April 2025

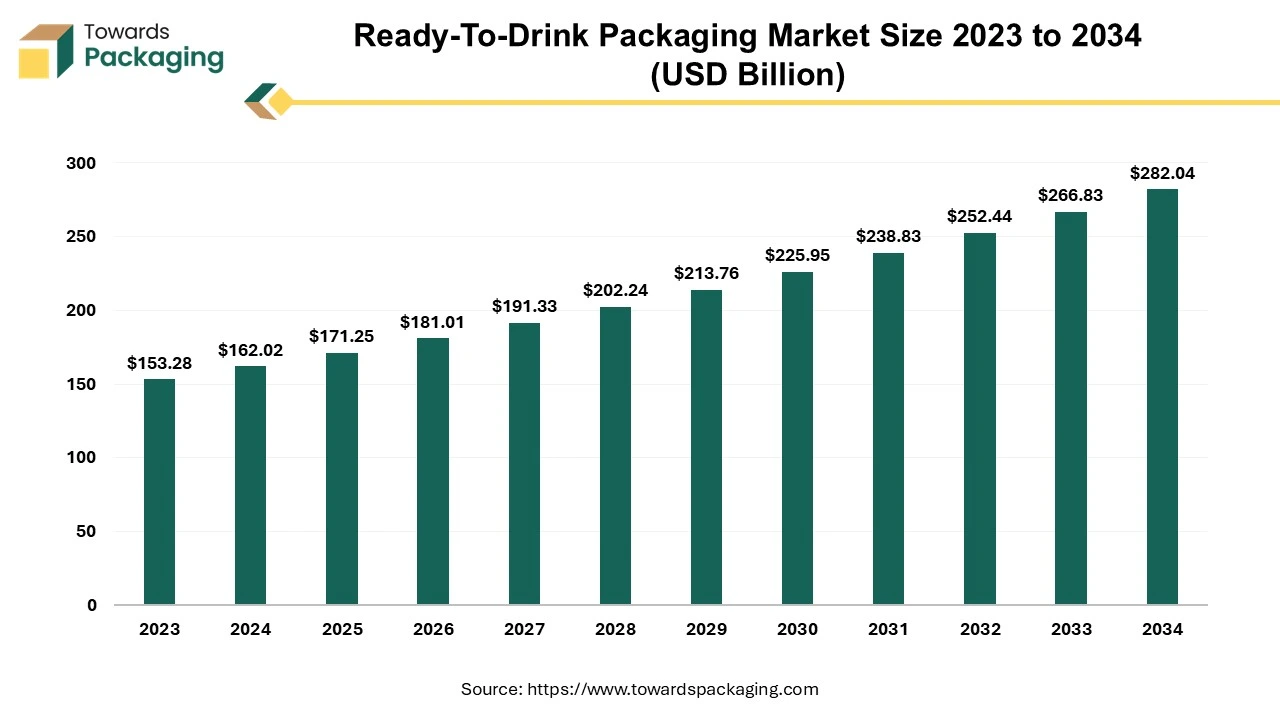

The ready-to-drink packaging market is projected to reach USD 282.04 billion by 2034, growing from USD 171.25 billion in 2025, at a CAGR of 5.7% during the forecast period from 2025 to 2034.

Consumers' "on the go" mentality has led to a developing trend in packaging: convenience. Indicates that consumers are drawn to products or packages that make things easy to use, such as divisible portion sizes, easy-to-tear mechanisms, or internal cooking capabilities. In this way, Modern lifestyles require convenience. A product gains extra value and increases the probability of being purchased by a customer if it is simple to open, use, reseal, and carry. Within the beverage sector, carriers and travel sizes have gained popularity.

The ease and stable shelf life of ready-to-drink packaging has led to its global growth. The ready-to-drink market in North America is still expanding quickly, which helps businesses fulfil rising consumer demand, which will be ideal for informal get-togethers and at-home occasions.

For the past ten years, there has been a divisive trend about the size of ready to drink packaging due to several issues, including increased health concerns. A blood sugar imbalance is caused by excessive consumption of consumables, such as aerated drinks. It increases the risk of Type 2 diabetes by impairing the liver's capacity to digest sugar intake. Consequently, there is a growing push on beverage makers to shrink the size of their containers so that customers have more choices and can regulate how much they drink. Smaller packaging is required because some manufacturers promise to lower the calorie content.

Innovation in packaging technologies and designs is a crucial focal point for market players. Companies are investing in smart packaging solutions, integrating technologies like QR codes and augmented reality to enhance consumer interaction and provide additional information. The pursuit of differentiation often involves creative and visually appealing designs, especially in the premium and craft segments.

The COVID-19 outbreak has had a significant impact on consumer behaviour. Consumers are more focused than ever on the sustainability and hygienic aspects of items. As this crisis persists, a customer-focused strategy and the changing needs of shoppers will continue to be essential. Undoubtedly, as the market concurrently becomes more acclimated to the current situation, consumer behaviour will continue to shift during the projection period. Considering this, the demand for ready-to-drink packaging following the COVID-19 pandemic appears to be favourable.

The RTD packaging market in North America is driven by a high demand for convenience and on-the-go products. Sustainable packaging practices are gaining prominence, with an increasing focus on reducing environmental impact. Key players in this region often invest in advanced technologies for smart packaging solutions. The regulatory environment, including stringent quality standards, shapes packaging choices, and there is a growing trend toward premium and differentiated packaging designs, particularly in the alcoholic RTD segment.

The Asia-Pacific region is a dynamic and rapidly growing market for RTD packaging. With changing lifestyles and a rising middle class, there is a notable shift towards on-the-go consumption, driving innovations in convenient and portable packaging formats. Sustainability is gaining traction, and companies are exploring cost-effective, eco-friendly materials. The diverse consumer landscape and cultural variations influence packaging choices, with a growing interest in unique and visually appealing designs.

Europe witnesses a robust RTD packaging market with a strong emphasis on sustainability and eco-friendly materials. The region is at the forefront of adopting circular economy principles, influencing packaging practices that minimize environmental impact. Smart packaging technologies like QR codes and interactive features are well-received. The alcoholic RTD sector experiences a surge in premium and craft packaging designs, aligning with discerning consumer preferences.

In recent years, the landscape of the beverage industry has undergone a remarkable transformation, with ready-to-drink cans emerging as the frontrunners in specialty drink categories. This shift can be attributed to the dynamic changes in consumer trends and evolving tastes, prompting producers and consumers to reconsider traditional packaging methods. The versatility and practicality of cans have enabled the creation of a diverse range of beverages, from carbonated and flavoured waters to the unexpected entry of still waters into this innovative packaging domain.

The driving force behind this trend lies in the significant strides made in filling technology. The advancements in packaging techniques have made it not only possible but highly efficient to encapsulate essential beverages within cans while preserving their freshness and ensuring security. This breakthrough has revolutionized the way consumers perceive and enjoy their favorite drinks, marking a departure from conventional packaging norms.

The superiority of cans in shielding sensitive components, such as spicy and aromatic hops, from the detrimental effects of light and air has positioned them as the go-to choose for preserving the distinctive Flavors of craft beers. Unlike traditional glass bottles, cans provide an impermeable barrier, preventing any external elements from compromising the integrity of the brew. This has proven to be a game-changer for craft brewers seeking to deliver an unparalleled tasting experience to their consumers.

The strategic advantages of packaging extend beyond preservation to logistical efficiency and environmental sustainability. Cans are not only lightweight, reducing transportation costs and carbon footprints, but they are also infinitely recyclable. This eco-friendly aspect aligns with the growing global consciousness towards sustainable practices, making ready-to-drink cans an appealing choice for environmentally conscious consumers.

Moreover, the rise of ready-to-drink cans has sparked innovation in the formulation of beverages themselves. Manufacturers are increasingly experimenting with unique combinations of flavors, infusing creativity into the beverage landscape. With its expansive surface area for eye-catching designs and branding, the can becomes a canvas for beverage companies to express their creativity and capture consumer attention.

The consumer experience is also enhanced by the convenience and portability that can offer. Whether enjoying a refreshing drink at a picnic, a music festival, or a casual gathering, cans' lightweight and easily stackable nature makes them the perfect companion for on-the-go enjoyment. This convenience factor resonates strongly with the modern lifestyle, where consumers seek products seamlessly integrating into their dynamic and fast-paced routines.

In the dynamic realm of Ready-to-Drink (RTD) alcoholic beverages, the importance of package design transcends mere aesthetics, playing a pivotal role in shaping market dynamics. As consumer preferences evolve, beverage developers find themselves at the crossroads of innovation and sustainability. Notably, the surge in demand for environmentally conscious practices has spurred a renaissance in packaging choices, prompting a strategic shift towards recyclable materials such as glass, metal, and paper-based alternatives.

The conscious choice of sustainable packaging is not merely an eco-friendly gesture; it has become a strategic imperative in targeting a consumer base that places a premium on environmentally responsible practices. As the global awareness of environmental issues intensifies, consumers increasingly seek products that align with their values. By opting for recyclable materials, beverage brands signal their commitment to sustainability, appealing to a generation prioritising the planet's well-being.

In this landscape, the quality of the product itself remains paramount in consumers' minds, emerging as the primary factor distinguishing one can or bottle from another. Whether it's the smoothness of a spirit or the refreshing taste of a cocktail, the inherent quality of the beverage takes centre stage in making a lasting impression. This underscores the importance for beverage developers to prioritize not only the concoction within but also the vessel that houses it.

Following closely behind product quality, the brand's reputation and the variety of flavours available claim the spotlight in consumers' decision-making processes. A positive brand reputation serves as a testament to reliability and consistency, fostering trust among consumers. Furthermore, the diverse array of Flavors offered by a brand adds an element of excitement and personalization, catering to the diverse palate preferences of the modern consumer.

Interestingly, bottle design exerts a significant influence on consumer choices, with men displaying a propensity to be twice as swayed by it compared to women. This gender-based divergence in preferences underscores the importance of understanding the nuanced factors that influence distinct demographic segments. For men, the bottle becomes more than a vessel; it transforms into a statement piece, reflecting personal style and taste. Beverage brands keen on capturing a broader market share must navigate the delicate balance between creating visually striking designs that resonate with diverse audiences.

In essence, the marriage of package design and RTD alcoholic beverages is a delicate dance between form and function, aesthetics and substance. It is an acknowledgment that the container is not just a vessel but a storyteller—a visual narrative that communicates the essence of the product within. As we navigate the intricacies of this evolving market, one thing remains clear: the fusion of innovative package design and sustainable practices is a winning formula, creating not just beverages, but experiences that leave a lasting imprint on the discerning consumer's mind.

In an era where environmental consciousness drives consumer choices, the Ready-to-Drink (RTD) packaging market stands as a beacon of positive change. The escalating preference for recyclable materials, zero waste production, ethical sourcing, and locally derived ingredients is not merely a trend but a seismic shift that is steering the growth of the RTD packaging industry towards a more sustainable future.

The escalating demand for recyclable materials is a testament to the growing eco-awareness among consumers. The quest to reduce environmental impact has spurred a wave of innovation in packaging solutions that generate zero waste. Now more than ever, consumers are seeking products that not only quench their thirst but also align with their commitment to reducing ecological footprints. This shift has catalyzed a transformation in the RTD packaging market, prompting companies to adopt sustainable practices and develop packaging solutions that champion environmental preservation.

Ethical sourcing and the emphasis on locally derived ingredients amplify the positive environmental impact propelling the RTD packaging market's growth. Consumers are increasingly drawn to brands prioritising fair trade practices and supporting local communities. Not only enhances the overall quality and authenticity of the product but also fosters a sense of environmental stewardship. The positive ripple effect extends beyond the product itself, contributing to the preservation of biodiversity and the sustainable cultivation of resources.

The surge in RTD beverage consumption, particularly among the younger demographic, mirrors the resonance of environmental values among this cohort. Younger customers are driving the demand for convenient, on-the-go beverages and becoming instrumental in steering the market towards sustainability. Companies that integrate environmental responsibility into their core values are aligning with consumer preferences and reaping the rewards of increased brand loyalty and positive word-of-mouth marketing.

As 2023 approaches, the trend of consumers making educated decisions shows no sign of waning. Beyond accurate chemical labeling, there is a discernible shift towards a more comprehensive and holistic approach to product information. Consumers are poised to demand thorough labelling that transcends ingredient lists, encompassing details about the company's environmental initiatives, its impact on local communities, and its carbon footprint credentials. This shift reflects an empowered consumer base that seeks transparency and takes pride in making choices that reflect their commitment to a sustainable and environmentally conscious lifestyle.

The positive environmental impact driving the growth of the RTD packaging market signifies a paradigm shift towards a more sustainable and responsible future. The industry's response to consumer preferences for recyclable materials, ethical sourcing, and transparent labelling is reshaping the products on the shelves and the ethos of the companies behind them. As the market continues to evolve, those who champion environmental stewardship will not only thrive economically but will also contribute significantly to the global mission of creating a healthier planet for future generations.

Brand owners are increasingly introducing designs including bag-in-box and resealable cans, demonstrating how the innovation dynamic that permeates the RTD market extends to packaging. In the US, attractive packaging, usually in glass, for spirit-based, premium-plus pre-mixed cocktails is becoming increasingly common, as is more oversized format ready-to-pour packaging.

According to consumer research, although metal cans are the most popular format, 47% of customers say they prefer glass over cans. The supply chain disruption has recently limited the options available to brand owners for materials. "Bag-in-box options that are fridge-friendly are becoming more popular, particularly for large gatherings," according to Rogers. The budget-friendly (margarita) and luxury (negroni) markets are seeing growth in this pack type.

Single-serve sizes are preferred by the great majority of customers, whether they are bought individually or in multipacks. Larger bottles of RTDs are comparatively more preferred by higher-income consumers, but multipacks are comparatively more preferred by hard seltzer users. For added variety, several RTD brands also provide multipacks of different flavours. Not many other drink categories have adopted this inventive packaging technique except for upscale gift packs.

In ready-to-drink (RTD) packaging, the competitive landscape is shaped by prominent players such as Tetra Laval Group, Crown Holdings, Inc., Amcor Limited, and Ball Corporation. Tetra Laval Group stands out with its global reach and commitment to sustainable packaging, while Crown Holdings boasts technological innovation. Amcor Limited positions itself with comprehensive packaging solutions and a focus on eco-friendly materials, and Ball Corporation leads in metal packaging with an emphasis on recyclability. Sustainable packaging is a prevailing trend, with a collective industry push towards environmentally friendly materials and innovative solutions. Convenience packaging is on the rise, driven by a demand for on-the-go consumption, resulting in user-friendly designs and resealable options.

Smart packaging, integrating technology for enhanced consumer engagement, is gaining momentum with QR codes and augmented reality. The market dynamics reflect regional consumer preferences and regulations variations, with companies adapting strategies accordingly. E-commerce's influence on packaging design and durability is notable, prompting investments in secure and sustainable e-commerce solutions. Recent global disruptions underscore the importance of resilient supply chains, leading companies to reassess strategies for increased agility. In conclusion, success in the RTD packaging market hinges on balancing sustainability, innovation, and adaptability to regional dynamics. Companies that navigate these factors adeptly are poised to lead in this competitive landscape.

By Product Type

By Material

By Application

By Region

April 2025

April 2025

April 2025

April 2025