February 2025

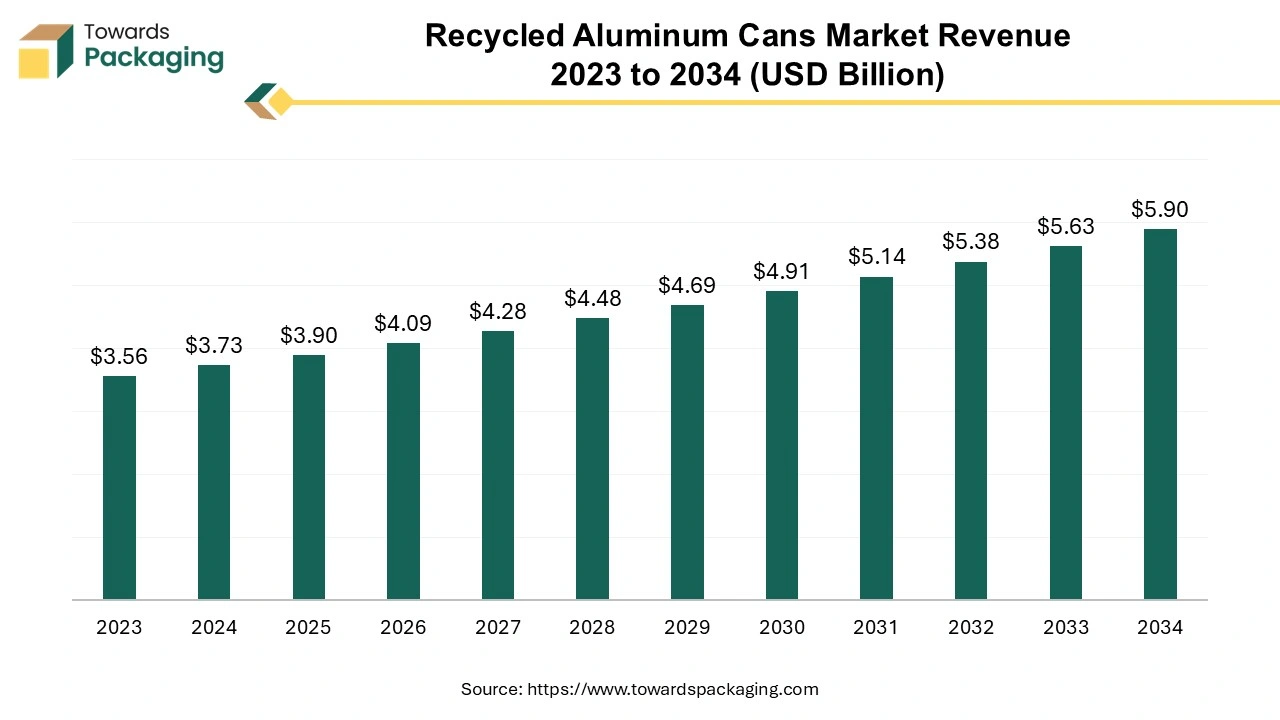

The recycled aluminum cans market is anticipated to grow from USD 3.90 billion in 2025 to USD 5.90 billion by 2034, with a compound annual growth rate (CAGR) of 4.7% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The market is flourishing due to the increasing medical sector, food and beverages, beauty and cosmetic brands, and several others which require aluminum cans to store various products in different sectors. The growing concern for health, hygiene, and medical cases is boosting the recycled aluminum cans market.

The recycled aluminum cans market plays a significant role in the packaging industry and it is driven due to its sustainable packaging solution. Aluminum is an important metal that is used in various industries such as food, transport, power transmission, construction, and electronics. It is well-known for recycling as it requires less energy for the recycling process and is highly valuable as scrap. When aluminum metal is recycled, it stays the same quality as its basic construction remains the same even after melting several times. This property makes it both environment-friendly and cost-effective. Only 5% of the energy is required for recycling aluminum than to make new aluminum cans, but all the properties of the metal stay still the same as the original one.

Aluminum can be recycled over and over again without losing any of its quality. Aluminum cans are lightweight and durable and have excellent barrier properties hence widely used for storage to preserve food and beverages for a longer duration. Due to the continuous rising concern towards healthcare among people, the demand for aluminum can packaging has enhanced to keep food and beverages safe and protected from contamination.

Aluminum cans are widely preferred in pharmaceutical packaging as these metals have unique natures and benefits. These cans are highly used in the pharmaceutical sector due to their influence on medicine storage and safety purposes. Aluminum cans are extensively used in medical packaging because of their extraordinary barrier properties. These are suitable for protecting medications from moisture, air, and light, and airtight sealing. This property is mainly important for complex medicines and these features, as the integrity and effectiveness of the medications can be well-maintained for extended periods. The global packaging industry size is growing at a 3.16% CAGR between 2025 and 2034.

Artificial intelligence is useful for the recycled aluminum cans market in multiple ways that inspire market players to use it. It helps to enhance the recycling of aluminum cans packaging purpose. This is beneficial in estimating the reduction of waste as well as the consumption of energy by analysing the production pattern of the packaging materials. By utilizing the sensor data which can deliver useful statistics for the improvisation of products. With the usage of artificial intelligence data analysis features the quality of the materials used to make recycled aluminum cans packaging can be recognized to detect its capacity for recycling.

Such detection makes the recycling process quite easier and enhances the production of good quality material for a variety of packaging purposes. The quality of these products plays a significant role during the recycling process. With this, the wastage of products can be reduced and influence eco-friendly production. Production facilities can be enhanced with artificial intelligence. It can decrease the consumption of energy needed for the production process and reduce the wastage of materials. Analysing the demand for the product before its production can reduce the wastage of products. With artificial intelligence analysing huge data is possible to produce according to the requirement.

Governments of foremost countries in the world are realizing strict guidelines to manufacture recycled aluminum cans to decrease waste and endorse sustainability. Development in environmental awareness concerning the growing negative impact of surplus production on the environment and the value of resource conservation is anticipated to drive the recycled aluminum cans market development shortly. Recycled aluminum cans aid in reducing the amount of excess thrown into landfills. It also assists in protecting natural resources, as recycling needs less energy and resources than manufacturing new aluminum cans. This allows numerous industries to endorse sustainability, decrease their carbon footprint, and restrict requirements on ores for producing raw aluminum. These benefits are enlarging the request for recycled aluminum cans in various sectors such as packaging, automotive, and construction. This is likely to outgrowth the recycled aluminum cans market development in the upcoming years.

Developments in recycling techniques have made processing, production, recycling, and fabrication procedures more well-organized and cost-effective. This is allowing numerous markets to enhance energy efficacy, decrease waste and releases, and expand efficiency. The charge for recycled aluminum cans is frequently less than that of new aluminum cans which makes it a cost-effective substitute for producers. Hence, technical progressions in producing recycled aluminum cans boost the growth of the market.

There are numerous ecological difficulties related to the recycling of used aluminium products these issues are the main challenges for the recycled aluminium cans market. Here are a few of the problems associated with the recycling of aluminium cans. Recycling aluminum products requires less energy than is needed to produce new products from raw materials. In numerous countries, there are different laws for waste disposal. Hence, these are the major factors that` hinder the growth of the recycled aluminum cans market. In some cases, it is instructed not to use aluminum as it reacts with salty or acidic foods when aluminum ions come in contact with such foods are acidic or salty aluminum ions start dissolving and get into food items. Due to these reactive properties, many companies avoid using recycled aluminum cans for their product packaging.

Apart from beverage packaging only, recycled aluminum cans are expanding their ways into additional applications. Recycled aluminum cans are used more frequently in the automotive industry to manufacture lightweight car machinery that reduces the weight of the vehicle and raises fuel proficiency. Because of its durability, resistance to corrosion, and sustainability recycled aluminum is also used by the construction sector for various structural workings, cladding, and roofing.

The market is anticipated to develop as more usage for recycled aluminum grows, which as a result enhances the demand for recycled aluminum cans. Plastic and aluminum both are non-biodegradable products but aluminum can be recycled numerous times so it is considered the best fit for packaging purposes by various industries. The enormous production of aluminum benefits major market players to experiment with several methods that can be sustainable, eco-friendly, durable, cheaper, lighter in weight, and many such advantages that can attract several businesses to use this material as a packaging solution.

In the recycled aluminum cans market the curbside pickup spots source segment is anticipated to govern the market during the predicted period. Curbside recycled products are the most extensively used method for the collection of aluminum cans. Commercial spots and residential places distinct recyclable products from their other waste and keep them in different recycling bins or spaces to help waste management market employees collect them. Several recycling programs naturally allow aluminum cans with other recyclable materials such as plastic, glass, paper, and plastic. These recyclable aluminum cans are shifted to a place where they are stored, segregated, cleaned, and then processed to recycle into new aluminum products. The recycled aluminum cans market has a significant role in the packaging industry, indicating a substantial shift towards eco-friendly and sustainable packaging solutions in the catering, food and retail sector.

The major market players are regularly introducing innovative designs and production methods for aluminum cans. These are widely used in the food & beverages industry as they keep drinks safe for long-term storage.

| CHINA | 2021 | 2022 | 2023 |

| Volume (KG) | 15,180,798 | 25,947,970 | 24,603,285 |

| Value (USD) | $56,216,384 | $112,086,402 | $90,145,613 |

This closed-loop recycling segment held the largest share of the market in 2024, the segment is expected to hold the largest share of the recycled aluminum cans market. In this process, all the scraped aluminum is recycled under a closed loop and then manufactured into a new product. This process of continuous production of recycled aluminum happens in a loop for indefinite times. These are preferred as they can be sterilized easily which makes them ideal for keeping everything contamination-free. Aluminum recyclable nature makes it more suitable as it can be reused even after any kind of damage.

The food & beverages segment is expected to dominate the recycled aluminum cans market. Soft drinks are generally packaged in aluminum cans as they are considered to be non-reactive which makes them easy to store for a longer period. These are also convenient to transport from one place to another this leakproof quality makes them preferable to the industry. Various market players are working constantly to provide the best quality packaging solutions that can be useful to keep food items safe and protect them from contamination. As people in majority are seeking ready food which is a hassle-free option for having a meal. Due to eco-friendly properties, there is a huge investment in this sector from government as well as private companies that led to the development of various methods which are beneficial in several ways.

Europe is considered to hold the largest share of the recycled aluminum cans market during this predicted period. Due to the growing concern for environmental issues, the government of several countries have implemented strict guidelines for packaging industries which has enhanced the recycling process of aluminum cans. This also led to an increase in the picking up of aluminum scraps and recycling with cleaning into other materials.

The growing concern among people about the environmental impacts forced industries to use recycled aluminum cans in countries like the U.S., Canada and others. Recycled aluminum cans are extremely favoured because of their recyclable nature and low carbon footprint during production. Due to regular efforts from the government as well as major market players the usage of plastic is reduced by promoting such elements which are eco-friendly and cost-effective solutions. The rising health concern also forbids people from using plastic materials instead preference for aluminum packaging increased. These are reliable solutions for packaging as they maintain food quality as well as easy to recycle.

By Source

By Technology

By Type

By End Use

By Region

February 2025

February 2025

February 2025

February 2025