October 2025

The compostable and recyclable cups market is set for significant growth, with revenue expected to reach hundreds of millions between 2025 and 2034. Driven by increasing demand for eco-friendly alternatives, this surge is fueling sustainable infrastructure worldwide, reducing plastic waste, and promoting a greener future for the beverage and food packaging industries.

The compostable and recyclable cups market is likely to witness considerable growth during the forecast period. The majority of recyclable cups are composed of recyclable paper and plastic lining. Paper is frequently made from pulped wood chips; however polyethylene (PET) is still used as an inner covering due to its affordability and practicality. Paper cups can be recycled and used to manufacture paper, tissue, paperboard, and containerboard. Most types of compostable cups are made up of materials from nature that decompose naturally over time, such as woodchips, corn starch, or recovered food waste. Compostable cups are now a common choice for companies trying to minimize their impact on the environment.

The rising consumer awareness about environmental sustainability along with the harmful effects of plastic waste and the growing trend of sustainable lifestyles among millennials and Gen Z is expected to augment the growth of the compostable and recyclable cups market during the forecast period. Furthermore, the government regulations and bans on the single-use plastics coupled with the technological advancements in the materials such as plant-based plastics (PLA), biodegradable paper, and bagasse is also anticipated to augment the growth of the market. Additionally, the expansion of the foodservice and beverage industry as well as the corporate focus on the sustainability initiatives and eco-conscious branding and the improvements in the waste management infrastructure is also projected to contribute to the growth of the market in the near future.

The rapid expansion of the cafes, fast-food outlets and takeaway services is expected to augment the growth of the compostable and recyclable cups market within the estimated timeframe. This is owing to the changing consumer lifestyles and the convenience of the on-the-go food and beverages. Cafes and fast-food restaurants support these needs by providing a diverse selection of ready-to-eat meals, beverages and snacks that are compatible with modern, on-the-go lives. Global fast-food chains and coffeehouse franchises are entering into new markets, capitalizing on a growing demand for unique dining experiences. For instance:

This strong market entry and continuous growth have not only altered global dining preferences, but have also had a positive impact on connected industries, such as sustainable packaging, as they adjust to rising consumer and regulatory expectations for sustainable alternatives.

The higher production costs associated with sustainable alternatives is likely to restraint the growth of the compostable and recyclable cups market during the forecast period. Even while compostable and recyclable materials perform remarkably well for the environment, there is a major obstacle to their widespread use. The ingredients used to make compostable cups are usually plant-based and are more costly than plastics derived from petroleum.

Additionally, the manufacturing of these materials usually involves more complicated processes that need for specialized technologies. Cups made-up of plastic has benefited from economies of scale brought about by decades of mass production. But due to their relative infancy and limited production, compostable alternatives are more expensive per unit. These increased production costs have a negative effect on the pricing of compostable and recyclable cups, making them more expensive for both makers and end users.

For small enterprises, specifically independent cafes, food trucks and local restaurants, the price gap can be a substantial barrier. The cost of compostable products is further increased by a mandate that they fulfill strict biodegradability and composting standards such as ASTM D6400 or EN 13432. Compostable materials, in contrast to plastics, may break down over time under specific circumstances, therefore requiring improved storage as well as faster turnover, which increase logistical expenses. As a result, cost-conscious customers who do not value sustainability over the price may choose regular plastic cups, thereby hampering the adoption of compostable and recyclable cups. Until production techniques grow more effective and economies of scale are achieved, greater costs will remain a substantial barrier to wider adoption.

The increasing investments in the recycling infrastructure owing to the growing focus on sustainable waste management as well as global environmental challenges and public awareness of the environmental issues is expected to create substantial growth opportunity for the compostable and recyclable cups market in the near future. The developed regions such as North America and Europe are at the forefront of this transformation, with private entities investing in the waste processing facilities to support the transition towards a circular economy.

The development of the recycling facilities can help promote hybrid packaging products that combine compostable materials with recyclable plastics, providing both sustainability as well as recyclability. This will result in efficient recycling paths, increasing the market by expanding options for companies looking for sustainable packaging. Furthermore, improvements in the paper recycling facilities can lower the costs associated with the paper-based recyclable cups, which is an important segment of the market. These improvements will eventually increase the scalability of the sustainable packaging and help in the widespread adoption by both companies and consumers, driving the demand for compostable and recyclable cups.

Artificial Intelligence (AI) emerges as a silent but transformative force, reshaping the industries as well as redefining the possibilities in terms of sustainability. The compostable and recyclable cups market, an important element of the global drive towards the eco-friendly products, is no exception. AI's integration into this sector goes beyond mere automation; it introduces an entirely new approach that helps in solving the core challenges in production, waste management and consumer engagement. AI algorithms are presently fine-tuning production processes in real time, eliminating waste and improving the quality and uniformity of recyclable materials.

Artificial intelligence-enabled robots can recognize, sort and separate various materials. They outperform human workers in terms of speed and accuracy. These robots identify different objects and materials on conveyor belts utilizing computer vision and machine learning. These developments are no longer just aspirations; they are actively changing the market today.

As consumer demand for the sustainable packaging increases, AI becomes a strategic tool for organizations, evaluating trends, improving supply chains as well as assisting in the manufacturing of next-generation materials. From improved biopolymers with increased durability to predictive models that identify market demands, AI is unlocking previously impossible performance. AI can track the complete lifecycle of a product, from the production to disposal. This guarantees responsibility and transparency across the process. Additionally, AI can detect new prospects for resource recovery. This consists of obtaining beneficial materials from streams of waste that would have been neglected using traditional procedures. As AI evolves, it is projected to accelerate innovation and push wider acceptance of compostable and recyclable cups, making a substantial contribution to the circular economy.

The compostable segment is likely to grow at a considerable CAGR during the forecast period. The FDA-approved natural, sustainable materials used to make compostable cups consist of cornstarch, cellulose molded fiber, and sugarcane bagasse. The harmful chemicals that other types of packaging are made of or employ in their production process are decreased when these 100% natural and renewable materials are used. They are therefore an ideal substitute for single-use cups, which frequently contribute to pollution in the environment.

The compostable materials can be integrated into composting systems, benefitting both households as well as businesses and this is further expected to contribute to the growth of the segment within the estimated timeframe. Additionally, compostables require less energy to make and don’t expose workers to harmful chemicals like in traditional plastic manufacturing. For instance, compared to traditional plastic cups derived from petroleum, PLA cups produce 50% less energy that is not renewable and 75% less greenhouse gas emissions. This factor is also likely to support the segmental growth of the market during the forecast period.

The online segment is expected to grow at a steady CAGR within the estimated timeframe. This is owing to the rapid growth of the e-commerce platforms as well as the increasing digitalization of the business operations across the globe. Furthermore, the rise of the online channels dedicated to the eco-friendly products along with the increasing number of suppliers and manufacturers utilizing the online platforms to expand their reach are also likely to contribute to the growth of the segment within the estimated timeframe. Additionally, the advancements in the logistics and payment technologies coupled with the bulk purchasing and subscription options available online are further expected to support the segmental growth of the market in the near future.

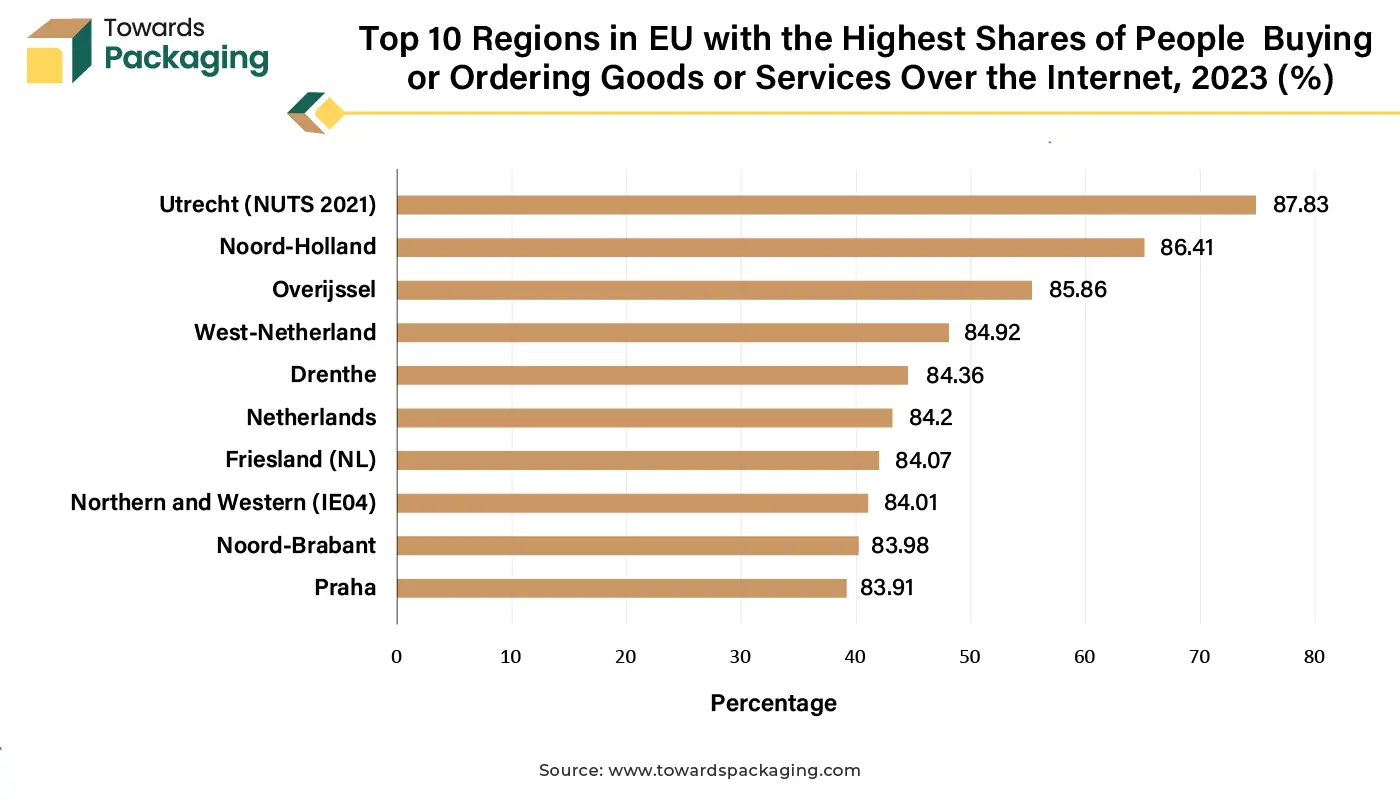

Europe held substantial market share in the year 2024. This is owing to the stringent regulatory frameworks like EN 13432 set standards for the compostable materials. Additionally, the increasing online sales along with the flourishing café and takeaway culture are also expected to contribute to the regional growth of the market. As per the data by the Eurostat, in 2023, 58.1% of EU citizens between the ages of 16 and 74 stated they had placed an online order for products or services. A minimum of 80% of the individuals between the ages of 16 and 74 in 21 EU regions made a private online purchase or placed an order in the year 2023. Utrecht (87.8%), Noord-Holland (86.4%) and Overijssel (85.9%) were the three Netherlands regions with the largest percentages of persons purchasing or ordering products or services online. Furthermore, the presence of most advanced recycling systems is also expected to contribute to the regional growth of the market.

Asia Pacific is likely to grow at the fastest CAGR during the forecast period. This is due to the increasing urban populations in countries like China, India and Southeast Asia. Also, the expansion of quick-service restaurants, cafes and street food vendors is likely to contribute to the regional growth of the market. According to the NRAI Indian Foodservices Industry report, as of FY24, the Indian food services industry is projected to be worth USD 68.31 billion (Rs 5, 69,487 crores). By FY28, it is anticipated to reach USD 93.16 billion (Rs 7, 76,511 crores), with a compound annual growth rate (CAGR) of 8.1% overall, while the organized category growing at a CAGR of 13.2%.

With an estimated 6.6 Crore urban residents using food delivery platforms, the industry has also seen tremendous development in the online food delivery segment, illustrating how convenience is driving changes in the consumer behavior. Furthermore, the growing middle class and increased awareness about the environmental issue are also expected to contribute to the regional growth of the market.

By Material Type

By Product Type

By End-Use Industry

By Distribution Channel

By Region

October 2025

October 2025

October 2025

October 2025