April 2025

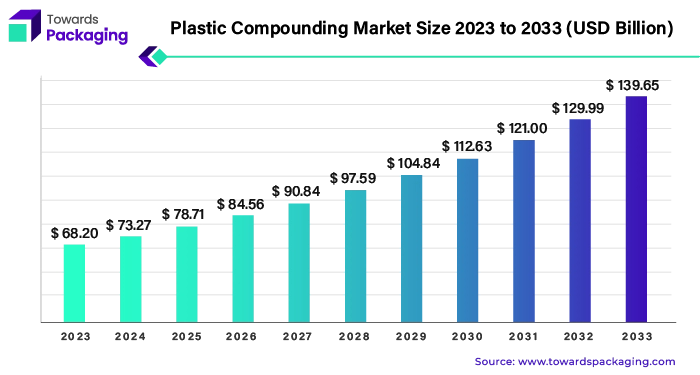

The plastic compounding market is projected to reach USD 150.03 billion by 2034, growing from USD 78.71 billion in 2025, at a CAGR of 7.43% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

Plastic compounding benefits include cost efficiency, sustainability, improved processing, and improved material performance. Applications include aerospace and defense, optical media, medical devices, industrial machinery, consumer goods, packaging, electrical and electronics, building and construction, and the automotive sector. These factors help to the growth of the market.

The plastic compounding market incorporates the manufacturing and distribution of compounded plastics, which involves combining different polymers, colorants, reinforcements, fillers, or additives to enhance their properties. The enhanced properties include improved flame retardancy, strength, and durability. Plastic compounding benefits include improved material performance as compared to basic polymers alone; plastic compounds with reinforcements, fillers, and additives exhibit improved chemical, electrical, thermal, or mechanical properties. The advantages of plastic compounding include versatility and customization to achieve particular colors, provide UV tolerance, improve fire retardation, and ensure food safety. These factors help to the growth of the market. The packaging market size to grow at a 3.16% CAGR between 2025 and 2034.

Increased demand for plastic products helps the growth of the market. There are many benefits of plastic products' strong weatherability because of their ability to achieve tight seals. Good safety and hygiene properties for food packaging. Lightweight with a high strength to weight ratio than the other materials, which makes it easy for transportation. Thermally and electrically insulating, secure, very versatile, very durable, different textures are possible, hygienic, shatter resistant, non-biodegradable, resistant to chemicals, hardness, permeability, transparency, stability, recyclability, reactivity, solubility, flammability, safety, and inexpensive properties are helpful for the growth of the market. Applications of plastic compounding in toys, electronics, automotive, construction, textiles, packaging, medical devices, etc. These factors help to the growth of the plastic compounding market.

Adverse effects of plastic compounding include endocrine disruption, which may lead to birth defects, cancers, developmental problems, and immune system suppression problems in children. Carcinogens, as in the case of DEHP (diethyl hexyl phthalate), and direct toxicity, as in cases of mercury, lead, and cadmium. It also includes agrochemical microplastics, which may be hazardous to health and the environment. Due to the difference in filling pattern and melt profile of individual alloys, plastic compounding has a downside. This may lead to cosmetic defects. Challenges in plastic compounding include equipment costs, environmental concerns, and quality control. Advanced plastic compounding equipment may be expensive, environmental concerns regarding toxicity and biodegradability, and inconsistent mixing may lead to a reduction in product performance, and achieving uniformity in plastic compounding is necessary. These factors may restrict the growth of the plastic compounding market.

The use of advanced technology in plastic compounding with the development of bio-based and sustainable additives. Plastic compounding continues to develop by providing innovative solutions for a more environmentally friendly and sustainable future. Advanced technology in plastic compounding may be helpful in overcoming the challenges regarding quality control, equipment costs, and environmental concerns. Unique requirements of plastic compounding in different industries like healthcare, construction, packaging, electronics, and automotive, there are advanced technologies necessary. These factors help to the growth of the plastic compounding market.

The fossil-based segment dominated the market in 2024. In fossil-based plastic compounding, hydrocarbons from fossil fuels are the primary source material, which comes from non-renewable sources. These fossil-based plastic compounding materials include polypropylene (PP), polyethylene (PE), polyethylene terephthalate (PET), polyvinyl chloride (PVC), and others. Fossil-based plastics are highly used for packaging material. These are extremely durable plastics used in the automobile and construction industry. Their lightweight and durable property makes them more eco-friendly and an alternative for many metals. For prolonging the shelf life of many products like foods, fossil-based plastic compounding material use can be an affordable solution. These factors helped to the growth of the fossil-based segment and contributed to the growth of the plastic compounding market.

The recycled segment is estimated to be the fastest-growing during the forecast period. In the plastic recycling process, compounding is the final step. It involves the transformation of resized or shredded plastics into usable products for manufacturers. These resized plastics are formed into pellets that are used to produce other plastic products. Plastic compounding can help to support sustainability by using recycled plastic compounding as the basis material. It also helps to reduce waste reduction and improve the circular economy by improving the capacity and strength of plastic items to be recycled. Plastic recycling is important because plastic waste causes many issues, including health concerns, pollution, and animal fatalities. Recycling also helps to reduce irritants and pollutants in the environment. These factors helped the growth of the recycled segment and contributed to the growth of the plastic compounding market.

The bio-based segment is significantly growing during the forecast period. Bio-based plastic compounding involves the process of using additives and fillers in biodegradable polymers to improve their properties. Bio-based plastics are produced from renewable biomass sources like recycled food waste, sawdust, woodchips, straw, cornstarch, and vegetable fats and oils. Biobased plastic compounding offers many benefits, including independence from fossil fuels, a lower carbon footprint compared to fossil-based plastic compounding, and degradable and durable options.

The benefits of bio-based plastics include helping to improve end-of-life scenarios for recycling and disposal, developing innovative alternative solutions as compared to conventional plastics, reducing dependence on fossil resources, lowering the carbon footprint, saving fossil resources by using biomass which regenerates and provides the unique potential of carbon neutrality, reducing effects of climate change, and reducing fossil fuel use. These factors help the growth of the bio-based segment and contribute to the growth of the plastic compounding market.

The polypropylene (PP) segment dominated the market in 2024. Polypropylene (PP) is a plastic material used for plastic compounding that has many benefits, including it is an insulator as it does not conduct electricity, it has high tensile strength, it is fatigue resistant and malleable, it can be remolded or molded into any shape without degradation, it is highly resistant to chemical leaking and corrosion which make it suitable for piping systems, and it does not react with acids which make it ideal for containers which hold acidic liquids. It also helps to improve material performance, customization and versatility, cost efficiency, improved processing, and sustainability. These factors help the growth of the polypropylene (PP) segment and contribute to the growth of the plastic compounding market.

The polyethylene (PE) segment is estimated to be the fastest-growing during the forecast period. Polyethylene (PE) is used for plastic compounding due to its benefits, including easy to clean and eco-friendly, broad range of use temperatures, good gas and moisture barrier properties, lightweight, durable, water resistance, transparency, thin and strong films, tough and wear resistance, easy to process for injection molding, chemical resistance to dilute acids and solvents, electrical insulation, and low cost and easy availability. It will stretch rather than break. These factors help the growth of the polyethylene (PE) segment and contribute to the growth of the plastic compounding market.

The automotive segment dominated the market in 2024. The automotive sector progressively uses plastic compounds to replace traditional metal components because of their benefits, including lightweight nature, cost-effectiveness, design flexibility, environmental regulations, demand for automotive parts, and shift towards electric vehicles, which need lightweight materials. In the automotive industry, there are many plastic applications, including interior trim, body panels, and engine parts. The plastics used in exterior parts include trims, air dams, fenders, bumpers, weatherstripping, wheel covers, seals, body panels, and interior parts, including decorative pieces, instrument panel skin, seat and associated parts, steering wheels, door panels, dashboard, and instrumental panels. These factors help the growth of the automotive segment and contribute to the growth of the plastic compounding market.

The packaging segment is expected to be the fastest-growing during the forecast period. Plastic compounds are highly used in the packaging sector because they protect and preserve things like foods, clothes, and other food items that need protection from damage due to direct contact with water or moisture. Plastic compounds provide protective barriers for products. Plastic packaging is cost-effective as compared to other materials, versatile as they can be molded into different shapes and sizes, and lighter than other materials like glass and metal, which helps to reduce carbon emissions and transportation costs, and is strong and durable, which helps to protect products at the time of transportation. These factors help to the growth of the packaging segment and contribute to the growth of the plastic compounding market.

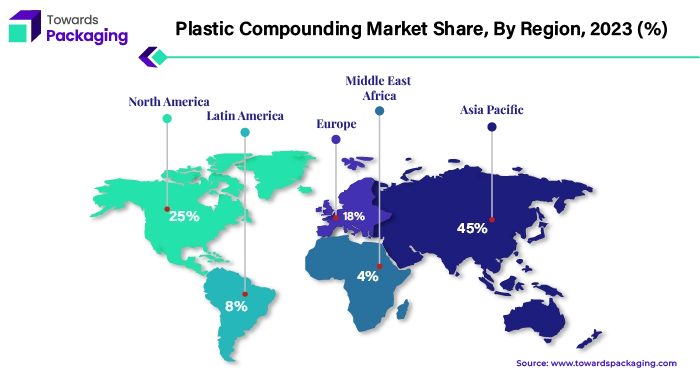

Asia Pacific dominated the plastic compounding market by 25% in 2024. Increased infrastructure and supply chain facilities help to grow the market in the Asia Pacific region. The region's contribution is mainly attributable to the fast-expanding industrialization and urbanization in emerging nations, as well as to increased manufacturing production, a booming e-commerce industry, and favorable demographics. In order to address the growing demand for consumer electronics in countries like China, India, Japan, and South Korea, there will likely be a greater need for plastic compounding in applications like washing machines, cars, and refrigerators. In addition, the need for electronic gadgets is growing across a range of markets. For example, BenQ India, a consumer electronics manufacturer, achieved significant milestones in October 2023 when it surpassed Japan to become the largest market in the Asia Pacific region. The primary cause of this rise has been India's rising demand for display items and consumer electronics in recent years.

By Source

By Product

By Application

By Region

April 2025

March 2025

March 2025

March 2025