The on-the-go packaging market is forecasted to expand from USD 2.26 billion in 2026 to USD 3.60 billion by 2035, growing at a CAGR of 5.3% from 2026 to 2035. This growth is driven by the increasing demand for convenient and portable packaging solutions across North America and Asia-Pacific, two regions heavily influenced by fast-paced lifestyles.

Trends such as sustainability, eco-friendly packaging solutions, and smarter packaging technologies like AI and interactive features are transforming the industry. This report highlights key market drivers, emerging trends, and the role of innovative packaging formats like pouches, bags, and resealable containers.

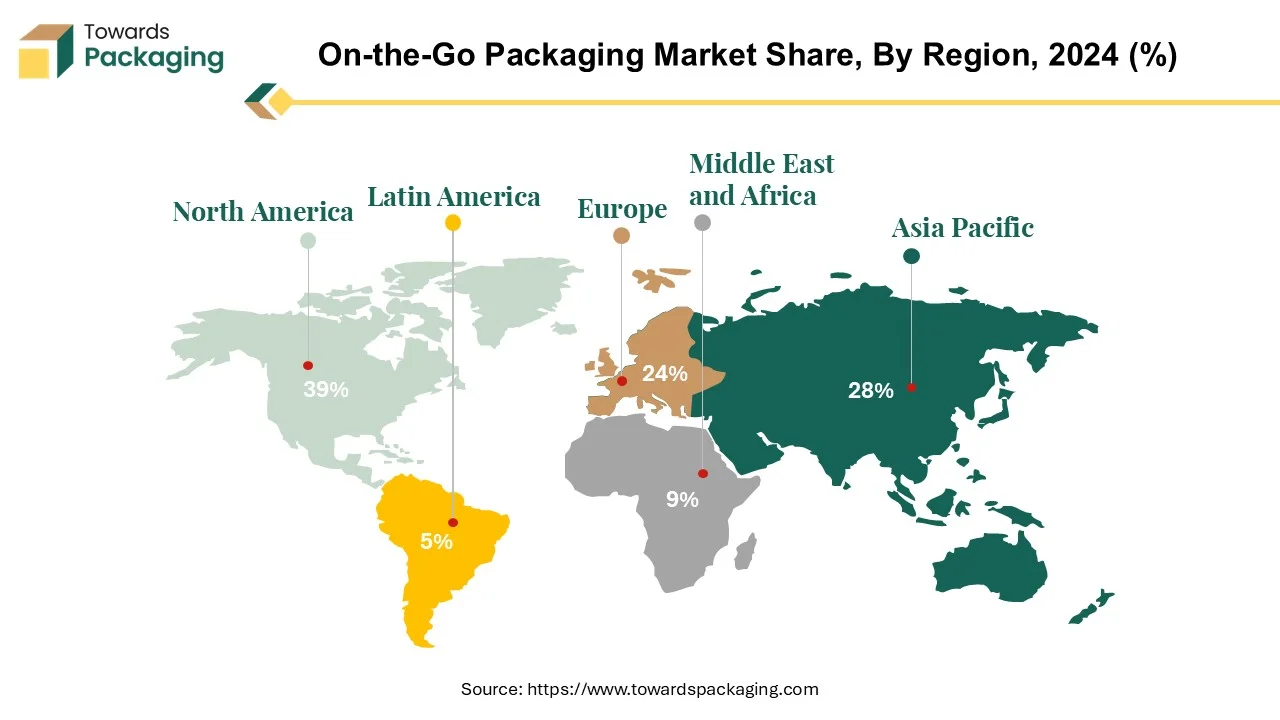

The packaging for “on-the-go” is more in demand, which in turn is dictated by the dynamic lives of many and increased snacking patterns. It serves different purposes such as healthy and environmentally-friendly goals. Related Readings North America holds leadership in the market as a result of its high-speed culture trending, whereas Asia-Pacific, mentioning Seoul and Bangkok, shows sky rocketing in the market. Plastics still possess many desirable attributes of versatility and cost-effectiveness, but environmentally friendly alternatives are gaining ground. Consumption ease and sustainability by means of smart packaging and mini formats are the needs that modern-day consumers have. The key players of the industry are Nestle, P&G and Unilever that put emphasis on the innovation and sustainability to become the best ones.

On-the-go packaging is the tailor-made solution to societal needs, providing convenience and portability for busy people who are constantly on the move. Mainly used for snacks, drinks and other food items which are eaten out of the house or during the travel, these packaging formats include single serve snack packs, resealable pouches, portable bottles, and individual portion containers. Lightweight, durable, and with the convenience of easy access, on-the-go packaging is meant for people with a hectic lifestyle and it enables consumption in transit or while doing any other activity.

The habit of on-the-go consumption can be seen in the growth of snacking, from breakfast on-the-go to snacking between meals or as a meal replacement. It goes beyond the age groups, affecting not only adults but also kids of any age, from toddlers to infants. Acknowledging this transition, consumer goods brands are changing their product lines to give the customers a variety of options for consumption on-the-go, most often stressing the importance of health.

When it comes to demographic differences, millennials are the ones who like snacking from time to time and eat snacks up to four times a day. Snacking is widespread among all age groups as 94% of Americans snack at least once a day. This pattern is evidenced by the further expansions of the retail sale market of consumer goods and the growth of the sales of on-the-go packaged products. This reinforces the importance of on-the-go packaging for meeting the ever-increasing needs and wants of today's consumers.

Artificial Intelligence is playing a major role in on-the-go packaging by developing efficiency, sustainability, and invention across the value chain. AI-driven systems are being used to update packaging design for ease and material reduction, predict consumer preference, and allow for smart, personalized packaging solutions. In production, AI assists automation, quality control, and predictive maintenance, lowering downtime and waste. Additionally, AI-powered data analytics help brands track consumer behaviour and improve supply chain management, making sure the fastest delivery of portable and ready-to-consume products.

On-the-go packaging is gaining a lot of popularity these days in North America because of the fast-paced lifestyle of people and their shifting preferences in favour of the same. It has become increasingly imperative for consumers to have convenient and portable options that would allow them to snack or take their meals when they are on the move. This is so facilitated the growth of this product category.

A frustrating factor the powering the steady demand for portable packaging is the high snack culture's infiltration into the market. Having a hectic schedule and the consumer wanting smaller, quick foods options like single-serve snack portions, portable bottles, and pouches with resealable lids favors the taking of such foods when one is commuting, on a break at work, or outdoors. In the United States and Canada, together they form the most significant on-the-go packaging market, recording that up to 85% of customers consume at least one snack daily, either healthy or not.

| Mondelez's Product Revenue, 2024 (%) | |

| Biscuits & Bakery Snacks | 51% |

| Chocolate | 29% |

| Gum & Candy | 12% |

| Cheese & Grocery | 6% |

| Beverages | 2% |

Top manufacturing companies are prioritizing on-the-go packaging products which are in demand. Where Mondeleze based in North America have large consumer base with lage product shares. Examples like single-serve beverage bottles for hydration needs and pre-packaged meal solutions that are quick and convenient, are only are reference of the reason for why this kind of packaging has so much appeal to it. The market keeps growing on the account of technical progress and product improvement, such as portable snack packs with new packaging formats or the resealable pouches.

Consumers in North America while opting for convenience, mobility and flexibility as food and beverage choices give rise to more innovations and growth in the market due to the booming demand for on-the-go packaging. This change is aimed at filling up the diversity in needs among consumers in the region and that is what matches their on-the-go patterns.

Asia Pacific's packaging market is seeing a boost in growth at a fast pace as a result of the region's large and diverse packaging market. The Chinese and Indian markets are the biggest players in the areas of on-go snacking, ready-to-eat (RTE), and ready-to-cook (RTC) meals. Millennials, particularly in China, can even be said to be the forerunner of all the takeaway orders and with over 80% of all orders coming from this demographic, it is obvious that young urban consumers are the main driving force behind the popularity of online food delivery. having the size of Indian snacks market in 2023 of Rs 42,694.9 crore is likely to reach Rs 95,521.8 crore in 2032 with CAGR of 9.08%.

However, among the multitude of these big players, the South Korean cities such as Seoul, Tokyo, Bangkok, Jakarta and Singapore play their role as the main actors in stimulating the market for on-the-go packaging items. Seoul's bustling city crowd calls for miniature dishes and drinks to accompany their speedy urban life, and the frenetic nature of the Japanese big city creates a large take away food market for those in a hurry.

The booming of street food in the capital of Bangkok and the unstoppable urban growth in Jakarta make a convenient packaging solution that caters to busy people a necessity. In terms of Singapore being a major city with people from various population, the ease and speed of “to-go” food is making this market highly viable. These cities, which are characterized by urbanization and new lifestyles, show that cities in this area want foods that are easy-to-eat, which has a huge influence on the packaging sector because it stimulates production and growth in these sectors to meet the changing needs of people living in the Asia-Pacific urban area.

These towns along with others in the Asia-Pacific region are undergoing huge urbanization and lifestyle change which are accelerating the demand for the products that are ‘grab and go’ and their packaging. The on-the-go packaging market is set for sustained growth as consumers in these cities demand varied versatile forms that keep up with their fast-paced lifestyles.

The production of on-packaging in Europe is perfectly developed, driven by fast-paced lifestyles, high consumption of ready-to-eat meals, and strong demand for convenience in the food and beverage sectors. Countries such as Germany, France, and the UK are leading producers, assisted by advanced packaging technologies and strict regulatory frameworks, ensuring the quality and safety. There is a strong focus on sustainability with manufacturers increasingly shifting towards recyclable, compostable, and biodegradable materials.

The manufacturing of on-the-go packaging in Latin America is growing rapidly, fueled by changing consumer lifestyles, urbanization, and the growing demand for easy food and beverage options. Busy work schedules and increasing preference for ready-to-eat meals, snacks, and drinks are driving manufacturers to stretch production capacities. Countries like Brazil and Mexico lead the market with strong investments in flexible packaging, resealable pouches, and portable containers. Sustainability is also becoming a main focus, with producers adopting recyclable and eco-friendly materials to align with user experience expectations and regulatory requirements.

The manufacturing of on-the-packaging in the Middle East and Africa is gaining attention, assisted by growing urbanization, a young population, and growing demand for easy, portable food and beverage solutions. Increasing consumption of bottled water, soft drinks, and ready-to-eat snacks and single-serve products is fueling the demand for inventive packaging formats. Countries like the UAE, Saudi Arabia, and South Africa are leading production, with investments in flexible packaging, resealable snacks, and lightweight containers. Sustainability trends are also encouraging the market, encouraging the use recyclable and eco-friendly materials to meet global packaging needs.

Plastic products most commonly use those with on-the-go packaging for the reasons involving their versatility, durability, and cost-effectiveness. A majority of matters encountered in throwaway packaging are polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), and polystyrene (PS). These products offer a wide range of benefits like lightweight properties, moisture and chemical resistant, and of course, they can be molded into different shapes and sizes, hence, being user-friendly for packaging of snacks, beverages, and other carry-and-go products.

Plastic packaging facilitates the use of closing mechanisms such as resealable covers which extends the shelf life of perishable items, balancing the freshness of products. The consumption of plastics is usually the consequence and symptom of many economic development and social issues. Coca-Cola's packaging plastic system is the single largest FMCG user, but this only absorbs 2% of the globe`s total.

The plastic-based for the on-the-go food packaging sector is demonstrating a high-paced growth due to several reasons. The large companies such as pepsi-co, unilever and nestle are the focusing on these products. As the consumption of convenience foods and drinks rise, in line with fast and active lifestyles, and the habit of consumption at any location, the need for packaging that is portable and easy to use increase accordingly. rise in the urban population, especially in the developing nations, is pressurizing the food market to look for handy and prepacked food.

The pushing of environmental problem and sustainability awareness are forging more eco-friendly plastic packaging alternatives, including biodegradable and compostable plastics, which meet the rising need of environmentally conscious customers. The forecast demands for plastics on-the-go packaging to grow with the changing preferences of consumers, newer technologies, and the increasing demand for containers that are both convenient and eco-friendly internationally.

Bags and pouches packages have now occupied a large part of ready-to-eat food products which largely depend on the product's packaging against their convenience, flexibility, and functionality. These packaging solutions provide a wide range of benefits and are dedicated to help meet the needs consumers who prefer portable options so they can consume their snacks, beverages and other on-the-go products. Bags and pouches are lightweight and compact, thus they can be easily compressed and delivered. Moreover, they can be carried either while working, commuting, or while outdoors. Flexibility is one of their key benefits as they provide a more efficient storage and transportation occupies, while allowing for customized options such as resealable closures and tear notches to make the packaging even more user-friendly.

Bags and pouches are the best options when it comes to their barrier properties, maintaining the integrity of the package from moisture, oxygen, etc. that can spoil the quality of the product inside. The demand for pouches and bags in the packaging market also caters to the ease of marketability and branding through their attractive appearance. Practicality, functionality, and consumer attraction are key characteristics of bags and pouches, and they control the direction of on-the-go packaging as these features ultimately shape the market.

Mini food formats, characterized by their bite-sized or small portions, offer a wide range of options, from sweet or savory treats to healthy alternatives and occasional indulgences. These mini formats require specific transportation and protection, which on-the-go packaging meets perfectly. Brands like Oreo and Milka have introduced on-the-go ‘mini’ versions of their popular biscuits and chocolate bars to cater to this trend. The demand for pouches used in candy and snack food packaging is projected to grow at a rate of 3.8% annually through 2022, reaching $3.4 billion. The shift towards consuming small meals throughout the day disrupts the traditional three-meals-a-day mantra, driving the demand for single-portion packages and attractive, resealable, and easily disposable pouches.

In India, major FMCG companies such as Nestle, Hindustan Unilever, Godrej, ITC, PepsiCo, Coca-Cola, and P&G deploy plastic packaging across various products, reflecting the widespread adoption of on-the-go packaging. Not only is this trend limited to human consumption; the pet food market is also increasingly embracing on-the-go packaging solutions. The market growth is heavily influenced by changing consumption patterns, with consumers seeking convenient, portable, and portion-controlled options both for themselves and their pets.

The competitive landscape of the on-the-go packaging market is dominated by established industry giants such as Nestlé, Procter & Gamble (P&G), Unilever, Amcor plc, Mondi Group, Sonoco Products Company, Berry Global Group, Smurfit Kappa Group, Sealed Air Corporation, WestRock Company, Georgia-Pacific LLC, Huhtamaki Oyj, Tetra Pak, Constantia Flexibles Group GmbH, Winpak Ltd., ProAmpac LLC, Pactiv LLC, Glenroy Inc., and Stora Enso Oyj. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

Nestlé concentrates on a designing process and product creation for takeaway soft packages what the need lately for which increases. The organization recognizes the importance of packing smooth into the marketable shelves among its range of food items, meanwhile, making sure that packages are portable and consume on-the-go.

P&G relies on its wide-spanning research and development facilities to incorporate on-the-go packaging innovations in line with the assorted products under its consumer goods portfolio. For students, the biggest benefit of the EatWell catering service is undoubtably the fact that it makes their daily lives easier by making sure their food is easy to carry and use, but also is fresh and retains quality.

Unilever uses a holistic method to optimize presence by incorporating radical innovation in design, material, and consumer insights in the development of its products. The enterprise delivers a wide-spreading line of instant mobile meals across the brands, satisfying the demand of the users whatsoever.

Amcor holds a unique position as a packaging solutions supplier across different industry sectors, such as food & beverage. With regard to the disposable packaging market, the company emphasizes the offering of tailored and eco-friendly packaging solution which implies both the peculiarities of its customers and factors that may affect the environment.

By Material

By Packaging Type

By End User

By Region

January 2026

January 2026

January 2026

January 2026