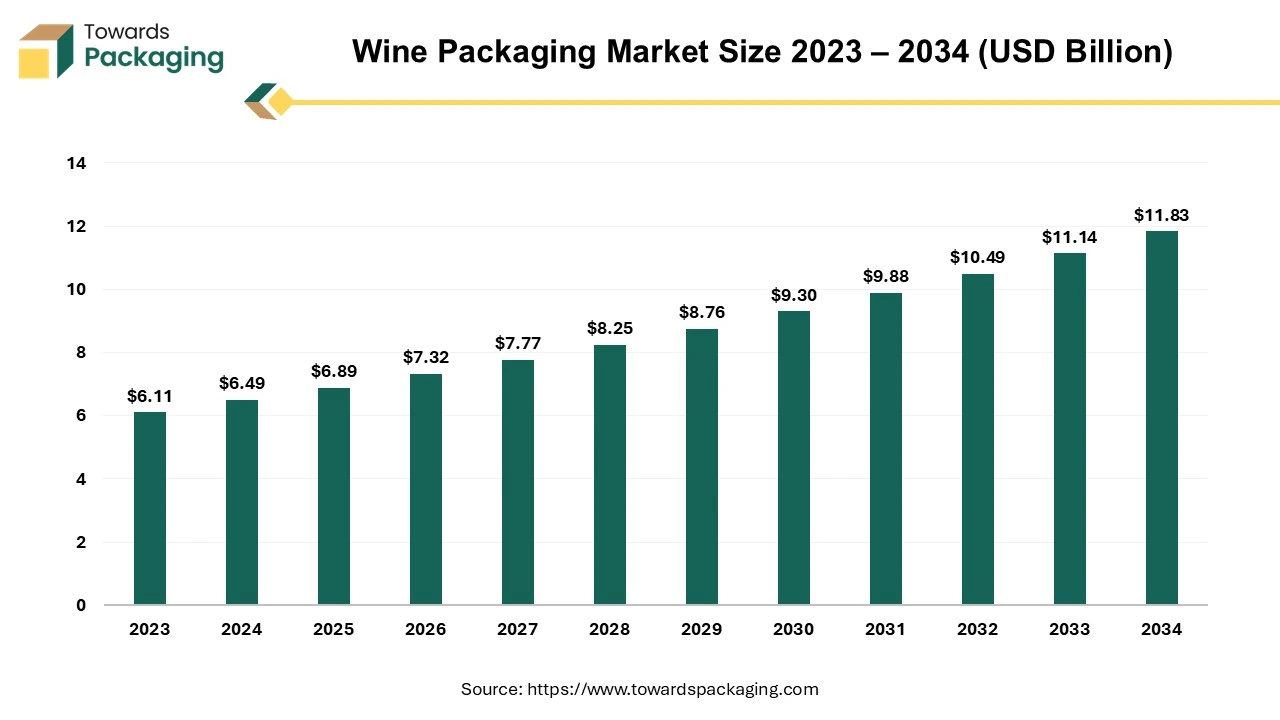

The wine packaging market was valued at USD 6.89 billion in 2025 and is projected to reach USD 11.83 billion by 2034, expanding at a CAGR of 6.19%. The report provides an in-depth analysis of material, product type, and application segments, along with regional data across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. It covers key players such as Amcor Limited, Ardagh Group, Crown Holdings Inc., and Verallia, and includes value chain and trade flow insights that explain how manufacturers and suppliers interact across global markets.

The wine packaging market is expected to augment with a substantial CAGR during the forecast period. The majority of wine consumed is from the glass bottles. Due to the stringent packing requirements, wine packaging is mostly standardized throughout the wine industry and also has a strong historical foundation. Wine can only be sold in certain sizes, according to the Alcohol and Tobacco Tax and Trade Bureau (TTB), unlike beer, which is permitted in all sizes. However, winemakers can now pack goods in ways that the customers want due to the new sizes. The newly added 355 ml capacity is equivalent to a standard 12-oz can of beer. This form of packaging gives the consumers a glass-free choice, making wine more portable as well as approachable for wineries. The TTB is contributing to economic growth and expanding the wine industry's reach by introducing new package sizes.

From 2025 to 2030, the wine packaging market is projected to experience robust growth, driven by increasing consumer demand for convenience, sustainability, and innovative packaging solutions. During this period, the market is expected to expand at a compound annual growth rate (CAGR) of approximately 6.19%, with the market size anticipated to rise from USD 6.73 billion in 2025 to around USD 8.95 billion by 2030.

The increasing consumer demand for convenience has led to the popularity of alternative packaging formats coupled with growing emphasis on sustainability is anticipated to augment the growth of the wine packaging market within the estimated timeframe. The rise of online wine sales along with the improvements in the packaging technology are also expected to support the market growth. Furthermore, the expansion of the wine market in developing economies as well as the increasing consumer interest in premium and artisanal wines is also likely to contribute to the growth of the market in the years to come. The global packaging market size is estimated to grow from USD 1.20 trillion in 2022 to reach an estimated USD 1.58 trillion by 2032, growing at a 3.16% CAGR between 2023 and 2032.

Artificial Intelligence (AI) is slowly being adopted across the packaging industry at different levels. AI can make notable difference in optimization of production processes, efficiency of supply chain and reducing costs are the primary draws for integrating AI into the infrastructure. Wine packaging is becoming a significant factor with companies looking to do something unique with the packaging to enhance their brand value and presence.

This customization of the packaging can be completed with AI-based technologies to personalize it, for example. There is a need for different packaging materials that are sustainable and recyclable so that the environmental impact is minimal. AI and machine learning (ML) combined can create algorithms that aid in development of materials in a quicker and efficient way. The adoption of AI could help the industry keep up with the demand in an efficient manner and open new avenues of opportunities.

Consumers have become increasingly aware of effect of non-renewable material usage on the environment. This has shifted the perspective towards utilization of eco-friendly and renewable materials that are not harmful for the ecosystem. The key players of the wine packaging market are trying to use innovative materials that recyclable or sustainable to cater to a broader consumer base. With Government and other agencies emphasizing and enforcing strict regulations regarding waste and other environment harming activities has pushed manufacturers to consider alternative materials.

This material requires to be durable and strong to withstand the logistics to sales journey. Many manufacturers are experimenting with recyclable materials like rubber, metal etc. which are sustainable. The growing demand for eco-friendly wine packaging solutions will help boost the demand for this market in the forecast period.

The wine e-commerce sector is constantly changing and for the wineries and the producers, getting digital is now more of a need than a choice. The emergence of the digital platforms and e-commerce has revolutionized the way wine is discovered, bought and enjoyed by consumers. Online retailers give the customers access to a huge global wine variety, allowing them to try the new flavors and find niche vineyards that may not have been readily available in the conventional brick-and-mortar establishments. Additionally, the social media and digital marketing have made it possible for wineries to communicate with the customers more directly, tell their stories as well as develop a sense of brand loyalty.

As e-commerce continues to grow in importance within the wine industry, many platforms have taken advantage of this market. A software program provided by an e-commerce platform enables wine sales and purchases to take place in the same location for both the vendor and the customer. Wineries can now use e-commerce solutions from a number of organizations. For instance, Underground Cellar, an online wine platform that preserves the value of expensive wines, is developing an intriguing idea to benefit the winemakers. Rather than offering high-quality wines at discounted costs, they make wine shopping more like a form of gaming.

Also, VinoShipper is a specialized platform designed to increase and streamline wineries, distillers, breweries, retailers and other businesses direct sales to US customers. It assists the wineries by handling their shipping, gathering orders and reporting, and handling their taxes. The introduction of the digitalization and e-commerce has facilitated wineries with the ability to connect with a worldwide consumer base, promoting a more diverse and integrated wine community. As a result, there is an increasing demand for the versatile and innovative packaging options that provide superior protection, such as reinforced bottles, tamper-evident closures and shock-absorbing materials.

The carbon footprint with production of wine bottles is likely to hinder the growth of the wine packaging market within the estimated timeframe. Wine sustainability certifications typically only take into the consideration the distance the wine must travel to reach its ultimate destination, rather than how it is packed. However, a 2022 analysis of the carbon emission studies related to the wine sector found that packaging is frequently identified as the leading source of greenhouse gas emissions, frequently generating more emissions than the combined effects of the winemaking and cultivating grapes. Glass, the most common material used to make wine bottles, produces a significant amount of carbon dioxide during manufacture; heat-intensive procedures release about 86 million metric tons of carbon dioxide yearly.

Additionally, the carbon footprint of these bulky, delicate glass bottles is increased by their transportation, particularly when they are made in one place and sent to another for manufacturing. The world might accept this, but there's a big catch: those bottles are usually thrown away as soon as the wine is drained out. The entire process that consumes energy and releases greenhouse gases is required to be repeated again. But the environmental impact of wine bottle packaging extends beyond glass; capsules, corks and labels are just a few of the other materials that contribute to the waste generated by the wine industry. Also, over the past few years, numerous companies have complained about the rising prices and reported issues acquiring the bottles. Since 2018, bottles from China, a significant supplier to the US, have been impacted by 25% tariffs on top of the standard supply-chain issues.

These days, it's common to see designs where the package is a work of art itself. This is generally true for luxury goods like wine and chocolates, but it can also happen with mid-range goods. However some firms are going over and above by fusing augmented reality with wine labels! Through a blend of entertainment, storytelling, and brand involvement, augmented reality leads the customer on an interactive trip. It gives the owner of the brand the chance to interact with their audience, contribute content, and learn more about them.

For instance,

The glass segment captured largest market share of 60.14% in 2023. Glass has been one of the key materials used for packaging the wine for ages. The production of the wine bottles only requires three natural resources: recycled glass, sand and soda ash. These materials are obtained without causing any harm to the environment or hazardous chemical leakage. Furthermore, the process of making the wine bottles has become significantly more sustainable due to the modern research and improvements in the energy-saving techniques. New bottles can be made in as little as 30 days using about 80% of the recycled glass.

Additionally, glass wine bottles provide an effective barrier against air, UV rays and other environmental elements that could deteriorate the wine's flavor as well as the quality. This material doesn't react chemically with the wine, unlike aluminum or plastic, assuring that the wine's qualities are maintained till it reaches the customer's glass. Also, since wine has traditionally been linked with the glass bottles, buyers have felt more at familiarity and confident. They identify wine in the glass bottles with authenticity and superior quality, viewing them as one of the luxury goods. This view can increase the perceived value of the wine overall and have a significant influence on the purchasing decisions.

The bottles segment held largest market share of 54.32% in 2023. Bottles provide a classic and aesthetically appealing presentation, which is highly valued by the consumers and is essential to the branding and marketing strategies of the companies. The tradition and the perception of quality associated with the glass bottle packaging contribute significantly to its market share. Bottles differ in size, color, finish, and height. Wines are usually packed in the 750ml bottles. Shapes can differ, frequently according to the kind of wine contained within. While some wines are bottled in the transparent glass called as Flint to highlight the light or dark color of the wine, numerous wines are bottled in amber glass known as Antique Green, which helps shield the wine from excessive light during aging. The majority of wineries base their marketing campaigns around the bottle of wine and their label. Due to their concern over losing market share, they are reluctant to step away from this.

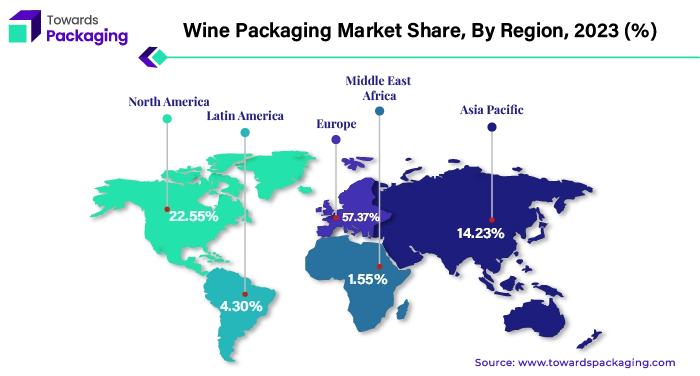

Asia Pacific is expected to grow at a fastest CAGR of 9.65% during the forecast period. This is owing to the urbanization and modern lifestyles in the region which are increasing the demand for convenient and portable packaging options. Urban consumers are more likely to seek out single-serve or on-the-go packaging formats, such as cans and pouches. Alcohol consumption in India is being driven by a sizeable middle-class population with the increasing spending power and a growing economy. A favorable demographic dividend, with over 10 million more people entering the working age population annually for the next 20 years, will augment the alcoholic beverage market. The increasing number of young adult earners has created a whole new generation of the buyers who did not exist earlier. Indians are entering the workforce earlier than in the past, and these changes, along with the changing lifestyles and the removal of social barriers to alcohol consumption, are accelerating the consumption of wine in India. This in turn is expected to support the growth of the wine packaging market in the region. Furthermore, the growing preference for premium products is also likely to support the regional growth of the market.

Europe held largest market share of 57.37% in 2023. This is due to the presence of world’s largest wine-growing areas and long-standing history and tradition of wine production across the region. According to the data by the Eurostat, in 2020, the EU's entire area under vines was 3.2 million hectares (ha), or 2.0% of the total area used for agriculture (UAA). In 2020, three-quarters (74.9%) of the EU's vine-planted land and over two-fifths (387.7%) of vineyard holdings were collectively attributed to Spain, France and Italy. Furthermore, expansion of online wine sales as well as the diverse consumer base is also expected to support the regional growth of the market in the near future.

Some of the key players in wine packaging market are Amcor Limited, Ardagh Group, Crown Holdings Inc., O-I Glass, Inc., Verallia, CCL Industries, Sonoco Products Company, Tetra Pak International S.A., Greif, Inc., AptarGroup, Inc., Mondi, Berry Global Inc, Frugalpac, and Libbey Inc., among others.

By Material

By Product Type

By Application

By Region

December 2025

December 2025

December 2025

December 2025