April 2025

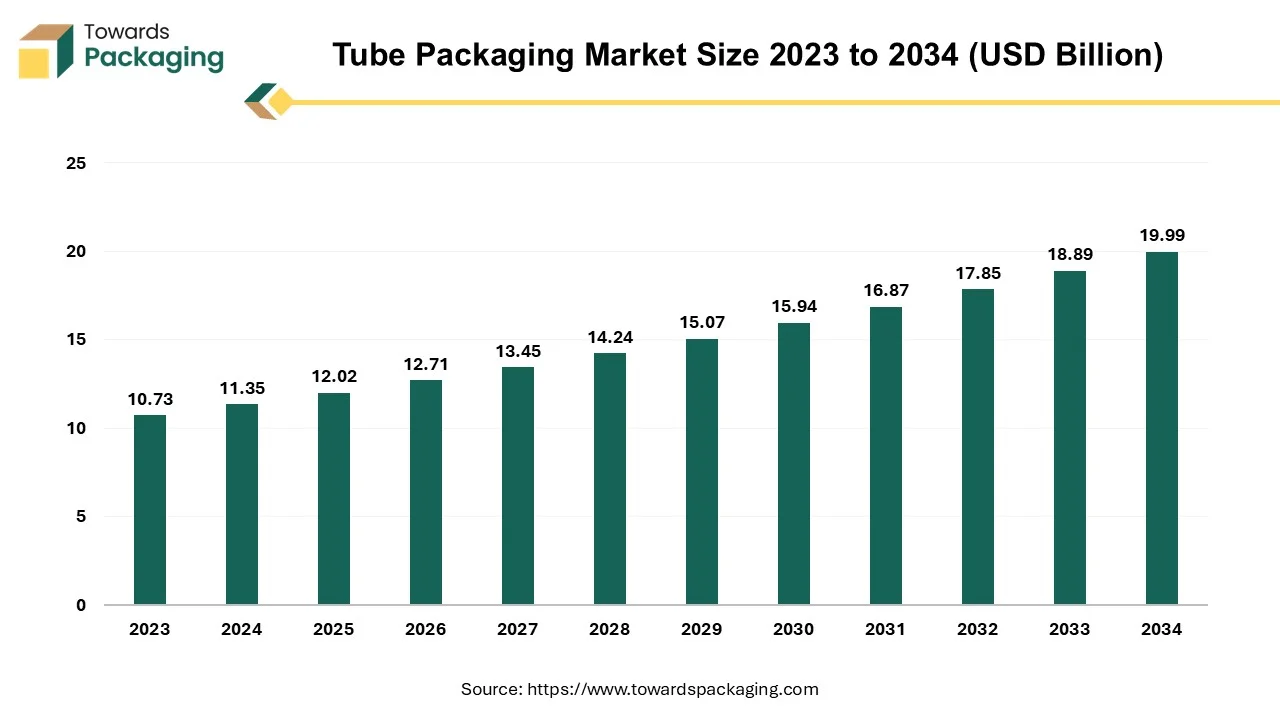

The tube packaging market is projected to reach USD 19.99 billion by 2034, growing from USD 12.02 billion in 2025, at a CAGR of 5.82% during the forecast period from 2025 to 2034.

A number of brands are choosing to package cosmetics and various other items in tubes. It is widely used for thick liquids, gels, ointments and the creams. Since it provides a layer of protection that keeps the contents from breaking, it can also be utilized for solids. Tubes may now store a wider variety of contents due to the development of plastic tubes rather than aluminum ones. Nonetheless, tubes made of cardboard with eco-friendly credentials and aluminum tubes are still widely used. Tubes are increasingly chosen as packing container for many products since tube closures come in a variety of sizes and forms. Apart from their affordability, eco-friendliness, and ability to safeguard active ingredients, they are also highly adaptable and convenient. Thus, the tube packaging market is anticipated to augment with a considerable CAGR during the forecast period.

The growing consumer preference for convenience and ease of use in household products coupled with the rise of e-commerce and online retailing is anticipated to augment the growth of the Tube packaging market within the estimated timeframe. The growing awareness and concern for environmental sustainability along with advancements in packaging technology are also expected to support the market growth. Furthermore, the expanding middle-class population in emerging economies as well as the rising disposable incomes and changing lifestyle patterns is also likely to contribute to the growth of the market in the years to come. The global packaging market size to grow at a 3.16% CAGR between 2025 and 2034.

The global trade of plastic products is booming, with numerous companies engaging in significant shipments across international waters. Recent data highlights key players, loading and unloading ports, and the scale of transactions, reflecting the dynamic nature of this market segment. Here’s a closer look at some notable transactions in the plastic industry:

This shipment illustrates a strong demand for plastic products and the efficient logistics between the Dominican Republic and Puerto Rico.

This significant import activity underscores Fetzer’s strategic trade relationships within the Americas.

This collaboration highlights strong ties between German manufacturers and U.S. distributors in the scientific and industrial sectors.

These shipments reflect the ongoing demand for plastic products in various U.S. markets.

This transaction highlights the strong trade relationships between European manufacturers and U.S. importers in the beverage industry.

The growing demand in personal care and cosmetics is likely to support the growth of the market during the forecast period. This is owing to the increasing awareness of beauty products, changing consumption patterns, growing personal grooming and improved purchasing power of women. When it comes to buying makeup, women's shopping behavior differs significantly compared to that of the other genders, particularly men. The myth that women need to spend huge amounts on cosmetics so as to be viewed as "attractive" has undoubtedly been supported by the past systems of patriarchy and "feminine" beauty standards.

Furthermore, for generations, inflexible beauty standards have shaped women's perceptions of attractiveness, greatly boosting the cosmetics industry's revenues. Women's sense of value, confidence as well as self-worth has decreased as a result of the cosmetic industry's success. Nevertheless, cosmetics has evolved to represent much more to people these days, and the industry keeps creating products that can drastically alter someone's appearance, either momentarily or permanently. Nowadays, makeup is not just limited to the famous personalities; it is worn on a daily basis by both men and women.

With this growing need for cosmetic products amongst both men and women, the demand for tubes is also expected to increase as tubes are universally popular cosmetic packaging solutions. In addition to being user-friendly and brand-protective, it also safeguards the product. Tubes are the best option for packaging the cosmetics; they work well for gels, creams, lotions, and scrubs equally. Tubes effectively protect the products against potential pollutants like the air, light exposure, and users due to their durable exteriors and lockable lids. This is quite advantageous for both long-term product users and cosmetics manufacturers looking to uphold their good name.

The availability of substitutes is likely to hinder the growth of the tube packaging market within the estimated timeframe. Among packaging options, the bottle is one of the most adaptable options. They may be utilized to hold chemicals, food, medications and cosmetics. The ergonomics of the bottle are undoubtedly one of its main advantages. The bottle's size and form make it easy to hold in the hand and using it to dispense the product is much simpler. Glass polymer-made acrylic cosmetic packaging and containers are in high demand as well since they closely resemble glass yet are far more robust. Nowadays, most of the companies are going with recycled bottles, which benefit the environment and improve their reputation with consumers.

Additionally, another common alternative to packing, which is typically composed of glass, plastic, or aluminum, is a jar. These are also utilized for packaging chemicals, food items, cosmetics, and pharmaceuticals. Samples of various cosmetics as well as creams and medications can be kept in the little containers. But for items like scrubs and lotions, larger jars are utilized. Jars provide the benefit of variety. This makes it simpler to utilize them to grab a prospective client's attention who is considering the brand. Jars with a glossy or matte finish are also highly popular, as are multicolored containers. Also, pouches are becoming increasingly well-liked as a great way to cut waste and promote the products being sold. Perfect for a range of products, including munchies, health drinks, face cloths, brushes and other makeup applicators. The presence of these wide varieties of products means that consumers and businesses can readily switch if they find a better value proposition.

Packaging is seeing a shift toward sustainability that is evident in nearly every category and is part of an overall shift in the consumer attitudes. Indeed, it might be argued that sustainability is becoming more of a movement and should no longer be classified as a trend. Based on the latest findings, women are even more likely to choose a socially conscious brand if the features and the cost of the product are comparable. Furthermore, nearly three-fourths (74%) of customers are willing to pay extra for sustainable packaging, according to the latest study by Trivium Packaging. More than ever, consumers are concerned about living sustainably and are prepared to pay to safeguard the environment. This gives companies a great chance to influence consumer decisions through the provision of eco-friendly options.

Sustainable tube packaging is usually a reflection of the brand. For instance, the mixtures are frequently non-toxic, biodegradable or otherwise environmentally beneficial. This trend tends to use the sustainable materials in the production of both primary and secondary packaging. Hence most of the organizations are taking various initiatives towards development of eco-friendly packaging options.

The squeeze and collapsible segment captured largest market share of 72.61% in 2024. Since they are more flexible and are able to hold and dispense more types of products than traditional containers like jars and bottles, as well as being less complicated and costly to build, fill and cap, squeezable and collapsible tubes are becoming much more common in practically every industry today. For all of the above stated reasons along with the superior durability, improved resistance to breakage, airtightness as well as the extended product shelf life; the cosmetics and personal care sectors have substantially increased their usage of plastic squeeze tubes. Squeeze tubes are being used more and more and this has led to the introduction of numerous varieties such as plastic, laminate and metal tubes.

The personal care & oral care segment held largest market share of 62.34% in 2024. This is owing to the increasing consumer awareness and demand for hygiene and grooming products. The innovation and variety in the product formulations and packaging designs within the personal care and oral care industries is also likely to support the segmental growth the market. Companies are continuously launching new products with specialized packaging to maintain efficacy and appeal to consumers.

For instance,

Asia Pacific held largest market share of 34.23% in 2024 and is expected to grow at a fastest CAGR of 7.83% during the forecast period. This is owing to the growing demand for cosmetics and personal care products in economies like Korea, China and India. According to the data by the International Trade Administration, in 2021, South Korea's cosmetic production reached the pre-pandemic levels, with a 9.8% increase in value from the year before to $14.5 billion. Additionally, the cosmetic exports reached a new high, rising by 21.3 percent to $9.2 billion from the year before. Furthermore, the increasing middle-class population and a growing preference for premium products are also likely to support the regional growth of the market.

North America is expected to grow at a substantial CAGR of 4.89% in 2024. This is due to the increasing demand for demand for pharmaceutical products such as medications, ointments, and creams across the region. Also, the increasing rise of direct-to-consumer brands, particularly in the beauty and personal care sectors along with the growing online shopping trend is further expected to support regional growth of the market in the years to come. Furthermore, the growing demand for convenience and ease of use in packaging as well as increasing use of candles for home décor, relaxation and stress reduction is also expected to support the regional growth of the market in the near future.

By Product

By Type

By Application

By Region

April 2025

April 2025

April 2025

April 2025