March 2025

.webp)

Principal Consultant

Reviewed By

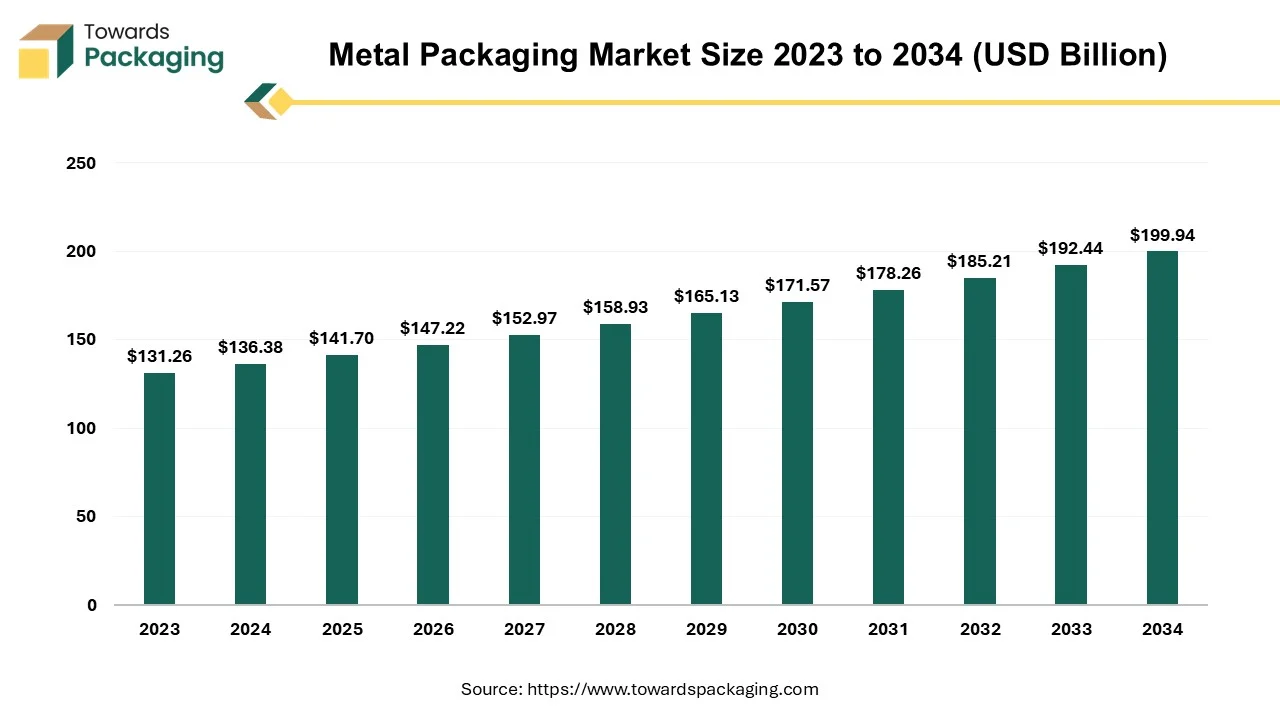

The metal packaging market is expected to increase from USD 141.70 billion in 2025 to USD 199.94 billion by 2034, growing at a CAGR of 3.9% throughout the forecast period from 2025 to 2034.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing metal packaging which is estimated to drive the global metal packaging market over the forecast period.

Metal packaging refers to containers and enclosures made from metals like aluminum, steel, and tinplate to store and protect various products. It is widely used in industries such as food & beverages, pharmaceuticals, cosmetics, chemicals, and personal care due to its durability, recyclability, and excellent barrier properties. Metal packaging is strong, heat-resistant, and impact-resistant.

Advancements in metal packaging, such as nitrogen-infused widgets in aluminum cans, are enhancing product quality and consumer experience. These innovations are particularly popular in the ready-to-drink beverage segment, offering durability and improved shelf stability.

AI-powered computer vision can detect micro-defects (e.g., cracks, dents, or coating inconsistencies) in cans and other metal packaging at high speeds. Machine learning models can classify defects and suggest corrective actions in real time, reducing waste and rework. AI-driven predictive analytics can monitor machinery (presses, cutters, coaters) and predict failures before they happen, minimizing downtime and extending equipment life. Sensors and IoT devices collect real-time data, which AI analyzes to optimize maintenance schedules.

AI can fine-tune production parameters (e.g., temperature, pressure, speed) to optimize metal forming, cutting, and coating processes, reducing material waste and energy consumption. Smart algorithms can automate workflow scheduling to balance demand, reduce bottlenecks, and enhance productivity. AI can predict demand fluctuations based on market trends and historical data, helping to avoid overproduction or shortages.

The rise in urbanization and busy lifestyles has increased demand for ready-to-eat meals, canned foods, and beverages. Growth of the beverage industry, especially carbonated soft drinks, alcoholic beverages, and energy drinks, boosts the demand for aluminum cans. Metal packaging is highly durable, making it ideal for e-commerce shipping, where products face handling, stacking, and long transit times. It protects contents from damage, contamination, and external factors like moisture and light, especially for food, beverages, and pharmaceuticals.

Online grocery shopping is increasing demand for canned foods, beverages, and preserved products that require long shelf life and secure packaging. Meal kits and subscription food services rely on metal packaging to keep products fresh. Consumers prefer recyclable and eco-friendly materials, and aluminum and steel packaging align with sustainability goals. Many e-commerce brands are replacing plastic with metal alternatives to appeal to environmentally conscious buyers.

The key players operating in the market are facing issue due to high initial investment and production costs which has estimated to drive the growth of the metal packaging market. Stringent recycling and carbon footprint regulations make compliance costly. BPA concerns in metal can linings have led to stricter rules and reformulations. Growing demand for lightweight and resealable packaging favors plastic and composite materials. Eco-conscious consumers are pushing brands toward recyclable and biodegradable options. Dependence on global metal supply chains makes the industry vulnerable to disruptions (e.g., trade restrictions, logistics bottlenecks). Geopolitical tensions can affect raw material availability.

Aluminum and steel packaging are 100% recyclable, with high global recycling rates, making them environmentally preferred over plastic. Government regulations and consumer preferences are pushing companies toward eco-friendly packaging solutions. For instance, in October 2023, Eviosys, a pioneer in the metal packaging sector with sustainability and innovation at its heart, makes its debut as a brand-new, independent business. With hundreds of customers for food and consumer goods both locally and internationally, the company is the biggest producer of steel and aluminum food packaging in Europe.

The aluminium material segment to dominated the global metal packaging market in 2024. Aluminum is significantly lighter than steel, reducing transportation costs and making handling easier. Naturally forms an oxide layer that protects it from corrosion, making it ideal for moisture-sensitive products like beverages and canned foods. The aluminium metal offers 100% protection against light, oxygen, and moisture, preserving product freshness and extending shelf life.

The cans segment accounted for a significant share of the metal packaging market in 2024. One of the most prominent types of metal packaging is the can, which is usually used for chemicals, food, and beverages. Growth in this market is also being driven by the increased demand for canned drinks, including soda, energy drinks, and alcoholic beverages. Designed to seal and safeguard the contents of containers like bottles, jars, and cans, caps and closures are crucial parts of metal packaging. They are employed in the food and beverage, pharmaceutical, cosmetic, and chemical sectors and come in a variety of forms, such as screw caps, flip-top caps, and crown caps. Metal closures, which are frequently composed of steel or aluminum, guarantee product freshness, safety, and tamper proof.

The food and beverages segment registered its dominance over the global metal packaging market in 2024. The global consumption of canned foods and beverages continues to rise, especially in urban areas. Consumers prefer convenient, long-shelf-life products, making metal packaging ideal for items like soft drinks, beer, canned vegetables, and ready-to-eat meals. Metal packaging provides excellent barrier properties, protecting food and drinks from oxygen, light, and moisture. Canning extends the shelf life of food without preservatives, making it ideal for long-term storage. Aluminum and steel cans are 100% recyclable, with high global recycling rates, making them a preferred choice for brands aiming for sustainability.

Consumers and regulations are pushing brands toward eco-friendly packaging, reinforcing metal’s dominance. The rising demand for carbonated soft drinks, energy drinks, and alcoholic beverages drives significant use of aluminum cans. Lightweight aluminum cans are cost-effective to transport and easy to cool, making them popular in on-the-go consumption. Stringent food safety regulations favour metal packaging due to its non-reactive and protective nature. Unlike plastic, metal packaging does not contain harmful chemicals like BPA in its raw form, making it safer for food storage. Advanced printing technologies allow brands to use eye-catching designs on cans, boosting marketing appeal. Lightweight and resealable cans (e.g., aluminum bottles) enhance user convenience, driving further adoption.

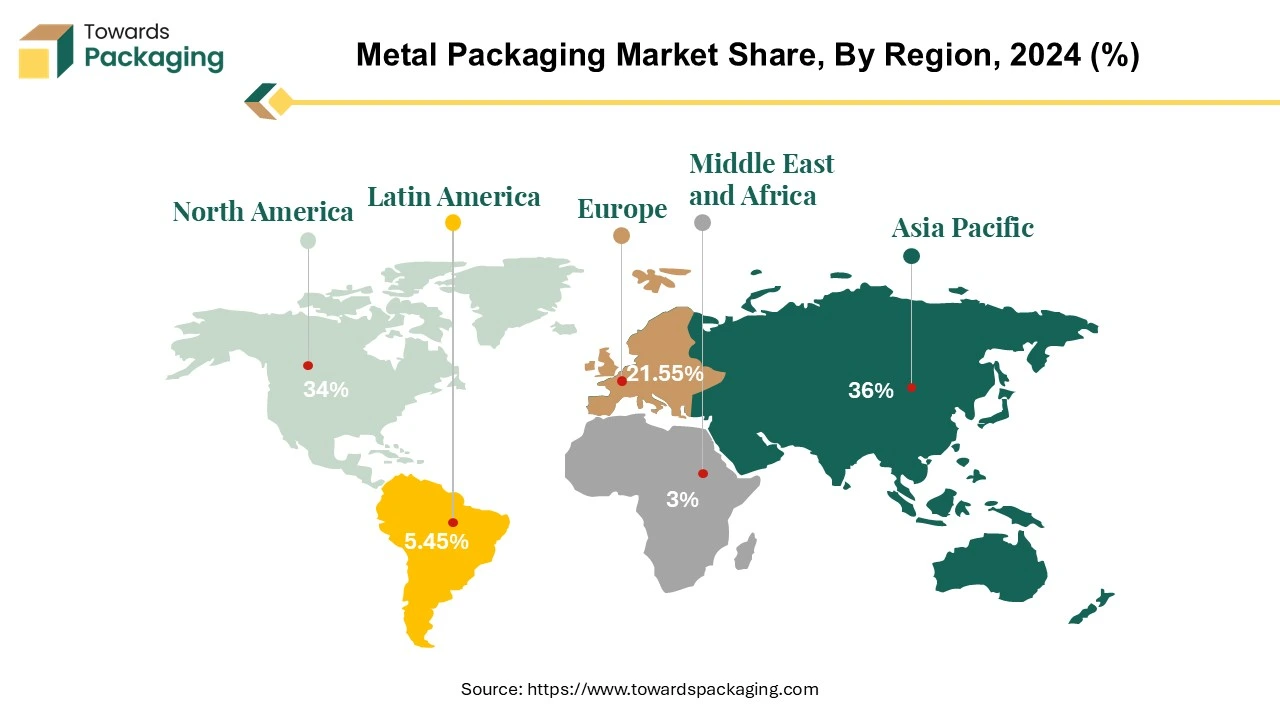

Asia Pacific region dominated the global metal packaging market in 2024. The metal packaging market is dominated by the Asia Pacific area because of a number of interrelated variables. In nations like China, India, Vietnam, and Indonesia in particular, the middle class is expanding and has more disposable money as a result of rapid urbanization and industrialization. The desire for premium packaged goods that are portable, easy to use, and handy is increasing due to this demographic transition, and metal packaging can meet this need. Additionally, the region's enormous growth in the food and beverage sector in response to shifting consumer preferences has opened up a lot of potential for metal packaging solutions, particularly for beverages, canned goods, and prepared foods.

China has a huge production base and a sizable and expanding consumer base, which together have generated an unprecedented demand for metal packaging solutions across a variety of industries, driving the China metal packaging market. Also, well-known Chinese companies like Wahaha and Master Kong have started using metal containers for their teas and soft beverages, which is encouraging the country's market to grow even more. Metal packaging communicates quality and safety to consumers who are concerned about their status, which has increased the trend of premium packaged goods among China's expanding middle class.

North America region is anticipated to grow at the fastest rate in the market during the forecast period. The need for metal packaging is mostly driven by North America's thriving food and beverage sector. While canned food businesses like Campbell's and Del Monte continue to sustain a consistent need for steel packaging, major beverage corporations like Coca-Cola and Anheuser-Busch InBev are responsible for large volumes of aluminum can use. With more than 2,000 craft breweries in the United States alone moving from glass bottles to cans for benefits in shipping, storage, and brand uniqueness through creative designs, the craft beer boom has further increased the use of aluminum cans.

The growing food and beverage industry and the growing emphasis on sustainability are the main factors propelling the metal packaging market in the United States. The U.S. regulatory climate has also been conducive to the expansion of metal packaging. Market potential have been generated by the FDA's approval of many metal packaging methods as well as tightening regulations on some plastics. Significant investment has also been made in metal packaging innovation in the United States, leading to advancements in coating systems, smart packaging technologies, and lightweight materials.

Europe is seen to grow at a notable rate in the foreseeable future. The Circular Economy Action Plan and the European Green Deal have encouraged businesses to use more environmentally friendly packaging options. Metal packaging is particularly recyclable, with recycling rates for steel and aluminum exceeding 80%. Strict waste management laws in nations like Germany, France, and the Netherlands encourage metal packaging since it can be recycled endlessly without losing quality.

With more than 1,500 breweries and an annual per capita beer consumption of about 100 liters, Germany has a well-established beer sector that mostly depends on metal cans for distribution and packaging. Metal packaging, which preserves product freshness and carbonation integrity, naturally fits with the German fondness for carbonated beverages, both alcoholic and non-alcoholic. Furthermore, aluminum cans are becoming more and more popular in the nation's expanding craft beer market because of their exceptional resistance to light and air, which helps maintain the unique aromas and qualities of specialty brews.

By Material

By Product Type

By End-Use

By Region

March 2025

March 2025

March 2025

March 2025