April 2025

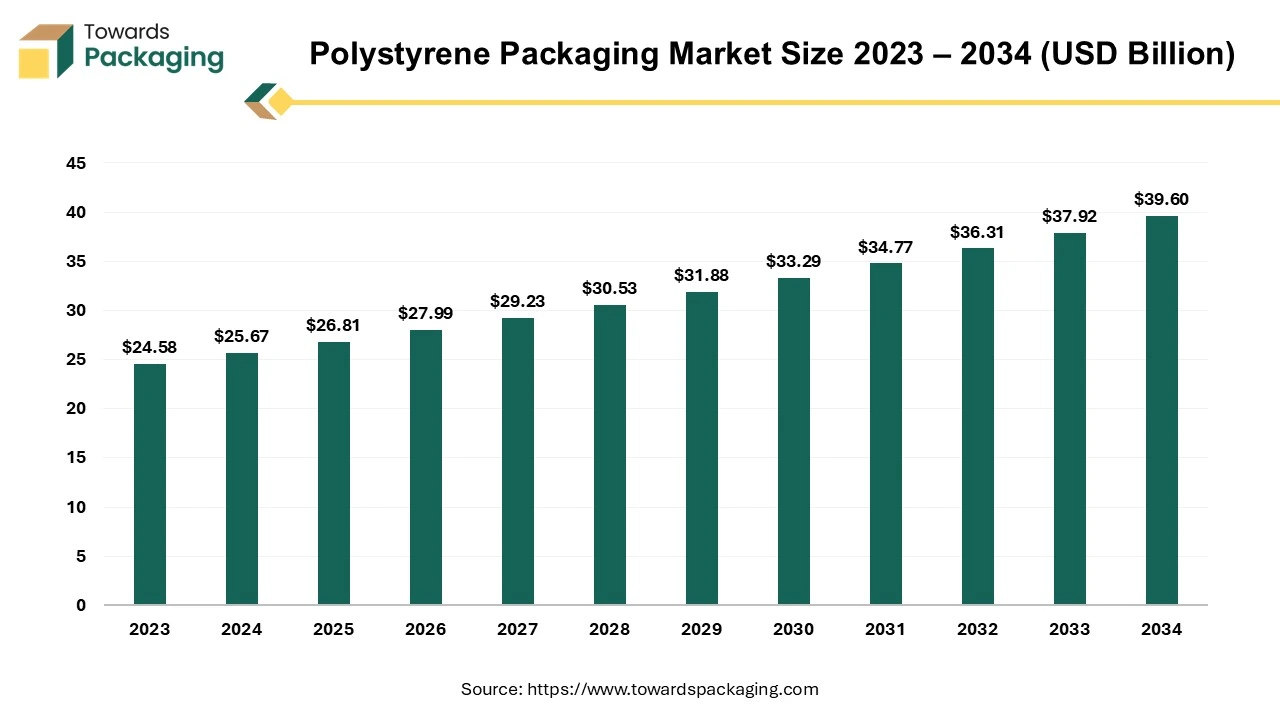

The polystyrene packaging market is projected to reach USD 39.60 billion by 2034, expanding from USD 26.81 billion in 2025, at an annual growth rate of 4.43% during the forecast period from 2025 to 2034.

Increasing adoption of the inorganic growth strategies like merger by the key market players for modifying and designing industrial bulk packaging is estimated to drive the growth of the global polystyrene packaging market over the forecast.

An amorphous plastic that is commonly employed in the production of numerous consumer goods is called polystyrene. Its melting temperature range is vast, and it lacks an identifiable melting point. This implies that it can be mixed with other polymers of the same kind to create new, better-performing plastic components. With the chemical formula (C8H8) n, where n is the number of repeating units in the polymer, polystyrene is a polymer made up of multiple polystyrene molecules joined by styrene monomers.

Polystyrene material is light in weight and has low thermal conductivity. Polystyrene material is a good electrical insulator and is able to maintain good dimensional stability. Polystyrene compound’s five main types are generally used; they have been mentioned here as follows: Crystalline Polystyrene (GPPS), extruded polystyrene (XPS), High Impact Polystyrene (HIPS), Expanded polystyrene (EPS), and Flame-retardant (FR) polystyrene. Polystyrene is used for making parts of the car including instrument panel, trim, sound dampening foam, knobs, and energy absorbing door panels. Polystyrene material is also used in manufacturing vacuum cleaners, refrigerators, microwaves, air conditioners, blenders, ovens, IT equipment, foodservice packaging, CD and DVD cases, and egg cartons among other applications.

| Consignee Name | Shipper Name | Product Name | Loading Port | Unloading Port | Sum of Quantity | Sum of Weight |

| STONE BREWING CO LLC | TOYO SEIKAN CO LIMITED | Plastic articles for the conveyance or packing of goods | 58023, Pusan | 1401, Norfolk, VA | 5,489,708 | 355,550 |

| STONE BREWING CO LLC | TOYO SEIKAN CO LIMITED | Plastic articles for the conveyance or packing of goods | 58309, Kao Hsiung | 1401, Norfolk, VA | 1,931,812 | 87,700 |

| SAKUMA INTERNATIONAL AMERICA INC | NIPPO LIMITED | Plastic articles for the conveyance or packing of goods | 58857, Nagoya Ko | 2704, Los Angeles, CA | 1,299,456 | 16,356 |

| AISIN NORTH CAROLINA CORP | AISIN CORP | Plastic articles for the conveyance or packing of goods | 58857, Nagoya Ko | 2704, Los Angeles, CA | 1,234,464 | 109,665 |

| RETRIEVER PACKAGING COMPANY LLC | NABER PLASTICS BV | Plastic articles for the conveyance or packing of goods | 42157, Rotterdam | 4601, New York/Newark Area, NJ | 545,524 | 168,667 |

| VITAL FARMS C O SHOW ME | GIORDANO POULTRY PLAST SPA | Plastic articles for the conveyance or packing of goods | 47527, Genoa | 4601, New York/Newark Area, NJ | 286,420 | 95,104 |

| RETRIEVER PACKAGING COMPANY LLC | NABER PLASTICS BV | Plastic articles for the conveyance or packing of goods | 42157, Rotterdam | 1401, Norfolk, VA | 264,300 | 38,220 |

| WABASH VALLEY PRODUCE INC | GIORDANO POULTRY PLAST SPA | Plastic articles for the conveyance or packing of goods | 47527, Genoa | 4601, New York/Newark Area, NJ | 255,014 | 76,476 |

| GILDAN YARN LLC | GILDAN MAYAN TEXTILE S DE RL | Plastic articles for the conveyance or packing of goods | 21531, Puerto Cortes | 1501, Wilmington, NC | 254,410 | 1,135,851 |

Increasing demand for polystyrene packaging in cosmetics and other personal care goods is expected to drive the growth of the polystyrene packaging market over the forecast period. The increasing demand for cosmetics and personal care products is driven by rising disposable incomes, a desire for beauty, and a focus on personal hygiene. However, these products are perishable and sensitive to factors like air, heat, light, and cold, which can affect their quality and stability. Polystyrene packaging addresses these challenges by maintaining product integrity and facilitating easy transportation. Moreover, increasing launch of cosmetic and personal care products is raising the demand of polystyrene packaging which is estimated to fuel the growth of the polystyrene packaging market in near future.

Polystyrene is non-biodegradable, meaning it does not break down naturally in the environment. This leads to long-term pollution, as polystyrene waste accumulates in landfills and natural habitats. Marine pollution is a significant issue, with polystyrene debris harming marine life and ecosystems. The production of polystyrene is resource-intensive, requiring significant amounts of non-renewable fossil fuels. This contributes to the depletion of natural resources and environmental degradation.

There is a rising demand for high-quality polystyrene packaging solutions in the medical and pharmaceutical sectors, driven by an increased focus on product safety, contamination prevention, and regulatory requirements. The medical and pharmaceutical industries are experiencing growth due to improved healthcare access, rising medical insurance coverage, increased public health awareness, favourable demographics, and higher disposable incomes. In this sector, pharmaceutical products are highly sensitive to contamination and require secure healthcare packaging solutions. Polystyrene packaging is widely used in this industry to ensure the safe delivery of these products, helping to meet stringent safety and quality requirements.

For instance,

The foam segment held the dominating share of the polystyrene packaging market in 2024 owing to its broad application in packing and insulation, which corresponds with the growing need for shipping solutions that are both protective and energy-efficient. Since polystyrene foams are so good at insulating, they are very convenient. For uses like insulation panels and roofing materials, this makes them the preferred option in the construction and building sector. The increasing global concern about energy efficiency has led to a boom in demand for efficient insulation materials, which in turn has fueled the expansion of polystyrene foam products. Polystyrene (PS) foams have also been widely used in the packaging industry. The demand for packing materials that can protect goods during transit has increased due to the growth of online shopping and e-commerce. Polystyrene (PS) foam is a preferable option because of its cushioning and shock-absorbing qualities.

Polystyrene (PS) foams is a great option for delivering delicate and fragile goods because of its shock-absorbing and cushioning qualities. Furthermore, polystyrene foams' lightweight design lowers transportation costs, which increases their allure in the packaging sector. Furthermore, polystyrene foam's versatility goes beyond assembly and packing. It is used in many consumer goods, such as food containers, product packaging, and disposable dinnerware. Because of its low cost and ease of production, producers find it to be a cost-effective option, which helps to explain its dominance in the polystyrene packaging market.

Finally, in order to ensure that polystyrene foam stays a stiff force in the global market, producers are looking into sustainable alternatives within the polystyrene foam category, such as biodegradable foams and recycling programs, as environmental concerns continue to drive the market. Moreover, the key players operating in the market are focused in adopting inorganic growth strategies like collaboration to develop safe foam packaging technology, which is estimated to drive the growth of the segment over the forecast period.

For instance,

The plastic segment is estimated to grow at fastest rate over the forecast period. The polystyrene packaging is widely used in manufacturing the part of automotive equipments, cars and air conditioners due to its properties like low thermal conductivity, highly chemical resistant and due to its good dimensional stability. The key players operating in the market are receiving funding from the government bodies for recycling plastic polystyrene for production of sustainable polystyrene, which is expected to drive the growth of the segment over the forecast period.

For instance,

The cups segment holds a dominant share of the global polystyrene packaging market. The cups manufactured using foam polystyrene are light in weight and disposable which make it hygienic to use while travelling and even there is no need of washing it as it is single use. In foam cup the optimum serving temperature of hot and cold beverages is maintained as it is insulated from heat. Rigid polystyrene is widely used in manufacturing yogurt cups and plastic cutlery cups. Due to its many advantages, including its superior ability to retain carbonation and keep hot food hot and cold food cold, polystyrene cup packaging has the largest market share. Furthermore, it is anticipated that the beverage industry's growing desire for these cups will increase demand.

Double cupping is not necessary with polystyrene cups, because they shield hands from hot liquids like tea or coffee. Because it uses less energy and resources during production, producers are concentrating on increasing their output. It is expected that polystyrene cups will account for a sizeable portion of the market. The demand for polystyrene cups is predicted to rise due to their extensive advantages.

The key market players are focused on developing new recycling polystyrene and manufacturing cups out of it, to reduce the harmful effect of polystyrene on the environment, which is estimated to drive the growth of the segment over the forecast period.

For instance,

The food & beverages segment held the largest share of the polystyrene packaging market in 2024. There is an imminent likelihood of global expansion for the quick-service restaurant industry, over the forecast period. The two main factors driving segment expansion are rising staff counts and shifting consumer preferences. The polystyrene packaging is done to protect consumer products. It is extensively used for packaging dry fruits, peanuts, poultry/meat in trays and eggs in polystyrene trays.

Food packaging frequently uses polystyrene, which is available in two varieties rigid and foam. Clear food containers, plates, bowls, straws, cutlery, and beverage cups with lids are all made of the hard shape. The foam form, commonly referred to by its trade name, styrofoam, is used to make clamshell food containers, trays, insulated drinking cups, and bowls. Moreover, increasing trend of online food ordering due rapid urbanization and changing lifestyle has risen the demand for the polystyrene food packaging which is estimated to drive the growth of the market over the forecast period. Moreover, the key players operating in the market are focused on adopting inorganic growth strategies like collaboration to introduce polystyrene food packaging products, which is estimated to drive the growth of the polystyrene packaging market over the forecast period.

For instance,

The packaging segment's dominance has been further cemented by the notable surge in demand for packaging materials resulting from the swift expansion of e-commerce and online retail. Goods are being moved throughout the world at an increasing rate, which has increased need for packaging solutions that are economical and protective. Polystyrene is superior in this aspect because it can protect and cushion delicate things while in transportation and is lightweight, which lowers shipping expenses. Polystyrene packaging's clarity and visibility improve items' visual attractiveness and boost customer happiness. Even while environmental concerns about sustainability have made polystyrene packaging more examined, continuous attempts to provide recyclable and eco-friendly polystyrene substitutes guarantee that polystyrene will always remain the first choice for packaging applications, retaining its leading position in the worldwide market.

In conclusion, polystyrene's adaptable qualities, affordability, and fit for a range of packaging requirements, especially in light of the growing e-commerce sector and the emphasis on sustainable packaging solutions, are what will lead to the packaging sector's domination in the global market in 2024.

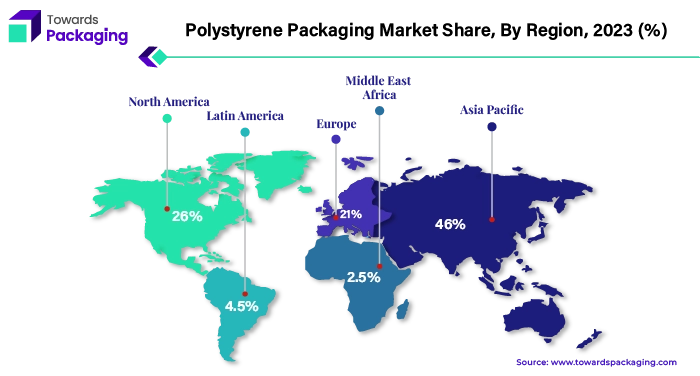

Asia Pacific held the largest share of the market in 2024. Due to a number of important factors, including industrialization and economic expansion, Asia Pacific led the market in 2024. The manufacturing and packaging sectors' rapid expansion throughout the region is one of the main drivers. Over the past few decades, industrial activity and production have increased dramatically in Asia Pacific countries including China, India, and Southeast Asian countries. Since polystyrene is so versatile and reasonably priced, it is an essential material in these industries. It is widely utilized in the production of electronics, consumer items, automobile parts, and packaging materials. The region's leading market position is fuelled by the robust demand for polystyrene from these industries as they grow and diversify.

In addition, the population expansion and rising middle-class income levels in Asia Pacific have resulted in a rise in the consumption of packaged goods and consumer goods. The increased demand from consumers has increased the need for packaging solutions that are both effective and affordable, with polystyrene playing a key role in this regard. In addition, with increased urbanization and infrastructure development, the region's construction industry has been flourishing. Polystyrene foam sheets and boards are preferred for their insulating qualities, which make them necessary for both residential and commercial building construction. The need for polystyrene foam in construction applications has increased as energy efficiency becomes more important, which has further contributed to the region's market dominance.

Furthermore, because of the advantageous labor circumstances and cheaper production costs, the Asia Pacific area has been a hub for the manufacturing of polystyrene products. Because of the reasonable prices and consistent availability of polystyrene materials made possible by this, both local and foreign manufacturers have chosen to locate in the area. While sustainability and environmental concerns are new hurdles, Asia Pacific is actively looking into eco-friendly alternatives and recycling programs to address these problems, which will guarantee the polystyrene market's continuous expansion in the area.

North America is estimated to grow at fastest rate over the forecast period. The North America extensively make use of polystyrene foam packaging for packaging electronics devices, fruits, meat, eggs and vegetables. Rapid urbanization and innovation of new stationary material has risen the demand for the polystyrene packaging which is estimated to drive the growth of the polystyrene packaging market in North America region over the forecast period. Moreover, rising food outlet in North America has increased the demand for the polystyrene packaging, which is estimated to fuel the growth of the polystyrene packaging market over the forecast period.

For instance,

The U.S. polystyrene packaging market is shaped by evolving trends and key factors. A major trend is the increasing demand for expanded polystyrene (EPS) foam driven by the building and construction sector. EPS foam, valued for its superior insulation properties, is widely used in residential and commercial construction for insulation panels and roofing materials. As energy efficiency and sustainable building practices gain importance, the need for expanded polystyrene foam insulation is expected to rise.

Additionally, the packaging sector significantly impacts the PS market in the U.S. The growth of e-commerce and food delivery services has boosted the demand for protective packaging solutions, including polystyrene foam and rigid polystyrene containers. In response, manufacturers are working to create polystyrene products that are both functional and environmentally friendly to meet the growing consumer demand for sustainable packaging options.

By Material Type

By Technology Type

By End Use

By Region

April 2025

April 2025

April 2025

April 2025