April 2025

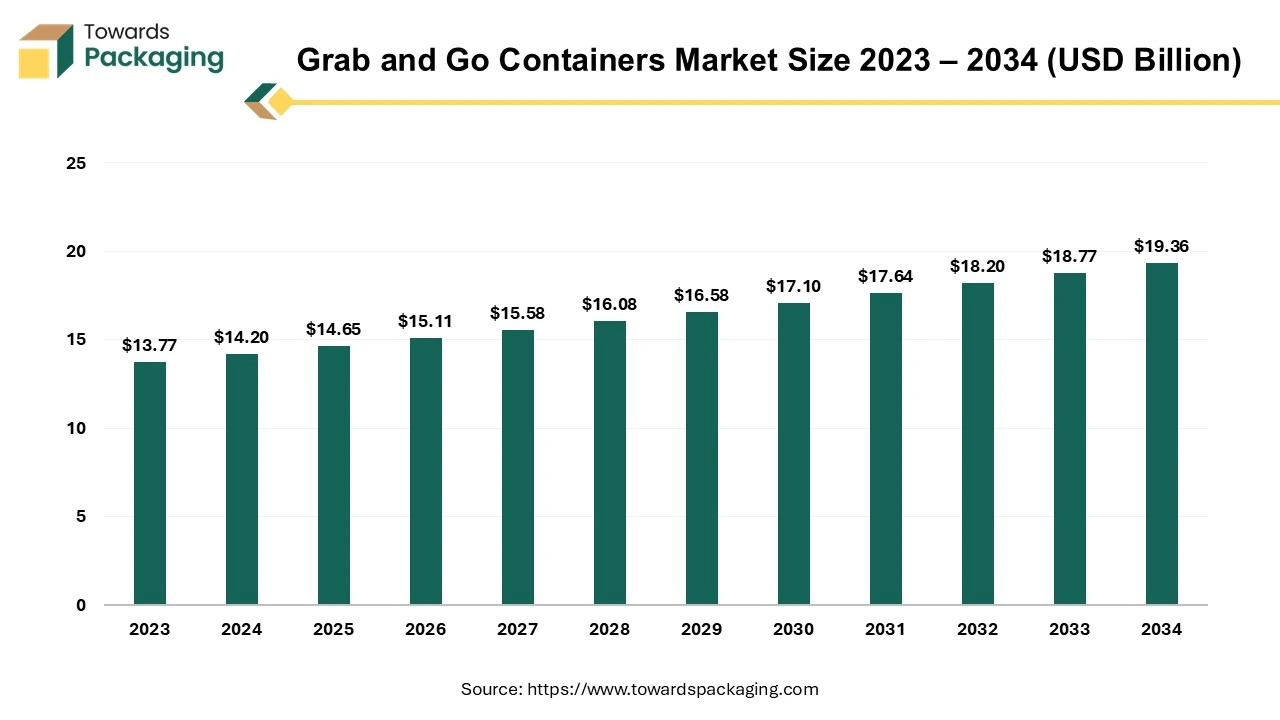

The global grab-and-go containers market was valued at $14.65 billion in 2025 and is projected to grow to $19.36 billion by 2034, expanding at a CAGR of 3.15%. Driven by the rising demand for convenient and sustainable packaging, this market presents significant growth opportunities for businesses looking to innovate in the food and beverage packaging industry.

Unlock Infinite Advantages: Subscribe to Annual Membership

Grab and go containers is known as packaging solutions designed for convenience, allowing consumers to easily pick up and take their food or beverages on the go. These containers are typically utilized in the food service industry, particularly for quick-service cafes, restaurants, and grocery stores. They are designed to be portable, durable, and often disposable, making them ideal for busy lifestyles. Easy to carry and often designed for single-use, making them perfect for takeout and delivery. Suitable for an extensive range of food items, including hot and cold meals, salads, snacks, and beverages.

The grab and go containers are made from various materials such as paper, plastic, or biodegradable options, depending on environmental considerations and the type of food being packaged. The grab and go containers are often equipped with secure lids to prevent spills, and some may have compartments for separating different food items. These containers cater to the increasing demand for quick, convenient meal options, especially in urban areas where busy consumers prefer ready-to-eat meals.

Urbanization and fast-paced lifestyles are propelling the demand for ready-to-eat and takeaway meals, boosting the need for efficient grab-and-go packaging solutions.

Environmental concerns are leading manufacturers to develop recyclable, biodegradable, and compostable containers. Innovations include seaweed-based bioplastics and reusable container systems, aiming to reduce single-use plastic waste.

While plastic containers, particularly those manufactured from PET and PP, currently dominate due to their durability and cost-effectiveness, there's a significant shift towards paper-based and biodegradable materials to meet eco-friendly consumer preferences.

The expansion of e-commerce and food delivery platforms is increasing the demand for packaging that maintains product integrity during transit, further driving the grab-and-go containers market.

Rising awareness about food contamination from certain packaging materials is influencing consumer choices and prompting manufacturers to adopt safer, non-toxic materials.

AI can analyze historical sales data, weather patterns, and local events to accurately predict demand, helping companies optimize inventory and minimize waste. By analyzing customer preferences and purchase history, AI can recommend personalized meal options, enhancing customer satisfaction and loyalty. AI-driven systems can monitor inventory levels in real-time, automate restocking, and reduce the chances of overstocking or stockouts. AI-powered vision systems can inspect products for quality assurance, ensuring that only the best products reach customers.

AI can streamline the supply chain by predicting delays, optimizing routes, and reducing transportation costs, leading to faster and more reliable deliveries. AI chatbots and virtual assistants can provide instant customer support, answer queries, and offer recommendations, improving the overall customer experience. AI can optimize energy usage in storage and production facilities by predicting peak usage times and adjusting energy consumption accordingly.

The AI integration assists in product development by carrying out analyses of market trends and customer feedback to develop new products that meet evolving consumer preferences. AI algorithms can adjust pricing based on demand, competition, and other factors, maximizing revenue and inventory levels, as well as by suggesting alternative uses for surplus products.

The popularity of meal kits and ready-to-eat meals in online grocery sales encourages the use of grab-and-go containers, which provide portion control, ease of use, and the ability to keep ingredients and meals fresh. Hence, the growth in the introduction and sales of ready-to-eat meals and meals kits has driven the growth of the grab and go containers market over the forecast period.

The key players operating in the market are facing issue due to supply chain and logistics challenges as well as environmental concerns, which has restricted the growth of the grab and go containers market in the near future. The production and distribution of sustainable grab-and-go containers can face logistical issues, including limited supply of raw materials, higher transportation costs, and complex recycling processes. Rising awareness and regulations related to plastic waste and environmental sustainability can limit the use of single-use containers. Many governments and organizations are pushing for bans or restrictions on plastic packaging.

With increasing awareness of environmental concerns, many online grocery and meal delivery companies prioritize sustainable packaging. This drives innovation and demand for eco-friendly grab-and-go containers that align with consumer values. Growth in the demand for the sustainable and eco-friendly grab and go containers has created lucrative opportunity for the growth of the grab and go containers market in the near future.

Rising introduction of smart packaging solutions has created lucrative opportunity for the growth of the grab and go containers market in the near future. Integration of technology in packaging, such as temperature indicators or QR codes for tracking and information. Development of containers that are safe for reheating in microwaves or ovens.

Opportunities for businesses to offer customized, branded containers to enhance customer experience and brand loyalty. Unique designs that improve functionality and aesthetics, such as stackable or compartmentalized containers. As more people live in urban areas, the need for convenient, portable food options grows. Busy lifestyles continue to drive demand for grab-and-go options in various sectors, including retail, office, and travel.

The plastic segment held a dominant presence in the market in 2024. Plastic is much lighter than alternatives like glass or metal, making it easier to transport and handle. Plastic is resistant to breaking or shattering, which makes it a safe choice for handling and transportation. Plastic is relatively inexpensive to produce, which keeps the costs of manufacturing and the final product low. Plastic material offers a good barrier against moisture, keeping food and beverages fresh for longer periods.

Plastic containers are often designed for single-use, which helps maintain hygiene by reducing the risk of contamination. Many plastic containers are designed to be disposable, making them convenient for on-the-go consumption. Many types of plastic can be recycled, which helps in managing waste and reducing environmental impact when disposed of properly. These properties make plastic an ideal material for grab-and-go containers, despite concerns about environmental impact.

The 250-500 ml segment accounted for a considerable share of the grab and go containers market in 2024. This size range is ideal for individual servings, helping consumers manage portion sizes and reduce food waste. These containers are easy to carry, making them perfect for on-the-go lifestyles, such as commuting, traveling, or quick meals during work breaks. The 250-500 ml capacity is suitable for a variety of food and beverage items, including soups, salads, snacks, drinks, and desserts. This capacity often aligns with single-serving portions, which is appealing for consumers looking for quick, ready-to-eat meals or snacks.

Many health-conscious consumers prefer smaller portions to control calorie intake, making these containers a popular choice. Smaller containers are often more affordable, making them accessible to a broader range of consumers. Smaller portions mean less food is wasted if the entire contents are not consumed, which is particularly important for perishable items. With increasing urbanization and busier lifestyles, consumers prefer quick, portable food options that fit into their daily routines.

The clamshell segment registered its dominance over the global grab and go containers market in 2024. Clamshell containers are designed to open and close easily, providing quick access to food or items. This is convenient for both consumers and vendors. The hinged design securely encloses the contents, providing better protection for food during transportation, reducing the risk of spills, and keeping the food fresh. Many clamshell containers are clear, allowing customers to see the contents easily, which enhances their appeal for take-out and food displays.

These containers come in various sizes, making them ideal for single-serving portions or take-out meals, which aligns with the growing trend of smaller, controlled servings. Clamshell containers can be used for a wide range of food items, including salads, sandwiches, fruits, baked goods, and more. Their versatility makes them suitable for different types of businesses, from fast food to delicatessens.

Clamshell containers can be stacked easily, making them efficient for storage and transport. This assists in businesses save space and cutting-down shipping costs. Many clamshell containers are made from recyclable or compostable materials, which appeals to environmentally conscious consumers and businesses.

The foodservice segment dominated the grab and go containers market globally. Expansion of online food delivery platform has estimated drive the growth of the segment over the forecast period. As more consumers order groceries and meals online, the need for reliable and efficient packaging solutions, including grab-and-go containers, increases to ensure the safe and fresh delivery of products. Online grocery and meal delivery services cater to consumers' desire for convenience. Grab-and-go containers provide an easy way to package and consume food directly, meeting the demand for hassle-free dining experiences. The diversity of products offered through online grocery and meal delivery platforms requires a wide range of container types, from sturdy containers for hot meals to specialized packaging for delicate produce, boosting the demand for versatile grab-and-go containers.

Online grocery and meal delivery services emphasize maintaining product freshness and quality. Grab-and-go containers are designed to preserve food integrity during transit, making them essential for these services. With growing awareness of environmental concerns, many online grocery and meal delivery companies prioritize sustainable packaging. This drives innovation and demand for eco-friendly grab-and-go containers that align with consumer values. The COVID-19 pandemic accelerated the shift towards online shopping and contactless delivery, further driving the reliance on grab-and-go containers to ensure safe and hygienic packaging.

Asia Pacific region held the largest share of the grab and go containers market in 2024. Rapid urbanization in countries like China, India, Japan, and South Korea has led to more people living in cities with fast-paced lifestyles. As a result, there is increased demand for convenient food packaging solutions like grab-and-go containers that cater to busy professionals and young consumers looking for ready-to-eat meals.

Economic growth in the Asia Pacific region, especially in emerging economies, has led to an increase in disposable income. This enables consumers to spend more on convenience products, including food packaging solutions like grab-and-go containers for meals from restaurants, cafes, and supermarkets.

The rise of Quick-Service Restaurants and cafes, fast casual dining, and coffee chains across Europe has expanded the need for efficient and convenient packaging solutions. Grab-and-go containers are crucial for these foodservice establishments to serve customers with pre-packaged meals, snacks, and beverages.

Europe region is anticipated to grow at the fastest rate in the grab and go containers market during the forecast period. In many European countries, consumers are adopting faster, on-the-go lifestyles, particularly in urban areas. Busy professionals, students, and travelers prefer convenient, portable food options that can be easily consumed while commuting, working, or on the move. Grab-and-go containers meet this need by offering a practical solution for pre-packaged meals, snacks, and drinks.

Europe has stringent environmental regulations and a strong emphasis on sustainability.

Many consumers are becoming more environmentally conscious, pushing for the use of eco-friendly, biodegradable, or recyclable packaging. The grab-and-go containers industry has responded to this demand by offering packaging made from sustainable materials such as recycled plastics, paper, and plant-based products.

Several companies like Huhtamäki Oyj, DS Smith, Biopac UK Ltd, Plasticos Españoles, Sappi Lanaken Mill, etc. in Europe are contributing to the growth of the grab-and-go containers industry, with their innovations in packaging solutions and increasing demand for convenience food.

North America to show prominent growth of the grab and go containers market. North America, particularly the United States and Canada, has a strong consumer preference for convenience-driven solutions, especially in food consumption.

Busy lifestyles and time constraints have led to an increased demand for grab-and-go meals, snacks, and beverages. Grab-and-go containers serve this need by providing portable and ready-to-consume food packaging solutions. North America has a well-established culture of food delivery, takeout, and takeaway dining. This has been amplified by the rise of online food delivery platforms like UberEats, Grubhub, and DoorDash. As a result, the demand for grab-and-go containers for packaging food in transit has grown significantly.

By Material Type

By Capacity

By Product Type

By End Use

By Region

April 2025

April 2025

April 2025

April 2025