March 2025

.webp)

Principal Consultant

Reviewed By

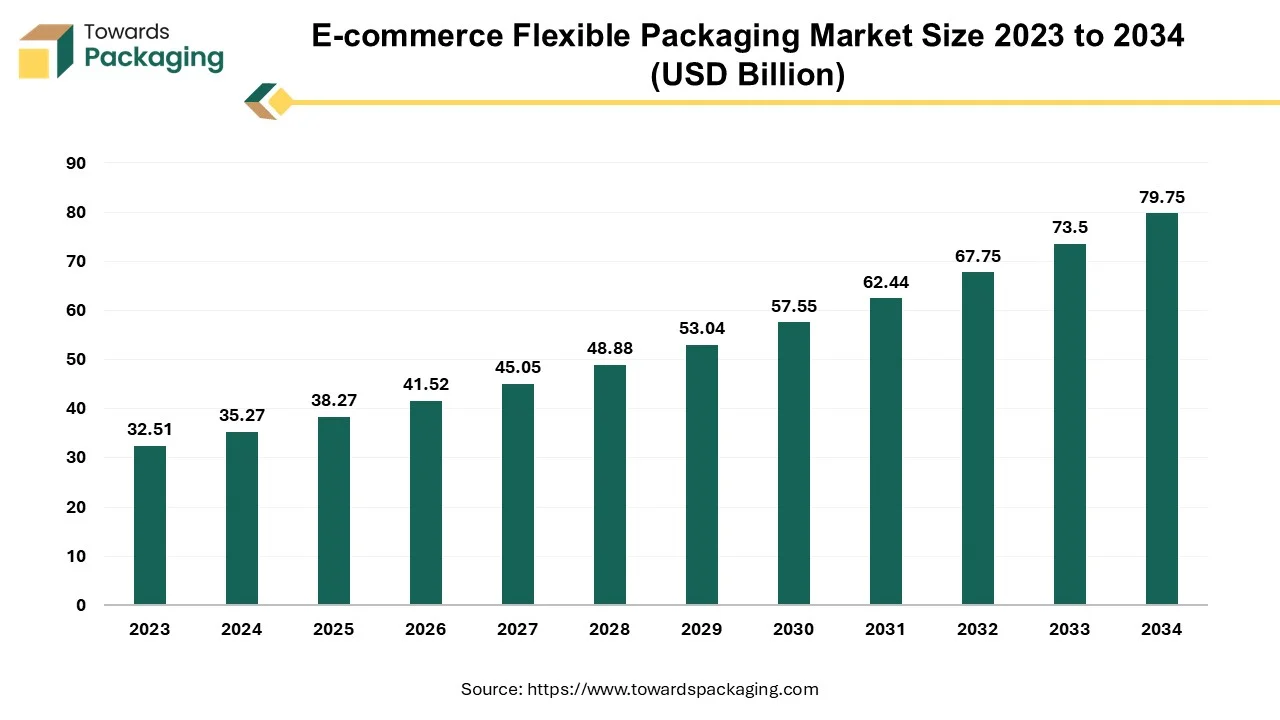

The e-commerce flexible packaging market is anticipated to grow from USD 41.52 billion in 2025 to USD 79.75 billion by 2034, with a compound annual growth rate (CAGR) of 8.50% during the forecast period from 2025 to 2034.

Flexible packaging is the rapidly growing sector of the global packaging industry and is one of the best solutions for the e-commerce applications. By using flexible packaging, retailers may accomplish e-commerce shipping that is affordable, effective, and lightweight. Flexible packaging typically uses less energy during production and transportation, produces less product waste, which lowers greenhouse gas emissions, and uses less landfill space. This is because flexible packaging makes it possible to use resources efficiently and hence widely adopted by the e-commerce sector. Thus, the e-commerce flexible packaging market is anticipated to witness significant growth during the forecast period.

The growth of the e-commerce platforms coupled with the consumer demand for convenient and lightweight packaging as well as the increasing awareness of sustainability among consumers is anticipated to augment the growth of the market within the estimated timeframe. The market is further driven by the increasing investments by most of the key market players in the eco-friendly packaging methods to create sustainable use of plastics. The global packaging market size is growing at a 3.16% CAGR between 2025 and 2034. Growing research and innovation in the packaging industry to guarantee safety, hygiene along with integrity of the products is also likely to contribute to the growth of the market in the years to come.

The increasing popularity of e-commerce among consumers has led to a gradual but continuous shift towards the online purchasing platforms. The epidemic augmented the growth of e-commerce, necessitating practical distribution methods, as digital customers adopted online channels for purchasing products. More and more packaged goods and the groceries that were traditionally purchased personally were being shipped straight to the customers.

Furthermore, the major retailers are focusing more and more on their digital marketing approach in an effort to profit from the clear advantages of online platforms such as increased reach, constant availability and customization. Major companies in this market state that mobile apps account for over 50% of their total income. Also, according to the data by Adobe, online spending by Americans from January 1 to April 30, 2024, was $331.6 billion, an increase of 7% YoY. This is owing to the steady spending in the premium areas like electronics and fashion as well as continued increase in the online grocery shopping. Cosmetics are another growing online segment which generated $35 billion in online spending in 2023, growing at 15.6% YoY. Customers continue to maintain the upward trend, spending $13.2 billion (up 8% YoY) on cosmetics online so far in 2024.

This data indicates consumer’s inclination towards online shopping for its convenience, variety, better prices and direct shipping to homes. This shift necessitates packaging that is not only protective but also lightweight, cost-effective and environmentally friendly. These requirements are completely met by flexible packaging options that have many benefits over the conventional packaging. Due to its lightweight design, shipping costs are greatly reduced, which is essential for e-commerce companies who are running on limited profit margins. Additionally, flexible packaging can be designed to fit products snugly, reducing the need for excess materials and minimizing waste.

The rise in production of plastic packaging waste is likely to limit the growth of the market during the forecast period. As it's convenient and easy, online shopping has grown in popularity in the recent years. But the packaging that is been used for shipping of the products have considerably negative impact on the environment. Amazon alone generated around 465 million pounds of waste from the plastic packaging in 2019, based on a report by the Oceana. Included in this waste are the bubble wraps, air pillows and other types of plastic packing materials added to the almost 7 billion Amazon parcels that were shipped in 2019.

Furthermore, plastic packaging frequently ends up contaminating the oceans and damaging marine life since it requires numerous years to break down. A garbage truck load of plastic debris is dumped into the ocean every minute, as per the United Nations, which estimates more than 8 million metric tons of garbage made of plastic end up in the oceans annually.

Online shopping package waste has another drawback that it is frequently not reused or recycled. As per Ellen MacArthur Foundation report, only 14% of the plastic that is used worldwide is gathered for reuse and recycling purpose, with very less being recycled. The remaining waste ends up in the environment or landfills, where it may take countless years for the materials to decompose and release the toxic chemicals. It is remarkable how much garbage is produced by e-commerce packaging. In addition to consuming valuable landfill space, this waste damages the environment and generates greenhouse gas emissions. Therefore, improved waste management practices are essential to balance the demand for flexible packaging.

Reducing environmental impact is very important to distributors, manufacturers, retailers and suppliers. This is influenced by the implementation of laws and regulations from the government as well as pressure from stakeholders and customers. Companies will gain significant advantages from more exposure and openness regarding their environmental actions. The majority of firms have made it public that they are striving toward having all of their packaging recyclable. Numerous firms are also developing refillable and reusable systems. Lastly, in order to decrease the demand for additional virgin materials, the full supply chain is eager to witness more post-consumer recycled content (PCR) employed in packaging.

The shift towards the circular economy offers the market a pathway to sustainability. This transition not only benefits the environment but also improves the brand reputation and adheres with the regulations and standards favoring the sustainable practices.

The plastic segment captured largest market share of 64.31% in 2024. Plastic is the most widely used material owing to the several advantages it offers in packaging. Compared to the other materials, plastics use less energy, which lowers energy expenditures and the corresponding emissions of pollutants. This material has a wide range of performance characteristics and it can be easily molded into any desired shape. Furthermore, packaging made from the plastic is lightweight and takes up less space as compared to the other alternatives, resulting in smaller weights on the flights and trucks and hence less pollution. Also, as plastic packaging is capable of being recycled again to make new products, the recycling rates and the variety of plastics that can be recycled have been increasing globally.

The apparels and accessories segment captured a significant market share of 27.12% in 2024. Customers are now more at ease using their laptops and smartphones to make purchases of clothing. For a long time, customers were cautious about ordering the clothes online, but now that online merchants have reduced the risk with their generous return, refund procedures and active utilization of free delivery, they are beginning to feel more at ease about it.

Furthermore, online shopping platforms offer a broad range of options, enabling customers to peruse numerous high-end clothing designers and collections. Due to this accessibility, consumer behavior has significantly changed, with an increasing number of consumers choosing to purchase online for their fashion requirements. Additionally, the emergence of augmented reality has offered consumers with further interactive shopping experience and hence they can try on the clothes virtually now. These factors are likely to support segmental growth of the market within the estimated timeframe.

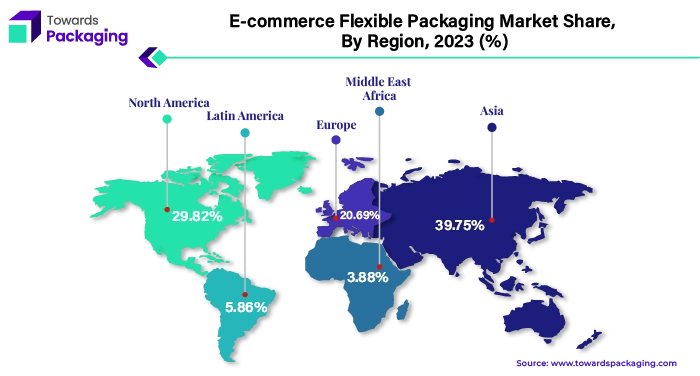

Asia Pacific held largest market share of 39.75% in 2024 and is expected to grow at a fastest CAGR of 10.28% during the forecast period. China is the largest market in the region. According to the National Bureau of Statistics of China, in 2023, the total value of online retail sales in the country was USD 2,163.51 billion (15,426.4 billion Yuan), representing an increase of 11.0 percent as compared to the previous year. Of these, the value of online retail sales of physical products was USD 1,825.65 billion (13,017.4 billion Yuan), representing an 8.4 percent increase and contributing to 27.6 percent of all consumer goods retail sales. This is owing to the rapid urbanization along with rising middle class population across the region.

Additionally, the changing lifestyles of the people and increasing smartphone and internet usage is also projected to contribute to the growth of the market across the region. Furthermore, increased preference for packaging options that are lightweight, recyclable and minimize waste is likely to support the regional growth of the market.

North America held considerable market shares of 29.82% in 2024. This is due to the wide range of product choices and reliable logistics networks across the region. Also, the strong consumer and regulatory push towards sustainable packaging are further expected to drive the demand for labels in the years to come. Furthermore, the advancements in barrier films and adoption of new printing technologies and smart packaging solutions are also expected to support the regional growth of the market in the near future.

By Material

By Product

By Application

By Region

March 2025

March 2025

March 2025

March 2025