April 2025

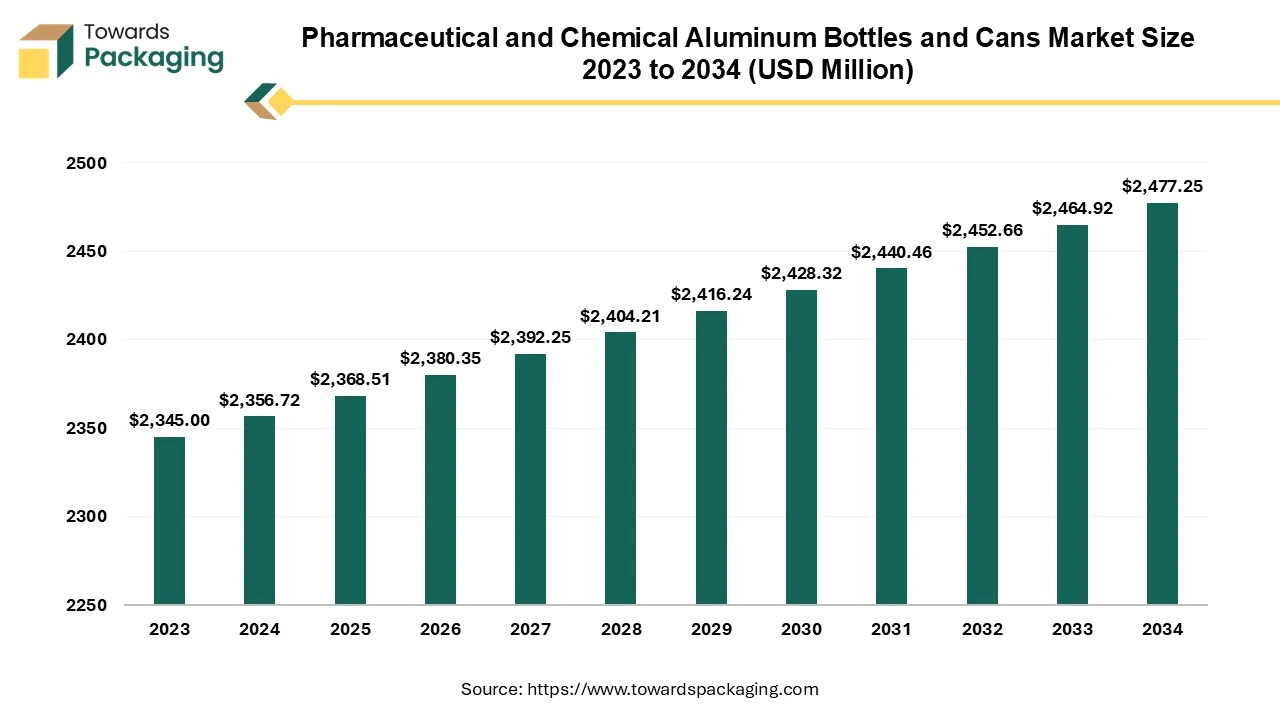

The pharmaceutical and chemical aluminum bottles and cans market is anticipated to grow from USD 2368.51 million in 2025 to USD 2477.25 million by 2034, with a compound annual growth rate (CAGR) of 0.5% during the forecast period from 2025 to 2034.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing pharmaceutical and chemical aluminum bottles and cans s which is estimated to drive the global pharmaceutical and chemical aluminum bottles and cans market over the forecast period.

Aluminium bottles and cans play a significant role in the pharmaceutical and chemical industries due to their unique properties and benefits. Aluminium provides excellent barrier protection against moisture, gases, and light, which is critical for maintaining the efficacy of pharmaceuticals and chemicals. Aluminium is highly recyclable, making it an environmentally friendly option. The recycling process requires only a fraction of the energy needed to produce new aluminum. Aluminium is lightweight yet strong, making it ideal for transportation and storage. Its resistance to breakage reduces the risk of spills and contamination. Manufacturers can easily print labels or branding directly on aluminum surfaces, allowing for enhanced product visibility and marketing. The design of aluminum bottles and cans can include tamper-evident features, enhancing product safety and integrity.

While aluminum is generally resistant to corrosion, it can react with certain chemicals (like strong acids) if not properly coated. Understanding the compatibility of materials is crucial. The production cost of aluminum containers can be higher than alternatives like plastic or glass, which may affect pricing strategies for manufacturers. Pharmaceutical and chemical industries are heavily regulated. Containers must meet specific standards for safety, quality, and efficacy, necessitating thorough testing and certification.

While aluminum provides excellent barrier properties, the shelf life of the contents also depends on other factors, including the formulation of the product and storage conditions. Aluminium bottles and cans are vital components in the pharmaceutical and chemical industries, offering a combination of durability, safety, and environmental benefits. Their ability to protect sensitive contents and their recyclability make them an increasingly popular choice among manufacturers. The global packaging market size is growing at a 3.16% CAGR between 2025 and 2034.

The key players operating in the market are focused on geographic expansion of pharmaceutical company and launching their brand in other countries which is expected to drive the growth of the global pharmaceutical and chemical aluminum bottles and cans market in the near future.

Growing pharmaceutical industries in emerging markets are increasing the demand for aluminum packaging. Events like the COVID-19 pandemic have heightened the focus on hygiene and safety, boosting demand for reliable packaging solutions. Stricter regulations regarding packaging materials in the pharmaceutical industry are promoting the use of aluminum, which is compliant with safety standards. A shift towards premium packaging, especially in pharmaceuticals, is driving the use of aluminum due to its aesthetic appeal and perceived quality. The rising demand for safe and durable packaging solutions in pharmaceuticals and chemicals is driving growth, as aluminum provides excellent protection against contamination and is lightweight.

Aluminum is highly recyclable, appealing to environmentally conscious consumers and companies. This aligns with global sustainability goals, encouraging more businesses to switch from plastic to aluminum packaging. The key players operating in the market are focused on introduction of the sustainable pharmaceutical grade aluminum bottles and cans, which is estimated to drive the growth of the pharmaceutical and chemical aluminum bottles and cans market.

Growth in the pharmaceutical industry, driven by increased drug production and demand for efficient packaging, is boosting the market. Innovations in manufacturing processes and coatings enhance the functionality and safety of aluminum containers, appealing to manufacturers. Increasing consumer preference for products in durable and non-reactive packaging can enhance demand for aluminum bottles and cans. The rise of personalized medicine and biopharmaceuticals can lead to a need for specialized packaging solutions. The key players operating in the market are focused on developing the pharmaceutical grade aerosol which can be utilized in treating respiratory disorders like asthma and chronic obstructive pulmonary disease (COPD), which is estimated to create lucrative opportunity for the growth of the pharmaceutical and chemical aluminum bottles and cans market.

North America region held a significant share of the pharmaceutical and chemical aluminum bottles and cans market in 2024. A stable economy of North America allows for consistent investment in the pharmaceutical and chemical industries, leading to higher packaging demand. North America boasts advanced manufacturing technologies that improve production efficiency and product quality. Increased awareness of the benefits of aluminum, such as its recyclability and lightweight properties, supports market growth. There is a growing preference for sustainable and recyclable packaging among consumers and manufacturers, driving demand for aluminum solutions. Significant investment in research and development fosters innovation in packaging technologies, enhancing the appeal of aluminum containers.

Asia Pacific region is projected to host the fastest-growing pharmaceutical and chemical aluminum bottles and cans market in the coming years. The Asia-Pacific region is experiencing rapid growth, primarily due to increasing pharmaceutical production and rising demand for chemical packaging solutions. Urbanization and an expanding middle class are driving the demand for packaged goods, including pharmaceuticals. Countries like India and China are investing heavily in the pharmaceutical sector, enhancing the need for reliable packaging.

Varying regulations across countries create challenges, but efforts to harmonize standards are underway, particularly in China and India. Expanding economies in the region provide significant opportunities for growth, with rising disposable incomes leading to increased pharmaceutical consumption. Expanding economies in the region provide significant opportunities for growth, with rising disposable incomes leading to increased pharmaceutical consumption.

The above 1L segment registered its dominance over the global pharmaceutical and chemical aluminum bottles and cans market in 2024. Chemical grade aluminum is designed to resist corrosion and reactions with various substances, making it suitable for storing a wide range of liquids. The production and recycling processes for aluminum can be more economical over time compared to alternatives, making it a favourable choice for manufacturers. The growing popularity of outdoor activities and the need for portable packaging solutions have driven demand for larger aluminum containers.

Cans made from chemical-grade materials ensure compatibility with various substances, preventing reactions that could compromise the integrity of the chemical. Many above 1L cans are designed with secure closures and robust materials that enhance safety during handling and transport, minimizing the risk of leaks or spills. Larger cans allow for bulk storage and transport of chemicals, reducing the need for multiple smaller containers and improving efficiency. Buying in bulk reduces per-unit costs, making larger cans a more economical choice for businesses. These advantages make above 1L cans an optimal choice for chemical supply across various industries.

The medical segment held a dominant presence in the pharmaceutical and chemical aluminum bottles and cans market in 2024. Aluminum can be easily sterilized, making it suitable for storing pharmaceuticals and medical products that require stringent hygiene standards. Aluminum provides excellent protection against light, moisture, and oxygen, which helps preserve the efficacy and shelf life of sensitive medications. The lightweight nature of aluminum makes it easy to transport, while its durability ensures that products are well-protected during handling and shipping. Aluminum is compatible with a variety of pharmaceuticals and can resist corrosion, ensuring that the packaging does not react adversely with its contents. The sustainability of aluminum appeals to the growing demand for eco-friendly packaging solutions in the industry. Aluminum bottles and cans can be easily customized for branding and labeling, which is important for differentiating products in the competitive pharma market.

By Capacity

By Application

By Region

April 2025

April 2025

April 2025

April 2025