April 2025

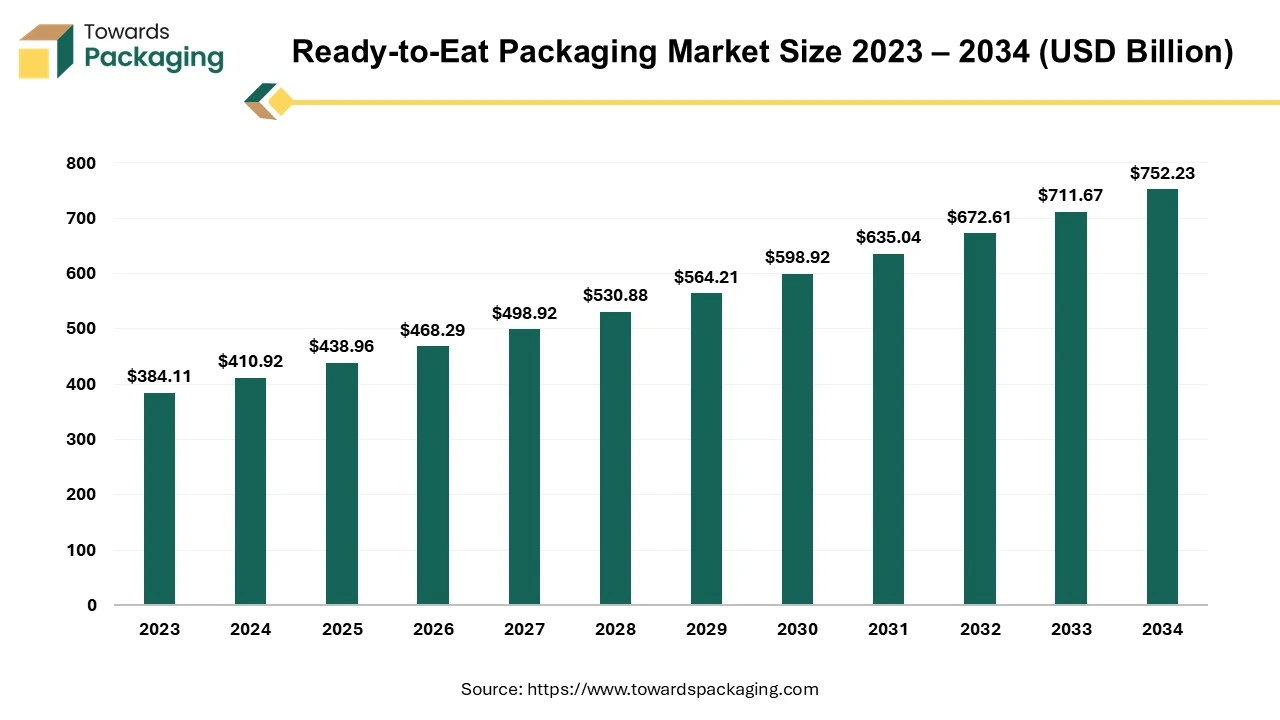

The global ready-to-eat packaging market size was evaluated at US$ 384.11 billion in 2023 and is expected to attain around US$ 752.23 billion by 2034, growing at a CAGR of 6.9% from 2024 to 2034.

Ready-to-eat is a food category that does not need to be cooked or heated before eating, consumer can open the package and consume it directly. Ready-to-eat have been invented and developed for military purposes, but now, thanks to the convenience they bring to life, ready-to-eat are becoming very popular in the entire society, with more and more demands. Ready-to-consume foods shall be prebaked or partially boiled and stored in a vacuum or refrigerated environment if the length of shelf life is required. They are not required to be further cooked or processed, for instance, boiled water immersion, microwave, and cooking for short periods when consumers need to eat them.

Consumers shift towards modernization and westernization leads to people's lifestyles and behaviours being attracted towards ready-to-eat products because of the abundance of fast foods on the market, and they are responding to products that are fresh and easy to serve. Ready-to-eat food items fall into a group of packaged foods that are meant to be consumed directly without needing to be cooked.

Ready-to-eat snacks have been the fastest-growing food category in the last five years, and their convenience has drawn most consumers. These food products attracted more attention from consumers because of their appealing qualities, affordable pricing, flavour, texture, appearance, etc. Because ready-to-eat snacking products are easy to prepare and do not require additional cooking, a variety of technologies have been used widely in their production, with a primary focus on attractive packaging. Foods that are sweet, salted, fried, canned, fast food, baked, dried, preserved, extruded, etc. are all included in the category of ready-to-eat food products.

Packaging of snack products is important to increase the shelf life of food and it controls weight loss and reduces transportation costs. To preserve texture attributes, moisture content, grease and airproofs of product, laminated packaging material is mostly used. Consumers prefer ready-to-eat products because of their advantages less time and effort. Packaging is used to show the quality of meals, nutritional content, marketing of products and shelf life. Due to variable aspects of packaging in ready-to-eat food products, companies are innovating new customised and attractive packaging materials as per the market demand.

The integration of artificial intelligence (AI) in the food industry in becoming a norm because of its varied applications at the different levels on process. Ready-to-eat products needs proper packaging that will preserve the food and extend shelf life without any compromise on quality. AL combined with machine learning (ML) algorithms.

For example, decreases the food waste and spoilage percentage. AI-based automation can enable smooth operational functioning with precision and accuracy that has a positive impact on the production output of the business. Functions like- predictive analysis, real-time monitoring, combining IoT, sensors, quality checks etc. can reduce the burden on the infrastructure while boosting productivity. It can help optimize the distribution, storage and supply chain for the read-to-eat packaging industry.

The food industry depends on appropriate food packaging as it crucial in the maintenance of quality and safety of the food products especially for ready to eat meals. The growth of ecommerce and food services platform worldwide provide ample new opportunities for the ready-to-eat packaging market. The rising demand for food packaging that is durable, prevents spilling while being easy to carry and handle for delivery persons and consumers. The prominence of these platforms will continue rising with many people choosing the convenience of ordering groceries or other food items that are delivered to their home.

There is also a need for eco-friendly packaging solutions even on ecommerce and food services platforms as consumers as becoming more aware about environmental impact so key players are constantly looking to develop sustainable packaging material that will not affect the quality of these ready-to-eat food products. Such factors have increased the scope and reach of this type food products and by association for the ready-to-eat packaging industry.

| Sustainable Packaging | Eye Catching-Designs |

| The emphasis on sustainability in ready-to-eat food packaging is one of the most noticeable trends. Customers want firms to be responsible as they grow more conscious of environmental challenges. | A key factor in gaining customers' attention is packaging design. Brands must differentiate themselves from the many products vying for store space. |

| Consequently, there is an increasing need for environmentally friendly packaging materials. Using recyclable, compostable, or biodegradable materials is part of this. | Designs that capture the eye with vivid colours, strong typography, and imaginative patterns are becoming more and more common. Still, an eye-catching design is insufficient on its own. |

| To limit waste, brands are also choosing smaller packing sizes. By following this trend, businesses support the broader effort to combat pollution while also appealing to environmentally concerned consumers. |

|

| Personalised for Consumers | Transparency In Packaging |

|

In an era where health and safety are paramount concerns, transparency in packaging has become crucial. Consumers want to know what they are consuming and expect accurate information. |

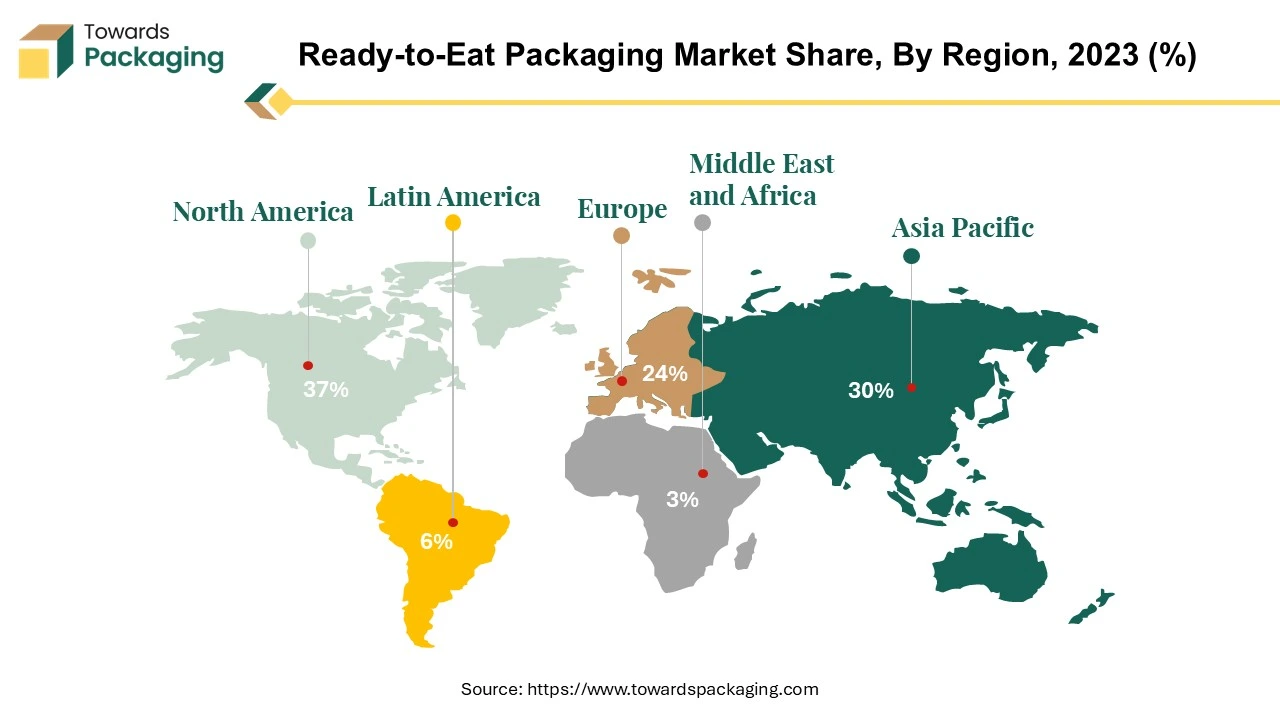

A significant increase in demand, stimulated by a dynamic consumer culture and an increasing preference among consumers for easy meal solutions, has taken place in the North American ready-to-eat food market, notably within the United States. Major retailers like Wal-Mart, Kroger and Albertsons dominate the retail market in the United States which has made it much more challenging for manufacturers to come up with innovative product concepts as well as packaging.

In the U.S., which is a key component of the ready-to-eat sector, strong growth could be expected from this market in flexible food packaging. North America represents about 30 per cent of the global consumption of flexible packaging. A key factor underpinning this upward trajectory is expected to be the increase in demand for on-the-go and cartons of ready-to-eat food. The need for packaging solutions that are in line with the lifestyles of on-the-go consumers is stimulated by their evolving habits based on a preference for fast and simple meal options.

Consumer preference for ready-to-eat foods is growing with the fast pace of modern life, giving priority to convenience as a key criterion when making their purchase decisions. In response to these trends, the North American packaging industry has been adapting and is providing new solutions that are suited to the specific needs of ready-to-eat food within the US.

The concept of single-serve packaging for breakfast cereals has made a very strong impression on the North American market. Demand for part-controlled individually packaged cereal, fruits, and meat packages has increased due to the crowded schedules of consumers. It is not just the convenience that improves, but also concerns relating to overcapacity and wastefulness are addressed in these simple serve packages. The packaging sector's ability to adapt to changing consumer demand and its commitment to providing solutions that meet the practical needs of today's households are illustrated by how it responds to these demands.

Packaging innovations will play a key role in shaping the North American market for ready-to-eat food, as it continues to grow. To exploit packaging solutions that meet both convenience requirements as well as sustainability goals and environmental consciousness, manufacturers and retailers are going to have to stay on top of changing consumer behaviour and preferences. In future, the evolution of ready-to-eat food packaging in a dynamic North American market will probably be driven by an intersection between convenience and sustainability.

China has established itself as the dominant player in the global market for ready-to-eat packaging materials. The country is the largest supplier of this industry due to its extensive production capabilities, technological progress, and robust supply chain. To meet the different needs of the ready meals sector, China's packaging industry is taking advantage of a large variety of materials, which includes plastic, paper and metal. Notably, Chinese manufacturers have been investing in innovative packaging solutions and sustainable materials to align with global trends and environmental concerns.

Ready-to-eat snacks like dosas, idlis, pav bhaji, etc., are marketed over the counter and boast a brief shelf life. Consequently, their packaging requirements differ significantly from those of other ready-to-eat products, such as upma, curry rice, and vegetable biryani, which undergo retort processing for extended shelf life. Retort processing is applied to products like Dal fry, Palak paneer, Curry rice, vegetable biryani, Upma, etc., as they fall under the category of low-acid food with a moderate to large particle size, facilitating the removal of oxygen from the headspace through gas flushing. The selection of polymers or combinations is carried out with careful consideration of the barrier properties needed. The retort pouch serves as a specialized packaging solution, employing physical and chemical methods to preserve perishable food items. This flexible laminate can withstand thermal processing, combining the benefits of a metal can and a boil-in-bag, ensuring the product's longevity and quality.

For Instance,

Ready-to-use Retort pouches are flexible packaging composed of many plastic layers, either containing or lacking an aluminium foil layer. Unlike typical flexible packaging, these plastics can withstand heat and can be processed in retorts at temperatures reaching as high as 121°C. These retort pouches typically need to be robust and puncture-resistant for any flexible packaging. It can also withstand the demanding conditions of processing and distribution. The pouches are printed in eye-catching colours. The retort pouch is a compact package in terms of design. Since it does not require adding brine to the food, it is a good alternative to tinplate cans. There will undoubtedly be a market for retort pouches in the future.

In the coming years, retort packs will become as acceptable as, if not better than, metal glass or containers. Additionally, the retort pouch can save about 60% of the energy used during processing. given that the product is sterilised and does not require refrigeration for storage.

Breakfast, which is typically consumed by 79% of global consumers, continues to be the most frequent eating occasion for cereals. However, the opportunity for manufacturers to refine their messaging, flavour profile and even package to be more focused on that occasion is emerging due to the increasing popularity of snack cereals. Consumers are reaching for cereal as a morning (28%), afternoon (25%), and evening (19%) snack, as well as for lunch and dinner.

23% of consumers globally reported consuming more cereal over the past year, and more than half of them attributed this increase to the health of the countries with the biggest recent increases in consumption—Vietnam (47%), India (39%), Saudi Arabia (36%), and Thailand (35%)—the majority of which are in Asia, suggesting an emerging opportunity in this sector.

Packaging of ready-to-eat breakfast cereal or pulses plays a crucial role in the market due to its shelf-life concern and protection of food content, there are various food packaging available in the market for breakfast cereal as an attractive and protective means for instance, resealable packaging, single serving packs, cereal boxes, and flexible laminated pouches.

Introducing a cutting-edge resealable packaging solution in the cereals market, this innovation not only offers enhanced convenience for consumers but also contributes to a significant reduction in environmental impact compared to conventional boxed packaging. The use of polypropylene as the primary material in these resealable bags ensures durability and sustainability, aligning with evolving consumer preferences for eco-friendly alternatives.

Single-serve package in breakfast cereals is designed to meet contemporary, on-the-go lifestyles and offers a convenient portable solution for consumers. By preventing overpouring and maintaining freshness, these individualised pieces not only make the use of them easier but also reduce waste. Single Serve Cereal Packaging ensures quick, easy consumption in a time of busy schedules and changing consumer habits, making it the preferred breakfast option for those who seek to avoid headaches and hassles by controlling portions.

For Instance,

By extending the shelf life and maintaining the freshness of every food group, modified atmosphere packaging (MAP) eliminates the need for chemical additives or preservatives. MAPs accomplish this by filling the packing with a blend of nitrogen, carbon dioxide, and pure oxygen. As such, the term "MAP" is also used to refer to the reduction in oxygen packaging. By keeping products from spoiling, MAP helps to avoid product degradation and is also economical because it saves money. Additionally, packaged food has gained market share and customer loyalty due to its seeming purity and better flavour and scent.

For ready-to-eat meals, food can also be kept fresher longer by using vacuum skin packaging, or VSP. The ready meal can be contained using the VSP film technology so that it is secure, and the container is not distorted or damaged in any way. The film and tray entirely seal together when it is time to eat, ensuring a ready-to-eat, fresh meal. Give customers whole, fresh food that is free of deterioration and damage.

In ready-to-eat (RTE) packaging, the competitive landscape is shaped by prominent players such as Amcor Plc, Berry Global Group Inc., CCL Industries Inc., Constantia Flexibles Group GmbH, FLAIR Flexible Packaging Corp., Mondi Group and ProAmpac Intermediate Inc. stands out with its global reach and commitment to sustainable packaging and variations in their packaging technology convenient for the consumers, while Amcor Limited positions itself with comprehensive packaging solutions and a focus on eco-friendly materials, Flair is continuously innovating to develop solutions that do more, with less material & impact. The market dynamics reflect regional consumer preferences and regulations variations, with companies adapting strategies accordingly.

Investments in safe and sustainable E-commerce solutions are being driven by the impact of electronic commerce on packaging design and durability. The importance of resilient supply chains has become clear from recent global disruptions, which will lead companies to reconsider their business strategies for increased adaptability. Finally, the market balance between sustainability, innovation and adaptability to local dynamics is crucial for success in ready-to-eat packaging. Companies that navigate these factors adeptly are poised to lead in this competitive landscape.

By Application

By Material

By Region

April 2025

April 2025

April 2025

April 2025