March 2025

Principal Consultant

Reviewed By

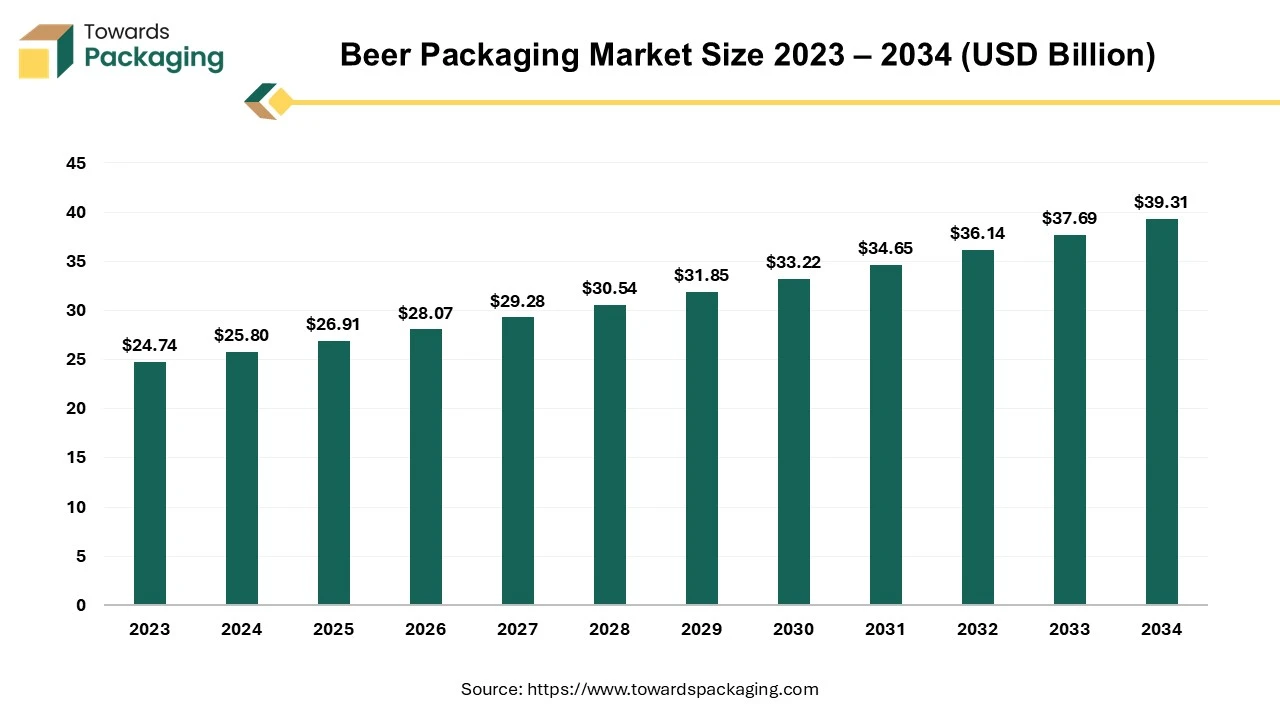

The beer packaging market is projected to reach USD 39.31 billion by 2034, expanding from USD 26.91 billion in 2025, at an annual growth rate of 4.3% during the forecast period from 2025 to 2034.

Beer, an alcoholic beverage, is one of the world's oldest and most popular fermented beverages made with water, malted barley, hops, and yeast. The beer packaging market defines the packaging industry segment that develops solutions for packaging and distributing beer goods.

Beer is the most popular alcoholic beverage globally, with billions of liters consumed yearly. However, the science of beer continues after brewing until the packaging phase, where the type of packaging used considerably impacts flavor and freshness. Global beer production will reach an astonishing 1.89 billion hectolitres in 2022 alone, demonstrating the industry's immense magnitude. Packaging is an essential aspect of the beer business, characterized by fierce competition between local breweries and large brands. It plays a critical function in defining a brand's identity and allows it to stand out on crowded shelves, attracting consumers' attention and preferences. The craft beer movement, recognized for its adherence to quality and creativity, has played a vital role in driving innovation in beer package design. Craft brewers, known for their willingness to experiment, frequently seek innovative and inventive packaging options.

The beer packaging market has grown recently, with a creative surge across various packaging solutions. In addition to classic glass bottles, alternatives such as aluminium cans, PET bottles, and pouches have gained popularity. Packaging materials are chosen to meet unique customer preferences and evolving market demands. To produce the ideal package for a beer brand, industry participants must keep up with the most recent consumer data, product trends, and packaging advancements.

A significant industrial trend has been the transition from bottles to cans. This shift might be linked to the greater availability of tiny canning lines for craft brewers, changes in customer behaviour, and supply chain issues, particularly during the COVID-19 epidemic. The capacity to use multiple packaging formats has become a strategic one, defining the consumer experience and contributing to the overall success of beer brands in a dynamic and competitive market.

For Instance,

| Top Beer Producing Countries, 2023 (hL) | ||

| Ranking | Country | Output Volume (hL) |

| 1 | China | 36,04,05,000 |

| 2 | The United States | 19,41,00,000 |

| 3 | Brazil | 14,74,33,000 |

| 4 | Mexico | 14,10,00,000 |

| 5 | Germany | 8,78,32,000 |

| 6 | Russia | 8,17,00,000 |

| 7 | Japan | 4,58,82,000 |

| 8 | Spain | 4,11,00,000 |

| 9 | Vietnam | 3,90,00,000 |

| 10 | Poland | 3,78,00,000 |

Brewing beer can be done in over a hundred ways, and certain nations have gained notoriety for their unique brews. Belgium, for instance, is well-known for its traditional wheat beer, witbier, whereas the UK is more well-known for its lagers. Global brewers create a wide range of beers to meet the demand of beer enthusiasts, even if some locations are recognized for producing particular types of beer.

Asia is the world's biggest market for beer packaging. China, the largest beer market in the world, had difficulties the year before because of stringent lockdown measures. On-premise business is expected to rebound as China reopens its borders in January 2023 following three years of travel bans and quarantine procedures. This revival is anticipated to affect the beer category favourably and support the expansion of the Asian packaging market. Since the COVID-19 restrictions were lifted, brewers have already observed a notable uptick in markets throughout the Asia-Pacific region, especially in nations like Vietnam, Malaysia, Cambodia, and Indonesia. Even if the two biggest beer markets in the area—China and Japan—are contracting and slowing down, there are still plenty of potential prospects for beer in Asia. In markets like the Philippines, Cambodia, Laos, Indonesia, and India, a spectacular growth in volume of 22% is anticipated during the next five years.

Asia's beer production increased by 1.5% in 2022 to 579 million hectoliters. India (plus 3.5 million hl), Thailand (plus 2.6 million hl), and South Korea (plus 2.3 million hl) were the main drivers of the region's output boom. China leads the market with highest output volume. The notable expansion of the beer packaging business in Asia can be attributed largely to these three countries.

Heineken launched the Amstel brand and acquired a majority stake in United Breweries, the country's largest beer company, after realizing the potential of the Indian market. Though India consumes more spirits than beer, there is still plenty of potential for beer sales, particularly as the country's middle class grows and more people have access to home refrigeration.

Many inventive and imaginative advancements are occurring in the Asian beer packaging market. Manufacturers are investigating distinctive packaging options to attract customers and set their companies apart. Innovations in packaging that meet changing consumer preferences and boost the overall performance of beer brands in the region may be found in plenty in the dynamic and growing Asian beer industry.

For Instance,

North America is the second largest market globally in the dynamic and rapidly changing beer packaging sector, with notable trends and transitions. A significant increase in product innovation has occurred along the whole value chain, primarily due to the growth of craft beer. Considerable changes have happened in the sector as American craft brewers have become more well-known and have officially overtaken their larger competitors. The craft brewing industry has been incredibly resilient despite a meager 0.5 percent growth in U.S. beer production overall. Small and independent brewers now account for 13.2% of the volume of the U.S. beer industry, despite a 3% decrease in overall beer volume sales in 2022. This is partly due to craft brewer volume sales, which demonstrated stability.

U.S. beer production in 2022, which includes regionals, taprooms, brewpubs, microbreweries, contract brewing companies. Regionals produced highest amount of beer compared to othes.

The beer market in the United States has changed significantly, especially regarding product variety. The increasing preference for plastic bottles among craft brewers is a significant factor in this change. While glass or aluminum packaging was formerly the norm for several American brands, plastic bottles are becoming more popular, especially in places like stadiums and music halls where glass may be prohibited.

The retail dollar sales of craft beer saw a notable 5% growth to $28.4 billion, accounting for 24.6% of the $115 billion U.S. beer industry. Price increases and the persistent tendency of customers to shift their beer volume consumption back to bars and restaurants from packaged sales are to blame for this significant increase in dollar sales. The craft brewing movement is still changing the beer landscape in North America, emphasizing how important it is to be innovative, flexible, and able to adjust to changing customer tastes.

For Instance,

Glass is the most common material used in beer packaging, with glass bottles and aluminium cans being the most popular mediums, except for occasional festive modifications such as the drinkable ornament during the holidays; plastic bottles, on the other hand, are rarely seen in the beer aisle, while being widely used in the juice and soft drink industries. Glass, known for its recyclability, has a remarkable recycling rate of around 95% for beer bottles. Within this percentage, around 60% are bottles that were returned and reused during manufacture, with the remaining 35% recycled in the market as cullets.

Conversely, plastic is judged unsuitable for beer packaging due to its molecular structure, which is less successful at keeping carbonation in the package and limiting oxygen ingress, both of which are critical for avoiding staleness.

When comparing glass versus cans, both materials emerge as preferable packaging solutions for delivering beer to customers while keeping the brewer's targeted levels of freshness and carbonation. Glass bottles and aluminum cans dominate the beer aisles across the country. This tendency will likely continue unless the industry undergoes a substantial transition, similar to Franzia's introduction of wine in a box.

For Instance,

Bottles are extensively used in beer packaging. Major breweries are increasingly turning to customized beer bottles as a strategic way to build and strengthen their brand identities. Krombacher Brewery in Germany, a market pioneer, designed a bottle with a more considerable bottleneck to increase brand appeal. The brewery enhanced its packaging by launching a new 0.5-liter recyclable bottle with high-quality materials and a modern, unique design to improve its appeal.

The 0.5-liter recyclable bottle has become the most popular packaging format in the retail industry. Its unusual shape and embossing on the bottleneck contribute to a strong visual presence, increasing brand awareness. Popular bottle types in Germany include Vichy, Euro, Longneck, NRW, and Steinie. Compared to other countries, the range of shapes and sizes increases dramatically. In addition to the typical 0.33-liter capacity, beer bottles range in size from 0.25 to 2.5 liters.

|

Top 10 Most Valuable Beer Brands

|

|

Corona ($7.0 billion)

|

|

Heineken ($6.9 billion)

|

|

Budweiser ($5.6 billion)

|

|

Bud Light ($4.5 billion)

|

|

Modelo ($3.9 billion)

|

|

Snow ($3.6 billion)

|

|

Miller Lite ($2.9 billion)

|

|

Coors Light ($2.9 billion)

|

|

Kirin ($2.8 billion)

|

|

Asahi ($2.5 billion)

|

During the pandemic, the Corona brand encountered some issues, particularly in the United States, due to the suddenly embarrassing name, but Heineken's success was ascribed to its environmental efforts. The brewer intends to achieve carbon neutral output by 2030 and throughout its entire value chain by 2040. Meanwhile, Desperados was the fastest-growing beer brand (brand value increased by 57% to $564 million), with particularly high growth in Europe.

For Instance,

In the United States, many beer bottle types have grown in popularity, including the nip/pony/grenade, stubby/steinie, longneck, Belgian, British, bomber/large format, Caguama/Ballena, forty, howler, magnum, and growler. Customized beer bottles offer trademark owners an excellent opportunity to establish their brand identities through unique bottle designs. However, some people have expressed worries over the customization of beer bottles.

Carlsberg, a Danish brewery, has launched an innovative initiative called the Green Fibre Bottle, a beer bottle manufactured from sustainably derived wood fibers. This innovative paper beer bottle is both biodegradable and entirely recyclable. Carlsberg claims to be on the approach of fulfilling its objective of making the world's first paper beer bottle, having nearly solved the final technological difficulties. The brewery has shown two prototypes of the Green Fibre Bottle, both made from sustainably sourced wood fibers and designed for complete recyclability.

For Instance,

| Waste Category | FY 2022-23 |

||

| Reuse (MT) | Recycled (MT) | Safely Disposed (MT) | |

| Plastics (including packaging) | - | 3,537 | - |

| E-waste | - | - | 6 |

| Hazardous Waste | 1088.714 | 26.99 | 7,190 |

| Other Waste | 1,91,721 | 41,169 | 4,793 |

The glass packing material is sustainable, evidenced by its remarkable 95% recycling rate. Since 60% of the glass bottles utilized in this recycling process come from returned bottles, their reuse in manufacturing promotes a circular economy. Additionally, the market recycling process produces 35% of glass bottles, which are then used to make cullets. Glass packaging is environmentally benign, and this effective recycling mechanism contributes significantly to reducing its environmental impact.

Because aluminum is naturally recyclable, beer cans made of aluminum also support eco-friendly practices. Aluminium is a sustainable material for beverage packaging since it can be recycled.

For Instance,

The competitive landscape of the beer packaging market is characterized by established industry leaders such Ardagh Group, Ball Corporation, Owens-Illinois, Inc., Amcor plc, WestRock Company, Berlin Packaging, Multi, Packaging Solution, Graphic Packaging International, LLC, Crown Holdings, Inc. and CCL Industries Inc. These giants face competition from emerging direct-to-consumer brands, leveraging digital platforms for market entry. Key factors influencing competition include innovation in product offerings, sustainable practices, and the ability to adapt to changing consumer preferences.

Sprecher Brewing Company has been AGP-North America's exclusive supplier of glass beer and beverage bottles. Sprecher Brewing Company is a part of the Ardagh Group. This partnership also includes the recently redesigned 16-ounce personalized glass bottle. The Sprecher Brewing Company and AGP's product design team worked together to improve their unique glass bottle through the application of the Vision4GlassSM approach. This collaboration demonstrated a shared dedication to creative and personalized packaging solutions.

Berlin Packaging has a wealth of knowledge and specializes in providing brewers and brand owners with specialized packaging solutions that guarantee their success in the market. Comprehensive offers include aluminum cans and glass and plastic bottles at reasonable prices reliably supplied on schedule. Provide closures, carriers, packaging necessities, and containers, providing a one-stop shop for all beer packaging requirements.

Ball cans, whether they contain beer, water, soda, or any other beverage, set the standard for visually arresting and aesthetically pleasing packaging. These cans come in various sizes and shapes, making them the perfect canvas for showcasing brands. Their creative ends and tabs draw customers in-store and online, effectively offering chances to engage and customize the brand experience.

By Material

By Packaging

By Region

March 2025

March 2025

March 2025

March 2025