2026 to 2035. The report provides a full breakdown by packaging type (plastic, paper & paperboard, metal, glass, others), service (designing, manufacturing, consulting, compliance, others), and end-use (food & beverage, retail, healthcare, consumer products, industrial applications).

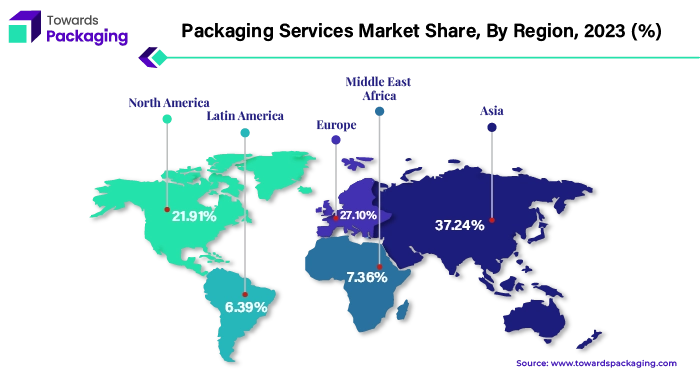

Regional analysis highlights Asia Pacific leading with 37.24% share in 2023, followed by strong growth in North America (CAGR 8.04%). Competitive insights feature major players such as SGS North America, Intertek Group, DHL Group, and Berry Global, with detailed value chain and trade data analysis across the global packaging ecosystem.

Packaging services support companies with designing, manufacturing, testing, compliance and other support as well. Innovation, sustainability, design and regulations are all constantly evolving in the packaging market. These services assist in monitoring the new and updated laws, inventions as well as other significant advancements in the packaging sector.

The increase in focus on sustainable packaging coupled with the growing use of biodegradable and recyclable materials is expected to contribute to the growth of the market during the forecast period. Additionally, the increasing demand for customized packaging and the personalization trends in packaging across the globe are also expected to drive the growth of the market in the near future. Moreover, the growing adoption of automation and digital technologies as well as the surge in smart packaging options is also anticipated to contribute to the growth of the market in the years to come.

In both the developed as well as the emerging markets, the e-commerce sector is rapidly growing and continuously evolving. Online shopping has been driven by the rise of non-banking players in the payments space, a swift increase in the smartphone usage and broadband connections along with the development of innovative payment products. The online retailers are attempting to understand the purchasing habits of their customers and are responding to their desire to shop while on the go and from the homes or offices. Due to the shift in the consumer behavior and the accessibility of affordable, dependable technology for safe transactions, online sales have increased significantly worldwide.

However, the majority of the e-commerce companies consider investing in the high-quality packaging to be essential since it can drastically reduce the expenses. Proper packaging reduces the possibility of the product returns by shielding it from any harm during the transit. Furthermore, a product that is packaged well leaves a lasting mark on the customer and can improve retention as well as loyalty. Additionally, it also helps in improving the image of a company among the consumers. Good printing, well-chosen packaging as well as the unique design all contribute to the user engagement and help set a brand apart from competitors. In order to meet the increasing demands of the e-commerce industry, companies are investing in new packaging technologies and sustainable materials. These innovations in packaging design and materials in turn are expected to drive the growth of the packaging services market.

Raw material sourcing is one of the major problems when it comes to packaging world and this is likely to limit the growth of the market. Production delays for the glass, plastic as well as other packaging materials arise from the lack of the raw materials. Additionally, it becomes more difficult for brands to obtain the materials they require due to the growing demand for the recyclable along with the sustainable packaging. The packaging supply chain may also be impacted by the pricing and availability of the raw materials for shipping. A low availability of the packaging products that is insufficient to meet the significant demand is the result of interrupted production cycles. And, when demand surges, prices are likely to rise.

Every year, the cost of raw materials like polyethylene and polyurethanes rises by 50%, driving up the cost of plastic product packaging. The same issue of rising costs affects substitutes like cardboard boxes, padding and envelopes since manufacturers of these materials also have to contend with an imbalance between supply and demand. Furthermore, the supply chain is further burdened by the requirement for packaging in a variety of sizes, shapes, colors and other aspects. Dispensing pumps, caps and lids may also increase the cost of inventory and warehousing. Variations in packaging further make it difficult to forecast customer demand. It may result in a rise in the stock-keeping units (SKUs), which makes it more difficult for manufacturers to predict the demand precisely for each completed good. Additionally, these SKUs may occupy priceless warehouse space.

Packaging with Internet of Things (IoT) improves both efficiency and sustainability. Like in every other industry, packaging companies have access to a huge amount of data that can offer important chances to find areas where efficiency can be improved. IoT is enabling packaging manufacturers to automate processes, make informed decisions and meet efficiency and cost-saving goals through integrated sensors, smart systems, processes, data, and analytics.

Reusable Transport Packaging (RTP) becomes the best platform for the data generation and inventory visibility in the developing supply chain with the integration of IoT technology. When backed by the business and technological models that encourage data sharing, IoT-enabled RTP provides complete, bottom-up overview of the whole supply chain, including forward and reverse movements. Consequently, this improves network cooperation and eliminates silo constraints. Fast-moving consumer goods pallets with RFID tags have also assisted operators in increasing truck fill and improving product visibility throughout the supply chain, which has reduced empty miles and nearly 60% of CO2 emissions.

Industry observers think that digitalization can frequently begin with IoT initiatives. Artificial intelligence (AI) and 5G are examples of peripheral technologies that offer support and improvements. IoT gathers the data, 5G transfers it and AI provides insights. Businesses across all industries are trying harder and harder to digitize their supply chains so they can use the data they gather to make quicker and informed decisions. Full integration of the technologies such as AI, ML, IoT, cloud and edge computing across every step of the packaging process reflects a major opportunity.

The plastic segment dominated the market with share of 41% in 2023 and is likely to grow at a CAGR of 9.15% during the forecast period. The raw material of plastic is made of the long polymer chains, which make it incredibly difficult to break. Packaging made of plastic is resistant to the breakage and does not break into sharp pieces when dropped. Furthermore, a growing variety of plastic packaging now includes recycling and plastic packaging is clearly recyclable. Regulations in the European Union allow recycled plastic to be used in the new food packaging. According to the data by the Plastics Europe, the EU27+3 economies reintroduced approximately 5.5 million tonnes of post-consumer recycled plastic in 2021, a 20% increase from 2018. This strong upward trend in the use of recycled plastics is expected to support the continued use and demand for plastic packaging.

The paper and paperboard segment is expected to grow at significant CAGR of 11.14% during the forecast period. Public acceptance of paper-based packaging is rising as end users seek out more environmentally friendly packaging options. Nowadays, most consumers believe that paper is even more environmentally friendly material as compared to plastic. Since paper can be re-pulped, recycling it is not too difficult. Thus, utilizing paper as a material for flexible packaging has certain benefits for the environment. This has even caused some brands to switch to paper packaging from plastic which is likely to support the segmental growth of the market within the estimated timeframe.

The food & beverage segment held largest market share of 40.35% in 2023. The primary driver of the food and beverage packaging segment is the growing demand for packaged goods among consumers owing to the changing lifestyles and the consumption patterns. This fast-paced market offers a wide range of products like wraps, bags, straws and containers, among others that are intended to protect or enclose the food. The need for the effective food packaging to make food items easier to store, transport and consume is further highlighted by the growing urban population. The growth of the sustainable food packaging, which uses harmless materials, is also being pushed by the environment conscious consumers.

Asia Pacific dominated the global packaging services industry with 37.24% of the share of the total market in 2023. The increased consumer spending along with the growing demand for packaged goods across various sectors, including food and beverages, personal care, pharmaceuticals, and consumer electronics are anticipated to support the regional growth of the market. Moreover, the increasing penetration of the internet and smartphones has led to expansion of e-commerce across the region which is also likely to contribute to the growth of the market in the region.

North America is likely to grow at a considerable CAGR of 8.04% in the packaging services market during the forecast period. This is owing to the increasing adoption of eco-friendly materials and demand for regulatory compliance services due to the stringent health and safety standards. Furthermore, the changing consumer preferences towards convenience and single-serve options as well as the growing food, beverage and healthcare industries in the region is also expected to augment the growth of the market within the estimated timeframe.

By Packaging Type

By Services

By End-use

By Region

January 2026

January 2026

January 2026

January 2026