April 2025

.webp)

Principal Consultant

Reviewed By

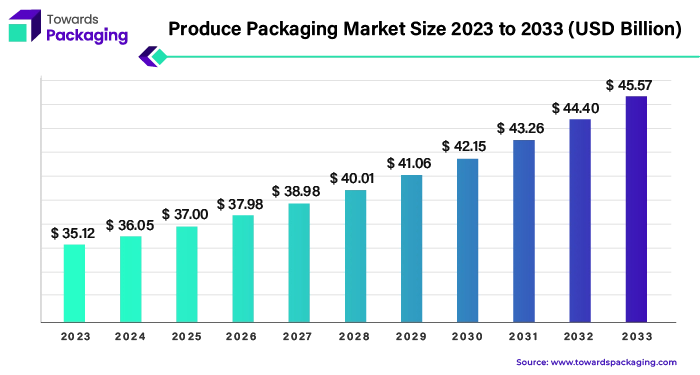

The global produce packaging market size reached US$ 35.12 billion in 2023 and is projected to hit around US$ 45.64 billion by 2034, expanding at a CAGR of 2.64% during the forecast period from 2024 to 2034.

Packaging of produce is one of the most desired trends today, especially for the on-the-go convenience that people are looking for. Fresh fruits are a significant part of the everyday routine. It is the foundation of any meal and the vitamins, minerals, antioxidants, and goodness that are contained in the fresh fruits and vegetables make them necessary for our meals, whether they are the main ingredient or an accompaniment. In the case of fresh products, the most crucial thing is to keep the taste, freshness, and natural goodness. Customers seek the produce with fresh and unspoiled look on the market shelves’ shelves thereby making the packaging of these characteristics of products a necessity. The global packaging market size is estimated to grow from USD 1.20 trillion in 2022 to reach an estimated USD 1.58 trillion by 2032, growing at a 3.16% CAGR between 2023 and 2032.

Through leading-edge packaging of fruits, vegetables and fresh produce, we offer you the innovative and convenient packaging solutions. Manufacturers have a wealth of choices for packaging fresh produce, including cardboard boxes, plastic containers, bags and pouches, trays, crates and others.

A common response to these demands on packaging is overspecification: the package is overwrapped and overstuffed and not even close to the ideal size. It is essential that the package be dimensioned correctly so that it is lighter, therefore, the emission of CO2 emissions in the transport will be lower as well as the waste reduction will be achieved. This will be achieved by a lower cost per package as well. This is the very essence of any good packaging solution as resource efficiency is in its foundation.

The options to truly impact the right materials within the fresh produce supply chain are apparent, and their number is big. In summary, a fresh produce package must be able to withstand different climates, tolerate heavy loads, cope with rough handling, arrive fresh and undamaged, and be environmentally friendly and resource efficient to ensure a final product in perfect shape and ready to eat. Ultimately, the packaging speaks for itself, and it is the low carbon and plastic-free nature of the material that distinguishes it from other materials and meets the additional purchase criteria of consumers.

For Instance,

The shift toward environmentally friendly materials, such as recyclable packaging or biodegradable is a significant growth driver as companies and consumers aim to minimize their carbon footprint. Innovations in packaging, including modified atmosphere packaging (MAP), active packaging, and smart labels, assists to maintain the quality of produce and enhance traceability. Hence, the technology advancement and shift towards eco-friendly packaging option has driven the growth of the produce packaging market over the forecast period.

The rise of online grocery shopping has increased the need for robust and protective packaging that can withstand shipping while maintaining product integrity. Online grocery platforms require specialized packaging to ensure the safe delivery of fresh produce. This includes protection against physical damage, temperature fluctuations, and contamination during transit. Extended supply chains in eCommerce require packaging solutions, such as modified atmosphere packaging (MAP) and vacuum-sealed options, to maintain produce freshness and extend shelf life. Packaging must be robust enough to handle transportation and storage challenges.

This has led to innovations in packaging materials that provide cushioning and durability while preserving product quality. Online platforms rely heavily on branding to differentiate themselves. Customized and aesthetically appealing packaging helps build brand identity, encouraging repeat purchases and driving packaging market growth.

Asia Pacific region holds the largest share in produce packaging market. Asia's leading trade show for the business of international fresh fruit and vegetables. The exhibition is the only international trade fair for fresh fruit and vegetable marketing which is an annual event in Asia and is dedicated only to the fresh produce sector and the value chain of the entire Asian region. Asia is the largest food producer in the world, with over three quarters of vegetable production and 73% of the total fruit production area being based in this region.

The consumption of vegetables and fruits in Asia Pacific is even one of the highest in the world, projected to grow with a rate of 12%. 3% by 2028. Indonesia, the Philippines and Thailand are the dominant fresh fruit producers in Southeast Asia. The region has seen the main commodity being fresh fruits, which has risen in the last three years, and still remains a net importer of fresh produce. Due to the increase in demand of fresh produce, the produce packaging market will also be high.

The primary location of production of packaging products is Asia pacific region due to the availability of a strong manufacturing base which makes the packaging of food products easy. Nowadays, the convenience and on-the-go packaging products are in high demand and therefore the future growth of produce packaging is a significant thing.

For Instance,

The produce packaging market in North America is showing the sign of rapid growth. The most important factor in the rise is the change in lifestyle and convenience as consumers want to buy packaged fruits and vegetables from the store.

As more and more US markets and many export markets have waste disposal restrictions for packaging materials, this issue becomes more critical. In the next few years, almost all fruit and vegetable packaging will be recyclable and/or biodegradable. A large number of the most important fresh produce buyers are also those who are most concerned about environmental issues. The American fresh produce industry has an imbalance and is increasingly being affected by climate change, as well as being unequally distributed with some regions being over-farmed and others being under-farmed. California is the leading provider of fresh produce in the United States today, and it provides more than half of all the fruits, vegetables, and nuts consumed in the country. California's fresh produce pre-eminence is in a vulnerable position.

Washington, Oregon, Texas, Florida, Georgia, South Carolina, and North Carolina offer a good chance to become the next fresh produce industry giants. This will in turn increase the demand for the produce packaging which are the saviours to reduce the waste and increase the products shelf life. These factors are the determinants for the growth in the produce packaging market in future.

For Instance,

Corrugated boxes are one of the most commonly used packing materials for produce. Corrugated fiberboard, which can be made in many different styles and weights. As a result of the low cost and its versatility, it is the main produce pack material, and will probably be the same in the next few years. The durability and the tensile strength of corrugated fiberboard have been increasing in the modern times.

The majority of fiberboard is made from a mix of recycled and new fibers. Mandatory use of recycled materials is required by laws and the figure is projected to rise in the future. triple- wall corrugated fiberboard containers have become an important one-way pallet bins in bulk produce shipments to processors and retailers. Among others, cabbage, melons, potatoes, pumpkins and citrus have also been successfully transported in these containers. The price for a container per pound of produce is as small as one fourth of the size of the traditional containers. Some may be squeezed and re-used.

The majority of organic foods are shipped and transported in corrugated produce boxes. Besides their healthy material, these cardboard picking bins are favored in transportation because they have a softer surface and so things are less likely to be damaged or squished. Thus, fruit shipping boxes have become the best option for shipping and transportation. The growth of the corrugated box market in produce packaging is projected to be exponential in the near future.

For Instance,

The top traded and consumed product is vegetables. The packaging of the vegetables is boxes, crates, basket and bags. Onions, Mixed Vegetables, Potatoes, Tomatoes, and Green Chilly are the major contributors to the vegetable export basket. The leading export destinations of Vegetable are China, United States, Germany, Netherlands and United Kingdom.

Fresh vegetable produced from corrugated cardboard has many benefits. Corrugated cardboard is strong and lightweight. It is very durable and it is easy to carry. This kind of packaging has less space when stacking in vehicles and warehouses. It is space-saving and transportation and warehouse costs are reduced by using fewer vehicles and fuel.

The packaging creates an environment that is conducive to controlling the moisture level of the products and thus preventing them from rotting. Rot is often caused when products are placed in wet environments. The packaging creates an environment that does not allow the products to get rotten by reducing the moisture level of the products. The demand for vegetables increases with the basic diet requirements of each individual being met by packaging support.

For Instance,

The competitive landscape of the produce packaging market is dominated by established industry giants such as Amcor, Berry Global, Sealed Air, Ball Corporation, Crown Holdings, International Paper Co, Mondi, Smurfit Kappa Group, Stora Enso, Plastipak Holdings, Bemis Company, Avery Dennison, Alpha Packaging, DS Smith, and Pactiv LLC. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

DS smith’ strategy in the produce industry is based on the fact that farmers are used to wax boxes for many years. Switching boxes may not have been a priority for many farmers at the start, but the financial and performance advantages have now persuaded many to do so.

For Instance,

By Product

By Packaging

By Region

April 2025

April 2025

March 2025

March 2025