The aluminium cans market is forecasted to expand from USD 65.22 billion in 2026 to USD 99.45 billion by 2035, growing at a CAGR of 4.8% from 2026 to 2035. The report provides detailed segmentation by packaging type (standard, sleek, slim), end user (food & beverage, pharmaceuticals, cosmetics, paints, chemicals), and distribution channels.

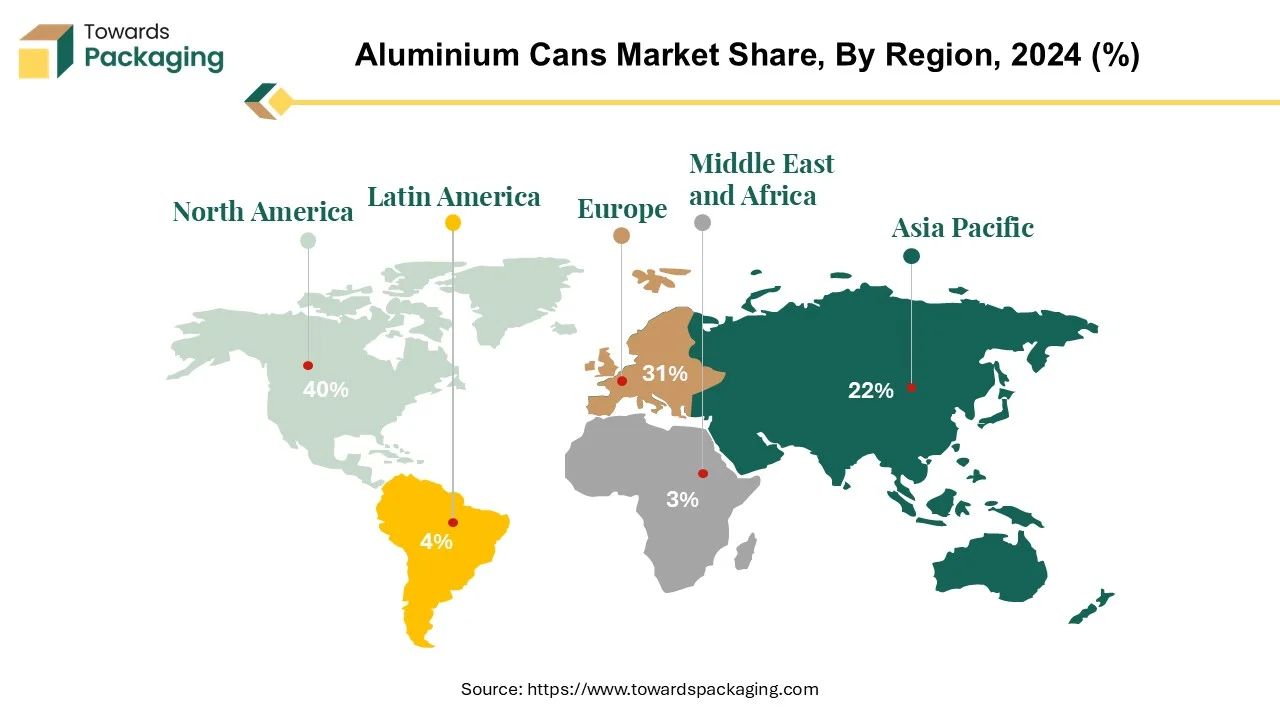

It includes regional coverage across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, with North America and Europe collectively dominating over 60% of global consumption. The study further covers value chain analysis, trade flows, cost structures, and benchmarking of leading manufacturers such as Ball Corporation, Crown Holdings, Amcor, and Ardagh Metal Packaging.

Aluminium cans for beverage are even more preferable because of their light, yet sturdy structure, which will considerably help to lower the bills for shipping and to improve product preservation. They provide 70% cost benefits over conventional glass bottles and are aligned with major stringent environmental standards. The market growth of North America is a slightly increasing trend which users want different beverages. The European zone also decides to manufacture more aluminium cans as a result of green tendency. Distributing channels are the essential functions in the aluminium cans industry, which is led by the renowned companies that do their best to maintain their competitive advantage through innovation and sustainability.

Aluminium beverage cans have become the cornerstone of the packaging industry, particularly in the beverage sector. Their prevalence can be attributed to a myriad of advantages over other packaging options. Aluminium cans are incredibly lightweight, making them easy to transport and handle. This characteristic not only reduces shipping costs but also enhances convenience for consumers. Their strength and durability ensure that beverages remain intact throughout the supply chain, minimizing the risk of damage or spoilage.

A significant advantage of aluminium cans lies in their superior barrier properties. They effectively shield the contents from light and oxygen, thus preserving freshness and quality. Unlike some packaging materials, aluminium cans require no additional coatings to maintain product integrity. Their resistance to rust offers a distinct advantage over steel cans, contributing to a longer shelf life and better overall product presentation.

Economically speaking, aluminium cans offer cost advantages compared to glass bottles. Their production is more efficient, and they are less expensive to manufacture and transport. This affordability extends to consumers, making aluminium cans an attractive choice for both producers and buyers.

The popularity of aluminium cans has surged, particularly in the beverage industry. Attributes such as sustainability and portability have positioned aluminium as a preferred packaging material. Additionally, its compatibility with emerging beverage trends has further fuelled its growth. Notably, the global consumption of beer and soda alone accounts for a staggering 180 billion aluminium cans annually, equivalent to 6,700 cans per second. This immense demand underscores the indispensability of aluminium cans in the modern beverage market, emphasizing their pivotal role in shaping industry dynamics. These drives the aluminium cans market growth.

The Aluminium can market of North America presents a consistent increase, therefore bringing a bright future outlook. It is estimated that the consumption of an Aluminium beverage can will persist at an annual 5% average rise until year 2030. By that year, remarkable 152 billion units of beverage cans will be sold in the region, which is the main indicator that North America remains the main force in the global market of Aluminium cans. Many factors are involved in this ground of expansion. The appearance of new beverage classes, including hard seltzers in the US, canned water in the US and Canada, and increased demand for canned beer, not only creates a higher demand but also it is a driving force behind the production of Aluminium beverage cans. The most common trend is the demand of users of metal cans instead of other types of containers.

Aluminium is considered as sustainable material because of its ability for highly recyclability and lightweight features. Consumers today tend to be environmentally conscious, making them link Aluminium beverage cans with the premium drinks. Consequently, this perception feeds the general public's need for Aluminium beverage cans in the region.

While there is high demand for aluminium cans, the local aluminium producers including the rolling mills and billet re-melters have faced a tough time. They've been hit with a significant decrease in sales that has forced them to close regularly or operate at half-capacity or less at times, 30%-40%. This redesign is to adjust production to match market fluctuations in demand in order to assure operational effectiveness regardless of the changing market circumstances.

The aluminium can market of North America will advance further fuelled by the advancement in consumer preferences, ec-owise approach, and growth in beverage sector. Agility is a must for the players within the industry as they should be ready to deal not only with challenges, but also be proactive in spotting future opportunities.

For Instance,

The European market for the aluminium beverage cans has demonstrated an increase in the demand which can be mostly attributed to the consumption of soft drinks, acquired waters, beers, and seltzers. This growth will probably hold out over the next decade, and will be accompanied by a significant move across the EU from tinplate to aluminium cans.

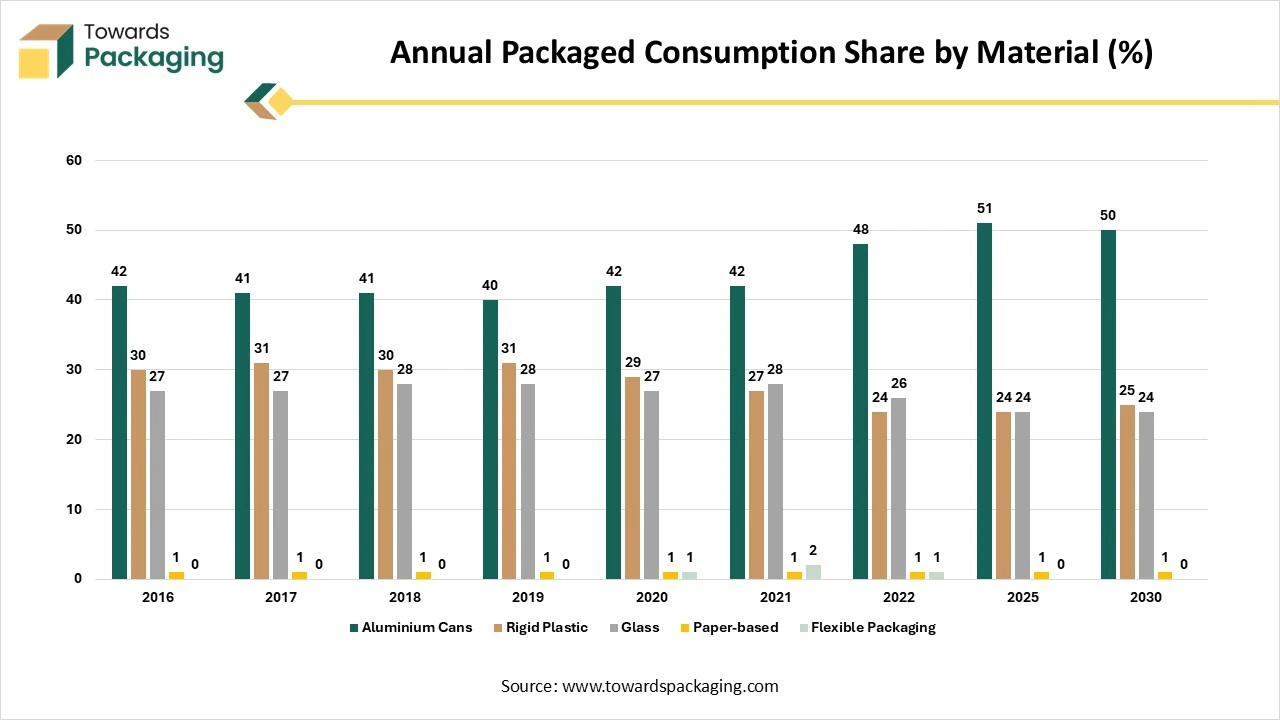

The global consumption of Aluminium in package applications was 95.7 million tonnes in 2022 which is speculated to attain the figure of 97.1 million tonnes by 2023 with a growth rate of 3.3%. This surge in demand for Aluminium largely happens for cans, packaging foil, and pharmaceutical packaging. The majority of canned beverage companies, including the Ball Corp and Crown, will mainly move their lines from tinplate to aluminium cans in the form of beverage packaging in the coming years in France and Spain. With this strategic approach being in line with the demand for aluminium cans for the reason of their being lightweight, recyclable, and environment-friendly.

It is estimated that 109 billion cans of aluminium will be produced in Europe alone by 2030. Therefore, the exponential increase in aluminium cans in the region will contribute to the large share of the beverages packaging market. Along with the rise of awareness about environmental protection, the preference of aluminium cans over the conventional tinplate cans as a packaging choice is likely to grow, thus accelerating the shift from traditional types of packaging. The movement towards aluminium cans in Europe signifies a major global move towards more eco-friendly packaging material. As the main players from the sector increasingly intend to this change, the European beverage industry is soon going to see continued increasing usage of aluminium cans, redefining the packaging environment for years.

A standard and increasingly popular beverage cans made of two Aluminium pieces joined at seam as far as the beverage industry packaging choice goes. Its design guarantees a secure enclosure, keeping the freshness and quality of the commodities still intact at the same time rendering services conveniently accessible for the consumers. These cans are almost as omnipresent in the drinks industry as carbonated drinks, juices, and energy drinks, providing a cost-efficient alternative that is sturdy and portable.

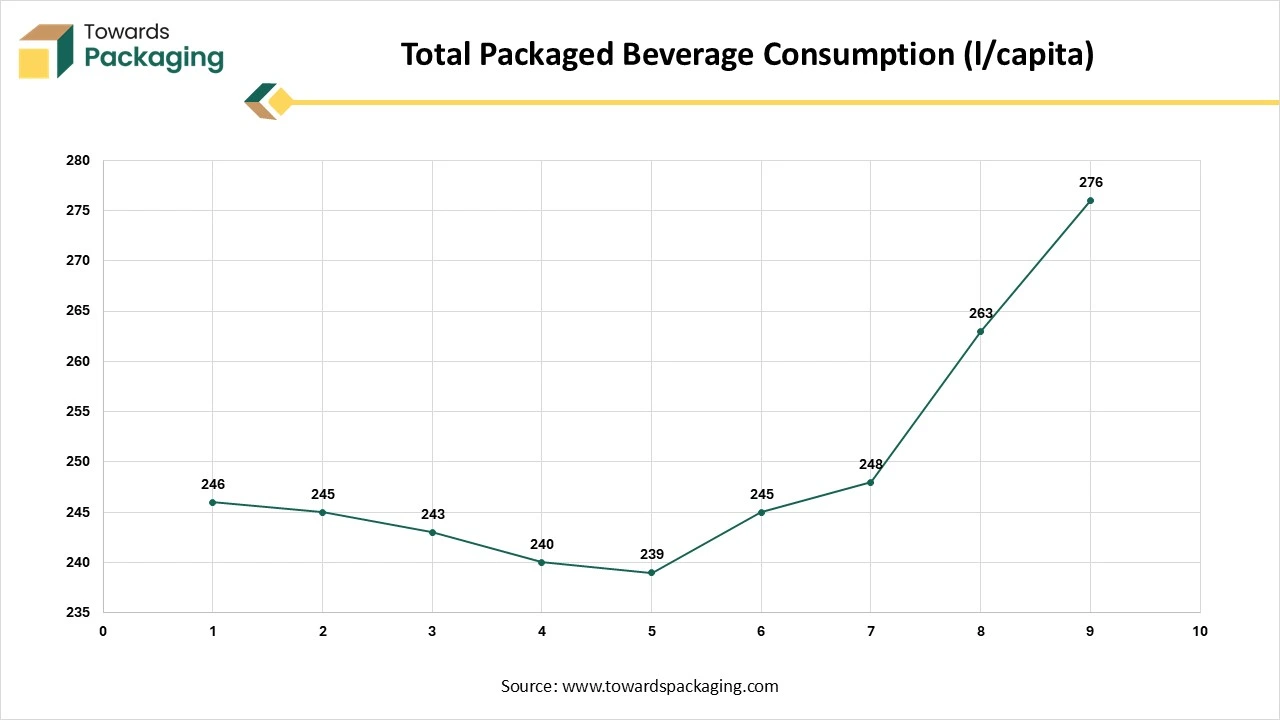

The standard Aluminium can have been evidenced to develop at a fairly high pace. These wins can be attributed to a number of different factors. developers and consumers are attracted to the comfort and familiarity of the standard; thus, it is more likely to be their preferential choice. In parallel with the rising consumption of drink per capita and the enlarging beverage market, the Aluminium can demand also grow. In addition to that first generation of cans had within their manufacturing technology the enhancement of the printing technique and the improvement of the material strength that helped the cans to increase their appeal and versatility.

This approach runs with consumer preferences for time-saving functionality and reliability despite the fact that traditional tin cans are used. In the end, the standard Aluminium beverage can is going to be a key part of the industry as it is well situated in terms of growth and development that will be aimed at serving the needs of the consumers and the trends in the market. People in the beverage industry are very cognizant of choice. It is the brand so for years until its real offering.

The can beverages serve as the primary application for aluminium packaging which is the symbol of the sustainable style by consumers and manufacturers. These cans are not only dedicated to environmental friendliness but also ensure the beverages are kept well, which has a 100% recyclable rate. The adaption of BPA-free Aluminium bottles has also driven forces as a chemical free packaging option.

As aluminium cans for a variety of beverages become more popular in both developed and developing economies, their growth is cosine-shaped.

The major reasons backing these positive figures are excellent performance in the majority of Red Bull’s markets worldwide, contributed highly to this, as well as the close attention to cost management and brand investment. Downgauging is an inherent risk to the packaging business sector. However, with its wide application, aluminium cans are extensively used as food containers for vegetables, soups, fruits, pet food, and meats, which reflect their infinite possibilities and significance to packaging industry. Promoting consumers to try to choose a good packaging option of food which will bring about remarkable effects on health. They assist to the progress of the market of aluminium cans.

For Instance,

Retail distribution channels assume a vital part when it comes to the industry development of aluminium cans by making sure the wide availability of these products all around the consumers. Aluminium cans can be distributed through retail channels such as supermarkets, convenience stores, and internet platforms to reach diverse and far-larged consumer groups. Usually, retailers’ deal with large networks and adroit partnerships with beverage companies to promote aluminium cans which implies the multiplying of their sales volume and market penetration.

| Company | Market Capitalization | Sales |

| Hindalco Inds. | 138125.16 | 52808 |

| Natl. Aluminium | 33683.83 | 3346.9 |

| Arfin India | 846.27 | 115.44 |

| Maan Aluminium | 820.2 | 212.97 |

| MMP Industries | 771.34 | 140.87 |

From one aspect, the aluminium companies are a key for the market growth while implementing some activities. These factories will be dedicated to research and development, and they will work to improve the quality, sustainability, and affordability of aluminium cans. As a result, these cans will become more favorable for both manufacturers and consumers. Furthermore, Aluminium manufacturers link with beverage companies on developing new packaging ideas to fulfill evolving client’s desires and market trends.

Aluminium producers running marketing activities and promotions aims at highlighting the aluminium cans benefits, which include its recyclability, durability, and environmental friendliness. These companies try to inform consumer and retailers about the uses of aluminium packaging, which helps to increase the demand of aluminium cans market and thereby stimulate its growth. This is, particularly, the symbiotic bond between the aluminium companies and the distribution channels that helps to lead to further expansion of the aluminium cans market.

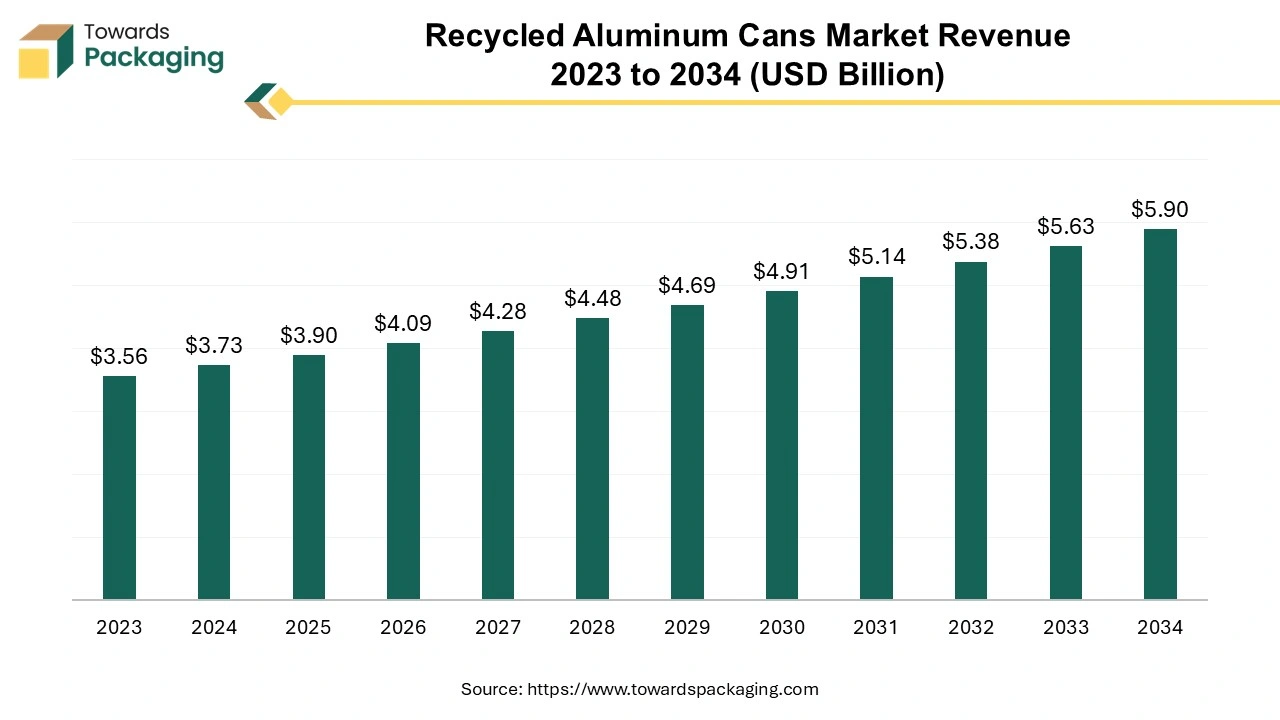

The recycled aluminum cans market is anticipated to grow from USD 3.90 billion in 2025 to USD 5.90 billion by 2034, with a compound annual growth rate (CAGR) of 4.7% during the forecast period from 2025 to 2034.

The market is flourishing due to the increasing medical sector, food and beverages, beauty and cosmetic brands, and several others which require aluminum cans to store various products in different sectors. The growing concern for health, hygiene, and medical cases is boosting the recycled aluminum cans market.

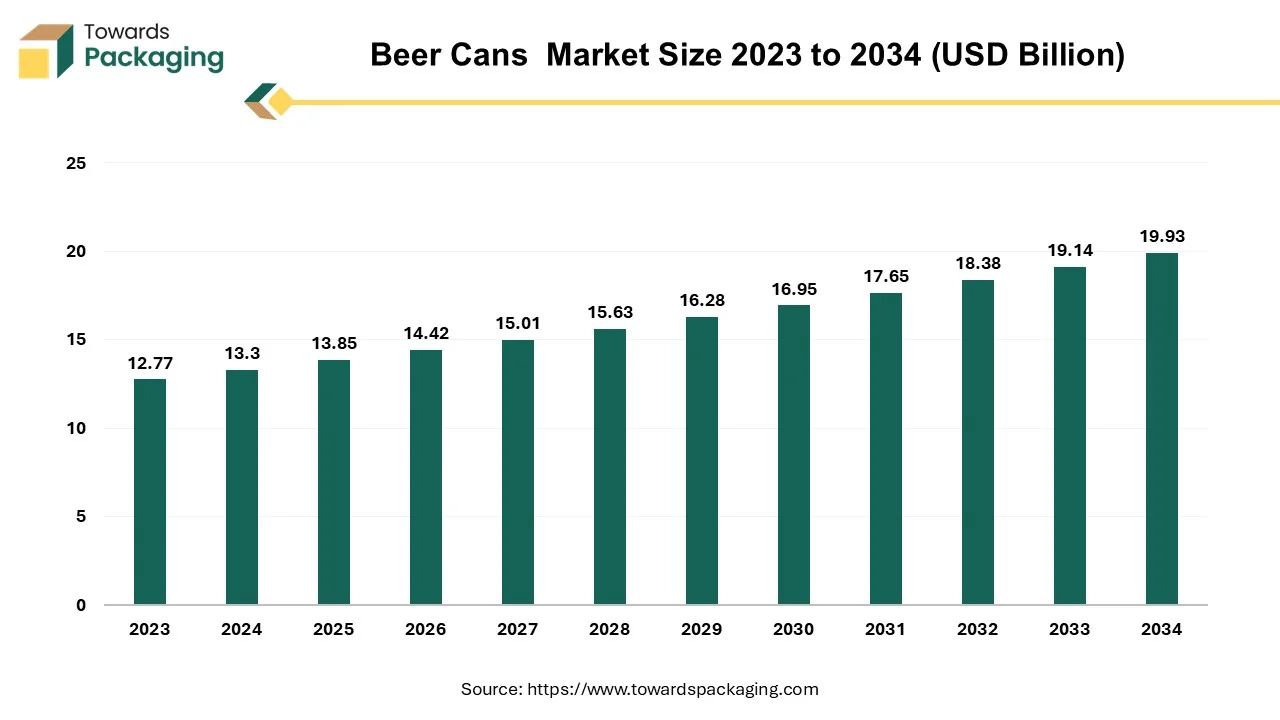

The global beer cans market is expected to increase from USD 13.85 billion in 2025 to USD 19.93 billion by 2034, growing at a CAGR of 4.13% throughout the forecast period from 2025 to 2034.

Rising beer consumption is projected to drive the growth of the global beer cans market over the forecast period. Cans are estimated to be the preferred and favoured choice of beer manufacturers when releasing limited-edition beer cans and other promotional events.

The beer cans market refers to the industry involved in the production, distribution, and consumption of beer packaged in cans. Beer cans are typically made from aluminum or steel. Aluminum cans are more popular due to their lighter weight, recyclability, and ability to protect beer from light and oxygen, which can affect taste.

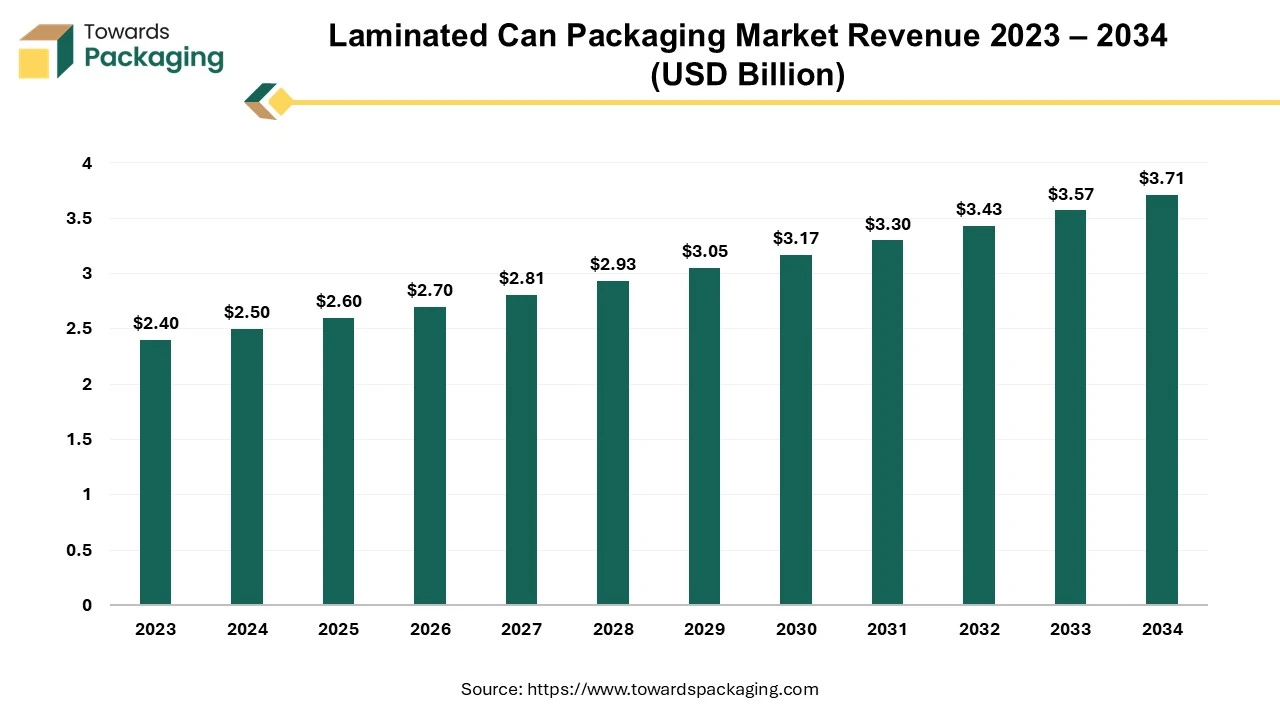

The global laminated can packaging market size reached US$ 2.50 billion in 2024 and is projected to hit around US$ 3.71 billion by 2034, expanding at a CAGR of 4.05% during the forecast period from 2024 to 2034.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing laminated can packaging which is estimated to drive the global laminated can packaging market over the forecast period.

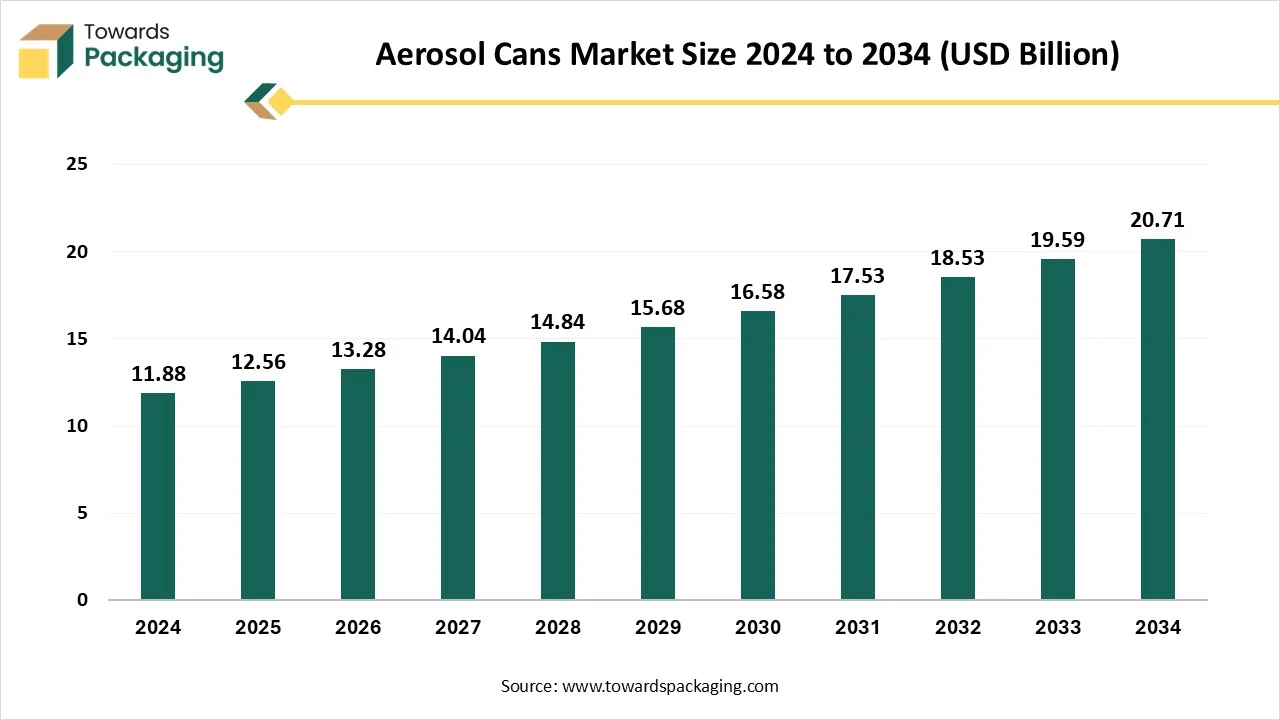

The aerosol cans market is projected to reach USD 20.71 billion by 2034, expanding from USD 12.56 billion in 2025, at an annual growth rate of 5.75% during the forecast period from 2025 to 2034. Expansion of the e-commerce sector, expansion of automotive and industrial applications, and increasing use in automotive and industrial applications contributing to the growth of the aerosol cans market.

Aerosol cans prove to be cost effective for both producers and consumers, while being incredibly convenient for transportation, storage, and packaging. Steel aerosol containers stand out for their ease of use and efficiency. It needs just a quick finger press for most applications.

The competitive landscape of the aluminium cans market is dominated by established industry giants such as Ball Corporation, Crown Holdings Inc., Amcor, Ardagh Group S.A., Hindustan Aluminium Company (HINDALCO), Novelis, Silgan Containers LLC, TricorBraun, Toyo Seikan Co., Ltd., Suntory, Nampak Ltd., CCL Industries Inc., CPMC Holdings Inc., Kian Joo Can Factory Berhad, and CAN-PACK S.A. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

BALL aims at advancement and keeps innovation on the whole for moving ahead, with constant creation of new designs and the technologies to meet all these new consumer demands. They play a pivotal role in the process, too, by emphasizing the sustainable production of aluminium cans areas like light-weighting and recycling systems.

The main emphasis is on product individuality and service orientation to outperform the competitors. They spend big on research and development to make these new edgy packages and keep up the friendship with beverage producers. By the same token, Crown concentrates on operational outputs and cost management to achieve the utmost profitability.

Amcor offers customized packaging solutions to their clients, bringing better service. They employ their worldwide network of operations and amplify their proficiency in aluminium packaging to deliver the wide array of options such as cans, pouches, and bottles. Amcor places great emphasis on environmentally friendly products and operations, reducing possible adverse effects on the environment.

Ardagh emphasizes Vertical Integration, mastering different stages of the production process and improving quality and efficiency. They like client participation as they partner closely with other beverage companies to roll the sleeves up and create bespoke packaging solution. Ardagh consequently takes a step forward to upgrade its technology and capacity expansion as a response to the growing use of aluminium cans.

By Packaging Type

By End User

By Distribution Channel

By Region

January 2026

January 2026

January 2026

January 2026