April 2025

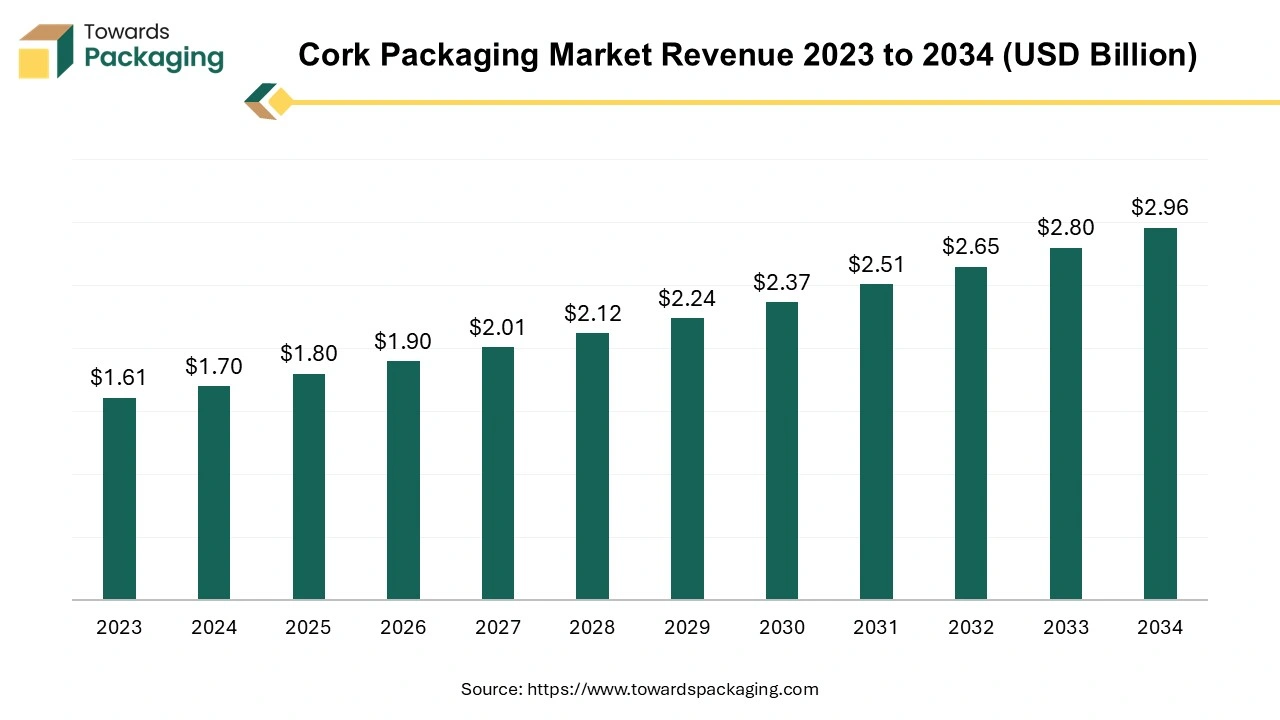

The cork packaging market is forecasted to expand from USD 1.80 billion in 2025 to USD 2.96 billion by 2034, growing at a CAGR of 5.7% from 2025 to 2034.

The demand for sustainable and natural packaging driving growth of global cork packaging market. additionally, increasing preference toward high-end premium and luxury products encouraging market expansion. Growth of e-commerce and dire-to-consumer sales projected to boost market in forecast period.

Growing consumer awareness about eco-friendly packaging materials and ongoing innovations in cork packaging are the drivers for adaption of cork in packaging. Cork packaging majorly being utilized in wine and spirits due to need to bottle stoppers. The increased R&D investments and promotions of sustainability programs, are encouraging business toward cork packaging applications.

Luxury food and beverages brands are utilizing cork packaging to improve their product appearance and build classic feel. Brand image and storyline brands are adapting cork packaging for their goods to maintain their significant elegance, exceptional quality.

Demand of cork-based packaging has increased in premium and luxury products due to cork packaging allows the high-quality image to products, which making it spectacularly turning toward premiumization. Growing trends of authentic options can be satisfied due to simple and natural appearance of cork. Growing requirement of high aesthetic standards, and visual appealing to consumer attraction, adoption of cork packaging has accomplished by cosmetics and personal care industries. The global packaging industry size is growing at a 3.16% CAGR between 2025 and 2034.

Cork production technologies are continuously innovating to enhance the performance and originality of cork stoppers. Cork demand in pharmaceutical and healthcare use has been increased due to improved consistency and quality. Novel processing system has minimized the presence of contaminations in cork materials and enhanced the materials sealing properties. Expansion in wine and spirits industries are driving business to advance their production technologies.

Hybrid closure solutions are driving the cork packaging market by improving advantages of various materials to create high-performance closures. Hybrid closures are beneficials to improve durability and corrosion resistance and sealing performance. Additionally, the risk of contamination and taint can be reduced by cork-based hybrid closures. Rising innovation in smart packaging solutions and combination of natural cork with other materials are driving the investments in cork-based packaging’s.

growing innovations in cork stopper technology and product advancements have the great market potential in cork packaging in upcoming years. Business is focusing on advancements in process technologies and innovating in creating novel cork-based products. Thanks to this innovations, cork-based closures are having major impact on still and wine sparkling. Growing requirement of sustainability packaging is likely to improve the adaption range of cork-based packaging’s.

E-commerce plays a crucial role in cork-based food and beverages packaging, which increasing requirement of enduring, safe and effective packaging solutions. Increasing need for protection during transportation, and premium & sustainability packaging boosting market. e-commers is able to offer the numerous customized and rand options to consumers. Additionally expanding online sales of food & beverages are driving market. these sales are boosting advancement in packaging materials and designs by increasing consumer wishes and improving need of online deliveries, which likely to expand market.

Food safety & shelf-life regulations have placed limitation on food & beverage packaging sector. Cork materials are sensitive to moisture and UV lights, which highly impacts on shelf-life of products. Additionally, it has high chances of chemical interactions and can produces allergies. Food contamination risk is likely to restraint the market growth. To ensure the safety of goods cork packaging are required to e sterilized, which could increase cost of industrial procedure. These limitations are challenging flexibility and investments in market.

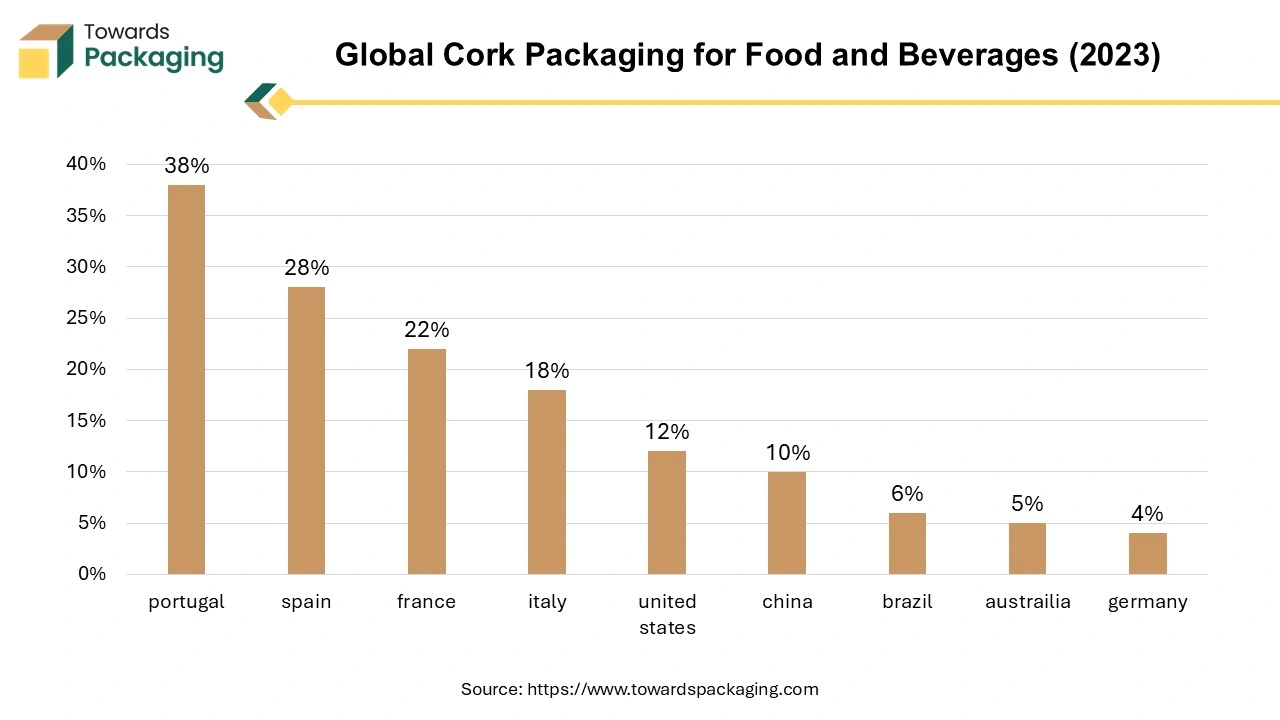

High-scale wine productions culture and presence of extensive cork oak forest are driving the cork packaging market in Europe. Availability of cork oak reduces the cost of transformations and offers high-quality sustainable sources of cork. Portugal is well known for the developed supply chain and largest infrastructure facility provider. Additionally, European government is encouraging companies to invest in research & development, which enhancing the quality and productivity of goods.

Additionally, increasing popularity of sustainable and luxury packaging as well as growing e-commerce network is likely to boost innovation of cork in region. Regulatory frameworks like EUs Circular Economy Package toward enhancing resource efficiency and setting standards of packaging materials and expanding global competitiveness. Increased eco-friendly trend movements in Germany and France are boosting demands of cork-based packaging in region.

Germany is encouraging emerge of wine-production countries. Factors like expand food & beverage market, large scale wine and luxury productions, environmental labeling and certification and favorable sustainable packaging are projected to continuous dominance on cork packaging market in Europe.

As per International Cork Oak, Portugal is the largest country for amount of cork oak trees and founded as world leader of cork productions.

Increasing population rising the demand of products with luxury packaging, which can lead toward hamper of environment. Moreover, expansion of food & beverages market and demand for specialty and gourmet products are lighting on requirement of packaging. Growing expansion in wine packaging manufacturing companies in China are crucial driving market. Food safety regulations, and government support for Eco-fridley packaging and creating standards of cork packaging. Additionally, foreign investments, collaborations and e-commerce market growth are trending in Asian cork packaging market.

Based on application, the food and beverages segment accounted as market’s dominant segment. Cork has eco-friendly, biodegradable and antimicrobial nature useful for preservation of food. Expanding utilization of cork packaging in wine and spirits industry are factors responsible for segment growth.

By Type

By Application

By Region

April 2025

April 2025

April 2025

April 2025