April 2025

.webp)

Principal Consultant

Reviewed By

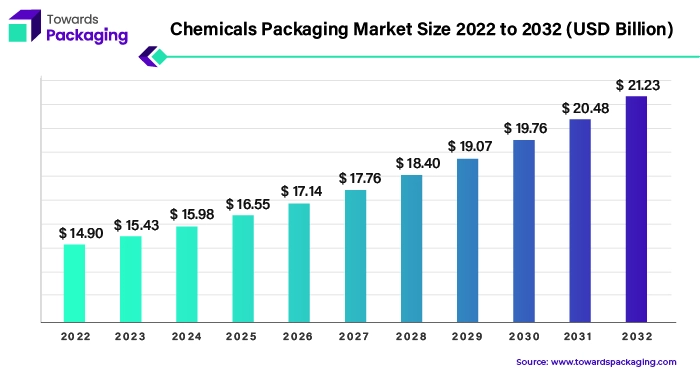

The chemicals packaging market is expected to increase from USD 16.56 billion in 2025 to USD 22.79 billion by 2034, growing at a CAGR of 3.61% throughout the forecast period from 2025 to 2034.

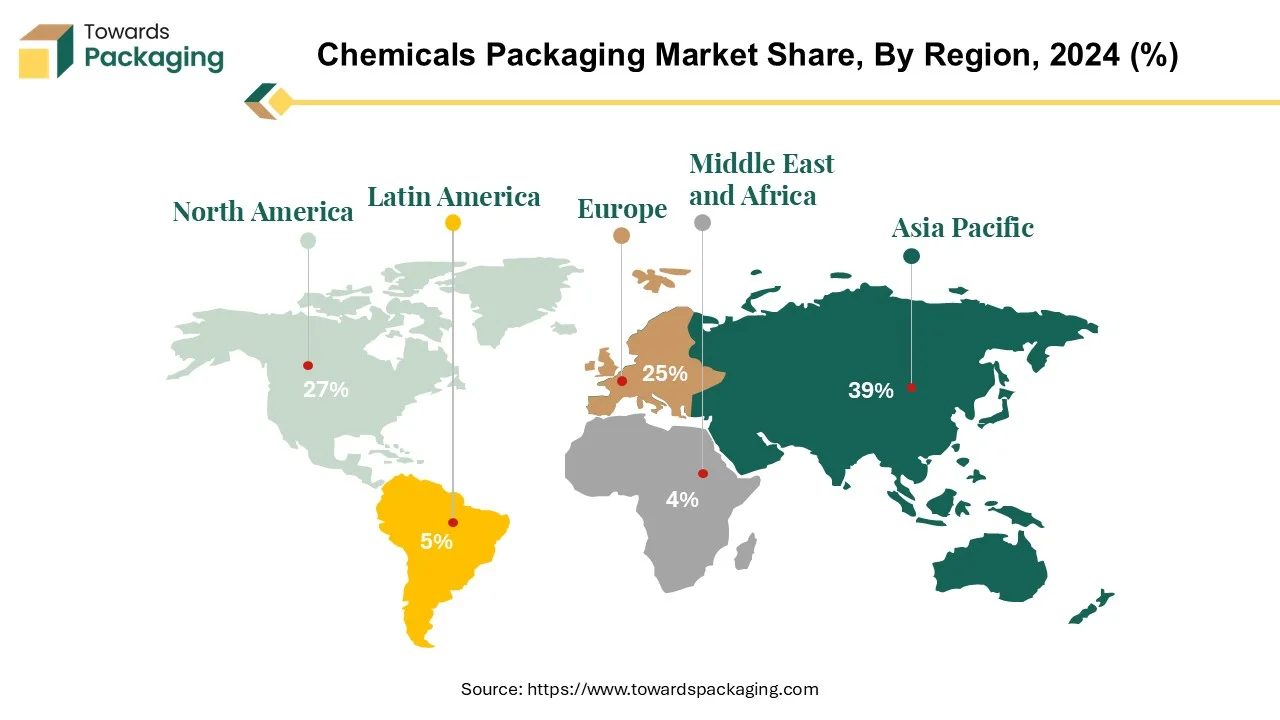

The chemicals packaging industry ensures safe transportation and storage of chemicals via particular containers and kinds of packaging. Safety, sustainability and technology are the said trends. Asia-Pacific gets ahead owing to the economic development. North America sees the growth from a rebound in the manufacturing of chemicals products. Commodity chemicals packaging, catering to a wide range of industries, expansion of users induces market growth. Plastic packaging is the most dominant or even the only one on the market, but there are eco-friendly substitutes are emerging. PP bags exhibit strength and reliability and chemicals resistance. The major co-players such as BASF, Dow and LG Chem develop the latest technologies and improve the sustainability of products while keeping pace with changing consumer demands.

Chemicals packaging is the specific containers, materials, and methods that are used to store, transport and keep chemicals safe from environmental contamination. Such packages will enable the chemicals to be carried safely and securely without danger of leaks, spills, pollution and other adverse effects. Packaging of chemicals is lengthy, from selecting the right packaging style to ensuring its security of delivery. The variations in the curves on the line graph are mainly because the chemicals compound- being complex in nature- show different patterns of chemicals properties in different environments. Chemicals packaging, while being widely used across the industry, particularly commodity chemicals, petrochemicals and speciality chemicals product and construction chemicals. Currently there are many options in the chemicals packaging pictures. They include drums, Intermediate bulk containers IBCs, jerrycans, bottles, bags and specialized containers.

The chemicals packaging industry develops better and better along with the world economy, as a result, the re-packaging business also raises its popularity. In regard to the chemistry packaging industry, chemicals handling and safety precautions mustn’t in any case be neglected. The chance of accidents greatly gets higher than the danger to people and the environment. Or during fire, an explosion takes place if products are not in the designated zoning areas that accommodate them following regulations and this can result in deaths.

The industrial chemicals packaging field involves a vast selection of materials and specific designs that are tailored entirely according to the special properties of each chemical. Whether it is hydraulic liquids or toxic powders, the right packaging product will significantly reduce the danger and assure safety of both humans and the planet. Manufacturing chemicals product packaging must abide all the very rigorous standards, no leak, spill, or contamination. It has to warn about the risks and provide well-designed labels along with the appropriate handling and disposal instructions. Overall market is growing fast as constant seeking for suppliers is its triggering factor.

The chemicals packaging market in the Asia-Pacific region is growing greatly because of strong economic and industrial development in this region. Some countries, such as China, India, and the southeast Asian nations that are going through industrialization, the need for chemicals packaging solutions has skyrocketed. This is now amplified by the rise in chemicals production in the area.

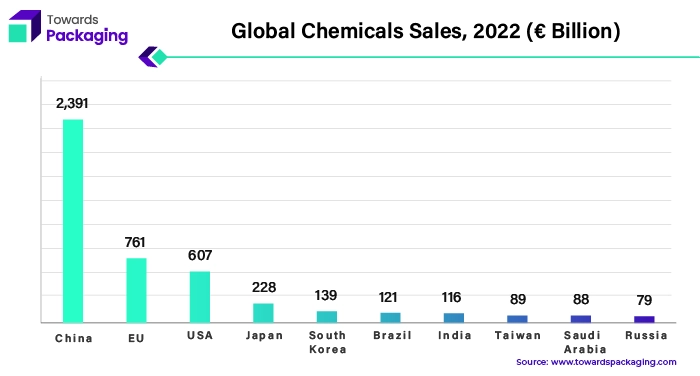

Globally, the sale of chemicals is substantial, and China is on top of the list the whole world. China's control in chemicals products derives from its massive industrial activities, sophisticated engineering capacity and the soaring internal appetite. The production of chemicals worldwide was 0.3% higher than last year, with the Asia-Pacific region becoming its leader. There, the biggest growth was demonstrated. The discontinuance of the zero-COVID approach by China towards the last quarter brought a positive effect on the other sectors causing expansion in the chemicals packaging market, mostly in Asia. India is the sixth largest chemicals producing countries of the world and the third largest producer in Asia. Also, it is one of top 3 biggest chemicals producing countries worldwide. In India, the chemicals and petrochemicals market are almost worth US$178 billion and is expected to grow by US$300 billion by 2025.

The rising demand for safe and efficient packaging solutions which stores, moves and secures chemicals, the stringent regulations of chemicals handling and transportation safety is driving demand for advanced chemicals packaging materials and technology in Asia-Pacific region. Chemicals packaging market is expected to sustain its expansion trend in the forthcoming years, supplying the profit chances for the producers and suppliers in the concerned region.

The chemicals packaging market in North America is thriving with a number of factors playing the roles of the lead facilitators such as the recovery in chemicals production and the demand for dependable packaging solutions. Global chemicals production did not show any signs of a recession, as per the American Chemistry Council (ACC), the Global Chemicals Production Regional Index (Global CPRI) posted a positive 0.1% growth in December. In the U.S. region, the production index of chemicals for December was 0.4% up, which means a recovery from the previous drop in November.

| U.S Chemicals Industry Trade, 2022-24 ($ Billion) | |||

| Trade | 2022 | 2023 | 2024 |

| Export | 179.2 | 165.7 | 170.8 |

| Imports | 154.6 | 138.3 | 149.5 |

| Trade Balance | 24.6 | 27.4 | 21.2 |

U.S. global trade, chemicals exports and imports bring a diverse set of products including specialty chemicals and commodities. Because of this, the booming market is stimulated with aggregated worldwide demands and needs. Have a trade advantage in exchange of different products ranging from specialty to commodities. Because of this, the booming market is stimulated with aggregated worldwide demands and needs. Output in the chemicals sector of the USA grew across the country, but some signs of recovery were seen in the sectors of agriculture and coatings, which compensated for standstills of basic industrial chemicals and synthetic raw materials. North American manufacturers are providing packages with excellent performance being delivered to the market to respond to fast line speeds and efforts to maintain chemicals and petrochemicals products safe during transportation and storage.

These packaging solutions are mainly designed to include features like dust-free automatic filling and antistatic fabric, besides having puncture and burst resistance, addressing the specific needs of the chemicals industry. Consequently, the chemicals packing market in North America is expected to continue its upward trend with the improvement of the industries and the continued investments in trusted packaging solutions.

The market for commodity packaging is highly dynamic nowadays, as a substantial demand for commodity chemicals is growing for diverse sectors. Formulations of commodity chemicals can be extremely diverse, made in large quantities to meet global needs, standardized, and interchangeable. Also, they play a vital role in being the key units for different products and applications. Industries like plastics, synthetic fibers, and rubber are the major consumers of chemicals that become commodities essential for colors, pigments, and coatings.

Commodities like fertilizers, chemicals for agricultural plants, pesticides, cosmetics, soaps, cleaning agents and detergents are everywhere we go, and ultimately, this also drives the demand for their packaging. The packaging aspects of these chemicals are very important in regard to how they are safely stored and transported and fulfills the regulatory requirements that are necessary.

The development of chemicals packaging market is given a push by commodity companies that are large scale chemicals suppliers as they produce volumes of standardized chemicals required to be packed across various industries and applications.

The rapid proliferation of global economy together with the increase in the scope of natural product manufacturing is among the main factors for the fast growth of requirement for commodity chemicals and their packaging as products. Production and supply in that market of commodity packaging remains dynamic in order to satisfy the increasing challenges of sectors and businesses changing. Companies seek solutions nature-friendly like sustainable packaging materials that help to decrease environmental issues. Therefore, this market of commodity packaging has huge and long term potential due to the high demand as the vital chemicals are in high worldwide demand.

Plastic packaging has become primary material of choice across various industries ranging from chemicals packaging to commercial or retail sectors. Though the point about one terrible effect of plastic is raised, it still stands as superior material for holding chemicals as it is hardy and resiliently not corrosive. Technological advances across the plastic industry have now created newer types of the carbon-based material plastics which are readily recyclable. These segments of the twenty-first century plastics are slowly, though surely inching toward the market providing eco-friendly alternatives to plastic packaging.

The household and automobile chemicals, majority of which also comes with plastic packaging. Plastic's versatile characteristics as compared to glass; cheap manufacturing process; resistance to most chemicals including corrosive substances; and easy-to-handle packaging make it the material of choice for chemicals industries. Nevertheless, assembly of plastic doesn't suit flammable or combustible things, unless it goes through a special treatment.

Plastic provides lot of benefits, despite this, the undesirable impact to the environment should not be undermined. Companies should be opting for green packaging options wherever they can this is a key to addressing environment degradation. This issue, still chemicals packaging industry is growing at a wide rate and this prevalence of use across different industries is the driving force behind the demand for plastic packaging solutions.

For Instance,

The development of bag and sack market in chemicals packaging is achieving accelerating pace due to the impressive features of materials such as polypropylene that provide resistance to chemicals reactions and environment. In conventional packaging materials, due to chemicals such as fertilizers, the latter are no longer usable. Still, PP braided sacks are chemically and radiation resistant, and thus best fit for encasing chemicals substances.

PP woven sacks maintained the leakage of chemicals and the environment dynamics to make sure that the packaged goods were unspoiled. Due to their superior tensile strength, a large amount of chemicals can be held by them securely. The resistant tear feature ensures their usability is enhanced, which in turn leads to high reliability.

PP bag is lighter and lighter than other plastic types regarding their weight thus it is easy to handle and transport and save the cost. The attributes to polypropylene are what make its packaging irreplaceable especially in chemicals products that demand durability, chemicals resistance and reliability.

As industries increase in size and the need for chemicals products grows, the market for forms of polypropylene and other similar materials which used in the manufacturing of bags and sacks will continue to show an upward trend. This market growth is driven by the need to have a reliable and safe packaging solutions that ensure the transportation of chemicals substances.

The competitive landscape of the chemicals packaging market is dominated by established industry giants such as BASF, Dow, LG Chem, Lyondell Basell, Mitsubishi Chemicals Group, Air Liquide, Braskem, Linde, SABIC, Evonik, ExxonMobil, INEOS, Mondi Group, PTT Global Chemical, Sinopec, Sumitomo Chemical, Toray Industries, MAUSER Group, and Formosa Plastic. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

BASF's chemicals packaging efforts have centers on innovation and sustainability. They develop the research and development methods for the creation of sustainable packaging options that fulfills the needs of the current industry while also having less negative impact on the environment.

Dow puts forward the idea that technology and collaboration are things that drive the chemicals packaging to grow in the market. Creating the most superior materials and technologies is their main task. They try to do it for the purpose to improve the performance of packaging and environmental sustainability as well. Dow places great value on collaborations with clients and stakeholders as it gears towards jointly creating inventive packaging solutions that cater to dynamic market needs.

LG Chem supplies packaged material with a customer-oriented approach to ensure they offer the customized solution that will respond to each customer’s specialized needs. Their know-how in materials science and manufacturing technologies is a crucial aspect that allows them develop best-quality packaging materials which show durability, chemicals resistance, and environmental sustainability.

LyondellBasell focuses on the product differentiation and operations excellence in the chemicals packaging market. They constitute a wide range of packaging materials, that comprise polyethylene, polypropylene and speciality polymers products, which fit many kinds of packaging requirements.

By Application

By Material

By Product

By Region

April 2025

March 2025

March 2025

March 2025